Egypt Real Estate Sector - Talaat Moustafa Group

Egypt Real Estate Sector - Talaat Moustafa Group

Egypt Real Estate Sector - Talaat Moustafa Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

05 October 2011<br />

Weak outlook; but TMG becomes<br />

our only differentiated story<br />

Short term threats to demand and developers’ sales<br />

due to land title disputes…<br />

Although we believe that strong fundamental demand in the housing market remains intact,<br />

especially in Middle and Lower income housing segments, we expect most developers<br />

sales volume to continue to remain under pressure in the near term as a result of ongoing<br />

land title legal disputes which may continue to push buyers to put their purchases on hold.<br />

Moreover, we also expect developers to continue to experience rising cancellations given<br />

the concerns regarding ownership of land, which could lead to significant delays in project<br />

completion for some developers such as PHD and SODIC.<br />

…but TMG’s sales still outperform on middle-income<br />

demand<br />

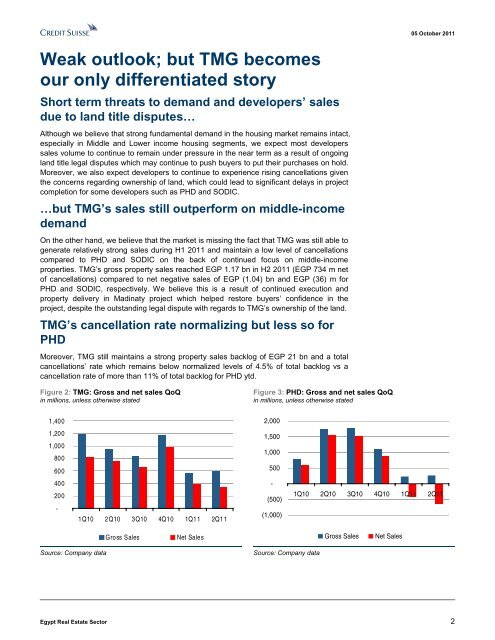

On the other hand, we believe that the market is missing the fact that TMG was still able to<br />

generate relatively strong sales during H1 2011 and maintain a low level of cancellations<br />

compared to PHD and SODIC on the back of continued focus on middle-income<br />

properties. TMG’s gross property sales reached EGP 1.17 bn in H2 2011 (EGP 734 m net<br />

of cancellations) compared to net negative sales of EGP (1.04) bn and EGP (36) m for<br />

PHD and SODIC, respectively. We believe this is a result of continued execution and<br />

property delivery in Madinaty project which helped restore buyers’ confidence in the<br />

project, despite the outstanding legal dispute with regards to TMG’s ownership of the land.<br />

TMG’s cancellation rate normalizing but less so for<br />

PHD<br />

Moreover, TMG still maintains a strong property sales backlog of EGP 21 bn and a total<br />

cancellations’ rate which remains below normalized levels of 4.5% of total backlog vs a<br />

cancellation rate of more than 11% of total backlog for PHD ytd.<br />

Figure 2: TMG: Gross and net sales QoQ<br />

in millions, unless otherwise stated<br />

Figure 3: PHD: Gross and net sales QoQ<br />

in millions, unless otherwise stated<br />

1,400<br />

2,000<br />

1,200<br />

1,000<br />

800<br />

600<br />

1,500<br />

1,000<br />

500<br />

400<br />

200<br />

-<br />

1Q10 2Q10 3Q10 4Q10 1Q11 2Q11<br />

-<br />

(500)<br />

(1,000)<br />

1Q10 2Q10 3Q10 4Q10 1Q11 2Q11<br />

Gross Sales<br />

Net Sales<br />

Gross Sales<br />

Net Sales<br />

Source: Company data<br />

Source: Company data<br />

<strong>Egypt</strong> <strong>Real</strong> <strong>Estate</strong> <strong>Sector</strong> 2