Information Document for Direct Listing OF ACI FORMULATIONS ...

Information Document for Direct Listing OF ACI FORMULATIONS ...

Information Document for Direct Listing OF ACI FORMULATIONS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

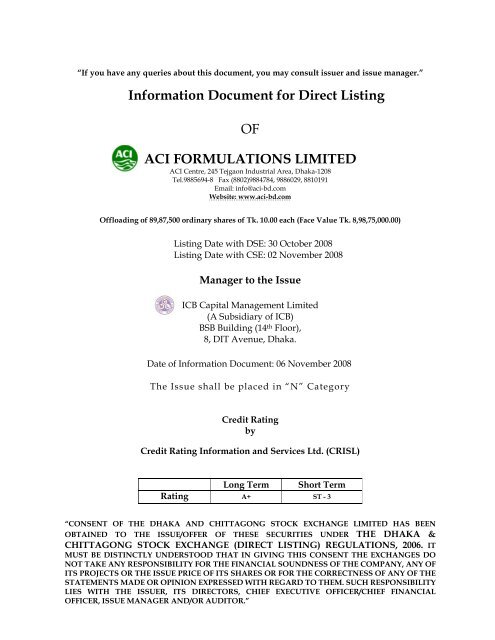

“If you have any queries about this document, you may consult issuer and issue manager.”<br />

<strong>In<strong>for</strong>mation</strong> <strong>Document</strong> <strong>for</strong> <strong>Direct</strong> <strong>Listing</strong><br />

<strong>OF</strong><br />

<strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED<br />

<strong>ACI</strong> Centre, 245 Tejgaon Industrial Area, Dhaka-1208<br />

Tel.9885694-8 Fax (8802)9884784, 9886029, 8810191<br />

Email: info@aci-bd.com<br />

Website: www.aci-bd.com<br />

Offloading of 89,87,500 ordinary shares of Tk. 10.00 each (Face Value Tk. 8,98,75,000.00)<br />

<strong>Listing</strong> Date with DSE: 30 October 2008<br />

<strong>Listing</strong> Date with CSE: 02 November 2008<br />

Manager to the Issue<br />

ICB Capital Management Limited<br />

(A Subsidiary of ICB)<br />

BSB Building (14 th Floor),<br />

8, DIT Avenue, Dhaka.<br />

Date of <strong>In<strong>for</strong>mation</strong> <strong>Document</strong>: 06 November 2008<br />

The Issue shall be placed in “N” Category<br />

Credit Rating<br />

by<br />

Credit Rating <strong>In<strong>for</strong>mation</strong> and Services Ltd. (CRISL)<br />

Long Term<br />

Short Term<br />

Rating A+ ST - 3<br />

“CONSENT <strong>OF</strong> THE DHAKA AND CHITTAGONG STOCK EXCHANGE LIMITED HAS BEEN<br />

OBTAINED TO THE ISSUE/<strong>OF</strong>FER <strong>OF</strong> THESE SECURITIES UNDER THE DHAKA &<br />

CHITTAGONG STOCK EXCHANGE (DIRECT LISTING) REGULATIONS, 2006. IT<br />

MUST BE DISTINCTLY UNDERSTOOD THAT IN GIVING THIS CONSENT THE EXCHANGES DO<br />

NOT TAKE ANY RESPONSIBILITY FOR THE FINANCIAL SOUNDNESS <strong>OF</strong> THE COMPANY, ANY <strong>OF</strong><br />

ITS PROJECTS OR THE ISSUE PRICE <strong>OF</strong> ITS SHARES OR FOR THE CORRECTNESS <strong>OF</strong> ANY <strong>OF</strong> THE<br />

STATEMENTS MADE OR OPINION EXPRESSED WITH REGARD TO THEM. SUCH RESPONSIBILITY<br />

LIES WITH THE ISSUER, ITS DIRECTORS, CHIEF EXECUTIVE <strong>OF</strong>FICER/CHIEF FINANCIAL<br />

<strong>OF</strong>FICER, ISSUE MANAGER AND/OR AUDITOR.”

AVAILABILITY <strong>OF</strong> INFORMATION DOCUMENT<br />

<strong>In<strong>for</strong>mation</strong> <strong>Document</strong> of the Company may be available at the following addresses:<br />

Company Contact Person Contact Number<br />

<strong>ACI</strong> Formulations Limited<br />

<strong>ACI</strong> Centre,<br />

245 Tejgaon Industrial Area<br />

Dhaka - 1208<br />

Ms. Sheema Abed Rahman<br />

Company Secretary<br />

Phone : 9885694-8<br />

Fax : (8802) 9884784, 9565257<br />

Email : info@aci-bd.com or<br />

gmcs@aci-bd.com<br />

Website : www.aci-bd.com<br />

Manager to the Issue Contact Person Contact Number<br />

ICB Capital Management Ltd.<br />

BSB Building (14 th Floor),<br />

8, DIT Avenue, Dhaka.<br />

Md. Iftikhar-uz-zaman<br />

Chief Executive Officer<br />

Phone : 02-7160422, 7160326-27, 9563455<br />

EX-196<br />

Fax : 880-2-9555707<br />

E-mail : ceocmcl@accesstel.net<br />

Website : www.icbcml.com.bd<br />

Stock Exchanges Available at Contact Number<br />

Dhaka Stock Exchange Ltd.<br />

9/F Motijheel C/A,<br />

Dhaka-1000.<br />

Chittagong Stock Exchange<br />

Ltd.<br />

CSE Building,<br />

1080 Sheikh Mujib Road,<br />

Chittagong.<br />

DSE Library Phone : 02-9564601-7, 7175705-9<br />

Fax : 88-02-9564727<br />

E-mail : dse@bol-online.com<br />

Website : www.dsebd.org<br />

CSE Library Phone : 031-714632-3, 031-720871-3<br />

Website : www. csebd.com<br />

<strong>In<strong>for</strong>mation</strong> <strong>Document</strong> would also be available on the website of SEC (www.secbd.org), DSE (www.<br />

dsebd.org), CSE (www.csebd.com), Issue Manager (www.icbcml.com.bd) and Public Reference Room of the<br />

Securities and Exchange Commission (SEC) <strong>for</strong> reading and study.<br />

FINANCIAL STRUCTURE <strong>OF</strong> THE COMPANY<br />

The Financial Structure of the Company as on 30.06.2008 is as follows:<br />

Particulars No. of shares Face Value (Taka) Amount in Taka<br />

Authorised Capital 5,00,00,000 10.00 50,00,00,000.00<br />

Paid-up Capital 2,50,00,000 10.00 25,00,00,000.00<br />

INFORMATION DOCUMENT Page 2 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

Definition and Elaboration of the abbreviated words and technical terms used<br />

in the <strong>In<strong>for</strong>mation</strong> <strong>Document</strong><br />

<strong>ACI</strong>FL : <strong>ACI</strong> Formulations Limited.<br />

<strong>ACI</strong> : Advanced Chemical Industries<br />

AGM : Annual General Meeting<br />

BCPA<br />

CAGR<br />

:<br />

:<br />

Bangladesh Crop Protection Association<br />

Compound Average Growth Rate<br />

CDBL : Central Depository Bangladesh Limited<br />

CIB : Credit <strong>In<strong>for</strong>mation</strong> Bureau<br />

COMMISSION : Securities and Exchange Commission<br />

CC & PH : Crop Care & Public Health<br />

CSE : Chittagong Stock Exchange Limited<br />

DSE : Dhaka Stock Exchange Limited<br />

EPS : Earning Per Share<br />

EGM : Extra-Ordinary General Meeting<br />

FAO : Food & Agricultural Organization<br />

FMC : Fast Moving Consumers<br />

GOB : Government of Bangladesh<br />

GDP : Gross Domestic Product<br />

GLC : Gas Liquid Chromatograph<br />

HPLC : High Per<strong>for</strong>mance Liquid Chromatograph<br />

ISSUE : <strong>Direct</strong> <strong>Listing</strong> of Shares of <strong>ACI</strong>FL<br />

ICML : ICB Capital Management Limited<br />

ICB : Investment Corporation of Bangladesh<br />

KW : Kilo Watt<br />

KWH : Kilo Watt Hour<br />

LATR : Loan Against Trust Receipt<br />

M COIL : Mosquito Coil<br />

NAV : Net Asset Value<br />

PHP : Public Health Product<br />

PPW : Plant Protection Wing<br />

RJSC : Registrar of Joint Stock Companies & Firms<br />

R & D : Research & Development<br />

RCC : Rein<strong>for</strong>cement Concrete<br />

REB : Rural Electrification Board<br />

RL : Revolving Loan<br />

SEC : Securities and Exchange Commission<br />

SECURITIES : Shares of <strong>ACI</strong>FL<br />

SECURITIES MARKET : The Share Market of Bangladesh<br />

STL : Short Term Loan<br />

THE COMPANY/ISSUER : <strong>ACI</strong> Formulations Limited.<br />

VAT : Value Added Tax<br />

WPPF : Workers Profit Participation Fund<br />

WDG : Water Dispersible Granular<br />

INFORMATION DOCUMENT Page 3 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

TABLE <strong>OF</strong> CONTENTS<br />

Particulars<br />

Page no.<br />

‣ Disclosure in respect of issuance of security in demat <strong>for</strong>m-------------- 7<br />

‣ Disposal of Shares ---------------------------------------------------------------------- ---------------- 7-8<br />

Shareholders Resolution in respect of disposal of shares in accordance with the regulation<br />

5 of Dhaka/Chittagong Stock Exchange (<strong>Direct</strong> <strong>Listing</strong>) Regulations, 2006<br />

‣ Undertaking to DSE -------------------------------------------------------------------- 9<br />

‣ Undertaking to CSE -------------------------------------------------------------------- 10<br />

‣ Purpose of Offloading / Use of Sale Proceeds -------------------------------------------- 11<br />

‣ Statement Regarding Holding Annual General Meeting ---------------------------------------- 11<br />

‣ Risk Factors and Management Perceptions ---------------------------------------------------- 12-13<br />

‣ Description of Business ------------------------------------------------------------------------------ 13-19<br />

• Corporate status and background<br />

• Nature of business<br />

• Principal products or services of the Company<br />

• Market <strong>for</strong> the products or services of the Company<br />

• Relative contribution of products contributing more than 10% of the total revenue<br />

• Name of associates, subsidiary/related holding company and their core areas of<br />

business<br />

• Distribution of products or services<br />

• Competitive conditions in the business<br />

• Sources and availability of raw materials and the names of the principal suppliers<br />

• Sources of requirement <strong>for</strong> power, gas and water<br />

• Name of customers who purchase 10% or more of the Company’s products<br />

• Contract with principal suppliers/customers<br />

• Material patents, trademarks, licenses or royalty agreements<br />

• Employees position<br />

• Production capacity and current utilization<br />

‣ Description of Property ------------------------------------------------------------------------------ 19-20<br />

INFORMATION DOCUMENT Page 4 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

• <strong>In<strong>for</strong>mation</strong> in respect of plant and property<br />

• Fixed assets<br />

• Condition of property<br />

• Ownership of property<br />

• Lien status<br />

• Lease property<br />

• Written down value of the property, plant and equipment<br />

‣ Plan Of Operation And Discussion On Financial Conditions --------------------------------- 21-30<br />

• Internal and external sources of cash<br />

• Material commitments <strong>for</strong> capital expenditure<br />

• Causes of any material changes in income, cost of goods sold, other operating<br />

expenses and net income<br />

• Seasonal aspects of business<br />

• Known trends, events or uncertainties<br />

• Change in the assets to pay off any liabilities<br />

• Loans taken from the holding/subsidiary company or loans given to those<br />

companies<br />

• Future contractual liabilities<br />

• Estimated future capital expenditure<br />

• Vat, income tax, customs duty or other tax liabilities<br />

• Sources from which VAT and Tax etc are paid<br />

• Finance lease during last 5 years<br />

• Financial and lease commitment during last 5 years<br />

• Personnel related schemes<br />

• Break down of all expenses including fee of issue manager and underwriters<br />

• Revaluation of assets<br />

• Transaction with holding or subsidiary companies which have been taken place<br />

during last 5 years<br />

• Special report from the auditors <strong>for</strong> issue of shares otherwise than <strong>for</strong> cash<br />

• Material in<strong>for</strong>mation having an impact on the affairs of the company<br />

• Statement of changes in shareholders’ equity<br />

‣ <strong>Direct</strong>ors And Officers -------------------------------------------------------------------------------- 31-37<br />

• Name, age and position of all <strong>Direct</strong>ors of the company and any person nominated to<br />

be a director<br />

• Date of becoming first <strong>Direct</strong>or and date of expiry of current term<br />

• Involvement of <strong>Direct</strong>ors with other companies<br />

• Involvement of <strong>Direct</strong>ors with listed companies in terms of dividend and category<br />

• Family relationship between directors and officers<br />

• Short bio-data of <strong>Direct</strong>ors<br />

• Holding of 5% or more shares in the paid-up capital by the <strong>Direct</strong>ors or shareholders<br />

of the Issuer is loan defaulter in terms of the CIB report of the Bangladesh Bank<br />

• Description of senior executives and officers<br />

‣ Involvement Of Officers And <strong>Direct</strong>ors In Certain Legal Proceedings --------------------- 38<br />

‣ Certain Relationships And Related Transactions ---------------------------------------------- 38<br />

INFORMATION DOCUMENT Page 5 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

‣ Executive Compensation ---------------------------------------------------------------------------- 39<br />

‣ Options Granted To Officers, <strong>Direct</strong>ors And Employees ------------------------------------- 39<br />

‣ Transaction With Promoters -------------------------------------------------------------------------- 40<br />

‣ Net Tangible Assets Per Share ------------------------------------------------------------------------ 40<br />

‣ Ownership Of The Company’s Securities - ---------------------------------------------------------- 41<br />

• Number of shares owned by the top ten salaried officers, directors and all other<br />

officers<br />

‣ Description Of Securities Outstanding Or Being Offered ------------------------------------- 41-42<br />

• Dividend, voting and preemption rights<br />

• Conversion and liquidation rights of any preferred stock outstanding or being offered<br />

• Dividend<br />

• Others material rights of common stockholders<br />

‣ Debt Securities ------------------------------------------------------------------------------------------ 42<br />

‣ Future Prospects ----------------------------------------------------------------------------------------- 43-44<br />

‣ Credit Rating Report ------------------------------------------------------------------------------------- 45-55<br />

‣ Financial Statements ------------------------------------------------------------------------------------- 56-81<br />

• Auditors’ Report and Audited Financial Statements <strong>for</strong> the half year ended 30 June 08<br />

• Comparative Income Statements, Balance sheet and Cash Flow Statement <strong>for</strong><br />

immediate preceding five accounting years<br />

• Selected Ratios<br />

‣ Additional Disclosures ------------------------------------------------------------------------------------- 82-89<br />

INFORMATION DOCUMENT Page 6 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

DISCLOSURE IN RESPECT <strong>OF</strong> ISSUANCE <strong>OF</strong> SECURITY IN DEMAT FORM<br />

As per provisions of the Depository Act, 1999 and regulations made thereunder, share of the company will be<br />

issued in dematerialized <strong>for</strong>m, only and, <strong>for</strong> this purpose, <strong>ACI</strong> Formulations Limited (<strong>ACI</strong>FL) has signed an<br />

agreement with the Central Depository Bangladesh Limited (CDBL). There<strong>for</strong>e, all transfers/transmissions,<br />

splitting or conversions will take place in the CDBL system and any further issuance of shares (including`<br />

rights/bonus) will also be issued in dematerialized <strong>for</strong>m only.<br />

DISPOSAL <strong>OF</strong> SHARES<br />

Details of offloading of shares by the Existing Shareholders as per Regulation 5 of<br />

Dhaka & Chittagong Stock Exchange (<strong>Direct</strong> <strong>Listing</strong>) Regulations, 2006<br />

<strong>ACI</strong> Limited, one of the Existing Shareholders of <strong>ACI</strong> Formulations Ltd, shall offload 89,87,500 ordinary<br />

shares of Tk. 10 each (Face value Tk. 8,98,75,000.00) with a minimum market lot of 50 (fifty) shares following<br />

the Regulation 5 of Dhaka & Chittagong Stock Exchange (<strong>Direct</strong> <strong>Listing</strong>) Regulations, 2006, the Depository<br />

Act, 1999 and regulations issued thereunder:<br />

1. As resolved in the Board of <strong>ACI</strong> Formulations Limited (<strong>ACI</strong>FL) and also as per resolution taken in the<br />

EGM of <strong>ACI</strong>FL, 35.95% of the Paid-up share capital (i.e. 89,87,500 shares) to be sold to the general<br />

public/institutions at market price.<br />

2. The <strong>In<strong>for</strong>mation</strong> <strong>Document</strong>, as vetted by DSE & CSE, have been published in two widely circulated<br />

national dailies (one in English and another in Bengali) minimum 7 (Seven) days be<strong>for</strong>e<br />

commencement of trade upon listing by DSE & CSE along with an electronic copy <strong>for</strong> posting in the<br />

web page of DSE & CSE.<br />

3. The company has simultaneously submitted the vetted <strong>In<strong>for</strong>mation</strong> <strong>Document</strong> with all exhibits to<br />

SEC, to the Stock Exchanges where it tends to list its securities.<br />

4. The existing shareholders of the company shall sell their shares through brokers of the exchange upon<br />

listing.<br />

5. No existing shareholder of the company shall sell more than 50% of his existing shareholdings until<br />

the company holds the Annual General Meeting after completion of one full accounting year of the<br />

company upon listing with the Exchanges.<br />

6. The conditions stated in 4 and 5 is subject to the provision that the existing shareholders shall offer <strong>for</strong><br />

sell at least 10% of the shareholdings in the company within 30(thirty) working days from the date of<br />

listing.<br />

7. Declaration about listing of Shares with the stock exchange (s):<br />

Applications have already been made to the Dhaka and Chittagong Stock Exchanges <strong>for</strong> permission<br />

of the shares of the company <strong>for</strong> dealing in both the said Stock Exchanges and <strong>for</strong> the quotation of the<br />

Stock Exchanges. After fulfillment of all requirements by the Company, the Exchanges shall list the<br />

Company’s shares within three weeks from the date of Publication of the <strong>In<strong>for</strong>mation</strong> <strong>Document</strong>, as<br />

mentioned in regulation 4, under intimation to the Commission, provided there is no contrary<br />

opinion of the Commission in this respect.<br />

In case of failure to fulfill the requirements by the company, the Exchanges shall reject the application<br />

<strong>for</strong> listing showing reasons thereof, under intimation to the Securities and Exchange Commission<br />

within 60 (sixty) days from the date of application.<br />

INFORMATION DOCUMENT Page 7 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

Shareholders Resolution in respect of disposal of shares in accordance with the regulation 5 of<br />

Dhaka/Chittagong Stock Exchange (<strong>Direct</strong> <strong>Listing</strong>) Regulations, 2006<br />

We the existing shareholders of <strong>ACI</strong> Formulations Limited (<strong>ACI</strong>FL) declare that-<br />

i) We shall sell our shares through the Exchanges (DSE/CSE) upon listing;<br />

ii) We shall not sell more than 50% of our existing shareholdings until the Company holds the Annual<br />

General Meeting after completion of one full accounting year of the Company upon listing with the<br />

exchanges (DSE/CSE);<br />

iii) We shall offer <strong>for</strong> sell at least 10% of the shareholdings in the Company within 30 (thirty) working days<br />

from the date of listing.<br />

Sd/-<br />

( M Anis Ud Dowla)<br />

Sd/-<br />

( Najma Dowla)<br />

Sd/-<br />

(Dr. Arif Dowla)<br />

Sd/-<br />

( Shusmita Anis Salam)<br />

Sd/-<br />

( Wajed Salam)<br />

Sd/-<br />

(Dr. F H Ansarey)<br />

Sd/-<br />

( Sheema Abed Rahman)<br />

Sd/-<br />

( M Anis Ud Dowla)<br />

Representative of <strong>ACI</strong> Ltd.<br />

INFORMATION DOCUMENT Page 8 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

Date: September 17, 2008<br />

To<br />

The Secretary<br />

Dhaka Stock Exchange Limited<br />

Dhaka.<br />

Dear Sir,<br />

UNDERTAKING<br />

We undertake, unconditionally, to abide by the <strong>Listing</strong> Regulations of the Dhaka Stock Exchange Limited as<br />

well as other relevant securities laws which presently are, or hereinafter may be in <strong>for</strong>ce.<br />

We further undertake:<br />

(1) That our shares and securities shall be quoted on the Ready Quotation List and/or the Cleared List at the<br />

discretion of the Exchange.<br />

(2) That the Exchange shall not be bound by our request to remove the shares or securities from the ready<br />

Quotation List and/or the Cleared List.<br />

(3) That the Exchange shall have the right, at any time to suspend or remove the said shares or securities <strong>for</strong><br />

any reason which the Exchange considers sufficient in public interest.<br />

(4) That such provisions in the Articles of Association of our Company or in any declaration or basis relating<br />

to any security as are or otherwise not deemed by the Exchange to be in con<strong>for</strong>mity with the <strong>Listing</strong><br />

Regulations of the Exchange shall, upon being called upon by the Exchange, be amended to supersede<br />

the Articles of Association of our Company or the declaration or basis relating to any security; and<br />

(5) That our company and /or the security may be delisted by the Exchange in the event of non-compliance<br />

and breach of the Regulations and/or of this undertaking after giving an opportunity of being heard to<br />

us.<br />

Yours faithfully,<br />

Sd/-<br />

M Anis Ud Dowla<br />

Managing <strong>Direct</strong>or<br />

INFORMATION DOCUMENT Page 9 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

Date: September 17, 2008<br />

To<br />

The Secretary<br />

Chittagong Stock Exchange Limited<br />

Chittagong.<br />

Dear Sir,<br />

UNDERTAKING<br />

We undertake, unconditionally, to abide by the <strong>Listing</strong> Regulations of the Chittagong Stock Exchange Limited<br />

as well as other relevant securities laws which presently are, or hereinafter may be in <strong>for</strong>ce.<br />

We further undertake:<br />

(1) That our shares and securities shall be quoted on the Ready Quotation List and/or the Cleared List at the<br />

discretion of the Exchange.<br />

(2) That the Exchange shall not be bound by our request to remove the shares or securities from the ready<br />

Quotation List and/or the Cleared List.<br />

(3) That the Exchange shall have the right, at any time to suspend or remove the said shares or securities <strong>for</strong><br />

any reason which the Exchange considers sufficient in public interest.<br />

(4) That such provisions in the Articles of Association of our Company or in any declaration or basis relating<br />

to any security as are or otherwise not deemed by the Exchange to be in con<strong>for</strong>mity with the <strong>Listing</strong><br />

Regulations of the Exchange shall, upon being called upon by the Exchange, be amended to supersede<br />

the Articles of Association of our Company or the declaration or basis relating to any security; and<br />

(5) That our company and /or the security may be delisted by the Exchange in the event of non-compliance<br />

and breach of the Regulations and/or of this undertaking after giving an opportunity of being heard to<br />

us.<br />

Yours faithfully,<br />

Sd/-<br />

M Anis Ud Dowla<br />

Managing <strong>Direct</strong>or<br />

INFORMATION DOCUMENT Page 10 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

PURPOSE <strong>OF</strong> <strong>OF</strong>FLOADING/USE <strong>OF</strong> SALE PROCEEDS:<br />

Out of all shareholders of <strong>ACI</strong> Formulations Limited, only <strong>ACI</strong> Limited will offload 89,87,500 shares of its<br />

shareholding in <strong>ACI</strong> Formulations Limited through <strong>Direct</strong> <strong>Listing</strong> of <strong>ACI</strong> Formulations Limited with DSE and<br />

CSE and the sale proceeds of the shares will be utilized by <strong>ACI</strong> Limited in the following manner :<br />

As a prudent and progressive company, <strong>ACI</strong> Limited endeavors to maximise the shareholders wealth. Last<br />

few years records will surely vouch that. Here, there will be no exception also. The company gives<br />

shareholders trust and confidence most important thing to cherish and this actually allows <strong>ACI</strong> Limited to<br />

drive its energy and ef<strong>for</strong>ts to realize company’s mission. In order to give consistent return to the<br />

shareholders in the longer term, money to be realized from the capital market will be utilized most<br />

judiciously:<br />

• one, to keep the pace of growth continues <strong>ACI</strong> Limited will invest in new projects or sectors<br />

which have proven track records of giving lower pay back period with high returns.<br />

• secondly, shareholders – company’s most important assets, will be rewarded with good returns<br />

commensurate with their contribution.<br />

• thirdly, steps will be taken to strengthen the Balance Sheet of the <strong>ACI</strong> Limited to keep the<br />

company remain in the strong footing.<br />

STATEMENT REGARDING HOLDING ANNUAL GENERAL MEETING <strong>OF</strong> THE COMPANY<br />

No. of AGM Date of AGM Financial year<br />

1 st 24-04-1997 1996<br />

2 nd 02-11-1998 1997<br />

3 rd 21-04-1999 1998<br />

4 th 22-05-2000 1999<br />

5 th 22-05-2001 2000<br />

6 th 09-05-2002 2001<br />

7 th 10-05-2003 2002<br />

8 th 26-05-2004 2003<br />

9 th 02-05-2005 2004<br />

10 th 28-05-2006 2005<br />

11 th 28-05-2007 2006<br />

12 th 23-06-2008 2007<br />

INFORMATION DOCUMENT Page 11 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

RISK FACTORS AND MANAGEMENT PERCEPTIONS<br />

The Company is operating in an industry involving both external and internal risk factors having direct as<br />

well as indirect effects on the investments by the investors. The assessable risk factors, both external and<br />

internal, and Management perception thereabout are enumerated hereunder:<br />

a) Interest rate risk: Interest/financial charges are paid against any kind of borrowed fund. Instability in<br />

money market and increased requirement <strong>for</strong> fund may put pressure on interest rate structure. Rising of<br />

interest rate increases the cost of fund and consequently there may be impact on profitability.<br />

Management Perception: While taking loan, Company always carefully considers the balance to be<br />

maintained between term loan which carries fixed interest rate and short term loan which carries variable<br />

interest rate so that any interest on inflation rate increase can be kept to the minimum. Additionally<br />

Company maintains very good reputation in the Banking Community and so far being able to attract very<br />

competitive rates from the Banks. Management of the Company is also emphasizing on equity based<br />

financing to reduce the dependency on bank borrowings which is reflected in the Financial Statements.<br />

b) Exchange rate risk: The Company imports raw materials against payment of <strong>for</strong>eign currency.<br />

Unfavorable volatility or currency fluctuation may affect the profitability of the Company.<br />

Management Perception: Company is fully aware of the risks related to currency fluctuation and as a<br />

prudent company we always take steps to hedge all major currency dealings to safeguard the interest of<br />

the Company.<br />

c) Industry risk: Environmentalists are likely to create pressure on Government <strong>for</strong> banning agro-chemicals<br />

<strong>for</strong> its negative effects on living beings thereby causing closure of business by the Company.<br />

Management Perception: With the world wide shortage of food products there is renewed importance<br />

and urgency in increasing food production. With the help of pesticides, insecticides and other crop care<br />

products farmers will be able to increase their crop yield and there by helping the country to become self<br />

sufficient in food. Bangladesh is one of the countries where per hector yield is lowest. No doubt product<br />

coming out from this Company will be used to increase yield. Company also strictly follows all the laid<br />

down regulations <strong>for</strong> marketing agrochemical products and there<strong>for</strong>e do not <strong>for</strong>esee any problems in<br />

doing the business.<br />

d) Market & Technology related risk: The production facilities are based on currently available technology.<br />

Any invention of new and more cost effective technology may cause operational obsolescence thereby<br />

causing in substantial new investments. Proposed new investments in diversified product lines may need<br />

diversified technology and management skills which may not be available. Any serious defects in the<br />

plant and machinery may affect production and profitability calling <strong>for</strong> additional investment <strong>for</strong><br />

replacement.<br />

Management Perception: Company owns modern technology with R&D infrastructure and shall be able<br />

to adapt to any new inventions with moderate investments as it has been doing in the past. The Company<br />

has access to international/multinational companies <strong>for</strong> supplying appropriate technology and technical<br />

management support <strong>for</strong> operation of new projects. The selected/installed plant and machinery have<br />

been manufactured by reputed manufacturer with proper warranty to take care any defects or<br />

confirmation of supplying of adequate spare parts. As such the Company does not envisage any major<br />

problem in this area.<br />

e) Potential or existing Government regulations: Environmentalists may like to create pressure on<br />

Government to reduce the use of crop protection products <strong>for</strong> its effects on living beings due to misuse or<br />

lack of awareness. Any adverse change by the Government in fiscal policies relating to agro-incentives<br />

may adversely affect Company’s profitability.<br />

Management Perception: Recently there is campaign to increase food production. FAO and other<br />

international bodies are also asking Bangladesh to improve its food security. This Company is poised in<br />

the right position to actively participate in increasing country’s food production as there will be an<br />

increasing demand <strong>for</strong> agrochemical products <strong>for</strong> enhancing the crop production.<br />

INFORMATION DOCUMENT Page 12 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

f) Potential changes in global or national policies: The Company’s product lines consist of crop protection<br />

products which are primarily based on imported raw materials. Any shortage in the international market<br />

might dent the production level and profitability. Law and order situation and political unrest may also<br />

jeopardize Company’s operations and adversely affect profitability.<br />

Management Perception: As a going concern, Company always takes step to safeguard its interest. The<br />

company’s supply chain is robust in accommodating large number of suppliers with proper contingency<br />

plan in place.<br />

g) Non-operating history: There is no history of non operation in case of <strong>ACI</strong>FL.<br />

h) Operational Risk: Shortage of power supply, labour unrest, unavailability or price increase of raw<br />

materials, natural calamities like flood, cyclone, earthquake etc. may disrupt the production of the<br />

Company and can adversely impact the profitability of the Company.<br />

Management Perception: The Company always provide competitive compensation package to its<br />

employees and maintain a healthy workers management relationship. The project of the Company is<br />

situated at a high land where there was no less record of flood. The factory building has strong RCC<br />

foundation, RCC floor, pre-fabricated steel structure to withstand wind, storm, rain etc. along with good<br />

drainage facility. The Company’s product has a good reputation in the market. Company always takes<br />

pragmatic steps to convince the customers to share a portion of the increased burden of cost increase<br />

which is possible because of strong reputation of company’s products in the market and we do not<br />

compromise on quality.<br />

Corporate Status and Background<br />

DESCRIPTION <strong>OF</strong> BUSINESS<br />

<strong>ACI</strong> Formulations Limited (<strong>ACI</strong>FL) is a public limited company which was incorporated on 29 October 1995<br />

as a private limited company with the Registrar of Joint Stock Companies and Firms, Dhaka, Bangladesh<br />

under the Companies Act 1994 with a mission to play dominant role in enhancing the quality of life and well<br />

being of the people of Bangladesh. The Company went into commercial operation on 01 July 1998. The status<br />

of the Company was converted from Private Limited to Public Limited Company on 04 May 2005. The<br />

Authorized Capital of the Company as of 30 June 2008 is Tk. 500,000,000.00 divided into 50,000,000 ordinary<br />

shares of Tk. 10.00 each. The paid up capital as of the same date was Tk. 250,000,000.00 divided into 25,000,000<br />

ordinary shares of Tk. 10.00 each. <strong>ACI</strong> Formulations Limited is the subsidiary of <strong>ACI</strong> Limited by virtue of its<br />

holding 86.95% of the paid up share capital of <strong>ACI</strong> Formulations Limited. The registered office of the<br />

Company is situated at <strong>ACI</strong> Center, 245 Tejgaon Industrial Area, Dhaka-1208 and the factory is located at<br />

Rajabaria, Sreepur, Gazipur.<br />

Nature of Business<br />

The current principal activities of the Company are to manufacture and market of a number of Agrochemicals<br />

and Consumer products. Most of the sales are made currently to <strong>ACI</strong> Limited which markets the products<br />

under the Marketing and Distribution agreement. As envisaged in the Memorandum of Association, the<br />

Company’s main object clause include, not being limited to, among others business of agro-chemicals and<br />

public health products to carry on the business of manufacturing, <strong>for</strong>mulation and packaging of<br />

granular/liquid/powder <strong>for</strong>ms of pesticides like insecticide, fungicide, herbicide, repellent, adjuvant etc.<br />

production of fertilizer, plant nutrient, growth regulator, hormone, stimulants, animal feed, cattle feed,<br />

poultry feed, fish feed, production/processing/development of all types of seeds like cereals, pulses, oil,<br />

fruits, vegetables, ornamentals, engage in farming, horticulture, tissue culture, plantation, aquaculture and<br />

varieties of allied industrial and service related operations.<br />

In the proposed new structure all the agro-chemical products (Crop-Care) will be manufactured and<br />

directly marketed by the Company (<strong>ACI</strong>FL) without using <strong>ACI</strong> Limited as a selling & marketing agent.<br />

This will allow the Company to have higher margin and more control in the market.<br />

INFORMATION DOCUMENT Page 13 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

Principal products or services of the Company<br />

The Company currently has three units; each of them produces different types of products which are as<br />

follows:<br />

a) Unit – 1: Insecticides, Herbicides, Fungicides and other related products.<br />

b) Unit – 2: Mosquito Coil<br />

c) Unit – 3: Aerosol and Air freshener<br />

Aside from these, the Company also provides services to <strong>ACI</strong> Ltd. by manufacturing Vanish Toilet Cleaner<br />

<strong>for</strong> <strong>ACI</strong> Ltd. under the contract manufacturing agreement (Marketing and Distribution agreement) with <strong>ACI</strong><br />

Limited.<br />

The Company’s products have distinct superiority due to high standard of quality control measures through<br />

use of quality control laboratory equipped with HPLC and GLC to check the quality as well as product<br />

development activities.<br />

Market <strong>for</strong> the products or services of the Company<br />

The Company has two major lines of business. One is Agro-chemicals which are crop protection products and<br />

has direct relationship with increasing and protecting crops of millions of farmers. Secondly, Public Health<br />

products like mosquito repellant (Coil, Aerosol) and other health and hygienic products like Air freshener &<br />

house cleaning. Since contribution of the agricultural sector to the GDP is still dominant and the sector is the<br />

largest employer of work<strong>for</strong>ce, public sector (Gov’t. agencies) and the private sectors (farmers) have been<br />

keen in applying Agro-chemicals along with fertilizers and other components to grow-more food. As a result<br />

the demand <strong>for</strong> these products have shown increasing trend over the years. This is reflected in the increased<br />

rate of turnover growth of the Company over the years. The Company enjoys a dominant market share of<br />

18% in crop pesticides (source: BCPA 2007), 87.9% in consumer pesticides (Aerosol), 27% in mosquito coil<br />

(source: Nielsen-BD, August 2008).<br />

Relative contribution of Products contributing more than 10% of the total revenue<br />

The relative contribution to sales and income of each product that accounts <strong>for</strong> more than 10% of the<br />

Company’s total revenue are mentioned below:<br />

Sl.<br />

No.<br />

Name of the products % of contribution to sales % of contribution to income<br />

1 Insecticides, Herbicides,<br />

56.38% 92.63%<br />

Fungicides<br />

2 Mosquito Coil 26.67% 3.83%<br />

3 Aerosol 16.95% 3.54%<br />

Name of associates, subsidiary/related holding company and their core areas of business<br />

The Company is a subsidiary of <strong>ACI</strong> Limited, a publicly listed company. <strong>ACI</strong> Limited holds 86.95% of the<br />

paid up share capital of the Company. The principal activities of <strong>ACI</strong> Ltd. are to manufacture pharmaceutical,<br />

consumer brands, public health and animal health products and to market them along with agrochemicals,<br />

seeds and other consumer brands items. Currently, <strong>ACI</strong> Limited is responsible <strong>for</strong> distribution and marketing<br />

of <strong>ACI</strong>FL’s products under the Marketing & Distribution agreement. The following companies are also the<br />

subsidiaries of <strong>ACI</strong> Limited:<br />

1. <strong>ACI</strong> Salt Limited having shares of 78%<br />

2. <strong>ACI</strong> Foods Limited having shares of 95%<br />

3. <strong>ACI</strong> Pure Flour Limited having shares of 95%<br />

4. Apex Leather Craft Limited having ownership of 100%<br />

5. Flyban Insecticides Ltd having shares of 51%<br />

6. <strong>ACI</strong> Agro-chemicals Limited having shares of 90%<br />

7. Premiaflex Plastics Limited having shares of 80%<br />

INFORMATION DOCUMENT Page 14 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

8. <strong>ACI</strong> Motors Limited having shares of 75%<br />

9. Creative Communication Limited having shares of 60%<br />

10. <strong>ACI</strong> Logistics Limited having shares of 76%<br />

The following are the Joint Ventures/Associates of <strong>ACI</strong> Limited:<br />

1. Tetley <strong>ACI</strong> (Bangladesh) Limited (processor, blender and distributor of tea) with Tetley UK Ltd.<br />

2. Asian Consumer Care (Pvt.) Limited ( manufacturer of shampoo, hair oil, toothpaste etc.) with Dabur Intl.<br />

Dubai<br />

3. <strong>ACI</strong> Godrej Agrovet Private Limited ( poultry feed) with Godrej India<br />

4. Computer Technology Limited<br />

5. Stochastic Logic Limited<br />

Distribution of products or services<br />

Almost the entire products (97% of Unit -1 and 2 and 100% of Unit-3) are currently distributed/marketed by<br />

<strong>ACI</strong> Limited through <strong>ACI</strong>’s channel of depots and agents throughout the country under Marketing &<br />

Distribution agreement. <strong>ACI</strong> Limited has 19 depots as on 30 June 2008. <strong>ACI</strong> Limited also maintains a fleet of<br />

84 transport vehicles consisting of 68 vans and 16 micro vans.<br />

Competitive conditions in the business<br />

The competitiveness of the market may be gauged by the presence of giants like Syngenta Bangladesh<br />

Limited & Padma Oil Company (agents of FMC and BASF). Other competitors include Shetu Pesticides<br />

Limited, Bayer Crop Science, Auto Crop Care Ltd., Mc Donald (Bangladesh) Ltd. ( agent of Nishan Chemical<br />

Co.), Shetu Corporation Limited ( agent of Sumitomo Corporation ) and Setu Marketing Company ( SEMCO).<br />

Sources and availability of raw materials and the name of principal suppliers<br />

The raw materials used by the Company in the <strong>for</strong>mulation processes are mainly basic chemicals, auxiliary,<br />

solvents and emulsifiers. About 20% of the raw materials are locally procured while about 80% is directly<br />

imported. For Crop Care & Public Health products, the company imports 22 chemical items while locally<br />

procures 12 items. For Aerosol, 12 items are imported and 5 items are locally sourced. For Mosquito Coil, 11<br />

items are imported and 12 items are locally purchased. The names of principal suppliers of raw materials are<br />

mentioned below:<br />

a) Pesticides <strong>for</strong> Crop Care business:<br />

Sl. No. Name of Supplier Address Raw Materials<br />

1 Aimco Pesticides Ltd. "Akand Jyoti" 8th Road, P.B. No.<br />

6822, Santacruz (East),<br />

Mumbai-400 055, India<br />

Butachlor, Carbendazim, Sulpher,<br />

Endosulfan, Carbofuran,<br />

Chloropyriphos, Acetamiprid<br />

2 Taicang Otsuka Chemical Co.<br />

Ltd.<br />

Shaxi, Taicang, Jiangsu Province,<br />

P R China<br />

3 Isagro Centro Uffici San Siro-Fabricato D-ala 3,<br />

Via calder, 21-20153, Milan-Italy<br />

4 Isagro (Asia) Agrochemicals Pvt. Ltd. 101, Solitaire Corporate Park, 151, M,<br />

Vasanji Road, Chakain Andheri<br />

(East), Mumbai 400 093, India<br />

5 Chimac Agriphar Rue de Renory, 26 B-4102 Ougree,<br />

Belgium<br />

6 Hui Kwang Corporation 17-10, Tzyy Lin Matau, Tainan<br />

Hsien, Taiwan, R.O.C.<br />

7 Cheminova A/S P O Box 9, DK-7620 Lemvig,<br />

Denmark<br />

Carbofuran,<br />

Mancozeb , Benalaxyl,<br />

Orthosulfamuron<br />

Phenthoate, Mancozeb, Dimetoate<br />

Cypermethrin, Diazinon<br />

Carbofuran, Mancozeb +, Metalaxyl,<br />

Butachlor, Cartap<br />

Malathion<br />

8 Cheminova India Ltd. Mumbai, India Chloropyriphos<br />

9 T. Stane & Co Ltd. 8/23-24, Race Course Road,<br />

Azadirachtin<br />

Coimbatore-641 018, India<br />

10 East Sun Chemical Co Ltd. 23/F Kinwic Centre, 32, Hollywood<br />

Road, Central Hong Kong, China<br />

Diazinon, Malathion, Carbofuran,<br />

Mancozeb<br />

INFORMATION DOCUMENT Page 15 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

Sl. No. Name of Supplier Address Raw Materials<br />

11 Tagros Chemicals India Ltd. "Jhavar Centre" Rajah Annamalai<br />

Building IV Fl72, Marshalls Road<br />

Cypermethrin, Propiconazole,<br />

Deltamethrin<br />

Egmore, Chennai 600 008, India<br />

12 Sundat (S) Pte Ltd. 26, Gul Crescent, Singapore Paraquat, 2,4 D amine, Lambda<br />

cyhalothrin, Primiphos methyl,<br />

Glyphosate<br />

13 Tide Int. Chemical Co. Ltd. Flat H&I, 19/F, Building 1, Huazhe Imidacloprid, Acephate, Cartap<br />

Plaza, Hangzhow (310006), China<br />

14 Sinochem Ningbo 21JianXia Street, Ningbo, China Abamectin, Propiconazole,<br />

Fenitrothion, Fipronil, Pretilachlor,<br />

Iprodione<br />

15 Jaishil Sulphur and Chemical<br />

Industries Ltd.<br />

16 Fulon Chemical Industrial Co.<br />

Ltd.<br />

b) Pesticides <strong>for</strong> Public Health business:<br />

212/213 Navjivan (Mandvi),<br />

125, Kazi sayed street, masjid,<br />

Mumbai,India<br />

Taiwan<br />

Sulpher<br />

Glyphasate<br />

Sl. Name of Supplier Address Raw Materials<br />

No.<br />

1 Sumitomo Corporation<br />

(Singapore) Pte. Ltd.<br />

20 Cecil Street# 23-02/08 and # 24-<br />

01/08 Equity Plaza, Singapore<br />

D-allethrin, Imiprothrin ,<br />

Deltamethrin, Metofluthrin,<br />

2 Sinochem Ningbo Ltd. 21JianXia Street, Ningbo, China d-allethrin, S-bilothrin,<br />

Tetramethrin, Permethrin, d-trans<br />

alethrin, ETOC ,Sumithrin,<br />

3 Sundat (s) pte Ltd, Singapore 26, Gul Crescent, Singapore Pirimiphos-methyl, Temephos,<br />

Lambda cyhalothrin<br />

4 Sinochem Ningbo Ltd. India Phenthoate<br />

5 Cheminova India Limited Formulation Division<br />

Chlorpyrifos<br />

242-P, GIDC PANOLI,<br />

Dist. Bharuch, Gujarat, India<br />

6 Tagros Chemicals India Limited "Jhavar Centre" Rajah Annamalai<br />

Building IV Fl72, Marshalls Road<br />

Egmore, Chennai 600 008, India<br />

Deltamethrin, Cypermethrin<br />

Sources of requirement <strong>for</strong>, Power, Gas and Water<br />

a) Power:<br />

The Company has power supply from REB with 500 KVA connected load which may be expanded to<br />

1250 KVA line passed through the factory site. The factory is further equipped with 3 diesel generators<br />

of total 615 KVA capacity and 2 gas generator of 380 KW and 1030 KW (expected to be commissioned<br />

by the end of the year 2008) capacity. Application have already been made <strong>for</strong> increasing gas supply<br />

which is in active consideration of the Titas Gas Authority and it is expected that by the end of this year<br />

permission will be received from Titas Gas Authority.<br />

Currently Company’s operation is being run with diesel generators. We presume that if there are<br />

inadvertent delay in getting permission to laying gas line, operation will be continued with existing<br />

diesel generators along with enjoying power supply from REB.<br />

b) Gas:<br />

Titas Gas Transmission and Distribution Co. Ltd. supplies required gas <strong>for</strong> the plant from 50 psl main<br />

line. For reducing production cost, the Company is working to get connection from 150 psl main line of<br />

Titas Gas Transmission and Distribution Co. Ltd.<br />

c) Water:<br />

The Company requires huge amount of water. During the year 2007, the factory consumed about<br />

196,344 m 3 of water, which was lifted by Company’s owned/installed deep-tube-well/pump and<br />

supplied to different points with a network of distribution pipelines. The quality of water is good and<br />

useable <strong>for</strong> all purposes.<br />

INFORMATION DOCUMENT Page 16 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

Name of customers who purchase 10% or more of the Company’s products<br />

At present, Advanced Chemical Industries Ltd. (<strong>ACI</strong> Ltd.) is the buyer who purchases almost the entire<br />

products (97% of Unit - 1 and 2 and 100% of Unit - 3) of the company individually. In future, <strong>ACI</strong>FL will<br />

directly market its Crop-Care products thereby maintain better margins and more control over the market.<br />

Contract with principal suppliers/customers<br />

The Company has entered into an agreement with <strong>ACI</strong> Limited, the major features of which are as follows:<br />

a) <strong>ACI</strong> Limited markets and distributes the products of Crop Care and Public Health business<br />

manufactured by <strong>ACI</strong>FL.<br />

b) <strong>ACI</strong>FL acts as a contract manufacturer of Coil and Aerosol products.<br />

c) <strong>ACI</strong> Ltd. provides management services to <strong>ACI</strong>FL.<br />

The agreement shall be valid <strong>for</strong> a period of five (5) years (renewable with mutual understanding) since 1<br />

January 2005.<br />

Material Patents, Trade Marks, Licenses or Royalty Agreements<br />

The Company has 72 Registered Products out of which 52 are <strong>for</strong> Corp Care and 20 are <strong>for</strong> Public Health. It<br />

has Registration with PPW <strong>for</strong> the following pesticides <strong>for</strong> Crop-Care and Public Health products:<br />

List of the pesticides <strong>for</strong> crop care business<br />

Sl. No. BRAND NAME REG. NO. Sl. No. BRAND NAME REG. NO.<br />

1 Acamite 1.8 EC AP-1286 27 Gola 48 EC AP-1271<br />

2 Acithrin 2.5 EC AP-880 28 Goolee 3GR AP-778<br />

3 Aimchlor 5G AP-403 29 Goolee 50 SC AP-779<br />

4 Aimcozim 50 WP AP-375 30 Kelion 50 WG AP-1176<br />

5 Amcoround AP-411 31 Limithion 57 EC AP – 264<br />

6 Aimcoflo 80 WDG AP-869 32 Nimbecidine AP-373<br />

7 Brifur 5G AP – 324 33 Nemispore AP – 166<br />

8 Carbofuran 3G AP – 05 34 Nuben 72 WP AP-612<br />

9 Care 4G AP-593 35 Nuchlor 5G AP-846<br />

10 Care 50 SP AP-654 36 Nutap 4G AP-807<br />

11 Caught 10 EC AP-639 37 Platinum 20 SP AP-826<br />

12 Cidial 50 L AP – 124 38 Proud 25 EC AP-609<br />

13 Cidial 5G AP - 139 39 Paraxone AP-495<br />

14 Classic 20 EC AP – 345 40 Pyriban 15 G AP-516<br />

15 Conza 5 EC AP- 1047 41 Razthion 57 EC AP – 288<br />

16 Conazole 25 EC AP-1264 42 Razfuran 5G AP – 305<br />

17 Cythrine 10 EC AP-310 43 Razdan 10G AP – 282<br />

18 Diazonyl T 60 AP-283 44 Razland 80 WP AP-351<br />

19 Endosol 35 EC AP-1276 45 Rogor L 40 AP – 141<br />

20 Feniton 50 EC AP-1046 46 Sulphotox 80 WP AP- 357<br />

21 Fielder AP-494 47 Rovanon 50 WP AP-1385<br />

22 Fighter 2.5 EC AP-502 48 Super Guard 50EC AP-580<br />

23 Furacarb 3G AP – 214 49 Superheat 500 EC AP-697<br />

24 Furan 3G AP-1008 50 Sun-up AP-669<br />

25 Galben-M AP-374 51 Tiddo 20 SL AP-468<br />

26 Greesul 80 WDG AP-1048 52 Tidphate AP-473<br />

INFORMATION DOCUMENT Page 17 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

List of the pesticides <strong>for</strong> Public Health business<br />

Sl. No. BRAND NAME REG. NO. Sl. No. BRAND NAME REG. NO.<br />

1 <strong>ACI</strong> Mosquito Coil PHP-73 11 Cidial 50 L PHP – 22<br />

2 <strong>ACI</strong> King Mosquito Coil PHP-187 12 Classic 20 EC PHP-123<br />

3 <strong>ACI</strong> Mosquito Coil Super PHP-241 13 Cleaner 50 EC PHP-175<br />

4 <strong>ACI</strong> Mosquito Coil Super PHP-183 14 Delete 2.5 EC PHP-162<br />

Plus<br />

5 <strong>ACI</strong> Queen Mosquito Coil PHP-206 15 Keeper 10 EC PHP-168<br />

6 <strong>ACI</strong> Cockroach Spray PHP-237 16 Missile 50 EC PHP-184<br />

7 <strong>ACI</strong> Aerosol Insect Spray PHP-08 17 Relax Mosquito Coil PHP-136<br />

8 New <strong>ACI</strong> Aerosol Insect PHP-122 18 Relax Mosquito Mat PHP-145<br />

Spray<br />

9 <strong>ACI</strong> Liquid Insecticide PHP – 17 19 Relax Mosquito<br />

PHP-133<br />

Vaporizer<br />

10 <strong>ACI</strong> Mosquito Insecticide PHP-186 20 Shooter 2. 5 EC PHP-140<br />

The Company does not have any Licenses or Royalty Agreements with anyone.<br />

Employees Position as on 30.06. 2008<br />

(a) Total employee 790<br />

(b) Full time 201<br />

(c) Contractual 589<br />

Production capacity and current utilization<br />

The utilization of production capacity of the company is increasing gradually due to expansion of sales<br />

network, launching of new products and customer demand this has commensurate with cost control as well<br />

as efficient and effective measures taken by the management. The production capacity and current utilization<br />

of the factory is as under:<br />

(A) CC & PH<br />

i) Granular<br />

Year Business Department Unit Capacity/Year Production/Year % of<br />

Utilization<br />

2005 CC & PH Granular MT 9,000 4,782 53.13<br />

2006 CC & PH Granular MT 9,000 5,715 63.50<br />

2007 CC & PH Granular MT 13,500 7,962 58.98<br />

Up to June<br />

2008<br />

CC & PH Granular MT 13,500 4,756 70.46<br />

ii) Powder (Manual Line)<br />

Year Business Department Unit Capacity/Year Production/Year % of<br />

Utilization<br />

2005 CC & PH Powder MT 1,500 454 30.27<br />

2006 CC & PH Powder MT 1,500 496 33.07<br />

2007 CC & PH Powder MT 1,500 671 44.73<br />

Up to June<br />

2008<br />

CC & PH Powder MT 1,500 812 108.27<br />

INFORMATION DOCUMENT Page 18 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

iii) Liquid<br />

Year Business Department Unit Capacity/Year Production/Year % of<br />

Utilization<br />

2005 CC & PH Liquid MT 1,500 378 25.20<br />

2006 CC & PH Liquid MT 1,500 457 30.47<br />

2007 CC & PH Liquid MT 1,500 597 39.80<br />

Up to June<br />

2008<br />

CC & PH Liquid MT 1,500 375 50.00<br />

(B) Mosquito Coil<br />

Year Business Department Unit Capacity/Year Production/Year % of<br />

Utilization<br />

2005 CB M Coil Carton 600,000 466,177 77.70<br />

2006 CB M Coil Carton 750,000 426,289 56.84<br />

2007 CB M Coil Carton 675,000 499,435 73.99<br />

Up to June<br />

2008<br />

CB M Coil Carton 1,056,,000 354,104 67.07<br />

(C) Aerosol, Air Freshener & Cockroach Killer<br />

Year Business Department Unit Capacity/Year Production/Year % of<br />

Utilization<br />

2005 CB Aerosol pcs 7,560,000 1,767,691 23.18<br />

2006 CB Aerosol pcs 7,560,000 1,909,605 25.26<br />

2007 CB Aerosol pcs 7,560,000 2,723,588 36.03<br />

Up to June<br />

2008<br />

CB Aerosol pcs 7,560,000 1,932,632 51.13<br />

The capacity utilization reflects average production throughout the year which is significantly lower<br />

than the peak season capacity utilization.<br />

DESCRIPTION <strong>OF</strong> PROPERTY<br />

<strong>In<strong>for</strong>mation</strong> in respect of Plants and Property<br />

The Company has set up its factory at Rajabari, Sreepur, Gazipur. The factory is situated on a tract of land<br />

measuring about 21 acres only 1000 ft off the 30 ft wide Dhaka-Kapasia high-way connected by road, rail &<br />

river which offer easiest and economic transport <strong>for</strong> both way movement of materials and finished goods. The<br />

project site level is about 10 ft higher above the highest flood level so far recorded. The factory is surrounded<br />

by <strong>for</strong>est creating a natural aesthetic beauty. In addition, in order to make the factory more environmental<br />

friendly, about 1000 timber plants have been sowed/planted inside and around the factory.<br />

The existing factory buildings, made of pre-fabricated steel, and civil constructions including, office-blocks,<br />

guest house, cafeteria, labour office, sanitary blocks, medical centre, pump-house, generator block, effluent<br />

system and incineration treatment facilities, internal roads (106,185 sft) & drainages, foot-path, boundary<br />

wall/fencing, gardens etc. occupy about 42% of the total land mass leaving scope <strong>for</strong> substantial expansion in<br />

various areas of goods and service. The existing total covered area <strong>for</strong> production & warehouses is about<br />

2,10,000 sft. The Company has constructed its own link road from factory site to the Dhaka-Kapasia high way.<br />

The buildings and civil construction facilities are of top quality materials with aesthetic architectural designs<br />

con<strong>for</strong>ming to the natural beauty of the site.<br />

INFORMATION DOCUMENT Page 19 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

Fixed Assets<br />

The Company possesses the following fixed assets :<br />

Sl. No. Name of Assets<br />

1 Land<br />

2 Building<br />

3 Plant<br />

4 Machinery & Equipment<br />

5 Electric & Other appliances<br />

6 Furniture & Fixture<br />

7 Vehicle<br />

8 Deep Tube-well<br />

Condition of property<br />

The conditions of the above property are physically good.<br />

Ownership of property<br />

The Company is the legal and absolute owner of all the fixed assets and properties.<br />

Lien status<br />

The tangible assets of the company are mortgaged to one of the lending banks’ namely Standard Chartered<br />

Bank against borrowing facilities enjoyed from them.<br />

Leased property<br />

The company doesn’t have any lease property.<br />

The written down value of the property, plant and equipment of the Company as of 30 June 2008 is as<br />

follows:<br />

(Amount in Taka)<br />

Sl.<br />

Written down value as<br />

Name of Assets<br />

No.<br />

of 30 June 2008<br />

1 Land 77,758,688<br />

Unit-1 73,689,139<br />

2 Building<br />

Unit-2 13,895,612<br />

Unit-3 12,883,220<br />

Sub-total 100,467,971<br />

Unit-1 18,804,425<br />

3 Plant<br />

Unit-2 49,015,144<br />

Unit-3 16,452,803<br />

Sub-total 84,272,372<br />

Unit-1 3,978,352<br />

4 Machinery & Equipment<br />

Unit-2 1,076,450<br />

Unit-3 255,788<br />

Sub-total 5,310,590<br />

Unit-1 2,888,961<br />

5 Electric & Other Appliance<br />

Unit-2 2,247,553<br />

Unit-3 1,901,668<br />

Sub-total 7,038,182<br />

Unit-1 1,788,304<br />

6 Furniture & Fixture<br />

Unit-2 3,098,192<br />

Unit-3 486,849<br />

Sub-total 5,373,345<br />

7 Vehicles Unit-1 663,530<br />

8 Deep Tube-well Unit- 1 20,400<br />

Total 280,905,078<br />

INFORMATION DOCUMENT Page 20 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

PLAN <strong>OF</strong> OPERATION AND DISCUSSION <strong>OF</strong> FINANCIAL CONDITIONS<br />

Internal and external sources of cash<br />

Internal Sources:<br />

(Amount in Taka)<br />

Particulars 01.01.08<br />

to<br />

30.06.08<br />

01.01.07<br />

to<br />

31.12.07<br />

01.01.06<br />

to<br />

31.12.06<br />

01.01.05<br />

to<br />

31.12.05<br />

01.01.04<br />

to<br />

31.12.04<br />

01.01.03<br />

to<br />

31.12.03<br />

Paid-up Capital 250,000,000 250,000,000 250,000,000 250,000,000 250,000,000 66,000,000<br />

Share Money<br />

- - - - - 14,500,000<br />

Deposit<br />

Revaluation 65,495,689 65,495,689 65,495,689 65,495,689 65,495,689 -<br />

Reserve<br />

Tax Holiday<br />

- - 39,635,436 30,209,027 13,323,809 85,763,329<br />

Reserve<br />

Retained Earnings 373,578,114 278,771,668 173,611,158 115,769,982 55,031,802 97,770,765<br />

Total 689,073,803 594,267,357 528,742,283 461,474,698 383,851,300 264,034,094<br />

External Sources:<br />

(Amount in Taka)<br />

Particulars 01.01.08<br />

to<br />

30.06.08<br />

01.01.07<br />

to<br />

31.12.07<br />

01.01.06<br />

to<br />

31.12.06<br />

01.01.05<br />

to<br />

31.12.05<br />

01.01.04<br />

to<br />

31.12.04<br />

01.01.03<br />

to<br />

31.12.03<br />

Long Term Loan - - - - - 3,750,000<br />

Deff. Tax Liability 74,856,290 76,787,324 77,049,191 73,152,354 67,804,115 -<br />

Total 74,856,290 76,787,324 77,049,191 73,152,354 67,804,115 3,750,000<br />

Material Commitments <strong>for</strong> Capital Expenditures<br />

The material commitments in terms of development activities with estimated cost, sources of fund, year of<br />

completion of the project with other relevant in<strong>for</strong>mation are shown as follows:<br />

(Amount in Taka)<br />

Sl.<br />

No.<br />

Name of Projects Cost Sources of Fund Year of<br />

Completion<br />

1 M Coil Expansion Project 30,770,480 Short Term Loan December 2008<br />

2 Gas Generator 26,486,000 Short Term Loan December 2008<br />

3 Gas Line Connection 47,58,103 Short Term Loan December 2008<br />

4 Jet Printer 2,500,000 Short Term Loan December 2008<br />

5 CC & PH 6,799,742 Short Term Loan December 2008<br />

Total 71,314,325<br />

INFORMATION DOCUMENT Page 21 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

Causes of any material changes in income, cost of goods sold, other operating expenses and net income<br />

Particulars<br />

01.01.08<br />

to<br />

30.06.08<br />

01.01.07<br />

to<br />

31.12.07<br />

01.01.06<br />

to<br />

31.12.06<br />

01.01.05<br />

to<br />

31.12.05<br />

(Amount in Taka)<br />

01.01.04 01.01.03<br />

to<br />

to<br />

31.12.04 31.12.03<br />

Sale 1,069,475,034 1,383,118,708 923,862,592 807,101,129 716,849,826 649,772,561<br />

Cost of goods sold 854,681,630 1,170,928,968 743,306,060 631,958,750 527,878,463 530,832,577<br />

Operating profit 214,793,404 212,189,740 180,556,532 175,142,379 188,971,363 118,939,984<br />

Other income (Non-<br />

Operating)<br />

2,108,484 1,187,728 850,980 (30,646) 1,804,216 1,222,309<br />

Total income 216,901,888 213,377,468 181,407,512 175,111,734 190,775,579 120,162,293<br />

Administrative, selling<br />

and distribution<br />

23,375,569 52,727,239 52,615,437 41,661,924 81,708,092 8,917,997<br />

expenses<br />

Financial costs 35,446,938 41,794,221 20,408,472 17,690,192 15,588,105 15,741,103<br />

Profit be<strong>for</strong>e<br />

contribution to WPPF<br />

158,079,381 118,856,008 108,383,603 115,759,618 93,479,382 95,503,193<br />

Provision <strong>for</strong><br />

contribution to WPPF<br />

7,903,968 5,942,801 5,419,180 5,787,981 4,673,969 4,923,115<br />

Net profit be<strong>for</strong>e tax 150,175,413 112,913,207 102,964,423 109,971,637 88,805,413 90,580,078<br />

Tax expenses 55,368,966 47,388,133 35,696,837 32,348,239 24,058,189 13,141,687<br />

Profit after tax 94,806,447 65,525,074 67,267,586 77,623,398 64,747,224 77,438,391<br />

The income of the Company has been increasing gradually without any significant fluctuation due to<br />

expansion of sales network, cost control and customers’ demand as well as efficient and effective measures<br />

taken by the management to its business.<br />

Seasonal aspect of business<br />

There are seasonal impact on few products, which are as follows :<br />

‣ Crop Care & Public Health - due to change in season and crop pattern.<br />

‣ Mosquito repellant- demand varies with weather and climate change.<br />

Known trends, events or uncertainties<br />

There is known tends in increasing demand <strong>for</strong> Company’s products because of crop pattern and seasonal<br />

variation. However uncertainties may arise from government policy, increased competition, natural<br />

calamities and political unrest.<br />

Changes in the assets to pay off liabilities<br />

None of the operating assets has been disposed off to pay off any liabilities of the Company.<br />

Loans taken from the holding/subsidiary company or loans given to those companies<br />

The company did neither take any loan from nor give any loan to its holding company during the last five<br />

years.<br />

Future contractual liabilities<br />

The Company is envisaging <strong>for</strong> future capital expenditure by setting up two projects namely –<br />

i) Sulpher 80 WDG<br />

ii) NPKS Fertilizer<br />

The above projects will be financed through bank loan.<br />

INFORMATION DOCUMENT Page 22 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

Estimated amount of future Capital Expenditure<br />

The Company has plan <strong>for</strong> future capital expenditure other than stated earlier under captioned “Material<br />

commitment <strong>for</strong> capital expenditure”. The detail of the future capital expenditure is given below:<br />

i) Name of the Project: Sulpher 80 WDG<br />

a. Products:<br />

Sulpher 80 WDG<br />

b. Production Capacity & Utilization<br />

UNIT<br />

Qty<br />

Capacity/yearly MT 4,500<br />

Production/yearly (initial) MT 2,000<br />

Utilization % 45<br />

The capacity utilization reflects average production throughout the year which is significantly lower than the<br />

peak season capacity utilization.<br />

c. Market<br />

Being an agricultural country, Bangladesh is very much dependent on fertilizer to produce various types of<br />

crops. The demand of food, protein and agricultural inputs including crop protection chemicals are increasing<br />

very significantly. Our soil is in extreme need of micronutrient and fertilizer. Sulpher 80 WDG is an important<br />

micronutrient <strong>for</strong> most of the crops and the usages of Sulpher 80 WDG is growing rapidly over the years.<br />

The total market demand of Sulpher 80 WDG in 2008 is estimated at 8,500 MT and the growth is around 20%<br />

over the last few years. Since the total market demand is fulfilled through import, there is a wide scope <strong>for</strong><br />

local manufacturer to enter into this business to meet local demand. The establishment of such manufacturing<br />

plant will be able to decrease our <strong>for</strong>eign dependency on Sulpher. Moreover, the local manufacturers will<br />

enjoy a significant value addition to this product compared to importing from outside. <strong>ACI</strong>FL is capable to<br />

serve this market through establishing modern manufacturing facilities to produce Sulpher. <strong>ACI</strong>FL will<br />

market this product along with other agricultural products that it is already marketing.<br />

d. Project Cost and Mode of finance<br />

i. Project Cost<br />

Particulars<br />

Taka<br />

Land and Land development 4,000,000<br />

Building & Civil Works 32,000,000<br />

Plant & Machinery 80,000,000<br />

Preliminary & others 17,573,140<br />

Total Fixed Cost 133,573,140<br />

Working Capital 1,897,008<br />

Total Project Cost 135,470,148<br />

ii. Mode of Finance<br />

Own fund -<br />

Project Loan 135,470,148<br />

135,470,148<br />

Debt/ Equity Ratio 1 : 0<br />

INFORMATION DOCUMENT Page 23 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

e. Projected Income Statement Figures in Million Taka.<br />

Year-1 Year-2 Year-3<br />

Net Sales 213.00 290.00 375.00<br />

Cost of Goods Sold (87.16) (112.31) (137.46)<br />

Gross Margin 125.84 177.69 237.54<br />

Admin, Selling & Distribution Expenses (76.68) (104.40) (135.00)<br />

Profit be<strong>for</strong>e Interest and Tax 49.16 73.29 102.54<br />

Interest Expenses (23.15) (22.75) (22.11)<br />

Profit be<strong>for</strong>e WPPF & Tax 26.01 50.54 80.43<br />

Provision <strong>for</strong> WPPF (1.30) (2.53) (4.02)<br />

Profit be<strong>for</strong>e Tax 24.71 48.01 76.41<br />

Taxation (6.92) (13.44) (21.39)<br />

Profit after tax 17.79 34.57 55.02<br />

Gross Profit to Sales-% 59% 61% 63%<br />

Net Profit Be<strong>for</strong>e Tax to Sales-% 23% 25% 27%<br />

Net Profit to Sales-% 8% 12% 15%<br />

f. Implementation schedule of the project is as follows :<br />

ID<br />

Task Name<br />

May<br />

08<br />

Jun<br />

08<br />

Jul<br />

08<br />

Aug<br />

08<br />

Sep<br />

08<br />

Oct<br />

08<br />

Nov<br />

08<br />

Dec<br />

08<br />

Jan<br />

09<br />

Feb<br />

09<br />

Mar<br />

09<br />

Apr<br />

09<br />

A LAND PROCUREMENT<br />

1 Location Finalization<br />

2 Land Development<br />

B<br />

LAYOUT & DESIGN<br />

DEVELOPMENT<br />

1 Layout of the Factory<br />

2 Structural Drawing<br />

3 Machinery Drawing<br />

4 Prequalification of Contractor<br />

BOQ & work order to the<br />

5<br />

contractor<br />

C CIVIL CONSTRUCTION<br />

1 Civil Construction<br />

2 Electrification<br />

3 Drainage & Plumbing<br />

D MACHINERY PROCUREMENT<br />

1 Selection of the Machinery<br />

2 L/C Opening/Advance<br />

3 Shipment of the Machinery<br />

4 Arrival of Machinery<br />

5 Erection of Machinery<br />

6 Commissioning of the plant<br />

7 Trial Production<br />

8 Commercial Production<br />

INFORMATION DOCUMENT Page 24 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

ID<br />

Task Name<br />

May<br />

08<br />

Jun<br />

08<br />

Jul<br />

08<br />

Aug<br />

08<br />

Sep<br />

08<br />

Oct<br />

08<br />

Nov<br />

08<br />

Dec<br />

08<br />

Jan<br />

09<br />

Feb<br />

09<br />

Mar<br />

09<br />

Apr<br />

09<br />

E DEVELOPMENT <strong>OF</strong> RM/PM<br />

1 Qualitative & Quantitative Survey<br />

2 Pack Design<br />

3 Finalizing the RM/PM<br />

4 Order Placement <strong>for</strong> RM/PM<br />

5 Supply receive of the RM/PM<br />

F<br />

REGULATORY PERMITS<br />

1 Environmental Clearance<br />

2 Necessary Licenses<br />

ii) Name of the Project: NPKS Fertilizer<br />

a. Products:<br />

Compound Fertilizer NPKS<br />

b. Production Capacity & Utilization<br />

UNIT<br />

Qty<br />

Capacity/yearly MT 100,000<br />

Production/yearly (initial) MT 40,000<br />

Utilization % 40%<br />

The capacity utilization reflects average production throughout the year which is significantly lower than the<br />

peak season capacity utilization.<br />

c. Market<br />

The use of compound (NPKS) fertilizer is scientific, economic and beneficial <strong>for</strong> the crop. NPKS is a<br />

compound of fertilizers like TSP, Urea, DAP, MOP and Gypsum, which are mixed in certain ratio. It helps<br />

crop to have nutrient like nitrogen, phosphorus, Potassium and Sulpher altogether in a balanced way. Due to<br />

lower cost and easier application process, the use of the NPKS is increasing day by day. The total market of<br />

NPKS in 2007 was 400,000 MT with 30% average growth. The current local production of NPKS is 300,000 MT<br />

and the remaining balance of the quantity is imported to meet the demand. Due to crop diversification and<br />

comparing intensity, it is expected that the demand of the NPKS will continue to grow. Being market leader in<br />

the crop protection sector and having advantage of its strong distribution network, <strong>ACI</strong>FL will be able to<br />

capture substantial market share and help farmer with superior product quality. <strong>ACI</strong>FL will produce 100,000<br />

MT NPKS yearly, which will cover 25 % of the total market.<br />

d. Project Cost and Mode of finance<br />

i<br />

Project Cost<br />

Particulars<br />

Taka<br />

Land and land development 15,000,000<br />

Building & Civil Works 55,000,000<br />

Plant & Machinery 91,390,000<br />

Furniture 1,000,000<br />

Erection and Installation 10,000,000<br />

Lab and Bridge 6,000,000<br />

Vehicles 14,860,000<br />

Contingency and others 2,000,000<br />

Total fixed cost 195,250,000<br />

Working capital 81,620,417<br />

Total Project Cost 276,870,417<br />

INFORMATION DOCUMENT Page 25 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

ii<br />

Particulars<br />

Taka<br />

Mode of Finance<br />

Equity -<br />

Project Loan 276,870,417<br />

Debt/ Equity Ratio 1 : 0<br />

e. Projected Income Statement<br />

Figure in Million Taka<br />

Year-1 Year-2 Year-3<br />

Net Sales 1,200.00 1,680.00 2,025.00<br />

Cost of Goods Sold (1,020.00) (1428.00) (1721.25)<br />

Gross Margin 180.00 252.00 303.75<br />

Admin, Selling & Distribution Expenses (42.00) (61.60) (67.20)<br />

Profit be<strong>for</strong>e Interest and Tax 84.00 117.60 131.62<br />

Interest Expenses (54.21) (60.66) (62.84)<br />

Profit be<strong>for</strong>e WPPF & Tax 41.78 73.73 109.27<br />

Provision <strong>for</strong> WPPF (2.08) (3.68) (5.46)<br />

Profit be<strong>for</strong>e Tax 39.69 70.04 103.81<br />

Taxation (11.11) (19.61) (29.06)<br />

Profit after tax 28.57 50.43 74.74<br />

Gross Profit to Sales-% 15.00% 15.00% 15.00%<br />

Net Profit Be<strong>for</strong>e Tax to Sales-% 3.31% 4.17% 5.13%<br />

Net Profit to Sales-% 2.38% 3.00% 3.69%<br />

f. Implementation schedule of the project is as follows:<br />

ID<br />

Task Name<br />

Jan<br />

09<br />

Feb<br />

09<br />

Mar<br />

09<br />

Apr<br />

09<br />

May<br />

09<br />

Jun<br />

09<br />

Jul<br />

09<br />

Aug<br />

09<br />

Sep<br />

09<br />

Oct<br />

09<br />

Nov<br />

09<br />

Dec<br />

09<br />

A<br />

LAND<br />

PROCUREMENT<br />

1 Location Finalization<br />

2 Land Development<br />

B<br />

LAYOUT & DESIGN<br />

DEVELOPMENT<br />

1 Layout of the Factory<br />

2 Structural Drawing<br />

3 Machinery Drawing<br />

4<br />

5<br />

Prequalification of<br />

Contractor<br />

BOQ & work order to the<br />

contractor<br />

C CIVIL CONSTRUCTION<br />

1 Civil Construction<br />

2 Electrification<br />

3 Drainage & Plumbing<br />

INFORMATION DOCUMENT Page 26 of 89 <strong>ACI</strong> <strong>FORMULATIONS</strong> LIMITED

ID<br />

D<br />

Task Name<br />

MACHINERY<br />

PROCUREMENT<br />

Jan<br />

09<br />

Feb<br />

09<br />

Mar<br />

09<br />

Apr<br />

09<br />

May<br />

09<br />

Jun<br />

09<br />

Jul<br />

09<br />

Aug<br />

09<br />

Sep<br />

09<br />

Oct<br />

09<br />

Nov<br />

09<br />

Dec<br />

09<br />

1 Selection of the Machinery<br />

2 L/C Opening/Advance<br />

3<br />

Shipment of the<br />

Machinery<br />

4 Arrival of Machinery<br />

5 Erection of Machinery<br />

6<br />

Commissioning of the<br />

plant<br />

7 Trial Production<br />

8 Commercial Production<br />

E<br />

DEVELOPMENT <strong>OF</strong><br />

RM/PM<br />

1<br />

Qualitative & Quantitative<br />

Survey<br />

2 Pack Design<br />

3 Finalizing the RM/PM<br />

4<br />

5<br />

Order Placement <strong>for</strong><br />

RM/PM<br />

Supply receive of the<br />

RM/PM<br />

F<br />

1<br />

REGULATORY<br />

PERMITS<br />