FCP OP MEDICAL BioHe@lth-Trends - medical.lu

FCP OP MEDICAL BioHe@lth-Trends - medical.lu

FCP OP MEDICAL BioHe@lth-Trends - medical.lu

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Development of the Capital Markets in the Period under Review<br />

Development of the capital markets in the period under review<br />

Health growth market and general financial conditions<br />

Health – that is to say a better quality of life and longer life<br />

expectancy – is generally regarded as one of the highest priorities<br />

in developed industrial nations. Accordingly, the risk of illness<br />

within the population is covered through various types of insurance<br />

in such countries. Generally speaking, the scope of services<br />

provided by health insurance companies has expanded<br />

continuously since the 1950s. This is reflected in the increase in<br />

premium rates among the health insurance companies. In<br />

Germany, these rates have increased among statutory health<br />

insurance funds from 6% of the basis for assessment of income in<br />

1950 to 14.2% in 2005 (source: Federal Ministry for Health and<br />

Social Security, FAZ Sunday, 26 June, 2005).<br />

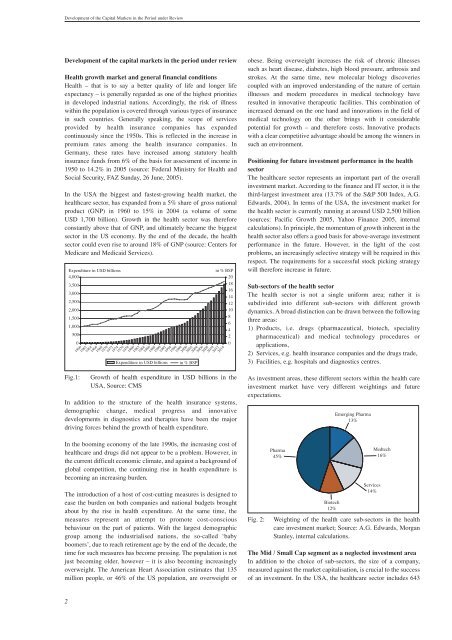

In the USA the biggest and fastest-growing health market, the<br />

healthcare sector, has expanded from a 5% share of gross national<br />

product (GNP) in 1960 to 15% in 2004 (a vo<strong>lu</strong>me of some<br />

USD 1,700 billion). Growth in the health sector was therefore<br />

constantly above that of GNP, and ultimately became the biggest<br />

sector in the US economy. By the end of the decade, the health<br />

sector could even rise to around 18% of GNP (source: Centers for<br />

Medicare and Medicaid Services).<br />

Fig.1: Growth of health expenditure in USD billions in the<br />

USA, Source: CMS<br />

In addition to the structure of the health insurance systems,<br />

demographic change, <strong>medical</strong> progress and innovative<br />

developments in diagnostics and therapies have been the major<br />

driving forces behind the growth of health expenditure.<br />

In the booming economy of the late 1990s, the increasing cost of<br />

healthcare and drugs did not appear to be a problem. However, in<br />

the current difficult economic climate, and against a background of<br />

global competition, the continuing rise in health expenditure is<br />

becoming an increasing burden.<br />

The introduction of a host of cost-cutting measures is designed to<br />

ease the burden on both companies and national budgets brought<br />

about by the rise in health expenditure. At the same time, the<br />

measures represent an attempt to promote cost-conscious<br />

behaviour on the part of patients. With the largest demographic<br />

group among the industrialised nations, the so-called ‘baby<br />

boomers’, due to reach retirement age by the end of the decade, the<br />

time for such measures has become pressing. The population is not<br />

just becoming older, however – it is also becoming increasingly<br />

overweight. The American Heart Association estimates that 135<br />

million people, or 46% of the US population, are overweight or<br />

2<br />

Expenditure in USD billions<br />

4,000<br />

3,500<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

1960<br />

1962<br />

1964<br />

1966<br />

1968<br />

1970<br />

1972<br />

1974<br />

1976<br />

Expenditure in USD billions in % BSP<br />

in % BSP<br />

20<br />

1978<br />

1980<br />

1982<br />

1984<br />

1986<br />

1988<br />

1990<br />

1992<br />

1994<br />

1996<br />

1998<br />

2000<br />

2002<br />

2004<br />

2006<br />

2008<br />

2010<br />

2012<br />

2014<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

obese. Being overweight increases the risk of chronic illnesses<br />

such as heart disease, diabetes, high blood pressure, arthrosis and<br />

strokes. At the same time, new molecular biology discoveries<br />

coupled with an improved understanding of the nature of certain<br />

illnesses and modern procedures in <strong>medical</strong> technology have<br />

resulted in innovative therapeutic facilities. This combination of<br />

increased demand on the one hand and innovations in the field of<br />

<strong>medical</strong> technology on the other brings with it considerable<br />

potential for growth – and therefore costs. Innovative products<br />

with a clear competitive advantage should be among the winners in<br />

such an environment.<br />

Positioning for future investment performance in the health<br />

sector<br />

The healthcare sector represents an important part of the overall<br />

investment market. According to the finance and IT sector, it is the<br />

third-largest investment area (13.7% of the S&P 500 Index, A.G.<br />

Edwards, 2004). In terms of the USA, the investment market for<br />

the health sector is currently running at around USD 2,500 billion<br />

(sources: Pacific Growth 2005, Yahoo Finance 2005, internal<br />

calculations). In principle, the momentum of growth inherent in the<br />

health sector also offers a good basis for above-average investment<br />

performance in the future. However, in the light of the cost<br />

problems, an increasingly selective strategy will be required in this<br />

respect. The requirements for a successful stock picking strategy<br />

will therefore increase in future.<br />

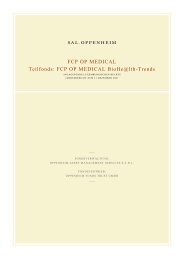

Sub-sectors of the health sector<br />

The health sector is not a single uniform area; rather it is<br />

subdivided into different sub-sectors with different growth<br />

dynamics. A broad distinction can be drawn between the following<br />

three areas:<br />

1) Products, i.e. drugs (pharmaceutical, biotech, speciality<br />

pharmaceutical) and <strong>medical</strong> technology procedures or<br />

applications,<br />

2) Services, e.g. health insurance companies and the drugs trade,<br />

3) Facilities, e.g. hospitals and diagnostics centres.<br />

As investment areas, these different sectors within the health care<br />

investment market have very different weightings and future<br />

expectations.<br />

Pharma<br />

45%<br />

Biotech<br />

12%<br />

Emerging Pharma<br />

13%<br />

Services<br />

14%<br />

Medtech<br />

16%<br />

Fig. 2: Weighting of the health care sub-sectors in the health<br />

care investment market; Source: A.G. Edwards, Morgan<br />

Stanley, internal calculations.<br />

The Mid / Small Cap segment as a neglected investment area<br />

In addition to the choice of sub-sectors, the size of a company,<br />

measured against the market capitalisation, is crucial to the success<br />

of an investment. In the USA, the healthcare sector inc<strong>lu</strong>des 643