Annual Report 2009 - Daiichi Sankyo

Annual Report 2009 - Daiichi Sankyo

Annual Report 2009 - Daiichi Sankyo

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

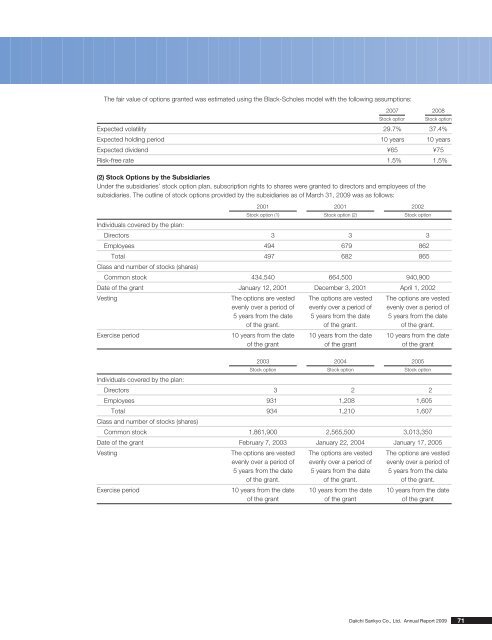

The fair value of options granted was estimated using the Black-Scholes model with the following assumptions:<br />

2007 2008<br />

Stock option<br />

Stock option<br />

Expected volatility 29.7% 37.4%<br />

Expected holding period 10 years 10 years<br />

Expected dividend ¥65 ¥75<br />

Risk-free rate 01.5% 01.5%<br />

(2) Stock Options by the Subsidiaries<br />

Under the subsidiaries’ stock option plan, subscription rights to shares were granted to directors and employees of the<br />

subsidiaries. The outline of stock options provided by the subsidiaries as of March 31, <strong>2009</strong> was as follows:<br />

2001 2001 2002<br />

Stock option (1) Stock option (2) Stock option<br />

Individuals covered by the plan:<br />

Directors 3 3 3<br />

Employees 494 679 862<br />

Total 497 682 865<br />

Class and number of stocks (shares)<br />

Common stock 434,540 664,500 940,900<br />

Date of the grant January 12, 2001 December 3, 2001 April 1, 2002<br />

Vesting The options are vested The options are vested The options are vested<br />

evenly over a period of evenly over a period of evenly over a period of<br />

5 years from the date 5 years from the date 5 years from the date<br />

of the grant. of the grant. of the grant.<br />

Exercise period 10 years from the date 10 years from the date 10 years from the date<br />

of the grant of the grant of the grant<br />

2003 2004 2005<br />

Stock option Stock option Stock option<br />

Individuals covered by the plan:<br />

Directors 3 2 2<br />

Employees 931 1,208 1,605<br />

Total 934 1,210 1,607<br />

Class and number of stocks (shares)<br />

Common stock 1,861,900 2,565,500 3,013,350<br />

Date of the grant February 7, 2003 January 22, 2004 January 17, 2005<br />

Vesting The options are vested The options are vested The options are vested<br />

evenly over a period of evenly over a period of evenly over a period of<br />

5 years from the date 5 years from the date 5 years from the date<br />

of the grant. of the grant. of the grant.<br />

Exercise period 10 years from the date 10 years from the date 10 years from the date<br />

of the grant of the grant of the grant<br />

<strong>Daiichi</strong> <strong>Sankyo</strong> Co., Ltd. <strong>Annual</strong> <strong>Report</strong> <strong>2009</strong> 71