2011. In this annual information form - Encana

2011. In this annual information form - Encana

2011. In this annual information form - Encana

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The decision to pay dividends and the amount of such dividends is subject to the discretion of the<br />

Company’s Board of Directors based on numerous factors and may vary from time to time.<br />

Although the Company currently intends to pay quarterly cash dividends to its shareholders, these cash dividends<br />

may be reduced or suspended. The amount of cash available to the Company to pay dividends, if any, can vary<br />

significantly from period to period for a number of reasons, including, among other things: <strong>Encana</strong>'s operational<br />

and financial per<strong>form</strong>ance; fluctuations in the costs to produce natural gas, oil and NGLs; the amount of cash<br />

required or retained for debt service or repayment; amounts required to fund capital expenditures and working<br />

capital requirements; access to equity markets; foreign currency exchange rates and interest rates; and the risk<br />

factors set forth in <strong>this</strong> <strong>annual</strong> <strong>in<strong>form</strong>ation</strong> <strong>form</strong>.<br />

The decision whether or not to pay dividends and the amount of any such dividends are subject to the discretion<br />

of the Company’s Board of Directors, which regularly evaluates the Company's proposed dividend payments and<br />

the solvency test requirements of the CBCA. <strong>In</strong> addition, the level of dividends per common share will be affected<br />

by the number of outstanding common shares and other securities that may be entitled to receive cash dividends<br />

or other payments. Dividends may be increased, reduced or suspended depending on the Company's operational<br />

success and the per<strong>form</strong>ance of its assets. The market value of the common shares may deteriorate if the<br />

Company is unable to meet dividend expectations in the future, and that deterioration may be material.<br />

The Company’s foreign operations will expose it to risks from abroad which could negatively affect its<br />

results of operations.<br />

Some of <strong>Encana</strong>’s operations and related assets may be located, from time to time, in countries outside North<br />

America, some of which may be considered to be politically and economically unstable. Exploration or<br />

development activities in such countries may require protracted negotiations with host governments, national oil<br />

companies and third parties and are frequently subject to economic and political considerations, such as taxation,<br />

nationalization, expropriation, inflation, currency fluctuations, increased regulation and approval requirements,<br />

governmental regulation and the risk of actions by terrorist or insurgent groups, any of which could adversely<br />

affect the economics of exploration or development projects.<br />

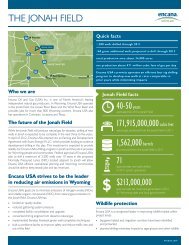

<strong>Encana</strong> Corporation<br />

37<br />

Annual <strong>In</strong><strong>form</strong>ation Form (prepared in US$)