EasyFile CFTC Form PQR Template

EasyFile CFTC Form PQR Template

EasyFile CFTC Form PQR Template

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

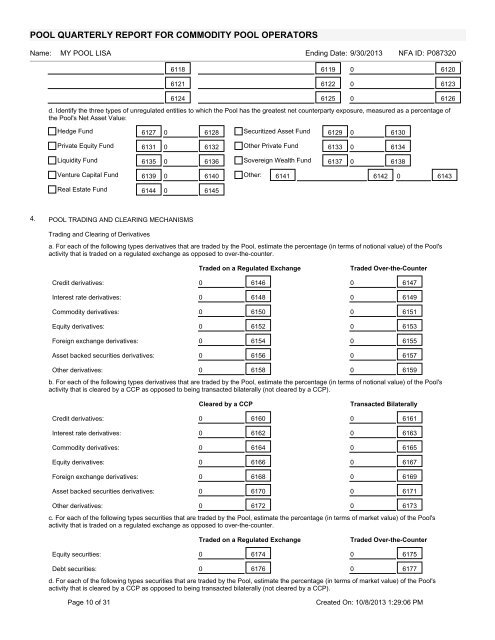

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

6118 6119 0 6120<br />

6121 6122 0 6123<br />

6124 6125 0 6126<br />

d. Identify the three types of unregulated entities to which the Pool has the greatest net counterparty exposure, measured as a percentage of<br />

the Pool's Net Asset Value:<br />

Hedge Fund 6127 0 6128 Securitized Asset Fund 6129 0 6130<br />

Private Equity Fund 6131 0 6132 Other Private Fund 6133 0 6134<br />

Liquidity Fund 6135 0 6136 Sovereign Wealth Fund 6137 0 6138<br />

Venture Capital Fund 6139 0 6140 Other: 6141 6142 0 6143<br />

Real Estate Fund 6144 0 6145<br />

4. POOL TRADING AND CLEARING MECHANISMS<br />

Trading and Clearing of Derivatives<br />

a. For each of the following types derivatives that are traded by the Pool, estimate the percentage (in terms of notional value) of the Pool's<br />

activity that is traded on a regulated exchange as opposed to over-the-counter.<br />

Traded on a Regulated Exchange<br />

Traded Over-the-Counter<br />

Credit derivatives: 0 6146 0 6147<br />

Interest rate derivatives: 0 6148 0 6149<br />

Commodity derivatives: 0 6150 0 6151<br />

Equity derivatives: 0 6152 0 6153<br />

Foreign exchange derivatives: 0 6154 0 6155<br />

Asset backed securities derivatives: 0 6156 0 6157<br />

Other derivatives: 0 6158 0 6159<br />

b. For each of the following types derivatives that are traded by the Pool, estimate the percentage (in terms of notional value) of the Pool's<br />

activity that is cleared by a CCP as opposed to being transacted bilaterally (not cleared by a CCP).<br />

Cleared by a CCP<br />

Transacted Bilaterally<br />

Credit derivatives: 0 6160 0 6161<br />

Interest rate derivatives: 0 6162 0 6163<br />

Commodity derivatives: 0 6164 0 6165<br />

Equity derivatives: 0 6166 0 6167<br />

Foreign exchange derivatives: 0 6168 0 6169<br />

Asset backed securities derivatives: 0 6170 0 6171<br />

Other derivatives: 0 6172 0 6173<br />

c. For each of the following types securities that are traded by the Pool, estimate the percentage (in terms of market value) of the Pool's<br />

activity that is traded on a regulated exchange as opposed to over-the-counter.<br />

Traded on a Regulated Exchange<br />

Traded Over-the-Counter<br />

Equity securities: 0 6174 0 6175<br />

Debt securities: 0 6176 0 6177<br />

d. For each of the following types securities that are traded by the Pool, estimate the percentage (in terms of market value) of the Pool's<br />

activity that is cleared by a CCP as opposed to being transacted bilaterally (not cleared by a CCP).<br />

Page 10 of 31<br />

Created On: 10/8/2013 1:29:06 PM