Click here to Download 1.01 MB - Reliance Communications

Click here to Download 1.01 MB - Reliance Communications

Click here to Download 1.01 MB - Reliance Communications

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Reliance</strong> <strong>Communications</strong><br />

Inves<strong>to</strong>r Presentation<br />

May 2009

Forward looking statements – Important Note<br />

This presentation and the discussion that follows may contain “forward looking<br />

statements” by <strong>Reliance</strong> <strong>Communications</strong> Ltd (“RCOM”) that are not his<strong>to</strong>rical in nature.<br />

These forward looking statements, which may include statements relating <strong>to</strong> future<br />

results of operation, financial condition, business prospects, plans and objectives, are<br />

based on the current beliefs, assumptions, expectations, estimates, and projections of<br />

the direc<strong>to</strong>rs and management of RCOM about the business, industry and markets in<br />

which RCOM operates. These statements are not guarantees of future performance, and<br />

are subject <strong>to</strong> known and unknown risks, uncertainties, and other fac<strong>to</strong>rs, some of which<br />

are beyond RCOM’s control and difficult <strong>to</strong> predict, that could cause actual results,<br />

performance or achievements <strong>to</strong> differ materially from those in the forward looking<br />

statements. Such statements are not, and should not be construed, as a representation<br />

as <strong>to</strong> future performance or achievements of RCOM. In particular, such statements<br />

should not be regarded as a projection of future performance of RCOM. It should be<br />

noted that the actual performance or achievements of RCOM may vary significantly<br />

from such statements.<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

2 of 55

Contents<br />

<br />

<strong>Reliance</strong> <strong>Communications</strong> – an integrated telco<br />

• Wireless<br />

• Infratel<br />

• Globalcom<br />

• Enterprise<br />

• Home<br />

<br />

Key takeaways<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

3 of 55

<strong>Reliance</strong> <strong>Communications</strong><br />

India’s leading fully integrated & Converged service provider…<br />

Wireless<br />

• Mobile (CDMA & GSM)<br />

• VAS (Mobile World)<br />

• Wireless Data<br />

• Fixed Wireless<br />

• Public Access Business<br />

Enterprise<br />

• Internet Data Center<br />

• Broadband<br />

• Leased Line<br />

• Office Centrex<br />

• MPLS & VPN<br />

• WiMax<br />

Tower (Infratel)<br />

Home<br />

• DTH (Big TV)<br />

• Multi tenancy <strong>to</strong>wers (4x)<br />

• IPTV (Digital Home)<br />

• Pan- India coverage<br />

• Backhaul<br />

• Support systems Other businesses<br />

Globalcom<br />

• Submarine cable (FLAG)<br />

• Ethernet Data services<br />

• Long Distance (NLD/ILD)<br />

• <strong>Reliance</strong> Global Call<br />

• Vanco<br />

• Yipes<br />

Tech Services<br />

• Leveraging Internal IT<br />

Development Capabilities<br />

BPO<br />

• Expertise in Telecom<br />

BFSI, Utilities & Media<br />

Retail<br />

• <strong>Reliance</strong> World<br />

• <strong>Reliance</strong> Mobile S<strong>to</strong>re<br />

…Integrated play covering the entire value chain<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

4 of 55

<strong>Reliance</strong> <strong>Communications</strong><br />

Complete range of telecom services<br />

Home Enterprise Globalcom Infratel Wireless<br />

Canada<br />

USA<br />

Netherland<br />

Spain<br />

Austria<br />

Russia<br />

UK<br />

London Netherland<br />

France<br />

Germany Belgium Switzerland<br />

Japan<br />

Germany<br />

Belgium<br />

d<br />

Austria<br />

Italy Saudi Arabia<br />

France Switzerland<br />

Italy Bahrain<br />

China<br />

UAE<br />

Japan<br />

Spain<br />

Qatar Pakistan<br />

Pakistan<br />

South Korea<br />

Qatar<br />

Oman<br />

Hong Kong<br />

Bahrain India<br />

Bangladesh<br />

Oman<br />

Taiwan<br />

Saudi Arabia<br />

Malaysia<br />

Sudan<br />

Hong Kong<br />

Nigeria Sudan<br />

UAE<br />

Malaysia<br />

Taiwan<br />

Sri Lanka<br />

New Zealand<br />

Nigeria<br />

South Korea<br />

Australia<br />

South<br />

South<br />

Africa<br />

Africa<br />

New Zealand<br />

6 th largest wireless opera<strong>to</strong>r in the world (cus<strong>to</strong>mer base in a single country)<br />

Only Indian company <strong>to</strong> offer nationwide both CDMA & GSM services<br />

Largest network covering a billion people in India<br />

Services offered includes Mobile, Home phones, PCOs, Datacards, etc<br />

Largest portfolio of multi-tenancy <strong>to</strong>wers with 4x tenancy<br />

Integrated solutions including <strong>to</strong>wers, optic fiber, network management, etc<br />

World’s largest submarine cable network with presence in 60 countries<br />

Wide range of services include Capacity services, MPLS-VPN, Ethernet,<br />

Managed services, etc<br />

One s<strong>to</strong>p shop for all kinds of enterprise connectivity solutions<br />

>50% market share in high growth data products<br />

Services offered include MPLS-VPN, Centrex, Data centers, WiMax, etc<br />

Only Indian DTH opera<strong>to</strong>r <strong>to</strong> provide services in 6,500 <strong>to</strong>wns<br />

Services offered by leveraging the existing infrastructure<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

5 of 55

<strong>Reliance</strong> <strong>Communications</strong><br />

Strategy<br />

Objectives<br />

Action Plans<br />

Cus<strong>to</strong>mer<br />

Growth<br />

Latest congestion free Next Generation network for highest quality<br />

Attractive plans & offers<br />

Revenue<br />

Growth<br />

Integration &<br />

Convergence<br />

More revenue streams from new product launches<br />

Increased revenue from new service streams like GSM (share of VAS & Inroaming<br />

revenue)<br />

Focused participation in the entire value chain of telco business<br />

Would also be participating in the new technological developments <strong>to</strong><br />

provide one-s<strong>to</strong>p shop for all communication needs<br />

Profitable<br />

Growth<br />

Profitable & sustainable growth<br />

Leveraging existing infrastructure for new launches leads <strong>to</strong> stable margins<br />

Focused & profitable growth<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

6 of 55

<strong>Reliance</strong> <strong>Communications</strong><br />

Building leadership position across all screens<br />

4 screen strategy<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

7 of 55

<strong>Reliance</strong> <strong>Communications</strong><br />

Recent performance<br />

Financial Performance<br />

Balance Sheet Strength*<br />

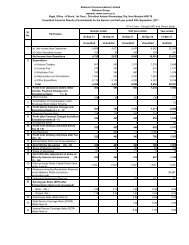

4Q FY09 Q-o-Q Y-o-Y<br />

Revenue (Rs. Mn) 61,237 4.7% 15.3%<br />

(As on Dec 31, 2008)<br />

Assets<br />

(Rs. Mn)<br />

880,000<br />

EBITDA (Rs. Mn) 23,832 1.3% 2.9%<br />

Networth<br />

290,000<br />

Net Profit (Rs. Mn) 14,544 3.1% -3.2%<br />

Gross Debt<br />

267,000<br />

EBITDA Margin 38.9% -1.3ppt -4.7ppt<br />

Net Debt<br />

186,000<br />

Net Profit Margin 23.8% -0.3ppt -4.5ppt<br />

Net Debt <strong>to</strong> Equity (x)<br />

0.64<br />

* Balance Sheet as on 31 st Dec 2008. Fiscal year 09 balance sheet will be published post the final approval of Shareholders and/ or the Hon’ble High Court of Judicature at Mumbai on the<br />

Scheme of Arrangement for demerger of the Optical Fibre Division of the Company <strong>to</strong> <strong>Reliance</strong> Infratel Limited (“RITL”)<br />

Maintaining the strong growth momentum<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

8 of 55

<strong>Reliance</strong> <strong>Communications</strong><br />

Financial Highlights<br />

Key Financial Parameters (Rs. Mn)<br />

Revenue EBITDA Net Profit<br />

+29%<br />

190,678<br />

229,411<br />

+55%<br />

81,989<br />

92,875<br />

+137%<br />

54,005<br />

59,078<br />

107,664<br />

144,683<br />

57,208<br />

31,637<br />

24,762<br />

4,438<br />

FY06 FY07 FY08 FY09<br />

FY06 FY07 FY08 FY09<br />

FY06 FY07 FY08 FY09<br />

Consistent & Substantial increase in profitability<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

9 of 55

<strong>Reliance</strong> <strong>Communications</strong><br />

Cost management (% of revenue) with stable margins…<br />

Margins 42.3% 40.8% 40.2% 38.9%<br />

% of Total Revenue<br />

100%<br />

90%<br />

15.3%<br />

18.2% 19.9%<br />

80%<br />

22.2%<br />

70%<br />

60%<br />

18.6%<br />

18.2%<br />

17.5%<br />

50%<br />

16.5%<br />

40%<br />

6.6%<br />

30%<br />

8.1% 7.5% 6.9%<br />

Network expenses<br />

- Increase in network cost due <strong>to</strong><br />

expansion of coverage & GSM<br />

launch<br />

- Opex of other new businesses like<br />

DTH, Vanco, etc<br />

SG&A expenses<br />

- Focused marketing & various cost<br />

control measures<br />

Staff cost<br />

20%<br />

10%<br />

0%<br />

17.2%<br />

14.7% 14.9% 15.5%<br />

1Q FY09 2Q FY09 3Q FY09 4Q FY09<br />

Access charges & LF<br />

- Expansion of fiber optic assets &<br />

increase in PoIs<br />

- Removal of ADC<br />

…inspite of launch of multiple new businesses<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

10 of 55

<strong>Reliance</strong> <strong>Communications</strong><br />

Profitability<br />

EBITDA Margin<br />

Net Profit Margin<br />

50%<br />

30%<br />

40%<br />

30%<br />

Bharti<br />

RCOM<br />

Idea<br />

25%<br />

20%<br />

15%<br />

RCOM<br />

Bharti<br />

20%<br />

10%<br />

4Q FY08 1Q FY09 2Q FY09 3Q FY09 4Q FY09<br />

10%<br />

5%<br />

Idea<br />

4Q FY08 1Q FY09 2Q FY09 3Q FY09 4Q FY09<br />

Source: Company reports<br />

<br />

<br />

Among the highest margins in the industry in spite of the launch of<br />

several new businesses<br />

Aimed at leveraging common infrastructure <strong>to</strong> protect/enhance margins<br />

Profitable growth<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

11 of 55

<strong>Reliance</strong> <strong>Communications</strong><br />

Capex intensity coming down significantly…<br />

30,000<br />

20,000<br />

Rs. Crore<br />

10,000<br />

Bharti<br />

RCOM<br />

0<br />

FY06 FY07 FY08 FY09 FY10<br />

Note: FY2010 capex amount is the company’s guidance in the earnings call<br />

Source: Company reports<br />

…moving <strong>to</strong>wards FCF positive<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

12 of 55

Contents<br />

<br />

<strong>Reliance</strong> <strong>Communications</strong> – an integrated telco<br />

• Wireless<br />

• Infratel<br />

• Globalcom<br />

• Enterprise<br />

• Home<br />

<br />

Key takeaways<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

13 of 55

Wireless Business<br />

Targets the largest untapped population in the world<br />

140%<br />

120%<br />

100%<br />

80%<br />

60%<br />

Low wireless penetration…<br />

48%<br />

80% 86% 89% 92% 126%<br />

…Leading <strong>to</strong> strong revenue growth<br />

40%<br />

30%<br />

26%<br />

20%<br />

18%<br />

14%<br />

40%<br />

20%<br />

0%<br />

30%<br />

10%<br />

0%<br />

0%<br />

3% 2%<br />

6%<br />

India China Brazil Japan US France UK<br />

Japan France UK US China Brazil India<br />

Source: Merrill Lynch Global Wireless Matrix, December 2008<br />

Low penetration + High Revenue growth = Huge opportunity<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

14 of 55

Wireless Business<br />

Mobile subscribers in India <strong>to</strong> cross 600 mn in 2 years…<br />

700<br />

600<br />

Mobile Subscribers (mn)<br />

Penetration<br />

50%<br />

60%<br />

50%<br />

400<br />

Subscriber additions (mn)<br />

13.7<br />

15.2<br />

386<br />

500<br />

400<br />

300<br />

200<br />

CAGR 44%<br />

22%<br />

14%<br />

256<br />

33%<br />

386<br />

42%<br />

496<br />

596<br />

40%<br />

30%<br />

20%<br />

350<br />

300<br />

9.1<br />

10.0<br />

10.4<br />

10.3<br />

10.7<br />

15.4<br />

100<br />

9%<br />

161<br />

10%<br />

96<br />

0<br />

2006 2007 2008 2009 2010E 2011E<br />

0%<br />

250<br />

Jul Aug Sept Oct Nov Dec Jan Feb Mar Mar<br />

Year end March 31<br />

Source: Industry estimates, COAI, AUSPI<br />

…even then t<strong>here</strong> will be 600 mn unserved people in India<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

15 of 55

Wireless Business<br />

RCOM: One of the fastest growing wireless companies globally<br />

<br />

<br />

Among India’s <strong>to</strong>p 2 opera<strong>to</strong>rs with over 73 mn wireless subscribers<br />

- Prepaid subscriber additions drive growth - 93% of <strong>to</strong>tal subscribers<br />

Key Performance Indica<strong>to</strong>rs<br />

- EBITDA margins among the highest in the industry - 37%...<br />

- … despite among the lowest tariffs in the world…<br />

- … backed by the highest Minutes Of Usage – 830 million minutes per day<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

16 of 55

Wireless Business<br />

Net adds market<br />

Net adds (mn) Net adds market share (%)<br />

12.0<br />

35.0%<br />

10.0<br />

RCOM<br />

Net adds (in mn)<br />

8.0<br />

6.0<br />

4.0<br />

Bharti<br />

Vodafone<br />

Idea<br />

25.0%<br />

15.0%<br />

RCOM<br />

Bharti<br />

Vodafone<br />

2.0<br />

Idea<br />

0.0<br />

4Q FY08 1Q FY09 2Q FY09 3Q FY09 4Q FY09<br />

5.0%<br />

4Q FY08 1Q FY09 2Q FY09 3Q FY09 4Q FY09<br />

Source: COAI, AUSPI<br />

<br />

<br />

Highest wireless subscriber acquisition in the world – 5 mn in the first<br />

month of our GSM launch<br />

Achieved more than 25% market share in 7-8 telecom opera<strong>to</strong>r market<br />

Significant acceleration in RCOM net adds post GSM launch<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

17 of 55

Wireless Business<br />

Mobility<br />

Over 73 million<br />

Happy cus<strong>to</strong>mers<br />

Wireless Data<br />

Fixed Wireless<br />

Market leadership<br />

in all segments<br />

*CDMA<br />

*<br />

PCO<br />

… shall replicate success with nationwide GSM service<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

18 of 55

Wireless Business<br />

24,000<br />

Towns<br />

600,000 Villages<br />

1 Billion Indians<br />

CDMA<br />

GSM<br />

Seamless coverage w<strong>here</strong>ver you go<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

19 of 55

Wireless Business<br />

India’s billion people can now expect an unbeatable<br />

choice and value proposition across….<br />

1. Coverage 2.<br />

3. Cus<strong>to</strong>mer Choice 4.<br />

Quality<br />

Handset Range<br />

5.<br />

Service Breadth<br />

6.<br />

Int’l Roaming<br />

7.<br />

Value Added Services<br />

<strong>Reliance</strong> GSM – Set <strong>to</strong> redefine mobility landscape in India<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

20 of 55

Wireless Business<br />

GSM network exploits huge capex and opex synergies<br />

Capex for new entrant : ~ US$ 10 bn<br />

Radio<br />

Electronics<br />

Retail Network<br />

Sales &<br />

Distribution<br />

BPO + Call Center<br />

IT Systems<br />

Billing + CRM + SAP<br />

Transport Backhaul + PoI<br />

Passive Infrastructure<br />

< 15% investment<br />

Leveraged for<br />

Multiple businesses<br />

incl. CDMA +GSM<br />

85% of capex is<br />

Technology<br />

Agnostic<br />

3G Ready<br />

Infrastructure<br />

Nationwide GSM service at marginal incremental cost<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

21 of 55

Wireless Business<br />

Dual network offers additional market share levers<br />

Existing growth<br />

momentum<br />

Industry monthly net adds of 8 - 10 mn GSM subscribers<br />

Impetus from network expansion in semi-urban/ rural areas<br />

Broad Market Segmentation<br />

Cross technology<br />

On-net plans: Unique<br />

Service offering<br />

Corporate Requirement<br />

GSM<br />

Senior executives<br />

- Smart phones<br />

- International travel<br />

Retail/Family<br />

Similar CUG family plans<br />

Field force<br />

- Large on-net talktime<br />

RCOM CDMA<br />

- Remote email access<br />

RCOM will bring both segments on-net, driving cus<strong>to</strong>mer value & stickiness<br />

Cus<strong>to</strong>mer churn<br />

Mobile Number<br />

Portability (MNP) CDMA GSM<br />

Incumbent GSM RCOM GSM<br />

Probability<br />

Unique advantage: Competition can’t replicate<br />

Low<br />

High<br />

Cus<strong>to</strong>mer has invested in Handset<br />

Cus<strong>to</strong>mer neither loses number<br />

nor investment in Handset<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

22 of 55

Wireless Business<br />

Drivers for additional revenue market share<br />

International<br />

in-roaming<br />

revenue<br />

<br />

<br />

<br />

Participation in rapidly growing ~US$ 1 bn<br />

international in-roaming market<br />

Currently enjoyed by few GSM incumbents<br />

Extremely profitable segment<br />

VAS revenue<br />

<br />

<br />

GSM non-voice revenue contribution ~10% with<br />

SMS contributing ~5% vs ~1.2% in CDMA<br />

Attract high SMS/VAS usage groups who also<br />

look for trendy & sleek multimedia handsets<br />

Thru GSM<br />

Handsets<br />

Ecosystem<br />

<br />

Mid <strong>to</strong> High-end range handset users contribute<br />

higher ARPU (incl. international roamers)<br />

Significant revenue upside from GSM launch<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

23 of 55

Wireless Business<br />

Most comprehensive wireless portfolio<br />

Technology<br />

Advantages CDMA GSM<br />

Spectrum efficiency<br />

Wireless Data capacity<br />

Unlimited usage plans<br />

PCO & FWP<br />

Mobile internet dominance<br />

ATM & PoS<br />

Multimedia/Video capability<br />

Near 3G experience<br />

Handset range at all price points<br />

International Roaming<br />

GSM ecosystem - 75% of<br />

Indian mobile sec<strong>to</strong>r<br />

High ARPU segment<br />

In-roaming revenues<br />

Only company <strong>to</strong> leverage strengths of both technologies<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

24 of 55

Wireless Business<br />

Best positioned <strong>to</strong> serve all cus<strong>to</strong>mer segments<br />

Segment Need Technology Supporting fac<strong>to</strong>rs<br />

Light pockets<br />

-Low handset prices<br />

GSM/EDGE<br />

-Presence of 2 nd hand handsets<br />

-Primarily incoming &<br />

low outgoing<br />

-SIM Distribution reach<br />

Business and<br />

Enterprise<br />

-E-mail<br />

-Browsers<br />

GSM/EDGE<br />

-Mid and High end handset range<br />

-International Roaming<br />

-Office <strong>to</strong>ols<br />

-Roaming<br />

Lifestyle aspirants<br />

-Multimedia<br />

GSM/EDGE<br />

-Mid and High end handset range<br />

-Design (look & feel)<br />

Anchored users<br />

-Fixed wireless<br />

CDMA<br />

-High data speeds possible with 1X<br />

-Data speeds<br />

-Low cost <strong>to</strong> operate limited<br />

mobility<br />

Data hungry users -Data speeds CDMA -High data speeds possible with 1X<br />

Value seekers<br />

-Value seeker of<br />

Handset and Minutes<br />

CDMA<br />

-Minutes bundled with handsets<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

25 of 55

Wireless Business<br />

Netconnect Broadband Plus<br />

Competitive differentiation<br />

Fastest internet broadband service of up <strong>to</strong> 3.1<br />

Mbps in India’s <strong>to</strong>p 35 cities<br />

Seamless handover & connectivity through CDMA<br />

1X in over 23K <strong>to</strong>wns and 6 lakh villages covering<br />

90% of the Indian population<br />

Wide reach compared <strong>to</strong> limited reach of wireline<br />

networks<br />

- Broadband coverage expansion the wireless way<br />

Easy plug & play USB devices<br />

Easy availability & instant activation within<br />

minutes compared <strong>to</strong> few weeks or even months<br />

in case of wired broadband<br />

Fastest internet connectivity under wireless platform<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

26 of 55

Wireless Business<br />

Service Innovations: First <strong>to</strong> reach the market<br />

Unlimited local & STD calls<br />

Mobile TV<br />

Yahoo on <strong>Reliance</strong><br />

Micro-billing<br />

Internet on the move<br />

<strong>MB</strong>log<br />

<strong>MB</strong>anking<br />

MPay<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

27 of 55

Wireless Business<br />

Multi-channel cus<strong>to</strong>mer delivery system<br />

<br />

<br />

<br />

<br />

World-class design , fit out & ambience<br />

at 2,000 exclusive retail showrooms on<br />

High streets/Malls<br />

High Quality Reach & National footprint<br />

through 5,000 distribu<strong>to</strong>rs & 1 million<br />

retailers<br />

5,000+ Direct & indirect outbound sales<br />

force <strong>to</strong> cater <strong>to</strong> cus<strong>to</strong>mers at their<br />

premises<br />

Dimensioned <strong>to</strong> handle over 35 mn<br />

sales transactions annually<br />

By far the largest retail distribution network in the industry<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

28 of 55

Wireless Business<br />

Financial Performance<br />

Revenue (Rs. Mn)<br />

EBITDA (Rs. Mn)<br />

46,000<br />

44,000<br />

42,000<br />

41,608<br />

41,187<br />

43,356<br />

44,119<br />

45,015<br />

17,000<br />

16,000<br />

16,763<br />

16,623<br />

16,859<br />

16,616 16,629<br />

40,000<br />

38,000<br />

15,000<br />

36,000<br />

34,000<br />

4Q FY08 1Q FY09 2Q FY09 3Q FY09 4Q FY09<br />

14,000<br />

4Q FY08 1Q FY09 2Q FY09 3Q FY09 4Q FY09<br />

EBITDA Margin<br />

80%<br />

60%<br />

40%<br />

40.3%<br />

40.4%<br />

38.9% 37.7%<br />

36.9%<br />

20%<br />

0%<br />

4Q FY08 1Q FY09 2Q FY09 3Q FY09 4Q FY09<br />

Maintained growth momentum with stable margins<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

29 of 55

Contents<br />

<br />

<strong>Reliance</strong> <strong>Communications</strong> – an integrated telco<br />

• Wireless<br />

• Infratel<br />

• Globalcom<br />

• Enterprise<br />

• Home<br />

<br />

Key takeaways<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

30 of 55

<strong>Reliance</strong> Infratel<br />

Infrastructure Tenancy Slots – Market<br />

RITL Ground based <strong>to</strong>wer<br />

2G, 3G & BWA<br />

700,000<br />

400,000<br />

200,000<br />

RITL Roof <strong>to</strong>p <strong>to</strong>wer<br />

2008A 2009A 2010E<br />

Source: Industry Estimates<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

31 of 55

<strong>Reliance</strong> Infratel<br />

Infrastructure sharing<br />

GSM and 3G roll outs<br />

Access large rural<br />

population<br />

Spectrum scarcity vs.<br />

coverage<br />

Speed of deployment<br />

Opera<strong>to</strong>r imperatives<br />

Growth<br />

Regulation<br />

Growth drivers<br />

Pressure on site<br />

sharing<br />

Active sharing<br />

allowed<br />

USO scheme for<br />

sharing<br />

infrastructure<br />

Rural roll out<br />

Reduced cost of<br />

service<br />

Increase penetration<br />

Government imperatives<br />

Social<br />

responsibility<br />

Key drivers of<br />

infrastructure<br />

sharing<br />

Financial<br />

&<br />

business<br />

impact<br />

Opera<strong>to</strong>r imperatives<br />

Capex burden<br />

Profitability amid<br />

falling ARPUs<br />

Network quality<br />

Focus on core<br />

business<br />

Infrastructure sharing – All drivers are in place<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

32 of 55

<strong>Reliance</strong> Infratel<br />

Infrastructure overview<br />

<br />

Operational in all 22 circles<br />

~48,000 multi-tenancy <strong>to</strong>wers as on March 31, 2009.<br />

<br />

<br />

<br />

Anchor cus<strong>to</strong>mer (<strong>Reliance</strong> <strong>Communications</strong>) driven strategy<br />

Current captive tenancy of 1.6x post our GSM launch; will further increase<br />

by 3 rd party (external) tenants<br />

Financial performance (FY2008)<br />

- Revenue: Rs. 14,566 mn<br />

- EBITDA: Rs. 6,746 mn; Margins: 46.3%<br />

- Total Assets: Rs. 117,205 mn<br />

Aim <strong>to</strong> be a preferred infrastructure provider for new opera<strong>to</strong>rs<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

33 of 55

Contents<br />

<br />

<strong>Reliance</strong> <strong>Communications</strong> – an integrated telco<br />

• Wireless<br />

• Infratel<br />

• Globalcom<br />

• Enterprise<br />

• Home<br />

<br />

Key takeaways<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

34 of 55

Globalcom Business<br />

Business structure<br />

<br />

Completed restructuring of our services under four core business segments<br />

of Data, Voice, WiMax and NLD<br />

Data Voice WiMAX NLD<br />

Accelerate growth in<strong>to</strong> $290 Billion communications market by<br />

providing comprehensive voice, video & data network services<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

35 of 55

Globalcom Business<br />

Market potential<br />

Business Unit<br />

2008F Global Market Demand ($bn)<br />

Past scope of services<br />

Typical<br />

margins<br />

WiMAX<br />

$185 bn<br />

$2.2 bn<br />

$1.5 bn<br />

35%–55%<br />

15%-25%<br />

NLD<br />

20%–40%<br />

Data<br />

$100 bn<br />

15%–35%<br />

Voice<br />

Sources: Telegeography, Ovum, Gartner Research<br />

Addressable market revenue is ~US$ 290 bn with EBITDA in range of<br />

15% <strong>to</strong> 55% based on service and geography<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

36 of 55

Globalcom Business<br />

Voice Business<br />

USA<br />

<br />

<br />

Canada<br />

Global Reach<br />

Retail services in U.S.,<br />

Canada, U.K., Australia,<br />

New Zealand, Hong Kong<br />

and Malaysia.<br />

<strong>Reliance</strong> Global Call offers<br />

Calling services for 200<br />

countries across the globe.<br />

Netherland<br />

Spain<br />

Austria<br />

Russia<br />

UK<br />

London Netherland<br />

France<br />

Germany Belgium Switzerland<br />

Japan<br />

Germany<br />

d<br />

Belgium<br />

Austria<br />

Italy Saudi Arabia<br />

France Switzerland<br />

Italy Bahrain<br />

China<br />

UAE<br />

Japan<br />

Spain<br />

Qatar Pakistan<br />

Qatar Pakistan<br />

South Korea<br />

Oman<br />

Hong Kong<br />

Bahrain India Bangladesh<br />

Oman<br />

Taiwan<br />

Saudi Arabia<br />

Malaysia<br />

Hong Kong<br />

NigeriaSudan<br />

Sudan<br />

UAE<br />

Malaysia<br />

Taiwan<br />

Sri Lanka<br />

New Zealand<br />

Nigeria<br />

South Korea<br />

<br />

<br />

Innovative Product<br />

Suite<br />

<strong>Reliance</strong> Global Call<br />

- International Calling Service<br />

- Web based service delivery,<br />

fulfillment<br />

<strong>Reliance</strong> Passport<br />

- Single SIM for 110<br />

countries with free incoming<br />

calls in 57 countries<br />

<br />

<br />

<br />

Leadership Position<br />

Market share of 30% for<br />

ILD wholesale inbound<br />

traffic<br />

Over 2 million cus<strong>to</strong>mers<br />

for <strong>Reliance</strong> Global Call<br />

service.<br />

Usage of <strong>Reliance</strong> Global<br />

Call accounts for 40% of<br />

<strong>to</strong>tal retail market calls<br />

from the United States <strong>to</strong><br />

India.<br />

South Africa<br />

South Africa<br />

Australia<br />

New Zealand<br />

Market leader in International Long Distance<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

37 of 55

Globalcom Business<br />

Business Performance & Product Development<br />

<br />

<br />

<br />

<br />

<br />

RGC continues <strong>to</strong> be #1 Retail Service for India calling<br />

from US – user base of over 2 mn<br />

Special promotional offers were given for Pongal, Holi,<br />

Valentine’s day, etc<br />

Launched South Asia based calling card portal as part of<br />

RGC expansion strategy<br />

Beta launch of MindBridge Audio conference services<br />

<strong>Reliance</strong> Global Call: New cus<strong>to</strong>mer friendly features <strong>to</strong><br />

existing products being added e.g. ‘Express Dial’ for Java<br />

based mobile<br />

Extending RGC services <strong>to</strong> enterprise cus<strong>to</strong>mers in<br />

Singapore and New Zealand<br />

Continues <strong>to</strong> be #1 Retail Service for India calling from US<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

38 of 55

Globalcom Business<br />

Voice Business - Plan <strong>to</strong> drive profitable growth<br />

Continued<br />

Product<br />

Innovation<br />

Value adds <strong>to</strong> drive retention and usage<br />

- Loyalty and reward program<br />

- Money transfer services<br />

- Entertainment and content features<br />

Launch new products like:<br />

- Web based Audio and Video Conferencing<br />

Expand<br />

Cus<strong>to</strong>mer<br />

Base<br />

Expand retail reach <strong>to</strong> new terri<strong>to</strong>ries like Bahrain<br />

Aggressively target Enterprise cus<strong>to</strong>mers through cross<br />

sell and up sell through <strong>Reliance</strong> Vanco sales team<br />

Maintain low cost leadership while aggressively growing business<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

39 of 55

Globalcom Business<br />

Data Business<br />

Unmatched<br />

Capabilities<br />

Global presence in over 60<br />

countries. World’s largest<br />

IP optical network<br />

Blue Chip Cus<strong>to</strong>mers<br />

Diverse base of over 200<br />

carriers, ISPs and content<br />

providers.<br />

<br />

Leadership Position<br />

Ranked amongst <strong>to</strong>p 5 in<br />

Global Network Service<br />

Providers by Gartner.<br />

<br />

Leadership in Global<br />

Ethernet (Yipes) and MPLS<br />

VPN (Vanco).<br />

<br />

Over 1,200 Blue Chip<br />

enterprise cus<strong>to</strong>mers.<br />

<br />

Among <strong>to</strong>p 3 IDC suppliers<br />

Coverage<br />

Among Top 5 Managed Network Services providers<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

40 of 55

Globalcom Business<br />

Data Business - Plan <strong>to</strong> drive profitable growth<br />

Vertical<br />

Expansion<br />

Enhance revenue contribution from higher margin<br />

value added services<br />

“Sell <strong>to</strong>, sell through, sell with” channel partners <strong>to</strong><br />

extend the cus<strong>to</strong>mer franchise<br />

Horizontal<br />

Expansion<br />

Expand Geographical Coverage:<br />

- Reach of cable network<br />

- VPoPs<br />

- Product suite<br />

Low risk investment strategy based on securing prebuild<br />

commitments<br />

Maintain low cost leadership while aggressively growing business<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

41 of 55

Globalcom Business<br />

WiMAX Business<br />

Building a Spectrum Bank<br />

Focused on acquiring licenses and spectrum in<br />

emerging markets; market size of WiMAX<br />

estimated <strong>to</strong> be US$ 10 bn by 2010<br />

Way Forward<br />

Operationalise WiMAX<br />

business in select<br />

geographies<br />

Leverage the low cost<br />

and scalable delivery<br />

center in Mumbai<br />

Deliver affordable broadband access across emerging markets<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

42 of 55

Globalcom Business<br />

Financial Performance<br />

Revenue (Rs. Mn)<br />

EBITDA (Rs. Mn)<br />

20,000<br />

15,000<br />

15,257 15,260<br />

16,915 16,783<br />

18,803<br />

6,000<br />

5,000<br />

4,000<br />

4,089<br />

3,222<br />

3,608<br />

4,315<br />

5,025<br />

10,000<br />

3,000<br />

5,000<br />

2,000<br />

1,000<br />

0<br />

4Q FY08 1Q FY09 2Q FY09 3Q FY09 4Q FY09<br />

0<br />

4Q FY08 1Q FY09 2Q FY09 3Q FY09 4Q FY09<br />

EBITDA Margin<br />

50%<br />

40%<br />

30%<br />

20%<br />

26.8%<br />

21.1%<br />

21.3%<br />

25.7%<br />

26.7%<br />

10%<br />

0%<br />

4Q FY08 1Q FY09 2Q FY09 3Q FY09 4Q FY09<br />

Short term margin impact due <strong>to</strong> VANCO acquisition<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

43 of 55

Contents<br />

<br />

<strong>Reliance</strong> <strong>Communications</strong> – an integrated telco<br />

• Wireless<br />

• Infratel<br />

• Globalcom<br />

• Enterprise<br />

• Home<br />

<br />

Key takeaways<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

44 of 55

Enterprise Business<br />

Underserved market: Provides strong growth opportunity<br />

Broadband market segment revenue (US$ bn)<br />

US$ 13 bn<br />

US$ 5.5 bn<br />

+ US$ 8 bn<br />

FY2008<br />

FY2012<br />

Household S<strong>MB</strong> + SME Enterprise<br />

Source : Industry Report<br />

Indian Market <strong>to</strong> grow <strong>to</strong> US$ 13 bn in the next 3 years<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

45 of 55

Enterprise Business<br />

RCOM: Best positioned <strong>to</strong> drive growth<br />

<br />

>50% market share in highest growth data<br />

products like IDC, Centrex solutions, VPN, etc<br />

1 Million buildings connected across <strong>to</strong>p 44<br />

cities <strong>to</strong> our fiber network, <strong>to</strong> cross 1.5 mn by<br />

next year end<br />

Fiber<br />

Ring<br />

Meshed Core<br />

Atlantic<br />

Pacific<br />

<br />

Have built the largest capability in India <strong>to</strong><br />

serve >7.5 mn Voice & Data cus<strong>to</strong>mers<br />

Who do we Serve<br />

<br />

<br />

<br />

Servicing over 900 of <strong>to</strong>p 1000 <strong>to</strong>p Enterprises<br />

250 MNCs and 50,000 S<strong>MB</strong> businesses<br />

Over 1.4 mn access subscribers<br />

India’s leading provider of enterprise services<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

46 of 55

Enterprise Business - IDC<br />

IDC: Largest in India with >60% market share<br />

<br />

Six data centres with level 3+ accreditation<br />

– more than 300,000 sq ft of facilities<br />

space<br />

Hosting >20,000 systems and >1400<br />

terabyte of information<br />

<br />

<br />

Geographic redundancy<br />

Wide & complex application hosted<br />

- Core Banking, ATM/ Internet Banking<br />

- Complex ERP/ SAP Applications<br />

- Complex Intranet/ Cus<strong>to</strong>mized Apps.<br />

- Large Messaging Applications<br />

Expanding capacity 4 times <strong>to</strong> cater <strong>to</strong> fast growing demand<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

47 of 55

Enterprise Business<br />

Financial Performance<br />

Revenue (Rs. Mn)<br />

EBITDA (Rs. Mn)<br />

8,000<br />

6,000<br />

5,100<br />

5,603<br />

6,023<br />

6,542<br />

7,075<br />

4,000<br />

3,000<br />

2,492<br />

2,714<br />

2,941<br />

2,760<br />

3,160<br />

4,000<br />

2,000<br />

2,000<br />

1,000<br />

0<br />

4Q FY08 1Q FY09 2Q FY09 3Q FY09 4Q FY09<br />

0<br />

4Q FY08 1Q FY09 2Q FY09 3Q FY09 4Q FY09<br />

EBITDA Margin<br />

80%<br />

60%<br />

40%<br />

48.9% 48.4%<br />

48.8%<br />

42.2%<br />

44.7%<br />

20%<br />

0%<br />

4Q FY08 1Q FY09 2Q FY09 3Q FY09 4Q FY09<br />

Consistent growth with strong margins<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

48 of 55

Contents<br />

<br />

<strong>Reliance</strong> <strong>Communications</strong> – an integrated telco<br />

• Wireless<br />

• Infratel<br />

• Globalcom<br />

• Enterprise<br />

• Home<br />

<br />

Key takeaways<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

49 of 55

Home<br />

Indian Market (as of March’09)<br />

400<br />

India’s TV Viewership<br />

• 2 nd largest in the world<br />

• 120 Mn TV Homes<br />

• 90 Mn C&S Homes<br />

• 12 Mn Pay TV DTH Homes<br />

TV HH (in mn)<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

China India US Japan<br />

TV Technology Evolution<br />

Analog cable HH<br />

90%<br />

• Analog Cable – Digital Cable – DTH<br />

• DTH <strong>to</strong> grow multi-fold by 2015<br />

Digital HH<br />

1%<br />

DTH HH<br />

9%<br />

One of the largest Pay TV markets globally<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

50 of 55

Home Business<br />

Big TV (DTH) - Commercially launched<br />

Key service differentia<strong>to</strong>rs<br />

- More channel choice<br />

- Pure Digital viewing<br />

- 32 Cinema channels<br />

- Easy program guide<br />

- Quick channel select<br />

- Interactive applications (iNews, iGames,<br />

iCricket, etc)<br />

- Superior Mpeg 4 technology<br />

Pioneering HD Experience in India<br />

Pioneering DVR – “Watch when you want”<br />

Digital viewing experience will create revolution in TV entertainment platforms<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

51 of 55

Home Business<br />

BIG TV Services: Complete suite of services<br />

BroadcastTV and Radio<br />

EPG / Mini EPG Mosaic Portal<br />

Information<br />

News<br />

S<strong>to</strong>ck<br />

Entertainment<br />

Game VoD / MoD / PVR Karaoke / Pho<strong>to</strong> Album<br />

Services<br />

Advertisments<br />

Interactive Promotion<br />

Dedicated Advertiser Location<br />

Messaging<br />

SMS / MMS Mail Polling / Voting<br />

Commerce<br />

Shopping / Banking<br />

Public Service<br />

T - Government / T - Learning<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

52 of 55

Contents<br />

<br />

<strong>Reliance</strong> <strong>Communications</strong> – an integrated telco<br />

• Wireless<br />

• Infratel<br />

• Globalcom<br />

• Enterprise<br />

• Home<br />

<br />

Key takeaways<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

53 of 55

Looking ahead<br />

Key Takeaways<br />

<br />

<br />

<br />

<br />

Drivers for growth<br />

RCOM launched nationwide GSM service<br />

with presence in 20,000 <strong>to</strong>wns in March<br />

2009<br />

RCOM GSM expanding coverage <strong>to</strong> 24K<br />

<strong>to</strong>wns <strong>to</strong> cover 1 billion people by mid<br />

CY2009<br />

Huge growth opportunity in Business<br />

segments like Infratel, DTH & expansion<br />

of Enterprise/IDC<br />

Time -<strong>to</strong>- Market advantage for launching<br />

new & unique products & services<br />

Impact<br />

Increases the Revenue<br />

generating ability<br />

High EBITDA margin<br />

Businesses improves the<br />

overall profitability<br />

Robust pipeline of<br />

business <strong>to</strong> support<br />

growth<br />

Integration of Telecom, Media, IT will be levers of tremendous future growth<br />

Wireless | Infratel | Globalcom | Enterprise | Home<br />

54 of 55

Thank you