- Page 1 and 2: Annual Report of ACS Group

- Page 3: Activity Report of ACS Group

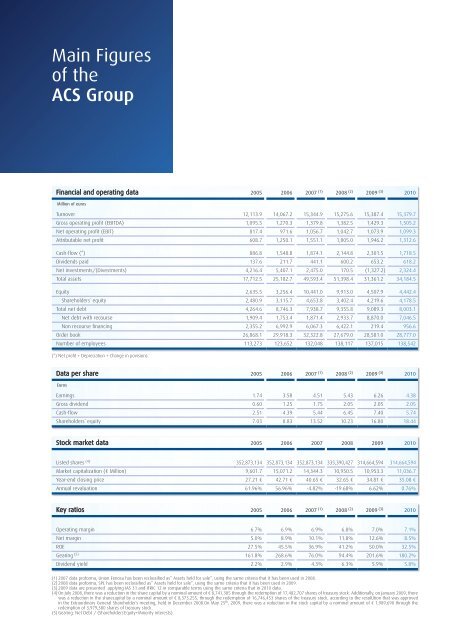

- Page 7 and 8: Earnings per share Dividends per sh

- Page 9 and 10: “Our business model is founded on

- Page 11 and 12: Dear Shareholder For another year I

- Page 13 and 14: Member of the Executive Committee M

- Page 15 and 16: CHAIRMAN Vice Chairman General Secr

- Page 17 and 18: ACS Services, Communications and En

- Page 19 and 20: Values Profitability Commitment Int

- Page 21 and 22: 2007 2003 2003 2006 In 2007, the AC

- Page 23 and 24: The infrastructure development is a

- Page 25 and 26: Evolution of investment by geograph

- Page 27 and 28: Primary energy consumption. USA and

- Page 29 and 30: Public-private partnership projects

- Page 31 and 32: United States and Canada North Amer

- Page 33 and 34: Characteristics, opportunities and

- Page 35 and 36: To tackle this great increase in en

- Page 37 and 38: 31 ACTIVITY REPORT CONSTRUCTION The

- Page 39 and 40: As a consequence of this clear comm

- Page 41 and 42: By type and technical characteristi

- Page 43 and 44: • Construction works for the wast

- Page 45 and 46: At 31 December 2010 the Group’s C

- Page 47 and 48: 2010 International Revenue per coun

- Page 49 and 50: It is also present in the bidding p

- Page 51 and 52: Organisational Structure 100% medio

- Page 53 and 54: Iridium Concesiones de Infraestruct

- Page 55 and 56:

Shown below is detail of the projec

- Page 57 and 58:

• On 28 October 2010, the concess

- Page 59 and 60:

new construction, hence it fi nds i

- Page 61 and 62:

The stations on Stretch II will go

- Page 63 and 64:

57 ACTIVITY REPORT ENVIRONMENT Urba

- Page 65 and 66:

To tackle these objectives and chal

- Page 67 and 68:

Revenue evolution International Rev

- Page 69 and 70:

Order Book evolution International

- Page 71 and 72:

2010 International Revenue per coun

- Page 73 and 74:

waste, offering a global solution t

- Page 75 and 76:

Organisational Structure Environmen

- Page 77 and 78:

71 ACTIVITY REPORT INDUSTRIAL SERVI

- Page 79 and 80:

sources (wind, solar, hydroelectric

- Page 81 and 82:

The ACS Group’s Industrial Servic

- Page 83 and 84:

- Signalling supply and maintenance

- Page 85 and 86:

Seven projects are also in the fi n

- Page 87 and 88:

Wind farms under Construction Locat

- Page 89 and 90:

Gross operating income grew 19.6% i

- Page 91 and 92:

een carried out in recent years in

- Page 93 and 94:

2010 International revenue per coun

- Page 95 and 96:

awarded in 2010, along with the wor

- Page 97 and 98:

Organisational Structure 100% Ancil

- Page 99 and 100:

93 ACTIVITY REPORT STRATEGIC INVEST

- Page 101 and 102:

Revenue 4% 1% % 7% EBITDA % 9% 3% 3

- Page 103 and 104:

Installed capacity 2010 Production

- Page 105 and 106:

Revenue breakdown by geographical a

- Page 107 and 108:

Mainly ACS Group presence Mainly Ho

- Page 109 and 110:

For the ACS Group 2010 has been a p

- Page 111 and 112:

Consolidated income statement of th

- Page 113 and 114:

Cash Flow Statement Cash Flow State

- Page 115 and 116:

The ACS Group’s Five Commitments

- Page 117 and 118:

Clients The commitment to clients i

- Page 119 and 120:

Commitment to Technological Develop

- Page 121 and 122:

Climate Change The ACS Group’s st

- Page 123 and 124:

Commitment to the Social Setting Th

- Page 125 and 126:

Social Action in the ACS Group The

- Page 127 and 128:

Ownership Structure The ACS Group

- Page 129 and 130:

their vote remotely is also express

- Page 131 and 132:

ACS, Servicios, Comunicaciones y En

- Page 133 and 134:

Economic and Financial Report of AC

- Page 135 and 136:

03 ECONOMIC AND FINANCIAL REPORT

- Page 137 and 138:

As far as the cash generation capac

- Page 139 and 140:

1.02.01. Net sales Sales amounted t

- Page 141 and 142:

1.02.04. Net fi nancial profi t/los

- Page 143 and 144:

1.03.01. Non-current assets Intangi

- Page 145 and 146:

The funds coming from the sale of 1

- Page 147 and 148:

The international backlog, which al

- Page 149 and 150:

1.05.04. Industrial Services Indust

- Page 151 and 152:

2. Securities Market performance 2.

- Page 153 and 154:

2.02. Treasury shares At 31 Decembe

- Page 155 and 156:

3) Growing and responsible investme

- Page 157 and 158:

In Environmental Services, the ACS

- Page 159 and 160:

The board members shall cease to ho

- Page 161 and 162:

closing prices of the Company share

- Page 163 and 164:

Likewise, the General Shareholders

- Page 165 and 166:

equest admission of the newly issue

- Page 167 and 168:

Equity and liabilities Thousands of

- Page 169 and 170:

Consolidated statement of comprehen

- Page 171 and 172:

Consolidated statement of cash flow

- Page 173 and 174:

6. The direction and execution of a

- Page 175 and 176:

24. Handling, packing and distribut

- Page 177 and 178:

• The assumptions used in the cal

- Page 179 and 180:

Thousands of euros 31/12/2009 appli

- Page 181 and 182:

Appendix I to these notes to the co

- Page 183 and 184:

In accordance with IAS 27, since al

- Page 185 and 186:

The detail of the allocation of the

- Page 187 and 188:

3.01. Goodwill Goodwill arising on

- Page 189 and 190:

3.02.04. Remaining intangible asset

- Page 191 and 192:

This heading also includes the amou

- Page 193 and 194:

Gains or losses arising from the re

- Page 195 and 196:

The fair value of investments activ

- Page 197 and 198:

Since the ACS Group continued to ha

- Page 199 and 200:

31/12/2010 SPL Renewable Energies T

- Page 201 and 202:

3.12.02. Trade and other payables T

- Page 203 and 204:

Provisions for termination benefi t

- Page 205 and 206:

3.16. Revenue recognition Revenue i

- Page 207 and 208:

The current income tax expense is c

- Page 209 and 210:

2010 2009 Thousands of euros Divide

- Page 211 and 212:

Transactions costs are expensed (pr

- Page 213 and 214:

The change in the scope of consolid

- Page 215 and 216:

In 2009 investments amounted to EUR

- Page 217 and 218:

The Group has mortgaged land and bu

- Page 219 and 220:

The changes in this heading in 2010

- Page 221 and 222:

7. Investment property The changes

- Page 223 and 224:

The detail, by company, of the Inve

- Page 225 and 226:

Additionally, ACS Actividades de Co

- Page 227 and 228:

market price of the share is less t

- Page 229 and 230:

Finally, and in order to complete t

- Page 231 and 232:

10.03. Other loans The detail of th

- Page 233 and 234:

12. Trade and other receivables The

- Page 235 and 236:

Change in the allowances for doubtf

- Page 237 and 238:

and in the event of incomplete subs

- Page 239 and 240:

Pursuant to Consolidated Companies

- Page 241 and 242:

The exchange differences on 1 Janua

- Page 243 and 244:

The composition of the balance at 3

- Page 245 and 246:

The balances of bank borrowings At

- Page 247 and 248:

It is the Group’s policy to lease

- Page 249 and 250:

from the shares acquired. The balan

- Page 251 and 252:

- On 30 April 2010, fi nancing was

- Page 253 and 254:

contingency or corresponding challe

- Page 255 and 256:

21. Financial risk management and c

- Page 257 and 258:

Liquidity risk This risk results fr

- Page 259 and 260:

22. Derivative financial instrument

- Page 261 and 262:

• The Concesionaria Santiago Bri

- Page 263 and 264:

24. Other current liabilities The b

- Page 265 and 266:

25.02.02. Income statement by busin

- Page 267 and 268:

25.02.04. Statement of fi nancial p

- Page 269 and 270:

The reconciliation of ordinary inco

- Page 271 and 272:

The Group’s other subsidiaries fi

- Page 273 and 274:

Charge/Credit to Equity Business co

- Page 275 and 276:

Under the heading of “Capitalised

- Page 277 and 278:

The share options under the 2004 Pl

- Page 279 and 280:

29. Impairment and gains or losses

- Page 281 and 282:

33.01. Transactions with associates

- Page 283 and 284:

At 31 December 2010, the pending ba

- Page 285 and 286:

The remuneration of the Directors,

- Page 287 and 288:

Additionally, and pursuant to the a

- Page 289 and 290:

Name Activity Performed Type of arr

- Page 291 and 292:

The main environmental measures tak

- Page 293 and 294:

Principal environmental management

- Page 295 and 296:

Company Registered Office Activity

- Page 297 and 298:

Company Registered Office Activity

- Page 299 and 300:

Company Registered Office Activity

- Page 301 and 302:

Company Registered Office Activity

- Page 303 and 304:

Company Registered Office Activity

- Page 305 and 306:

Company Registered Office Activity

- Page 307 and 308:

Company Registered Office Activity

- Page 309 and 310:

Company Registered Office Activity

- Page 311 and 312:

UTE/EIG Address Activity Auditor (*

- Page 313 and 314:

Data on the investee (100%) Company

- Page 315 and 316:

Data on the investee (100%) Company

- Page 317 and 318:

Data on the investee (100%) Company

- Page 319 and 320:

Companies with consolidation accoun

- Page 321 and 322:

189 ECONOMIC AND FINANCIAL REPORT A

- Page 323:

Consolidated balance sheet as of De

- Page 327 and 328:

Corporate Responsibility Report of

- Page 330 and 331:

Corporate Responsibility Milestones

- Page 332 and 333:

Concesiones Corporate Responsibilit

- Page 334 and 335:

Concesiones Letter from the Chairma

- Page 336 and 337:

The ACS Group Group’s Profile Cor

- Page 338 and 339:

The ACS Group ACS Group is present

- Page 340 and 341:

The ACS Group The ACS Group is a wo

- Page 342 and 343:

The ACS Group ACS’s Business Sust

- Page 344 and 345:

The ACS Group Corporate Governance

- Page 346 and 347:

The ACS Group Risk Control Systems

- Page 348 and 349:

Corporate Responsibility and the AC

- Page 350 and 351:

Commitment to the Creation of Value

- Page 352 and 353:

Commitment to the Creation of Value

- Page 354 and 355:

Commitment to the Creation of Value

- Page 356 and 357:

Commitment to the Creation of Value

- Page 358 and 359:

Commitment to the Creation of Value

- Page 360 and 361:

CICLOPE Project: minimising the imp

- Page 362 and 363:

Commitment to the Creation of Value

- Page 364 and 365:

Commitment to the Creation of Value

- Page 366 and 367:

Ethics, Integrity and Transparency

- Page 368 and 369:

Ethics, Integrity and Transparency

- Page 370 and 371:

Ethics, Integrity and Transparency

- Page 372 and 373:

Commitment to Technological Develop

- Page 374 and 375:

Commitment to Technological Develop

- Page 376 and 377:

Construction system for modular fa

- Page 378 and 379:

Commitment to Technological Develop

- Page 380 and 381:

Commitment to Technological Develop

- Page 382 and 383:

Commitment to Technological Develop

- Page 384 and 385:

Commitment to the Natural Environme

- Page 386 and 387:

Information system aligned with str

- Page 388 and 389:

Commitment to the Natural Environme

- Page 390 and 391:

Commitment to the Natural Environme

- Page 392 and 393:

Biodiversity: Study on the impact o

- Page 394 and 395:

Case Study Atlantic High-Speed Rail

- Page 396 and 397:

Case Study Atlantic High-Speed Rail

- Page 398 and 399:

Case Study Atlantic High-Speed Rail

- Page 400 and 401:

Case Study Atlantic High-Speed Rail

- Page 402 and 403:

Commitment to the Natural Environme

- Page 404 and 405:

Commitment to the Natural Environme

- Page 406 and 407:

Commitment to the Social Setting Th

- Page 408 and 409:

Commitment to the Social Setting Wo

- Page 410 and 411:

Commitment to the Social Setting Br

- Page 412 and 413:

Urbaser’s Performance Assessment

- Page 414 and 415:

Commitment to the Social Setting Sa

- Page 416 and 417:

Commitment to the Social Setting Ob

- Page 418 and 419:

Commitment to the Social Setting Mo

- Page 420 and 421:

Commitment to the Social Setting Pa

- Page 422 and 423:

Campaigns for risk prevention and s

- Page 424 and 425:

Commitment to the Social Setting He

- Page 426 and 427:

Dragados - finalist in the European

- Page 428 and 429:

Commitment to the Social Setting So

- Page 430 and 431:

Case Study San Lorenzo de El Escori

- Page 432 and 433:

Case Study San Lorenzo de El Escori

- Page 434 and 435:

Principles for the Preparation of t

- Page 436 and 437:

Principles for the Preparation of t

- Page 438 and 439:

Awards and Recognitions Forbes maga

- Page 440 and 441:

Verification Report Independent Ass

- Page 442 and 443:

Main Perfomance Indicators Profile

- Page 444 and 445:

Main Perfomance Indicators Standard

- Page 446 and 447:

Main Perfomance Indicators Biodiver

- Page 448 and 449:

Main Perfomance Indicators Cross-re

- Page 450 and 451:

www.grupoacs.com Cover photo: Storm

- Page 452 and 453:

Corporate Governance Report of ACS

- Page 454 and 455:

A. Ownership Structure A.1. Complet

- Page 456 and 457:

A. Ownership Structure Complete the

- Page 458 and 459:

B. A. Estructura Ownership de la Ad

- Page 460 and 461:

B. Structure of the Company Adminis

- Page 462 and 463:

B. Structure of the Company Adminis

- Page 464 and 465:

B. Structure of the Company Adminis

- Page 466 and 467:

B. Structure of the Company Adminis

- Page 468 and 469:

B. Structure of the Company Adminis

- Page 470 and 471:

B. Structure of the Company Adminis

- Page 472 and 473:

B. Structure of the Company Adminis

- Page 474 and 475:

B. Structure of the Company Adminis

- Page 476 and 477:

B. Structure of the Company Adminis

- Page 478 and 479:

B. Structure of the Company Adminis

- Page 480 and 481:

B. Structure of the Company Adminis

- Page 482 and 483:

B. Structure of the Company Adminis

- Page 484 and 485:

B. Structure of the Company Adminis

- Page 486 and 487:

C. Related-Party Transactions C.1 M

- Page 488 and 489:

C. Related-Party Transactions The M

- Page 490 and 491:

D. Risk Control Systems D.1 General

- Page 492 and 493:

D. Risk Control Systems • Risks a

- Page 494 and 495:

E. General Shareholders’ Meeting

- Page 496 and 497:

E. General Shareholders’ Meeting

- Page 498 and 499:

F. Degree of Compliance with the Co

- Page 500 and 501:

F. Degree of Compliance with the Co

- Page 502 and 503:

F. Degree of Compliance with the Co

- Page 504 and 505:

F. Degree of Compliance with the Co

- Page 506 and 507:

F. Degree of Compliance with the Co

- Page 508 and 509:

F. Degree of Compliance with the Co

- Page 510 and 511:

F. Degree of Compliance with the Co

- Page 512 and 513:

G. Other Information of Interest If

- Page 514 and 515:

G. Other Information of Interest F.

- Page 520:

Project Director and Editor ACS Gro