EasyFile CFTC Form PQR Template

EasyFile CFTC Form PQR Template

EasyFile CFTC Form PQR Template

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

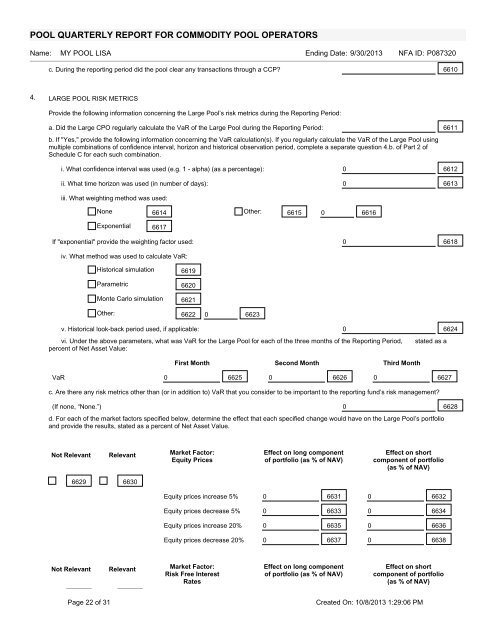

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

c. During the reporting period did the pool clear any transactions through a CCP 6610<br />

4. LARGE POOL RISK METRICS<br />

Provide the following information concerning the Large Pool’s risk metrics during the Reporting Period:<br />

a. Did the Large CPO regularly calculate the VaR of the Large Pool during the Reporting Period: 6611<br />

b. If "Yes," provide the following information concerning the VaR calculation(s). If you regularly calculate the VaR of the Large Pool using<br />

multiple combinations of confidence interval, horizon and historical observation period, complete a separate question 4.b. of Part 2 of<br />

Schedule C for each such combination.<br />

i. What confidence interval was used (e.g. 1 - alpha) (as a percentage): 0 6612<br />

ii. What time horizon was used (in number of days): 0 6613<br />

iii. What weighting method was used:<br />

None 6614 Other: 6615 0 6616<br />

Exponential 6617<br />

If "exponential" provide the weighting factor used: 0 6618<br />

iv. What method was used to calculate VaR:<br />

Historical simulation 6619<br />

Parametric 6620<br />

Monte Carlo simulation 6621<br />

Other: 6622 0 6623<br />

v. Historical look-back period used, if applicable: 0 6624<br />

vi. Under the above parameters, what was VaR for the Large Pool for each of the three months of the Reporting Period,<br />

percent of Net Asset Value:<br />

First Month Second Month Third Month<br />

stated as a<br />

VaR 0 6625 0 6626 0 6627<br />

c. Are there any risk metrics other than (or in addition to) VaR that you consider to be important to the reporting fund’s risk management<br />

(If none, “None.”) 0 6628<br />

d. For each of the market factors specified below, determine the effect that each specified change would have on the Large Pool’s portfolio<br />

and provide the results, stated as a percent of Net Asset Value.<br />

Not Relevant<br />

Relevant<br />

Market Factor:<br />

Equity Prices<br />

Effect on long component<br />

of portfolio (as % of NAV)<br />

Effect on short<br />

component of portfolio<br />

(as % of NAV)<br />

6629 6630<br />

Equity prices increase 5% 0 6631 0 6632<br />

Equity prices decrease 5% 0 6633 0 6634<br />

Equity prices increase 20% 0 6635 0 6636<br />

Equity prices decrease 20% 0 6637 0 6638<br />

Not Relevant<br />

Relevant<br />

Market Factor:<br />

Risk Free Interest<br />

Rates<br />

Effect on long component<br />

of portfolio (as % of NAV)<br />

Effect on short<br />

component of portfolio<br />

(as % of NAV)<br />

6639 6640<br />

Page 22 of 31<br />

Created On: 10/8/2013 1:29:06 PM