Financial Statements - International Planned Parenthood Federation

Financial Statements - International Planned Parenthood Federation

Financial Statements - International Planned Parenthood Federation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

60 IPPF <strong>Financial</strong> <strong>Statements</strong> 2009<br />

20 Pension schemes (continued)<br />

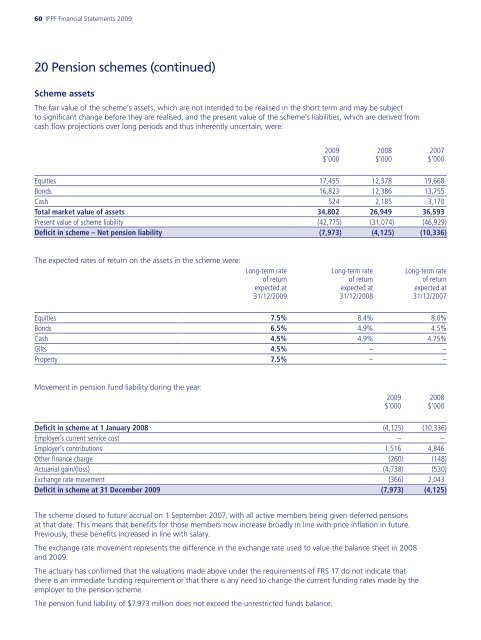

Scheme assets<br />

The fair value of the scheme’s assets, which are not intended to be realised in the short term and may be subject<br />

to significant change before they are realised, and the present value of the scheme’s liabilities, which are derived from<br />

cash flow projections over long periods and thus inherently uncertain, were:<br />

2009<br />

$’000<br />

2008<br />

$’000<br />

2007<br />

$’000<br />

Equities 17,455 12,378 19,668<br />

Bonds 16,823 12,386 13,755<br />

Cash 524 2,185 3,170<br />

Total market value of assets 34,802 26,949 36,593<br />

Present value of scheme liability (42,775) (31,074) (46,929)<br />

Deficit in scheme – Net pension liability (7,973) (4,125) (10,336)<br />

The expected rates of return on the assets in the scheme were:<br />

Long-term rate<br />

of return<br />

expected at<br />

31/12/2009<br />

Long-term rate<br />

of return<br />

expected at<br />

31/12/2008<br />

Long-term rate<br />

of return<br />

expected at<br />

31/12/2007<br />

Equities 7.5% 8.4% 8.0%<br />

Bonds 6.5% 4.9% 4.5%<br />

Cash 4.5% 4.9% 4.75%<br />

Gilts 4.5% – –<br />

Property 7.5% – –<br />

Movement in pension fund liability during the year:<br />

2009<br />

$’000<br />

2008<br />

$’000<br />

Deficit in scheme at 1 January 2008 (4,125) (10,336)<br />

Employer’s current service cost – –<br />

Employer’s contributions 1,516 4,846<br />

Other finance charge (260) (148)<br />

Actuarial gain/(loss) (4,738) (530)<br />

Exchange rate movement (366) 2,043<br />

Deficit in scheme at 31 December 2009 (7,973) (4,125)<br />

The scheme closed to future accrual on 1 September 2007, with all active members being given deferred pensions<br />

at that date. This means that benefits for those members now increase broadly in line with price inflation in future.<br />

Previously, these benefits increased in line with salary.<br />

The exchange rate movement represents the difference in the exchange rate used to value the balance sheet in 2008<br />

and 2009.<br />

The actuary has confirmed that the valuations made above under the requirements of FRS 17 do not indicate that<br />

there is an immediate funding requirement or that there is any need to change the current funding rates made by the<br />

employer to the pension scheme.<br />

The pension fund liability of $7.973 million does not exceed the unrestricted funds balance.