2011. In this annual information form - Encana

2011. In this annual information form - Encana

2011. In this annual information form - Encana

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

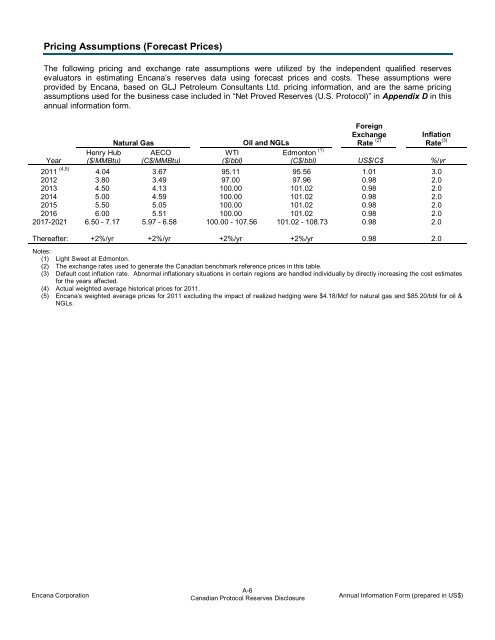

Pricing Assumptions (Forecast Prices)<br />

The following pricing and exchange rate assumptions were utilized by the independent qualified reserves<br />

evaluators in estimating <strong>Encana</strong>’s reserves data using forecast prices and costs. These assumptions were<br />

provided by <strong>Encana</strong>, based on GLJ Petroleum Consultants Ltd. pricing <strong>in<strong>form</strong>ation</strong>, and are the same pricing<br />

assumptions used for the business case included in “Net Proved Reserves (U.S. Protocol)” in Appendix D in <strong>this</strong><br />

<strong>annual</strong> <strong>in<strong>form</strong>ation</strong> <strong>form</strong>.<br />

Year<br />

Henry Hub<br />

($/MMBtu)<br />

Natural Gas<br />

AECO<br />

(C$/MMBtu)<br />

WTI<br />

($/bbl)<br />

Oil and NGLs<br />

Foreign<br />

Exchange<br />

Rate (2)<br />

<strong>In</strong>flation<br />

Rate (3)<br />

Edmonton (1)<br />

(C$/bbl) US$/C$ %/yr<br />

2011 (4,5) 4.04 3.67 95.11 95.56 1.01 3.0<br />

2012 3.80 3.49 97.00 97.96 0.98 2.0<br />

2013 4.50 4.13 100.00 101.02 0.98 2.0<br />

2014 5.00 4.59 100.00 101.02 0.98 2.0<br />

2015 5.50 5.05 100.00 101.02 0.98 2.0<br />

2016 6.00 5.51 100.00 101.02 0.98 2.0<br />

2017-2021 6.50 - 7.17 5.97 - 6.58 100.00 - 107.56 101.02 - 108.73 0.98 2.0<br />

Thereafter: +2%/yr +2%/yr +2%/yr +2%/yr 0.98 2.0<br />

Notes:<br />

(1) Light Sweet at Edmonton.<br />

(2) The exchange rates used to generate the Canadian benchmark reference prices in <strong>this</strong> table.<br />

(3) Default cost inflation rate. Abnormal inflationary situations in certain regions are handled individually by directly increasing the cost estimates<br />

for the years affected.<br />

(4) Actual weighted average historical prices for <strong>2011.</strong><br />

(5) <strong>Encana</strong>’s weighted average prices for 2011 excluding the impact of realized hedging were $4.18/Mcf for natural gas and $85.20/bbl for oil &<br />

NGLs.<br />

<strong>Encana</strong> Corporation<br />

A-6<br />

Canadian Protocol Reserves Disclosure<br />

Annual <strong>In</strong><strong>form</strong>ation Form (prepared in US$)