An opportunity to invest in global infrastructure ... - Macquarie

An opportunity to invest in global infrastructure ... - Macquarie

An opportunity to invest in global infrastructure ... - Macquarie

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

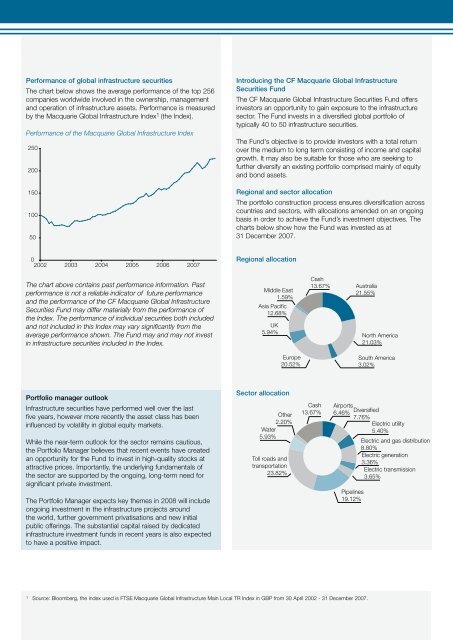

Performance of <strong>global</strong> <strong>in</strong>frastructure securities<br />

The chart below shows the average performance of the <strong>to</strong>p 256<br />

companies worldwide <strong>in</strong>volved <strong>in</strong> the ownership, management<br />

and operation of <strong>in</strong>frastructure assets. Performance is measured<br />

by the <strong>Macquarie</strong> Global Infrastructure Index 1 (the Index).<br />

Performance of the <strong>Macquarie</strong> Global Infrastructure Index<br />

250<br />

200<br />

150<br />

100<br />

50<br />

Introduc<strong>in</strong>g the CF <strong>Macquarie</strong> Global Infrastructure<br />

Securities Fund<br />

The CF <strong>Macquarie</strong> Global Infrastructure Securities Fund offers<br />

<strong>in</strong>ves<strong>to</strong>rs an <strong>opportunity</strong> <strong>to</strong> ga<strong>in</strong> exposure <strong>to</strong> the <strong>in</strong>frastructure<br />

sec<strong>to</strong>r. The Fund <strong><strong>in</strong>vest</strong>s <strong>in</strong> a diversified <strong>global</strong> portfolio of<br />

typically 40 <strong>to</strong> 50 <strong>in</strong>frastructure securities.<br />

The Fund's objective is <strong>to</strong> provide <strong>in</strong>ves<strong>to</strong>rs with a <strong>to</strong>tal return<br />

over the medium <strong>to</strong> long term consist<strong>in</strong>g of <strong>in</strong>come and capital<br />

growth. It may also be suitable for those who are seek<strong>in</strong>g <strong>to</strong><br />

further diversify an exist<strong>in</strong>g portfolio comprised ma<strong>in</strong>ly of equity<br />

and bond assets.<br />

Regional and sec<strong>to</strong>r allocation<br />

The portfolio construction process ensures diversification across<br />

countries and sec<strong>to</strong>rs, with allocations amended on an ongo<strong>in</strong>g<br />

basis <strong>in</strong> order <strong>to</strong> achieve the Fund’s <strong><strong>in</strong>vest</strong>ment objectives. The<br />

charts below show how the Fund was <strong><strong>in</strong>vest</strong>ed as at<br />

31 December 2007.<br />

0<br />

2002 2003 2004 2005 2006 2007<br />

Regional allocation<br />

The chart above conta<strong>in</strong>s past performance <strong>in</strong>formation. Past<br />

performance is not a reliable <strong>in</strong>dica<strong>to</strong>r of future performance<br />

and the performance of the CF <strong>Macquarie</strong> Global Infrastructure<br />

Securities Fund may differ materially from the performance of<br />

the Index. The performance of <strong>in</strong>dividual securities both <strong>in</strong>cluded<br />

and not <strong>in</strong>cluded <strong>in</strong> this Index may vary significantly from the<br />

average performance shown. The Fund may and may not <strong><strong>in</strong>vest</strong><br />

<strong>in</strong> <strong>in</strong>frastructure securities <strong>in</strong>cluded <strong>in</strong> the Index.<br />

Middle East<br />

1.59%<br />

Asia Pacific<br />

12.68%<br />

UK<br />

5.94%<br />

Cash<br />

13.67%<br />

Australia<br />

21.55%<br />

North America<br />

21.03%<br />

Europe<br />

20.52%<br />

South America<br />

3.02%<br />

Portfolio manager outlook<br />

Infrastructure securities have performed well over the last<br />

five years, however more recently the asset class has been<br />

<strong>in</strong>fluenced by volatility <strong>in</strong> <strong>global</strong> equity markets.<br />

While the near-term outlook for the sec<strong>to</strong>r rema<strong>in</strong>s cautious,<br />

the Portfolio Manager believes that recent events have created<br />

an <strong>opportunity</strong> for the Fund <strong>to</strong> <strong><strong>in</strong>vest</strong> <strong>in</strong> high-quality s<strong>to</strong>cks at<br />

attractive prices. Importantly, the underly<strong>in</strong>g fundamentals of<br />

the sec<strong>to</strong>r are supported by the ongo<strong>in</strong>g, long-term need for<br />

significant private <strong><strong>in</strong>vest</strong>ment.<br />

The Portfolio Manager expects key themes <strong>in</strong> 2008 will <strong>in</strong>clude<br />

ongo<strong>in</strong>g <strong><strong>in</strong>vest</strong>ment <strong>in</strong> the <strong>in</strong>frastructure projects around<br />

the world, further government privatisations and new <strong>in</strong>itial<br />

public offer<strong>in</strong>gs. The substantial capital raised by dedicated<br />

<strong>in</strong>frastructure <strong><strong>in</strong>vest</strong>ment funds <strong>in</strong> recent years is also expected<br />

<strong>to</strong> have a positive impact.<br />

Sec<strong>to</strong>r allocation<br />

Other<br />

2.20%<br />

Water<br />

5.93%<br />

Toll roads and<br />

transportation<br />

23.82%<br />

Cash<br />

13.67%<br />

Airports<br />

6.46% Diversified<br />

7.76%<br />

Electric utility<br />

5.40%<br />

Pipel<strong>in</strong>es<br />

19.12%<br />

Electric and gas distribution<br />

8.80%<br />

Electric generation<br />

3.36%<br />

Electric transmission<br />

3.65%<br />

1 Source: Bloomberg, the <strong>in</strong>dex used is FTSE <strong>Macquarie</strong> Global Infrastructure Ma<strong>in</strong> Local TR Index <strong>in</strong> GBP from 30 April 2002 - 31 December 2007.