Through a Glass Darkly: Measuring Loss Under ... - Land Use Law

Through a Glass Darkly: Measuring Loss Under ... - Land Use Law

Through a Glass Darkly: Measuring Loss Under ... - Land Use Law

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

598 THE URBAN LAWYER VOL. 39, NO. 3 SUMMER 2007<br />

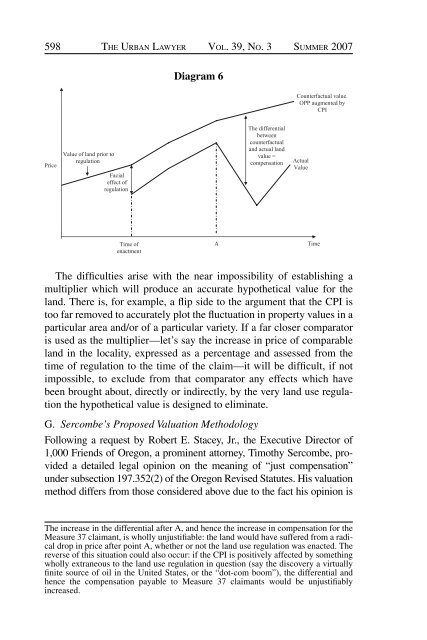

Diagram 6<br />

Counterfactual value.<br />

OPP augmented by<br />

CPI<br />

Price<br />

Value of land prior to<br />

regulation<br />

Facial<br />

effect of<br />

regulation<br />

The differential<br />

between<br />

counterfactual<br />

and actual land<br />

value =<br />

compensation<br />

Actual<br />

Value<br />

Time of<br />

enactment<br />

A<br />

Time<br />

The difficulties arise with the near impossibility of establishing a<br />

multiplier which will produce an accurate hypothetical value for the<br />

land. There is, for example, a flip side to the argument that the CPI is<br />

too far removed to accurately plot the fluctuation in property values in a<br />

particular area and/or of a particular variety. If a far closer comparator<br />

is used as the multiplier—let’s say the increase in price of comparable<br />

land in the locality, expressed as a percentage and assessed from the<br />

time of regulation to the time of the claim—it will be difficult, if not<br />

impossible, to exclude from that comparator any effects which have<br />

been brought about, directly or indirectly, by the very land use regulation<br />

the hypothetical value is designed to eliminate.<br />

G. Sercombe’s Proposed Valuation Methodology<br />

Following a request by Robert E. Stacey, Jr., the Executive Director of<br />

1,000 Friends of Oregon, a prominent attorney, Timothy Sercombe, provided<br />

a detailed legal opinion on the meaning of “just compensation”<br />

under subsection 197.352(2) of the Oregon Revised Statutes. His valuation<br />

method differs from those considered above due to the fact his opinion is<br />

The increase in the differential after A, and hence the increase in compensation for the<br />

Measure 37 claimant, is wholly unjustifiable: the land would have suffered from a radical<br />

drop in price after point A, whether or not the land use regulation was enacted. The<br />

reverse of this situation could also occur: if the CPI is positively affected by something<br />

wholly extraneous to the land use regulation in question (say the discovery a virtually<br />

finite source of oil in the United States, or the “dot-com boom”), the differential and<br />

hence the compensation payable to Measure 37 claimants would be unjustifiably<br />

increased.<br />

ABA-TUL-07-0701-Sullivan.indd 598<br />

9/18/07 10:43:43 AM