Bank Loan/Client Rating - Credit Rating Agency of Bangladesh

Bank Loan/Client Rating - Credit Rating Agency of Bangladesh

Bank Loan/Client Rating - Credit Rating Agency of Bangladesh

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Bank</strong> <strong>Loan</strong>/<strong>Client</strong> <strong>Rating</strong><br />

Proposal for <strong>Loan</strong>/<strong>Client</strong> <strong>Rating</strong> Service<br />

ABOUT CRAB<br />

<strong>Credit</strong> <strong>Rating</strong><br />

<strong>Agency</strong> <strong>of</strong><br />

<strong>Bangladesh</strong> Ltd<br />

Sena Kalyan Bhaban,<br />

Suite No: 403, Flr: 4th<br />

195 Motijheel C/A.<br />

Dhaka 1000<br />

Phone: 9571238,<br />

9571497, 9553254,<br />

Fax: (8802)9563837<br />

Email<br />

crab@intechworld.net<br />

info@crab.com.bd<br />

Web<br />

www.crab.com.bd<br />

Contact<br />

H S Sohrawardhi<br />

Vice President<br />

01713032807<br />

hss@crab.com.bd<br />

<strong>Credit</strong> <strong>Rating</strong> <strong>Agency</strong> <strong>of</strong> <strong>Bangladesh</strong> Limited (CRAB) was set up in 2003 by<br />

leading financial/investment institutions and individuals as an independent and<br />

pr<strong>of</strong>essional full service <strong>Credit</strong> <strong>Rating</strong> <strong>Agency</strong>. ICRA Ltd, India subsidiary <strong>of</strong><br />

international <strong>Credit</strong> <strong>Rating</strong> <strong>Agency</strong> Moody's Investors Service, USA is the<br />

technical partner <strong>of</strong> CRAB. CRAB is a Public Limited Company.<br />

Mr. M. Syeduzzaman, former Finance Minister, is the Chairman <strong>of</strong> the<br />

Company. Mr. Md. Matiul Islam, former Finance Secretary is the Vice<br />

Chairman. Among the Directors are Mr. Samson H Chowdhury, Mr. Syed<br />

Manzur Elahi, Mr. Anis-Ud-Dowla, Mr. A K M Rafiqul Islam, Mr. M. Haider<br />

Chowdhury, Mr. ASM Quasem, Mr. M. Faizur Rahman etc.<br />

Mr. Hamidul Huq, former MD <strong>of</strong> United Commercial <strong>Bank</strong> Ltd is the Managing<br />

Director <strong>of</strong> CRAB. He is aided by a pool <strong>of</strong> experienced and trained<br />

pr<strong>of</strong>essionals.<br />

CRAB’s ratings are awarded by an independent rating committee comprising <strong>of</strong><br />

former Deputy Governors <strong>of</strong> <strong>Bangladesh</strong> <strong>Bank</strong>, former Comptroller & Auditor<br />

Generals, noted economists, former Chairman <strong>of</strong> Securities & Exchange<br />

Commission, Islami <strong>Bank</strong> specialist etc.<br />

CRAB has conducted more than 200 credit rating assignments in various<br />

industrial and business sectors and is presently the leading credit rating agency<br />

<strong>of</strong> the country.<br />

ECAI Status<br />

In April 2009, <strong>Bangladesh</strong> <strong>Bank</strong> accredited <strong>Credit</strong> <strong>Rating</strong> <strong>Agency</strong> <strong>of</strong> <strong>Bangladesh</strong><br />

Ltd as an External <strong>Credit</strong> Assessment Institution (ECAI). Under the<br />

standardized approach for calculating risk weighted assets against credit risk, the<br />

credit rating is to be determined on the basis <strong>of</strong> risk pr<strong>of</strong>ile assessed by the<br />

ECAIs. <strong>Bank</strong>s will use the ratings <strong>of</strong> the ECAIs and corresponding risk weight for<br />

calculating RWA for credit risk under the standardized approach.<br />

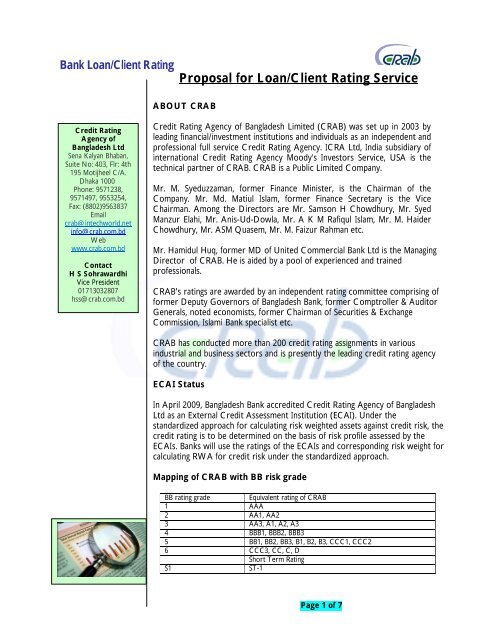

Mapping <strong>of</strong> CRAB with BB risk grade<br />

BB rating grade<br />

Equivalent rating <strong>of</strong> CRAB<br />

1 AAA<br />

2 AA1, AA2<br />

3 AA3, A1, A2, A3<br />

4 BBB1, BBB2, BBB3<br />

5 BB1, BB2, BB3, B1, B2, B3, CCC1, CCC2<br />

6 CCC3, CC, C, D<br />

Short Term <strong>Rating</strong><br />

S1<br />

ST-1<br />

Page 1 <strong>of</strong> 7

<strong>Bank</strong> <strong>Loan</strong>/<strong>Client</strong> <strong>Rating</strong><br />

S2<br />

S3<br />

S4<br />

S5<br />

S6<br />

ST-2<br />

ST-3<br />

ST-4<br />

ST-5<br />

ST-6<br />

<strong>Bank</strong> <strong>Loan</strong> <strong>Rating</strong><br />

CRAB <strong>of</strong>fers <strong>Bank</strong> <strong>Loan</strong> <strong>Rating</strong>s to various types <strong>of</strong> facilities provided by banks, such as<br />

working capital demand loans, cash credit, project loans, loans for general corporate<br />

purposes, and non-fund-based facilities. <strong>Bank</strong> loan ratings indicate the degree <strong>of</strong> risk with<br />

regard to timely payment <strong>of</strong> interest and principal on the facility being rated.<br />

<strong>Bangladesh</strong> <strong>Bank</strong> (BB) issued new guidelines on capital adequacy for banks. These guidelines<br />

require banks to link the minimum size <strong>of</strong> their capital to the credit risk in their portfolios.<br />

This is a departure from the present framework, under which banks calculate the minimum<br />

size <strong>of</strong> their capital as a proportion <strong>of</strong> the entire loan portfolio, regardless <strong>of</strong> the degree <strong>of</strong><br />

credit risk. To determine credit risk in their loan portfolios, banks will need to use credit<br />

ratings assigned by approved External <strong>Credit</strong> Assessment Institutions (ECAIs) such as CRAB.<br />

The <strong>Bank</strong> <strong>Loan</strong> <strong>Rating</strong> service from CRAB entails evaluating the capability <strong>of</strong> an issuer<br />

(borrower <strong>of</strong> a bank) to timely meet its debt obligations against a specific line <strong>of</strong> credit,<br />

in the light <strong>of</strong> the relevant terms, conditions and covenants. CRAB considers all relevant<br />

factors that have a bearing on the future cash generation and debt servicing ability <strong>of</strong> the<br />

issuer.<br />

These factors include:<br />

• Industry characteristics & regulations<br />

• Competitive position <strong>of</strong> the issuer<br />

• Operational efficiency<br />

• Management quality<br />

• Commitment to new projects<br />

• Securities and relationship<br />

• Strength <strong>of</strong> associate companies<br />

• Funding policies <strong>of</strong> the issuer<br />

A detailed analysis <strong>of</strong> past financial statements is made to assess performance under “real<br />

world” business dynamics. Estimates <strong>of</strong> future earnings over the next three to five years<br />

under various sensitivity scenarios are drawn up and evaluated against the claims and<br />

obligations that would require servicing. Primarily, it is the relative comfort on the level<br />

and quality <strong>of</strong> the issuer’s cash flows to service obligations that determines its rating.<br />

<strong>Bank</strong> <strong>Client</strong> <strong>Rating</strong><br />

CRAB also <strong>of</strong>fers entity ratings <strong>of</strong> different companies. CRAB has conducted more than<br />

hundred companies <strong>of</strong> different industries, including textile, telecom, engineering, agro<br />

processing, power, manufacturing, and service sector. The rating considers the overall<br />

position and credibility <strong>of</strong> an entity through analysis <strong>of</strong> the following factors:<br />

• Industry risk analysis<br />

• Business risk analysis<br />

• Operating environment<br />

• Financial Strength & Policies<br />

• Management<br />

• Corporate governance<br />

Page 2 <strong>of</strong> 7

<strong>Bank</strong> <strong>Loan</strong>/<strong>Client</strong> <strong>Rating</strong><br />

• Operating performance<br />

• Securities & Relationship risks<br />

About Basel II<br />

Basel II is recommendatory framework for banking supervision, issued by the Basel<br />

Committee on <strong>Bank</strong>ing Supervision in June 2004. The objective <strong>of</strong> Basel II is to bring about<br />

international convergence <strong>of</strong> capital measurement and standards in the banking system. The<br />

Basel Committee members who finalised the provisions are primarily representatives from<br />

the G10 countries, but several countries that are not represented on the committee have<br />

also stated their intent to adopt this framework.<br />

BB, in December 2008, has issued guidelines on the New Capital Adequacy Framework<br />

(BRPD Circular 09, dated 31.12.08) to banks operating in <strong>Bangladesh</strong>, based on the Basel II<br />

framework. These guidelines inform that BB suggests implementation <strong>of</strong> Basel II with the<br />

following approaches:<br />

i) standardised approach for calculating RWA against credit risk<br />

ii) standardised approach for calculating RWA against Market Risk; and<br />

iii) Basic indicator approach for calculating RWA against Operational Risk<br />

Under the standardised approach for measuring credit risks, the risk grades are determined<br />

on the basis <strong>of</strong> ratings assigned by the ECAIs.<br />

Risk Weights <strong>of</strong> Corporate Claims under Basel II<br />

CLAIMS ON<br />

CORPORATE<br />

(excluding equity<br />

exposures)<br />

<strong>Bangladesh</strong> <strong>Bank</strong><br />

<strong>Rating</strong> Grade<br />

Equivalent<br />

CRAB <strong>Rating</strong><br />

Risk Weight<br />

1 AAA 20<br />

2 AA1, AA2 50<br />

3,4 AA3, A1, A2, A3, 100<br />

BBB1, BBB2, BBB3<br />

5,6 BB1, BB2, BB3, B1, B2,<br />

B3, CCC1, CCC2<br />

CCC3, CC, C, D<br />

150<br />

Unrated - 125<br />

%<br />

Scope <strong>of</strong> Service: The services to be provided by CRAB will include initial rating<br />

and surveillance during use <strong>of</strong> the loan facility, also during the repayment period <strong>of</strong><br />

the loan facility. Surveillance will be done on an annual basis and will cover<br />

assessment <strong>of</strong> financial position as well as the quality <strong>of</strong> the corporate management<br />

<strong>of</strong> the client.<br />

<strong>Rating</strong> will be completed within 4-6 weeks and surveillance within 3-4 weeks from<br />

receipt <strong>of</strong> the data / information from the client<br />

Page 3 <strong>of</strong> 7

<strong>Bank</strong> <strong>Loan</strong>/<strong>Client</strong> <strong>Rating</strong><br />

Methodology: The methodology is based on the relevant Guidelines issued by the<br />

<strong>Bangladesh</strong> <strong>Bank</strong>. We have also included in the methodology criteria generally used<br />

by CRAB for rating <strong>of</strong> entities and instruments belonging to different industries and<br />

sectors. The methodology may be further revised to include the criteria used by<br />

your <strong>Bank</strong> and to address your particular needs.<br />

Information/Data Requirement: The requirements <strong>of</strong> the data have been<br />

identified in the light <strong>of</strong> the Guidelines and the methodology indicted above, which<br />

will be further revised in our standard process <strong>of</strong> validity testing.<br />

RATING FEE:<br />

Initial <strong>Rating</strong> Fee<br />

(Year 1)<br />

Surveillance/ Annual<br />

Review (From Year 2<br />

onwards)<br />

<strong>Bank</strong> <strong>Loan</strong>s/ Facility <strong>Rating</strong>s Long Term Exposures: Term <strong>Loan</strong>/Syndications<br />

(Both Funded & Non Funded)<br />

Limit Less than 20 crore Tk 2.0 Lac* Tk 1.60 Lac*<br />

Limit Above 20 crore & Less<br />

than 50 crore<br />

Limit Above 50 crore & Less<br />

than 100 crore<br />

Limit Above 100 crore<br />

Tk 2.0 Lac + .06% on<br />

limit above 20 crore<br />

Tk 3.80 Lac + .04% on<br />

limit above 50.0 crore<br />

Tk 5.80 Lac + .02% on<br />

limit above 100 crore<br />

Tk 1.60 Lac + .04% on<br />

limit above 20.0 crore<br />

Tk 2.80 Lac + .02% on<br />

limit above 50.0 crore<br />

Tk 3.80 Lac + .01% on<br />

limit above 100 crore<br />

Short Term Exposures: Working Capital (Both Funded & Non Funded)<br />

Limit Less than 20 crore Tk 1.50 Lac* Tk 1.0 Lac*<br />

Limit Above 20 crore & Less<br />

than 50 crore<br />

Limit Above 50 crore & Less<br />

than 100 crore<br />

Limit Above 100 crore<br />

Corporate Entity <strong>Rating</strong><br />

Tk 1.50 Lac + .05% on<br />

limit above 20 crore<br />

Tk 3.0 Lac + .03% on<br />

limit above 50.0 crore<br />

Tk 4.50 Lac + .01% on<br />

limit above 100 crore<br />

with asset size above Tk 75 crore Tk 5.50 Lac* Tk 4.0 Lac<br />

with asset size above 40 but less<br />

than 75 crore<br />

Tk 4.5 Lac<br />

Tk 1.0 Lac + .04% on limit<br />

above 20.0 crore<br />

Tk 2.20 Lac + .02% on<br />

limit above 50.0 crore<br />

Tk 3.20 Lac + .01% on<br />

limit above 100 crore<br />

Tk 3.0 Lac<br />

with asset size less than 40 crore Tk 3.50 Lac Tk 2.5 Lac<br />

Entity <strong>Rating</strong>s SME/ MFIs<br />

Asset size above Tk 20 crores Tk 3.0 Lac* Tk 2.5 Lac<br />

Asset size in the range <strong>of</strong> Tk 10<br />

crore to Tk 20 crores<br />

Tk 2.5 Lac<br />

Tk 2.0 Lac<br />

Asset size less than Tk 10 crores Tk 2.0 Lac Tk 1.5 Lac<br />

* <strong>Rating</strong> fees for more than 1 credit line/business unit will be negotiated<br />

in favour <strong>of</strong> the client.<br />

Page 4 <strong>of</strong> 7

<strong>Bank</strong> <strong>Loan</strong>/<strong>Client</strong> <strong>Rating</strong><br />

Special Arrangement with <strong>Bank</strong>s<br />

We <strong>of</strong>fer that <strong>Bank</strong>s would reach an MoU with CRAB for rating <strong>of</strong> their clients.<br />

Under the MoU <strong>Bank</strong>s will have the following privileges.<br />

• Assist <strong>Bank</strong>s in selecting exposures for rating<br />

• CRAB would <strong>of</strong>fer special rates to the clients <strong>of</strong> <strong>Bank</strong>s<br />

• CRAB would provide training workshops for the <strong>Bank</strong> <strong>of</strong>ficials to apply the<br />

Basel II guidelines in decision making<br />

• CRAB would arrange workshops fort <strong>Bank</strong> clients for familiarization <strong>of</strong> rating<br />

• CRAB would <strong>of</strong>fer special privileges to other rating requirements <strong>of</strong> the <strong>Bank</strong>,<br />

i.e. Entity <strong>Rating</strong>, Tier II Bonds etc.<br />

• CRAB pr<strong>of</strong>essionals would assist <strong>Bank</strong>s in transition to the IRB<br />

Agreement with <strong>Client</strong>s<br />

In accordance with our practice the client/obligor to be rated will have to sign an<br />

agreement with CRAB stipulating the terms <strong>of</strong> the ratings. The rating fee will be paid<br />

by the client (unless <strong>Bank</strong> wants to make the payment). The client will be<br />

responsible to supply the required information.<br />

<strong>Rating</strong> Process<br />

On demand by the <strong>Bank</strong> for rating <strong>of</strong> a client, CRAB on signing the agreement with<br />

client, will assign a team <strong>of</strong> analysts to perform the analysis. The rating team will<br />

collect the information and prepare the preliminary report for internal review. A<br />

draft report will then be given to the client, for their review. After getting feedback<br />

from client, the report will be revised accordingly, and will be presented to the<br />

independent <strong>Rating</strong> Committee. The <strong>Rating</strong> Committee will award the rating<br />

through a detailed discussion with the analysts. The rating award along with a<br />

detailed report containing the rationale and analysis will be given to the client.<br />

Page 5 <strong>of</strong> 7

<strong>Bank</strong> <strong>Loan</strong>/<strong>Client</strong> <strong>Rating</strong><br />

<strong>Rating</strong> Scale<br />

Long Term- Corporate<br />

AAA (Extremely Strong Capacity & Highest Quality)<br />

An obligor rated 'AAA' has extremely strong capacity to meet its financial commitments.<br />

'AAA' is the highest issuer credit rating assigned by CRAB. AAA is judged to be <strong>of</strong> the highest<br />

quality, with minimal credit risk.<br />

AA1, AA2, AA3 (Very Strong Capacity & Very High Quality)<br />

An obligor rated 'AA' has very strong capacity to meet its financial commitments. It differs<br />

from the highest-rated obligors only to a small degree. AA is judged to be <strong>of</strong> very high quality<br />

and is subject to very low credit risk.<br />

A1, A2, A3 (Strong Capacity & High Quality)<br />

An obligor rated 'A' has strong capacity to meet its financial commitments but is somewhat<br />

more susceptible to the adverse effects <strong>of</strong> changes in circumstances and economic conditions<br />

than obligors in higher-rated categories. A is judged to be <strong>of</strong> high quality and are subject to<br />

low credit risk.<br />

BBB1, BBB2, BBB3 Triple B (Adequate Capacity & Medium Quality)<br />

An obligor rated 'BBB' has adequate capacity to meet its financial commitments. However,<br />

adverse economic conditions or changing circumstances are more likely to lead to a<br />

weakened capacity <strong>of</strong> the obligor to meet its financial commitments. BBB is subject to<br />

moderate credit risk. They are considered medium-grade and as such may possess certain<br />

speculative characteristics.<br />

BB1, BB2, BB3 Double B (Inadequate Capacity & Substantial <strong>Credit</strong> Risk)<br />

An obligor rated 'BB' is less vulnerable in the near term than other lower-rated obligors.<br />

However, it faces major ongoing uncertainties and exposure to adverse business, financial, or<br />

economic conditions, which could lead to the obligor's inadequate capacity to meet its<br />

financial commitments. BB is judged to have speculative elements and is subject to substantial<br />

credit risk.<br />

B1, B2, B3 Single B (Weak Capacity & High <strong>Credit</strong> Risk)<br />

An obligor rated 'B' is more vulnerable than the obligors rated 'BB', but the obligor currently<br />

has the capacity to meet its financial commitments. Adverse business, financial, or economic<br />

conditions will likely impair the obligor's capacity or willingness to meet its financial<br />

commitments. B is considered speculative and weak capacity and is subject to high credit risk.<br />

CCC1, CCC2, CCC3 Triple C (Very Weak Capacity & Very High <strong>Credit</strong> Risk)<br />

An obligor rated 'CCC' is currently vulnerable, and is dependent upon favourable business,<br />

financial, and economic conditions to meet its financial commitments. CCC is judged to be <strong>of</strong><br />

very weak standing and is subject to very high credit risk.<br />

CC Double C (Extremely Weak Capacity & Extremely High <strong>Credit</strong> Risk)<br />

An obligor rated 'CC' is currently highly vulnerable. CC is highly speculative and is likely in, or<br />

very near, default, with some prospect <strong>of</strong> recovery <strong>of</strong> principal and interest.<br />

C Single C (Near to Default)<br />

A 'C' rating is assigned to obligors that are currently highly vulnerable to non-payment.<br />

Obligations rated C have payment arrearages allowed by the terms <strong>of</strong> the documents, or<br />

obligations <strong>of</strong> an issuer that is the subject <strong>of</strong> a bankruptcy petition or similar action which<br />

have not experienced a payment default.<br />

D (Default)<br />

'D' is in default. The 'D' rating also will be used upon the filing <strong>of</strong> a bankruptcy petition or the<br />

taking <strong>of</strong> a similar action if payments on an obligation are jeopardized.<br />

Page 6 <strong>of</strong> 7

<strong>Bank</strong> <strong>Loan</strong>/<strong>Client</strong> <strong>Rating</strong><br />

Short Term – Corporate<br />

ST-1<br />

<strong>Rating</strong> indicates that entity’s/issuer’s capacity to meet its financial commitment on the<br />

obligation is strong<br />

ST-2<br />

Rated entity/issuer is susceptible to adverse economic conditions however the<br />

obligor's capacity to meet its financial commitment on the obligation is satisfactory<br />

ST-3<br />

Adverse economic conditions are likely to weaken the entity’s/issuer’s capacity to<br />

meet its financial commitment on the obligation<br />

ST-4<br />

Entity/issuer has significant speculative characteristics. The obligor currently has the<br />

capacity to meet its financial obligation but faces major ongoing uncertainties that<br />

could impact its financial commitment on the obligation.<br />

ST-5<br />

Entity/issuer currently vulnerable to nonpayment and is dependent upon favourable<br />

business, financial and economic conditions for the obligor to meet its financial<br />

commitment on the obligation.<br />

ST -6<br />

Entity/issuer is in payment default. Obligation not made on due date and grace period<br />

may not have expired. The rating is also used upon the filing <strong>of</strong> a bankruptcy petition.<br />

© <strong>Credit</strong> <strong>Rating</strong> <strong>Agency</strong> <strong>of</strong> <strong>Bangladesh</strong> Ltd, May 2009.<br />

Enclosed:<br />

1. Draft MoU<br />

2. List <strong>of</strong> <strong>Client</strong>s<br />

Page 7 <strong>of</strong> 7