Ataskaita patvirtinta taisyta.indd - Lietuvos Respublikos muitinė

Ataskaita patvirtinta taisyta.indd - Lietuvos Respublikos muitinė

Ataskaita patvirtinta taisyta.indd - Lietuvos Respublikos muitinė

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

LITHUANIAN CUSTOMS 2006<br />

of enterprises wishing to perform and (or) performing the simplified procedures, controls on request of the institutions<br />

of foreign countries or other institutions are obligatory).<br />

4 joint controls with STI, in the course of which 46 500 LTL of taxes were assessed, were accomplished. Information<br />

on violations made by 246 enterprises and disclosed on performing the controls of their business and commercial activities<br />

was also transferred to STI.<br />

Tariff Classification and Control of Goods<br />

One of the most important factors making impact on taxes administered by the Customs is tariff measures.<br />

The post–clearance control of import Single Administrative Documents (SAD) is constantly performed at the<br />

territorial Customs offices with a view to verifying the correctness of the classification, origin of goods, application of tax<br />

rates. In 2006, 58 000 of goods were checked, 8 000 000 LTL were assessed additionally.<br />

One of the ways to control the classification of goods is taking samples of goods during Customs clearance in order to<br />

check the accuracy of the commodity codes indicated in a declaration.<br />

Samples of goods are classified by drawing up Goods Classification Statements (further – GCS).<br />

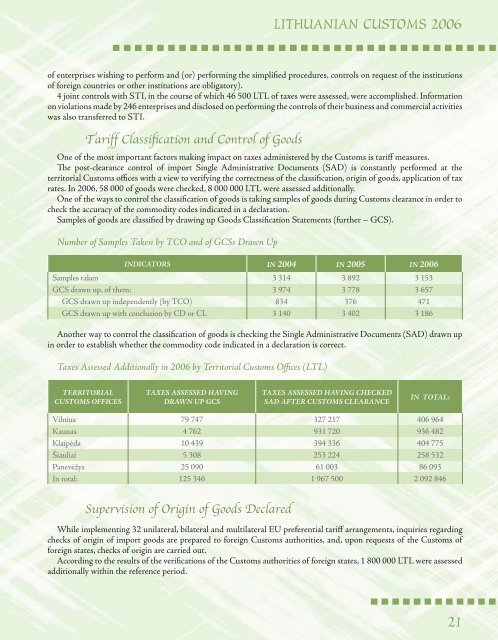

Number of Samples Taken by TCO and of GCSs Drawn Up<br />

INDICATORS IN 2004 IN 2005 IN 2006<br />

Samples taken 3 314 3 892 3 153<br />

GCS drawn up, of them: 3 974 3 778 3 657<br />

GCS drawn up independently (by TCO) 834 376 471<br />

GCS drawn up with conclusion by CD or CL 3 140 3 402 3 186<br />

Another way to control the classification of goods is checking the Single Administrative Documents (SAD) drawn up<br />

in order to establish whether the commodity code indicated in a declaration is correct.<br />

Taxes Assessed Additionally in 2006 by Territorial Customs Offices (LTL)<br />

TERRITORIAL<br />

CUSTOMS OFFICES<br />

TAXES ASSESSED HAVING<br />

DRAWN UP GCS<br />

TAXES ASSESSED HAVING CHECKED<br />

SAD AFTER CUSTOMS CLEARANCE<br />

IN TOTAL:<br />

Vilnius 79 747 327 217 406 964<br />

Kaunas 4 762 931 720 936 482<br />

Klaipėda 10 439 394 336 404 775<br />

Šiauliai 5 308 253 224 258 532<br />

Panevėžys 25 090 61 003 86 093<br />

In total: 125 346 1 967 500 2 092 846<br />

Supervision of Origin of Goods Declared<br />

While implementing 32 unilateral, bilateral and multilateral EU preferential tariff arrangements, inquiries regarding<br />

checks of origin of import goods are prepared to foreign Customs authorities, and, upon requests of the Customs of<br />

foreign states, checks of origin are carried out.<br />

According to the results of the verifications of the Customs authorities of foreign states, 1 800 000 LTL were assessed<br />

additionally within the reference period.<br />

21