Vol. 2007, No. 15 (08/01/2007) PDF - Administrative Rules - Utah.gov

Vol. 2007, No. 15 (08/01/2007) PDF - Administrative Rules - Utah.gov

Vol. 2007, No. 15 (08/01/2007) PDF - Administrative Rules - Utah.gov

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

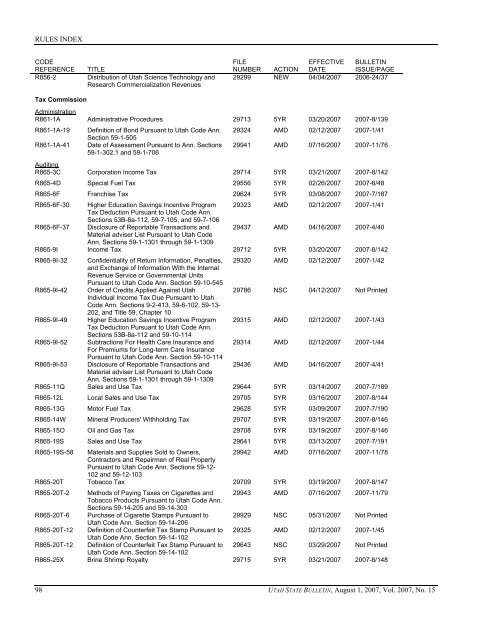

RULES INDEX<br />

CODE<br />

REFERENCE TITLE<br />

R856-2 Distribution of <strong>Utah</strong> Science Technology and<br />

Research Commercialization Revenues<br />

FILE<br />

EFFECTIVE BULLETIN<br />

NUMBER ACTION DATE ISSUE/PAGE<br />

29299 NEW 04/04/<strong>2007</strong> 2006-24/37<br />

Tax Commission<br />

Administration<br />

R861-1A <strong>Administrative</strong> Procedures 29713 5YR 03/20/<strong>2007</strong> <strong>2007</strong>-8/139<br />

R861-1A-19 Definition of Bond Pursuant to <strong>Utah</strong> Code Ann. 29324 AMD 02/12/<strong>2007</strong> <strong>2007</strong>-1/41<br />

Section 59-1-505<br />

R861-1A-41 Date of Assessment Pursuant to Ann. Sections<br />

59-1-302.1 and 59-1-706<br />

29941 AMD 07/16/<strong>2007</strong> <strong>2007</strong>-11/76<br />

Auditing<br />

R865-3C Corporation Income Tax 29714 5YR 03/21/<strong>2007</strong> <strong>2007</strong>-8/142<br />

R865-4D Special Fuel Tax 29556 5YR 02/26/<strong>2007</strong> <strong>2007</strong>-6/48<br />

R865-6F Franchise Tax 29624 5YR 03/<strong>08</strong>/<strong>2007</strong> <strong>2007</strong>-7/187<br />

R865-6F-30 Higher Education Savings Incentive Program 29323 AMD 02/12/<strong>2007</strong> <strong>2007</strong>-1/41<br />

Tax Deduction Pursuant to <strong>Utah</strong> Code Ann.<br />

Sections 53B-8a-112, 59-7-105, and 59-7-106<br />

R865-6F-37 Disclosure of Reportable Transactions and 29437 AMD 04/16/<strong>2007</strong> <strong>2007</strong>-4/40<br />

Material adviser List Pursuant to <strong>Utah</strong> Code<br />

Ann. Sections 59-1-13<strong>01</strong> through 59-1-1309<br />

R865-9I Income Tax 29712 5YR 03/20/<strong>2007</strong> <strong>2007</strong>-8/142<br />

R865-9I-32 Confidentiality of Return Information, Penalties, 29320 AMD 02/12/<strong>2007</strong> <strong>2007</strong>-1/42<br />

and Exchange of Information With the Internal<br />

Revenue Service or Governmental Units<br />

Pursuant to <strong>Utah</strong> Code Ann. Section 59-10-545<br />

R865-9I-42 Order of Credits Applied Against <strong>Utah</strong><br />

29786 NSC 04/12/<strong>2007</strong> <strong>No</strong>t Printed<br />

Individual Income Tax Due Pursuant to <strong>Utah</strong><br />

Code Ann. Sections 9-2-413, 59-6-102, 59-13-<br />

202, and Title 59, Chapter 10<br />

R865-9I-49 Higher Education Savings Incentive Program 293<strong>15</strong> AMD 02/12/<strong>2007</strong> <strong>2007</strong>-1/43<br />

Tax Deduction Pursuant to <strong>Utah</strong> Code Ann.<br />

Sections 53B-8a-112 and 59-10-114<br />

R865-9I-52 Subtractions For Health Care Insurance and 29314 AMD 02/12/<strong>2007</strong> <strong>2007</strong>-1/44<br />

For Premiums for Long-term Care Insurance<br />

Pursuant to <strong>Utah</strong> Code Ann. Section 59-10-114<br />

R865-9I-53 Disclosure of Reportable Transactions and 29436 AMD 04/16/<strong>2007</strong> <strong>2007</strong>-4/41<br />

Material adviser List Pursuant to <strong>Utah</strong> Code<br />

Ann. Sections 59-1-13<strong>01</strong> through 59-1-1309<br />

R865-11Q Sales and Use Tax 29644 5YR 03/14/<strong>2007</strong> <strong>2007</strong>-7/189<br />

R865-12L Local Sales and Use Tax 29705 5YR 03/16/<strong>2007</strong> <strong>2007</strong>-8/144<br />

R865-13G Motor Fuel Tax 29628 5YR 03/09/<strong>2007</strong> <strong>2007</strong>-7/190<br />

R865-14W Mineral Producers' Withholding Tax 29707 5YR 03/19/<strong>2007</strong> <strong>2007</strong>-8/146<br />

R865-<strong>15</strong>O Oil and Gas Tax 297<strong>08</strong> 5YR 03/19/<strong>2007</strong> <strong>2007</strong>-8/146<br />

R865-19S Sales and Use Tax 29641 5YR 03/13/<strong>2007</strong> <strong>2007</strong>-7/191<br />

R865-19S-58 Materials and Supplies Sold to Owners,<br />

29942 AMD 07/16/<strong>2007</strong> <strong>2007</strong>-11/78<br />

Contractors and Repairmen of Real Property<br />

Pursuant to <strong>Utah</strong> Code Ann. Sections 59-12-<br />

102 and 59-12-103<br />

R865-20T Tobacco Tax 29709 5YR 03/19/<strong>2007</strong> <strong>2007</strong>-8/147<br />

R865-20T-2 Methods of Paying Taxes on Cigarettes and 29943 AMD 07/16/<strong>2007</strong> <strong>2007</strong>-11/79<br />

Tobacco Products Pursuant to <strong>Utah</strong> Code Ann.<br />

Sections 59-14-205 and 59-14-303<br />

R865-20T-6 Purchase of Cigarette Stamps Pursuant to 29929 NSC 05/31/<strong>2007</strong> <strong>No</strong>t Printed<br />

<strong>Utah</strong> Code Ann. Section 59-14-206<br />

R865-20T-12 Definition of Counterfeit Tax Stamp Pursuant to 29325 AMD 02/12/<strong>2007</strong> <strong>2007</strong>-1/45<br />

<strong>Utah</strong> Code Ann. Section 59-14-102<br />

R865-20T-12 Definition of Counterfeit Tax Stamp Pursuant to 29643 NSC 03/29/<strong>2007</strong> <strong>No</strong>t Printed<br />

<strong>Utah</strong> Code Ann. Section 59-14-102<br />

R865-25X Brine Shrimp Royalty 297<strong>15</strong> 5YR 03/21/<strong>2007</strong> <strong>2007</strong>-8/148<br />

98 UTAH STATE BULLETIN, August 1, <strong>2007</strong>, <strong>Vol</strong>. <strong>2007</strong>, <strong>No</strong>. <strong>15</strong>

![Lynx avoidance [PDF] - Wisconsin Department of Natural Resources](https://img.yumpu.com/41279089/1/159x260/lynx-avoidance-pdf-wisconsin-department-of-natural-resources.jpg?quality=85)