Through a Glass Darkly: Measuring Loss Under ... - Land Use Law

Through a Glass Darkly: Measuring Loss Under ... - Land Use Law

Through a Glass Darkly: Measuring Loss Under ... - Land Use Law

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

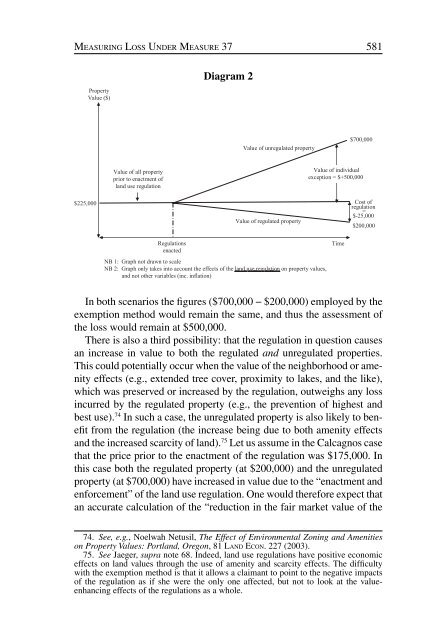

MEASURING LOSS UNDER MEASURE 37 581<br />

Property<br />

Value ($)<br />

Diagram 2<br />

Value of unregulated property<br />

$700,000<br />

Value of all property<br />

prior to enactment of<br />

land use regulation<br />

Value of individual<br />

exception = $+500,000<br />

$225,000<br />

Value of regulated property<br />

Cost of<br />

regulation<br />

=<br />

$-25,000<br />

$200,000<br />

Regulations<br />

enacted<br />

NB 1: Graph not drawn to scale<br />

NB 2: Graph only takes into account the effects of the land use regulation on property values,<br />

and not other variables (inc. inflation)<br />

Time<br />

In both scenarios the figures ($700,000 − $200,000) employed by the<br />

exemption method would remain the same, and thus the assessment of<br />

the loss would remain at $500,000.<br />

There is also a third possibility: that the regulation in question causes<br />

an increase in value to both the regulated and unregulated properties.<br />

This could potentially occur when the value of the neighborhood or amenity<br />

effects (e.g., extended tree cover, proximity to lakes, and the like),<br />

which was preserved or increased by the regulation, outweighs any loss<br />

incurred by the regulated property (e.g., the prevention of highest and<br />

best use). 74 In such a case, the unregulated property is also likely to benefit<br />

from the regulation (the increase being due to both amenity effects<br />

and the increased scarcity of land). 75 Let us assume in the Calcagnos case<br />

that the price prior to the enactment of the regulation was $175,000. In<br />

this case both the regulated property (at $200,000) and the unregulated<br />

property (at $700,000) have increased in value due to the “enactment and<br />

enforcement” of the land use regulation. One would therefore expect that<br />

an accurate calculation of the “reduction in the fair market value of the<br />

74. See, e.g., Noelwah Netusil, The Effect of Environmental Zoning and Amenities<br />

on Property Values: Portland, Oregon, 81 LAND ECON. 227 (2003).<br />

75. See Jaeger, supra note 68. Indeed, land use regulations have positive economic<br />

effects on land values through the use of amenity and scarcity effects. The difficulty<br />

with the exemption method is that it allows a claimant to point to the negative impacts<br />

of the regulation as if she were the only one affected, but not to look at the valueenhancing<br />

effects of the regulations as a whole.<br />

ABA-TUL-07-0701-Sullivan.indd 581<br />

9/18/07 10:43:40 AM