FCP OP MEDICAL BioHe@lth-Trends - medical.lu

FCP OP MEDICAL BioHe@lth-Trends - medical.lu

FCP OP MEDICAL BioHe@lth-Trends - medical.lu

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

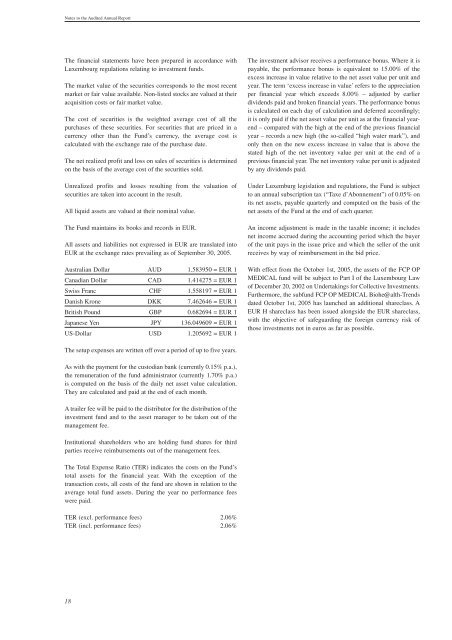

Notes to the Audited Annual Report<br />

The financial statements have been prepared in accordance with<br />

Luxembourg regulations relating to investment funds.<br />

The market va<strong>lu</strong>e of the securities corresponds to the most recent<br />

market or fair va<strong>lu</strong>e available. Non-listed stocks are va<strong>lu</strong>ed at their<br />

acquisition costs or fair market va<strong>lu</strong>e.<br />

The cost of securities is the weighted average cost of all the<br />

purchases of these securities. For securities that are priced in a<br />

currency other than the Fund’s currency, the average cost is<br />

calculated with the exchange rate of the purchase date.<br />

The net realized profit and loss on sales of securities is determined<br />

on the basis of the average cost of the securities sold.<br />

Unrealized profits and losses resulting from the va<strong>lu</strong>ation of<br />

securities are taken into account in the result.<br />

All liquid assets are va<strong>lu</strong>ed at their nominal va<strong>lu</strong>e.<br />

The Fund maintains its books and records in EUR.<br />

All assets and liabilities not expressed in EUR are translated into<br />

EUR at the exchange rates prevailing as of September 30, 2005.<br />

Australian Dollar AUD 1.583950 = EUR 1<br />

Canadian Dollar CAD 1.414275 = EUR 1<br />

Swiss Franc CHF 1.558197 = EUR 1<br />

Danish Krone DKK 7.462646 = EUR 1<br />

British Pound GBP 0.682694 = EUR 1<br />

Japanese Yen JPY 136.049609 = EUR 1<br />

US-Dollar USD 1.205692 = EUR 1<br />

The setup expenses are written off over a period of up to five years.<br />

As with the payment for the custodian bank (currently 0.15% p.a.),<br />

the remuneration of the fund administrator (currently 1.70% p.a.)<br />

is computed on the basis of the daily net asset va<strong>lu</strong>e calculation.<br />

They are calculated and paid at the end of each month.<br />

A trailer fee will be paid to the distributor for the distribution of the<br />

investment fund and to the asset manager to be taken out of the<br />

management fee.<br />

Institutional shareholders who are holding fund shares for third<br />

parties receive reimbursements out of the management fees.<br />

The Total Expense Ratio (TER) indicates the costs on the Fund’s<br />

total assets for the financial year. With the exception of the<br />

transaction costs, all costs of the fund are shown in relation to the<br />

average total fund assets. During the year no performance fees<br />

were paid.<br />

TER (excl. performance fees) 2.06%<br />

TER (incl. performance fees) 2.06%<br />

18<br />

The investment advisor receives a performance bonus. Where it is<br />

payable, the performance bonus is equivalent to 15.00% of the<br />

excess increase in va<strong>lu</strong>e relative to the net asset va<strong>lu</strong>e per unit and<br />

year. The term ‘excess increase in va<strong>lu</strong>e’ refers to the appreciation<br />

per financial year which exceeds 8.00% – adjusted by earlier<br />

dividends paid and broken financial years. The performance bonus<br />

is calculated on each day of calculation and deferred accordingly;<br />

it is only paid if the net asset va<strong>lu</strong>e per unit as at the financial yearend<br />

– compared with the high at the end of the previous financial<br />

year – records a new high (the so-called “high water mark”), and<br />

only then on the new excess increase in va<strong>lu</strong>e that is above the<br />

stated high of the net inventory va<strong>lu</strong>e per unit at the end of a<br />

previous financial year. The net inventory va<strong>lu</strong>e per unit is adjusted<br />

by any dividends paid.<br />

Under Luxemburg legislation and regulations, the Fund is subject<br />

to an annual subscription tax (“Taxe d’Abonnement”) of 0.05% on<br />

its net assets, payable quarterly and computed on the basis of the<br />

net assets of the Fund at the end of each quarter.<br />

An income adjustment is made in the taxable income; it inc<strong>lu</strong>des<br />

net income accrued during the accounting period which the buyer<br />

of the unit pays in the issue price and which the seller of the unit<br />

receives by way of reimbursement in the bid price.<br />

With effect from the October 1st, 2005, the assets of the <strong>FCP</strong> <strong>OP</strong><br />

<strong>MEDICAL</strong> fund will be subject to Part I of the Luxembourg Law<br />

of December 20, 2002 on Undertakings for Collective Investments.<br />

Furthermore, the subfund <strong>FCP</strong> <strong>OP</strong> <strong>MEDICAL</strong> Biohe@alth-<strong>Trends</strong><br />

dated October 1st, 2005 has launched an additional shareclass. A<br />

EUR H shareclass has been issued alongside the EUR shareclass,<br />

with the objective of safeguarding the foreign currency risk of<br />

those investments not in euros as far as possible.