Annual Report 2011 - Goodbaby International Holdings Limited

Annual Report 2011 - Goodbaby International Holdings Limited

Annual Report 2011 - Goodbaby International Holdings Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO FINANCIAL STATEMENTS<br />

31 December <strong>2011</strong><br />

22. TRADE AND NOTES RECEIVABLES (Continued)<br />

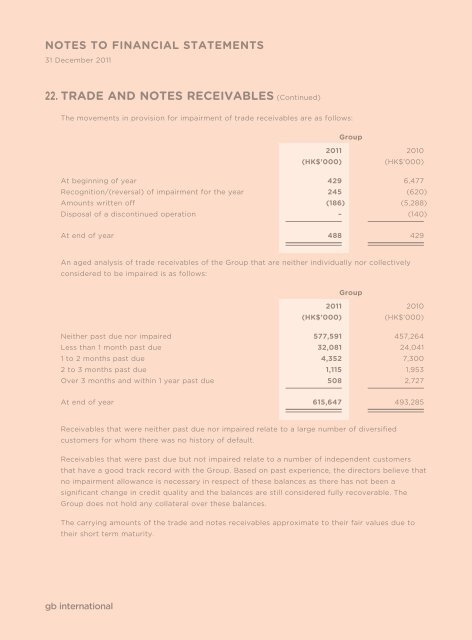

The movements in provision for impairment of trade receivables are as follows:<br />

gb international<br />

Group<br />

<strong>2011</strong> 2010<br />

(HK$’000) (HK$’000)<br />

At beginning of year 429 6,477<br />

Recognition/(reversal) of impairment for the year 245 (620)<br />

Amounts written off (186) (5,288)<br />

Disposal of a discontinued operation – (140)<br />

At end of year 488 429<br />

An aged analysis of trade receivables of the Group that are neither individually nor collectively<br />

considered to be impaired is as follows:<br />

Group<br />

<strong>2011</strong> 2010<br />

(HK$’000) (HK$’000)<br />

Neither past due nor impaired 577,591 457,264<br />

Less than 1 month past due 32,081 24,041<br />

1 to 2 months past due 4,352 7,300<br />

2 to 3 months past due 1,115 1,953<br />

Over 3 months and within 1 year past due 508 2,727<br />

At end of year 615,647 493,285<br />

Receivables that were neither past due nor impaired relate to a large number of diversified<br />

customers for whom there was no history of default.<br />

Receivables that were past due but not impaired relate to a number of independent customers<br />

that have a good track record with the Group. Based on past experience, the directors believe that<br />

no impairment allowance is necessary in respect of these balances as there has not been a<br />

significant change in credit quality and the balances are still considered fully recoverable. The<br />

Group does not hold any collateral over these balances.<br />

The carrying amounts of the trade and notes receivables approximate to their fair values due to<br />

their short term maturity.