Expatriate taxation - CIOT - The Chartered Institute of Taxation

Expatriate taxation - CIOT - The Chartered Institute of Taxation

Expatriate taxation - CIOT - The Chartered Institute of Taxation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>CIOT</strong> RESEARCH PROJECT ON EXPATRIATE TAXATION<br />

7.18 Although the SP is solely to do with CGT, the principle <strong>of</strong> comparing tax<br />

against tax when computed by reference to the same quantum, be it income<br />

tax, capital gains tax or even payroll tax, is clear. However, it is not clear that<br />

relief will always be given on an equitable basis if there is tax in two or more<br />

jurisdictions based solely upon SP 6/88.<br />

7.19 A far more tricky issue for the expatriate is the fact that the tax rules drawing<br />

up the taxable amount <strong>of</strong> income will differ between countries. An example is<br />

the fact that the taxable income in the home country may be reduced for, say,<br />

alimony and pension scheme deductions, neither <strong>of</strong> which would attract tax<br />

relief in the UK. It would be logical to ignore such factors but, strictly<br />

speaking, they should be taken into account.<br />

c) Taxed at different times<br />

7.20 Because the tax has to be paid in order for there to be a credit against UK<br />

tax, there will always be a delay and extra administration for expatriates<br />

working in the UK. This is especially so when the tax payment dates differ<br />

between the UK and the other country. Income received in March 2006 will<br />

be paid as PAYE in the UK, and any balance due is paid with the tax return in<br />

January 2007. <strong>The</strong> US tax will be paid when the 2006 calendar year tax<br />

return is filed, and this could be as late as January 2008 depending on when<br />

the expatriate has arrived in the UK and filing extensions. It is worthy <strong>of</strong> note<br />

that US expatriates get an extension in filing their first year’s return until 13<br />

months after the end <strong>of</strong> the tax year, something for the Carter Report review<br />

team to consider.<br />

d) Top slice or average rate for the home country<br />

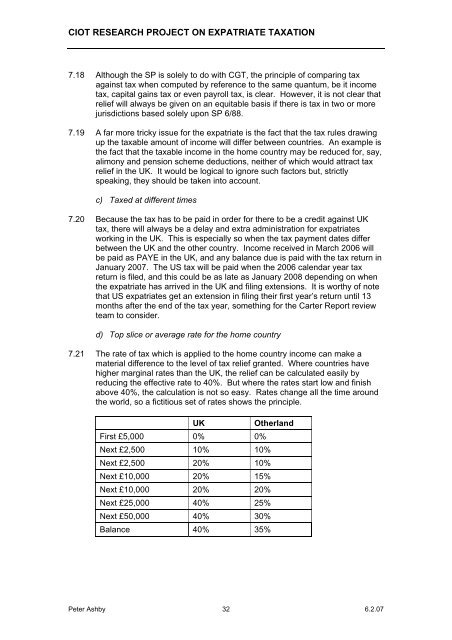

7.21 <strong>The</strong> rate <strong>of</strong> tax which is applied to the home country income can make a<br />

material difference to the level <strong>of</strong> tax relief granted. Where countries have<br />

higher marginal rates than the UK, the relief can be calculated easily by<br />

reducing the effective rate to 40%. But where the rates start low and finish<br />

above 40%, the calculation is not so easy. Rates change all the time around<br />

the world, so a fictitious set <strong>of</strong> rates shows the principle.<br />

UK<br />

First £5,000 0% 0%<br />

Next £2,500 10% 10%<br />

Next £2,500 20% 10%<br />

Next £10,000 20% 15%<br />

Next £10,000 20% 20%<br />

Next £25,000 40% 25%<br />

Next £50,000 40% 30%<br />

Balance 40% 35%<br />

Otherland<br />

Peter Ashby 32 6.2.07