Rupali Bank Rating Report-final - Credit Rating Agency of Bangladesh

Rupali Bank Rating Report-final - Credit Rating Agency of Bangladesh

Rupali Bank Rating Report-final - Credit Rating Agency of Bangladesh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

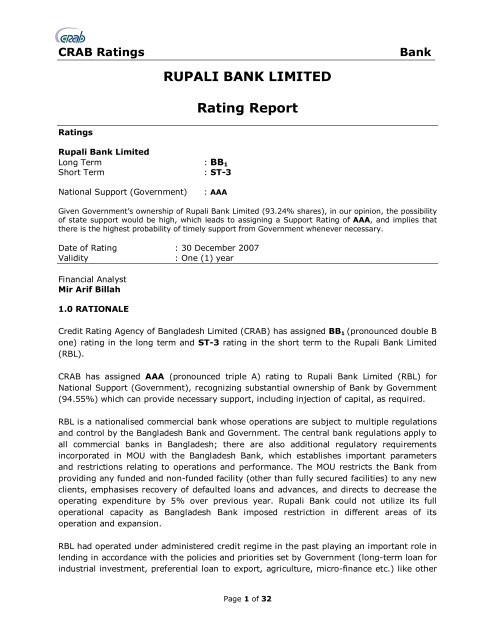

CRAB <strong>Rating</strong>s<br />

<strong>Bank</strong><br />

RUPALI BANK LIMITED<br />

<strong>Rating</strong> <strong>Report</strong><br />

<strong>Rating</strong>s<br />

<strong>Rupali</strong> <strong>Bank</strong> Limited<br />

Long Term : BB 1<br />

Short Term<br />

: ST-3<br />

National Support (Government)<br />

: AAA<br />

Given Government’s ownership <strong>of</strong> <strong>Rupali</strong> <strong>Bank</strong> Limited (93.24% shares), in our opinion, the possibility<br />

<strong>of</strong> state support would be high, which leads to assigning a Support <strong>Rating</strong> <strong>of</strong> AAA, and implies that<br />

there is the highest probability <strong>of</strong> timely support from Government whenever necessary.<br />

Date <strong>of</strong> <strong>Rating</strong> : 30 December 2007<br />

Validity<br />

: One (1) year<br />

Financial Analyst<br />

Mir Arif Billah<br />

1.0 RATIONALE<br />

<strong>Credit</strong> <strong>Rating</strong> <strong>Agency</strong> <strong>of</strong> <strong>Bangladesh</strong> Limited (CRAB) has assigned BB 1 (pronounced double B<br />

one) rating in the long term and ST-3 rating in the short term to the <strong>Rupali</strong> <strong>Bank</strong> Limited<br />

(RBL).<br />

CRAB has assigned AAA (pronounced triple A) rating to <strong>Rupali</strong> <strong>Bank</strong> Limited (RBL) for<br />

National Support (Government), recognizing substantial ownership <strong>of</strong> <strong>Bank</strong> by Government<br />

(94.55%) which can provide necessary support, including injection <strong>of</strong> capital, as required.<br />

RBL is a nationalised commercial bank whose operations are subject to multiple regulations<br />

and control by the <strong>Bangladesh</strong> <strong>Bank</strong> and Government. The central bank regulations apply to<br />

all commercial banks in <strong>Bangladesh</strong>; there are also additional regulatory requirements<br />

incorporated in MOU with the <strong>Bangladesh</strong> <strong>Bank</strong>, which establishes important parameters<br />

and restrictions relating to operations and performance. The MOU restricts the <strong>Bank</strong> from<br />

providing any funded and non-funded facility (other than fully secured facilities) to any new<br />

clients, emphasises recovery <strong>of</strong> defaulted loans and advances, and directs to decrease the<br />

operating expenditure by 5% over previous year. <strong>Rupali</strong> <strong>Bank</strong> could not utilize its full<br />

operational capacity as <strong>Bangladesh</strong> <strong>Bank</strong> imposed restriction in different areas <strong>of</strong> its<br />

operation and expansion.<br />

RBL had operated under administered credit regime in the past playing an important role in<br />

lending in accordance with the policies and priorities set by Government (long-term loan for<br />

industrial investment, preferential loan to export, agriculture, micro-finance etc.) like other<br />

Page 1 <strong>of</strong> 32

CRAB <strong>Rating</strong>s<br />

<strong>Bank</strong><br />

NCBs. RBL also carries a large portfolio <strong>of</strong> loan to public sector corporations for which<br />

Government has issued bonds and guarantees or implicit guarantees. Much <strong>of</strong> the portfolio<br />

<strong>of</strong> loan to the state enterprises is non-performing but protected by the above mentioned<br />

bonds and guarantees.<br />

RBL is presently under process <strong>of</strong> privatisation, as the government shares (67%) <strong>of</strong> the<br />

<strong>Bank</strong> will be handed over to private investor/s. The process <strong>of</strong> sale has protracted for a long<br />

time, and the uncertainty over the ownership and consequent management change has<br />

affected the performance <strong>of</strong> the <strong>Bank</strong>. The management <strong>of</strong> the <strong>Bank</strong> deserves the credit <strong>of</strong><br />

keeping the bank operational with success in liquidity management and loan recovery in<br />

spite <strong>of</strong> the uncertainties, restriction on business growth and expenditure, and human<br />

resources constraints. Because <strong>of</strong> these diverse constraints, the <strong>Bank</strong>’s operation fell below<br />

its potential.<br />

Exhibit 1: Key Financial Indicators<br />

(Amount in Million BDT)<br />

Particulars FY04 FY05 FY06<br />

Total Assets 71,579.60 75,124.00 76,240.50<br />

Total Deposits 63,673.60 66,870.50 67,832.10<br />

Total Loans & Advances 45,344.90 44,920.70 45,709.50<br />

Paid Up Capital 1,250.00 1,250.00 1,250.00<br />

Total Capital (Core & Supplementary) 2,953.60 2,953.60 2,960.60<br />

Total Operating Income 1,682.52 2,146.10 1,770.44<br />

Pr<strong>of</strong>it Before Provision & Taxes 513.44 810.81 254.70<br />

Pr<strong>of</strong>it After Tax & Provision 203.44 350.81 144.70<br />

Classified Loans (Gross NPL) 7,721.16 7,509.20 12,124.39<br />

Net Interest Margin (%) 1.05 1.67 1.38<br />

Net Loans To Total Deposits (%) 65.59 62.16 62.29<br />

Net Loans & Advances To Total Assets (%) 58.35 55.33 55.42<br />

Gross NPL Ratio (%) 11.27 11.74 22.14<br />

Net NPL Ratio (%) 9.92 10.00 20.52<br />

Loan Loss Reserve Coverage (%) 1.50 1.94 2.05<br />

Net NPL / Total Assets (%) 5.79 5.53 11.37<br />

Return On Average Assets (ROAA) (%) 0.29 0.48 0.19<br />

Earning Per Share (BDT) 8.06 15.09 7.50<br />

The <strong>Bank</strong>’s asset quality further deteriorated in recent years. The NPL had increased sharply<br />

to BDT 12.12 billion in FY06 from BDT 7.51 billion in FY05 (61% growth). In FY06 RBL’s<br />

Gross NPL ratio was 26.52% 1 , Gross NPL Ratio with adjustment Interest Suspense was<br />

22.14% 2 and Gross NPL ratio with adjustment SMA was 26.89% 3 . These classified amounts<br />

22% were from lending to public sector, while the rest were to private sector. There is<br />

significant shortfall <strong>of</strong> provisioning against the loans, advances and investments and the<br />

1<br />

Classified Loans / Total Loans, Advance and Bills<br />

2 (Classified Loans – Interest Suspense Account) / (Total Loans – Interest Suspense Account)<br />

3 (Classified Loans + SMA) / Total Loans<br />

Page 2 <strong>of</strong> 32

CRAB <strong>Rating</strong>s<br />

<strong>Bank</strong><br />

deficit is increasing (yearly shortfall <strong>of</strong> provisioning for FY06 BDT 3.43 billion, accumulated<br />

shortfall <strong>of</strong> provisioning for FY06 BDT 8.16 billion).<br />

The overall pr<strong>of</strong>itability <strong>of</strong> the <strong>Bank</strong> declined last year with fall in income from both interest<br />

and investment and increase in interest and operating expenses. Net interest income<br />

decreased by 13% over previous year and summed to BDT 651.18 million in FY06. Income<br />

from investment also decreased by 39% over previous year and amounted to BDT 523.26<br />

million in FY06. Total operating income decreased to BDT 1.77 billion (decrease by 18%) in<br />

FY06 from BDT 2.15 billion in FY05. Pr<strong>of</strong>it before provision and tax stood at BDT 254.70<br />

million in FY06 from BDT 810.81 million in FY05 having a decline <strong>of</strong> 60%; pr<strong>of</strong>it after<br />

provision and tax was BDT 93.76 million compared to BDT 188.65 million in FY05 (there is<br />

huge shortfall from required provision in each year).<br />

<strong>Bank</strong>’s shareholders equity stood at BDT 328.66 million in FY06 against paid up capital <strong>of</strong><br />

BDT 1.25 billion after adjustments <strong>of</strong> carried forward loss <strong>of</strong> BDT 2.60 billion. Adjustments<br />

for provision shortfall <strong>of</strong> BDT 8.16 billion brings the net worth to a negative figure <strong>of</strong> BDT<br />

7.81 billion. There is also a capital shortfall <strong>of</strong> BDT 1.14 billion from the required level to<br />

maintain risk weighted capital adequacy at 9% (RBL had 6.5% risk weighted capital<br />

adequacy).<br />

Absolute and relative size <strong>of</strong> RBL in terms <strong>of</strong> asset and deposit is a good indication <strong>of</strong> its<br />

strong market position and brand name. RBL with its wide network captures around 10% <strong>of</strong><br />

the total deposit <strong>of</strong> the country, in spite <strong>of</strong> comparatively weaker customer service than the<br />

other private commercial banks and lower deposit yield to the savers. CRAB expects that it<br />

is an indication <strong>of</strong> pricing power <strong>of</strong> RBL and perception <strong>of</strong> the depositors about the future<br />

viability <strong>of</strong> the bank.<br />

Commercial <strong>Bank</strong>s rated BB 1 are adjudged to <strong>of</strong>fer below average safety to its obligors,<br />

characterised by relatively weak financials, weak business franchises, and an unstable<br />

operating environment. This level <strong>of</strong> rating indicates below average capacity for timely<br />

payment <strong>of</strong> financial commitments with high likeliness to be adversely affected by<br />

foreseeable events.<br />

<strong>Bank</strong> rated in ST-3 category are considered to have average capacity for timely repayment<br />

<strong>of</strong> obligations, although such capacity may be impair by adverse changes in business,<br />

economic, or financial conditions. <strong>Bank</strong>s rated in this category are characterised with<br />

satisfactory level <strong>of</strong> liquidity, internal fund generation, and access to alternative sources <strong>of</strong><br />

funds is outstanding in the sort term.<br />

2.0 ECONOMIC AND OPERATING ENVIRONMENT<br />

Increased economic activity, reflected in the GDP growth (6.5% in FY 06), is the key driver<br />

behind the increase in the business expansion and growth <strong>of</strong> the banking industry in<br />

<strong>Bangladesh</strong>.<br />

Page 3 <strong>of</strong> 32