iron-ore-report_May 13.pdf

iron-ore-report_May 13.pdf

iron-ore-report_May 13.pdf

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

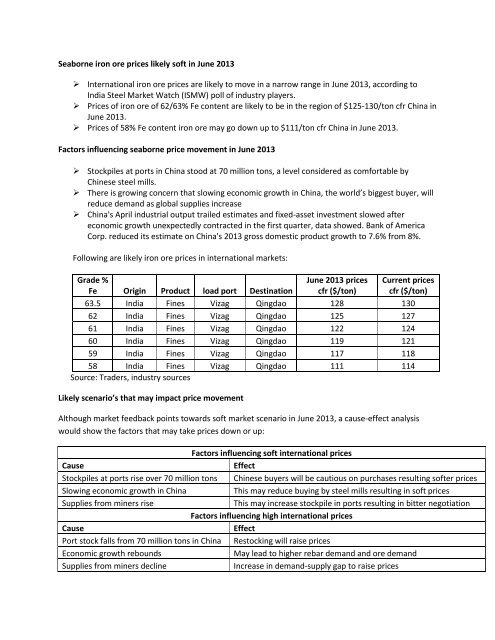

Seaborne <strong>iron</strong> <strong>ore</strong> prices likely soft in June 2013<br />

‣ International <strong>iron</strong> <strong>ore</strong> prices are likely to move in a narrow range in June 2013, according to<br />

India Steel Market Watch (ISMW) poll of industry players.<br />

‣ Prices of <strong>iron</strong> <strong>ore</strong> of 62/63% Fe content are likely to be in the region of $125-130/ton cfr China in<br />

June 2013.<br />

‣ Prices of 58% Fe content <strong>iron</strong> <strong>ore</strong> may go down up to $111/ton cfr China in June 2013.<br />

Factors influencing seaborne price movement in June 2013<br />

‣ Stockpiles at ports in China stood at 70 million tons, a level considered as comfortable by<br />

Chinese steel mills.<br />

‣ There is growing concern that slowing economic growth in China, the world’s biggest buyer, will<br />

reduce demand as global supplies increase<br />

‣ China's April industrial output trailed estimates and fixed-asset investment slowed after<br />

economic growth unexpectedly contracted in the first quarter, data showed. Bank of America<br />

Corp. reduced its estimate on China's 2013 gross domestic product growth to 7.6% from 8%.<br />

Following are likely <strong>iron</strong> <strong>ore</strong> prices in international markets:<br />

Grade %<br />

Fe Origin Product load port Destination<br />

June 2013 prices<br />

cfr ($/ton)<br />

Current prices<br />

cfr ($/ton)<br />

63.5 India Fines Vizag Qingdao 128 130<br />

62 India Fines Vizag Qingdao 125 127<br />

61 India Fines Vizag Qingdao 122 124<br />

60 India Fines Vizag Qingdao 119 121<br />

59 India Fines Vizag Qingdao 117 118<br />

58 India Fines Vizag Qingdao 111 114<br />

Source: Traders, industry sources<br />

Likely scenario’s that may impact price movement<br />

Although market feedback points towards soft market scenario in June 2013, a cause-effect analysis<br />

would show the factors that may take prices down or up:<br />

Factors influencing soft international prices<br />

Cause<br />

Effect<br />

Stockpiles at ports rise over 70 million tons Chinese buyers will be cautious on purchases resulting softer prices<br />

Slowing economic growth in China<br />

This may reduce buying by steel mills resulting in soft prices<br />

Supplies from miners rise<br />

This may increase stockpile in ports resulting in bitter negotiation<br />

Factors influencing high international prices<br />

Cause<br />

Effect<br />

Port stock falls from 70 million tons in China Restocking will raise prices<br />

Economic growth rebounds<br />

<strong>May</strong> lead to higher rebar demand and <strong>ore</strong> demand<br />

Supplies from miners decline<br />

Increase in demand-supply gap to raise prices