Annual Report 2007 - Investing In Africa

Annual Report 2007 - Investing In Africa

Annual Report 2007 - Investing In Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Accordingly, the capital requirement for market<br />

risk under the standard approach was estimated<br />

at US$111 million, of which US$92 million for<br />

interest rate risk, US$15 million for foreign<br />

exchange risk and US$4 million for equity risk.<br />

The equivalent risk-weighted assets amounted<br />

to US$1.4 billion.<br />

4.4 Capital Adequacy<br />

<strong>In</strong> all the countries where Ecobank operates,<br />

banks are required to hold a minimum capital<br />

level determined by the regulators in line with<br />

the recommendations of the Basel Committee<br />

on Banking Supervision. Under the original<br />

Basel accord, banks were to maintain a ratio of<br />

regulatory capital to risk-weighted assets of 8%.<br />

This ratio has been increased in some countries<br />

to 10%. With risk-weighted assets of US$4.0 billion<br />

and regulatory capital of US$628 million, the<br />

group reported a capital adequacy ratio of<br />

15.7% as of 31 December <strong>2007</strong>, largely exceeding<br />

the international standard set under Basel I.<br />

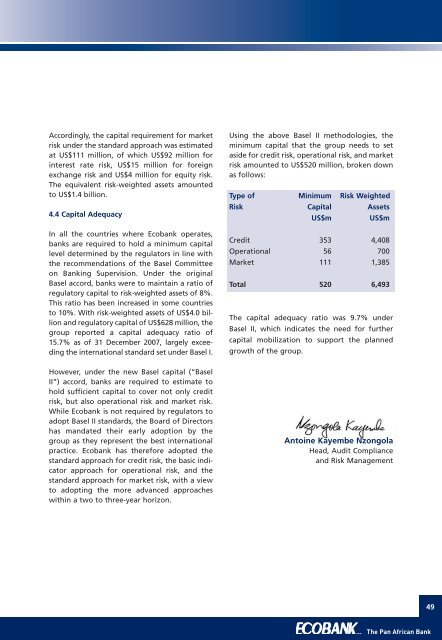

Using the above Basel II methodologies, the<br />

minimum capital that the group needs to set<br />

aside for credit risk, operational risk, and market<br />

risk amounted to US$520 million, broken down<br />

as follows:<br />

Type of Minimum Risk Weighted<br />

Risk Capital Assets<br />

US$m<br />

US$m<br />

Credit 353 4,408<br />

Operational 56 700<br />

Market 111 1,385<br />

Total 520 6,493<br />

The capital adequacy ratio was 9.7% under<br />

Basel II, which indicates the need for further<br />

capital mobilization to support the planned<br />

growth of the group.<br />

However, under the new Basel capital (“Basel<br />

II”) accord, banks are required to estimate to<br />

hold sufficient capital to cover not only credit<br />

risk, but also operational risk and market risk.<br />

While Ecobank is not required by regulators to<br />

adopt Basel II standards, the Board of Directors<br />

has mandated their early adoption by the<br />

group as they represent the best international<br />

practice. Ecobank has therefore adopted the<br />

standard approach for credit risk, the basic indicator<br />

approach for operational risk, and the<br />

standard approach for market risk, with a view<br />

to adopting the more advanced approaches<br />

within a two to three-year horizon.<br />

Antoine Kayembe Nzongola<br />

Head, Audit Compliance<br />

and Risk Management<br />

49<br />

... The Pan <strong>Africa</strong>n Bank