Through a Glass Darkly: Measuring Loss Under ... - Land Use Law

Through a Glass Darkly: Measuring Loss Under ... - Land Use Law

Through a Glass Darkly: Measuring Loss Under ... - Land Use Law

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

582 THE URBAN LAWYER VOL. 39, NO. 3 SUMMER 2007<br />

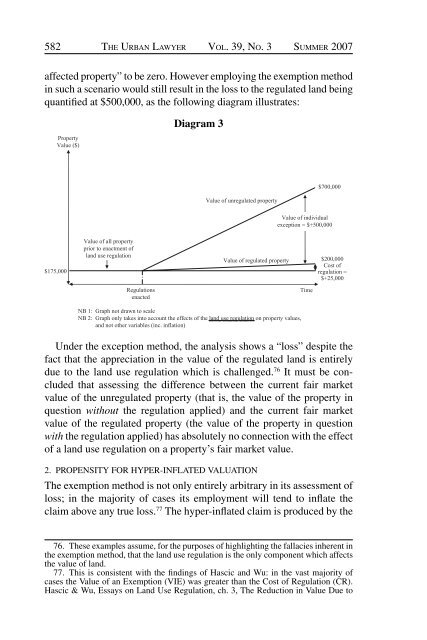

affected property” to be zero. However employing the exemption method<br />

in such a scenario would still result in the loss to the regulated land being<br />

quantified at $500,000, as the following diagram illustrates:<br />

Property<br />

Value ($)<br />

Diagram 3<br />

Value of unregulated property<br />

$700,000<br />

Value of individual<br />

exception = $+500,000<br />

$175,000<br />

Value of all property<br />

prior to enactment of<br />

land use regulation<br />

Value of regulated property<br />

$200,000<br />

Cost of<br />

regulation =<br />

$+25,000<br />

Regulations<br />

enacted<br />

Time<br />

NB 1: Graph not drawn to scale<br />

NB 2: Graph only takes into account the effects of the land use regulation on property values,<br />

and not other variables (inc. inflation)<br />

<strong>Under</strong> the exception method, the analysis shows a “loss” despite the<br />

fact that the appreciation in the value of the regulated land is entirely<br />

due to the land use regulation which is challenged. 76 It must be concluded<br />

that assessing the difference between the current fair market<br />

value of the unregulated property (that is, the value of the property in<br />

question without the regulation applied) and the current fair market<br />

value of the regulated property (the value of the property in question<br />

with the regulation applied) has absolutely no connection with the effect<br />

of a land use regulation on a property’s fair market value.<br />

2. PROPENSITY FOR HYPER-INFLATED VALUATION<br />

The exemption method is not only entirely arbitrary in its assessment of<br />

loss; in the majority of cases its employment will tend to inflate the<br />

claim above any true loss. 77 The hyper-inflated claim is produced by the<br />

76. These examples assume, for the purposes of highlighting the fallacies inherent in<br />

the exemption method, that the land use regulation is the only component which affects<br />

the value of land.<br />

77. This is consistent with the findings of Hascic and Wu: in the vast majority of<br />

cases the Value of an Exemption (VIE) was greater than the Cost of Regulation (CR).<br />

Hascic & Wu, Essays on <strong>Land</strong> <strong>Use</strong> Regulation, ch. 3, The Reduction in Value Due to<br />

ABA-TUL-07-0701-Sullivan.indd 582<br />

9/18/07 10:43:40 AM