Annual Report - 2001 - ARC Resources Ltd.

Annual Report - 2001 - ARC Resources Ltd.

Annual Report - 2001 - ARC Resources Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PAGE 69<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

7. FINANCIAL INSTRUMENTS<br />

Financial instruments of the Trust carried on the balance sheet consist mainly of current assets, reclamation fund<br />

investments, current liabilities and long-term debt. As at December 31, <strong>2001</strong> and 2000, there were no significant<br />

differences between the carrying value of these financial instruments and their estimated fair value.<br />

Substantially all of the Trust’s accounts receivable are due from customers in the oil and gas industry and are<br />

subject to the normal industry credit risks. The carrying value of accounts receivable reflects management’s<br />

assessment of the associated credit risks.<br />

The Trust utilizes a variety of derivative instruments to reduce its exposure to changes in commodity prices and<br />

foreign exchange rates. The fair values of these derivative instruments are based on an estimate of the amounts<br />

that would have been received or paid to settle these instruments prior to maturity.<br />

The Trust is exposed to losses in the event of default by the counterparties to these derivative instruments. The<br />

Trust manages this risk by diversifying its derivative portfolio amongst a number of financially sound counterparties.<br />

Included in the total market value of all derivative instruments is a net gain of $1.8 million for contracts with one<br />

counterparty for which there is uncertainty with respect to the counterparty’s ability to fulfill the terms of the<br />

contracts.<br />

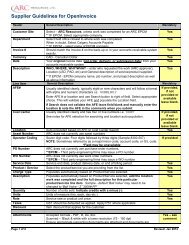

The following contracts were outstanding as at December 31, <strong>2001</strong>. Settlement of these contracts, which have no<br />

book value, would have resulted in a net receipt by the Trust of $13.0 million as at December 31, <strong>2001</strong>.<br />

Average<br />

Daily Contract Price<br />

Quantity Prices ($) (1) Index Term<br />

Crude oil fixed price contracts<br />

(embedded put option) (2) 2,000 bbls 42.91 (36.63) (2) WTI January 2002 – March 2002<br />

1,000 bbls 42.12 (35.80) (2) WTI April 2002 – December 2002<br />

Crude oil fixed price contracts<br />

(embedded double put option) (3) 2,000 bbls 41.81 (32.25) (3) WTI January 2002 – December 2002<br />

Crude oil fixed price contracts<br />

(embedded “cancel level”) (4) 10,000 bbls 40.17 (29.38) (4) WTI January 2002 – December 2002<br />

Crude oil call option 5,000 bbls 43.00 WTI January 2002 – December 2002<br />

Natural gas fixed price contracts 12,500 GJ 3.66 AECO January 2002 – March 2002<br />

10,000 GJ 3.62 AECO April 2002 – October 2002<br />

Natural gas collared contracts 5,000 GJ 3.50 – 5.64 AECO April 2002 – October 2002<br />

Natural gas put option<br />

(embedded 80 per cent put option) (5) 5,000 GJ 3.50 (3.50) (5) AECO January 2002 – March 2002<br />

Natural gas collared contract<br />

(embedded put option) (6) 10,000 GJ 3.50 – 4.00 (2.50) (6) AECO January 2002 – December 2002<br />

The Trust entered into a contract to fix the price of electricity on five megawatts per hour (“MW/h”) for the period<br />

April 17, <strong>2001</strong> through December 31, 2010 at a price of $63/MW/h. Settlement of this contract would have required<br />

a net payment by the Trust of $6.7 million as at December 31, <strong>2001</strong>.<br />

<strong>ARC</strong> ENERGY TRUST AR <strong>2001</strong>