2010-11_ANNUAL_REPORTS_-_FINAL_VERSION_(3)

2010-11_ANNUAL_REPORTS_-_FINAL_VERSION_(3)

2010-11_ANNUAL_REPORTS_-_FINAL_VERSION_(3)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

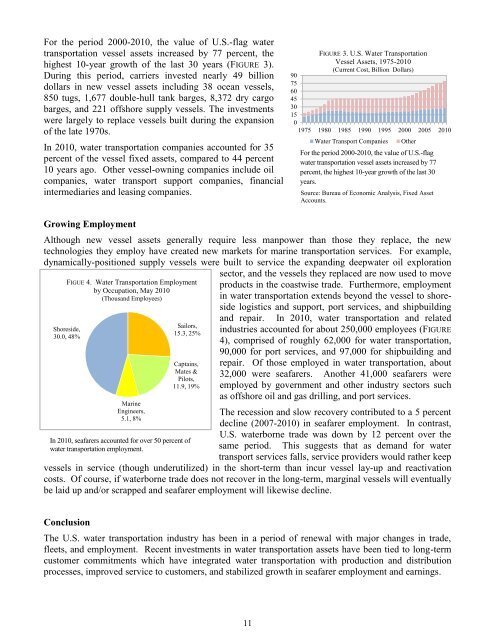

For the period 2000-<strong>2010</strong>, the value of U.S.-flag water<br />

transportation vessel assets increased by 77 percent, the<br />

highest 10-year growth of the last 30 years (FIGURE 3).<br />

During this period, carriers invested nearly 49 billion<br />

dollars in new vessel assets including 38 ocean vessels,<br />

850 tugs, 1,677 double-hull tank barges, 8,372 dry cargo<br />

barges, and 221 offshore supply vessels. The investments<br />

were largely to replace vessels built during the expansion<br />

of the late 1970s.<br />

In <strong>2010</strong>, water transportation companies accounted for 35<br />

percent of the vessel fixed assets, compared to 44 percent<br />

10 years ago. Other vessel-owning companies include oil<br />

companies, water transport support companies, financial<br />

intermediaries and leasing companies.<br />

FIGURE 3. U.S. Water Transportation<br />

Vessel Assets, 1975-<strong>2010</strong><br />

(Current Cost, Billion Dollars)<br />

90<br />

75<br />

60<br />

45<br />

30<br />

15<br />

0<br />

1975 1980 1985 1990 1995 2000 2005 <strong>2010</strong><br />

Water Transport Companies<br />

Other<br />

For the period 2000-<strong>2010</strong>, the value of U.S.-flag<br />

water transportation vessel assets increased by 77<br />

percent, the highest 10-year growth of the last 30<br />

years.<br />

Source: Bureau of Economic Analysis, Fixed Asset<br />

Accounts.<br />

Growing Employment<br />

Although new vessel assets generally require less manpower than those they replace, the new<br />

technologies they employ have created new markets for marine transportation services. For example,<br />

dynamically-positioned supply vessels were built to service the expanding deepwater oil exploration<br />

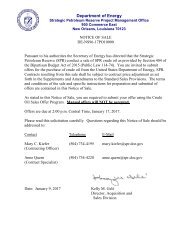

FIGUE 4. Water Transportation Employment<br />

by Occupation, May <strong>2010</strong><br />

(Thousand Employees)<br />

Shoreside,<br />

30.0, 48%<br />

Marine<br />

Engineers,<br />

5.1, 8%<br />

Sailors,<br />

15.3, 25%<br />

Captains,<br />

Mates &<br />

Pilots,<br />

<strong>11</strong>.9, 19%<br />

In <strong>2010</strong>, seafarers accounted for over 50 percent of<br />

water transportation employment.<br />

sector, and the vessels they replaced are now used to move<br />

products in the coastwise trade. Furthermore, employment<br />

in water transportation extends beyond the vessel to shoreside<br />

logistics and support, port services, and shipbuilding<br />

and repair. In <strong>2010</strong>, water transportation and related<br />

industries accounted for about 250,000 employees (FIGURE<br />

4), comprised of roughly 62,000 for water transportation,<br />

90,000 for port services, and 97,000 for shipbuilding and<br />

repair. Of those employed in water transportation, about<br />

32,000 were seafarers. Another 41,000 seafarers were<br />

employed by government and other industry sectors such<br />

as offshore oil and gas drilling, and port services.<br />

The recession and slow recovery contributed to a 5 percent<br />

decline (2007-<strong>2010</strong>) in seafarer employment. In contrast,<br />

U.S. waterborne trade was down by 12 percent over the<br />

same period. This suggests that as demand for water<br />

transport services falls, service providers would rather keep<br />

vessels in service (though underutilized) in the short-term than incur vessel lay-up and reactivation<br />

costs. Of course, if waterborne trade does not recover in the long-term, marginal vessels will eventually<br />

be laid up and/or scrapped and seafarer employment will likewise decline.<br />

Conclusion<br />

The U.S. water transportation industry has been in a period of renewal with major changes in trade,<br />

fleets, and employment. Recent investments in water transportation assets have been tied to long-term<br />

customer commitments which have integrated water transportation with production and distribution<br />

processes, improved service to customers, and stabilized growth in seafarer employment and earnings.<br />

<strong>11</strong>