iron-ore-report_May 13.pdf

iron-ore-report_May 13.pdf

iron-ore-report_May 13.pdf

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

‣ Due to high power prices, Indian sponge <strong>iron</strong> offers have touched levels seen two years back,<br />

which ultimately resulted in low capacities. Hence, pellet demand has been hampered and<br />

availability of expensive and inferior quality lumps has further squeezed margins of pellet<br />

producers.<br />

‣ Negative sentiments are built up at the moment due to continuous drop in steel prices. This has<br />

limited the buying interest from the few operational sponge <strong>iron</strong> units, running at minimum<br />

production capacities.<br />

‣ It is expected that around 13.1 mt of pellet capacity would be coming up in eastern India by<br />

2013-14 leading to excess supply in the area and pressurising prices.<br />

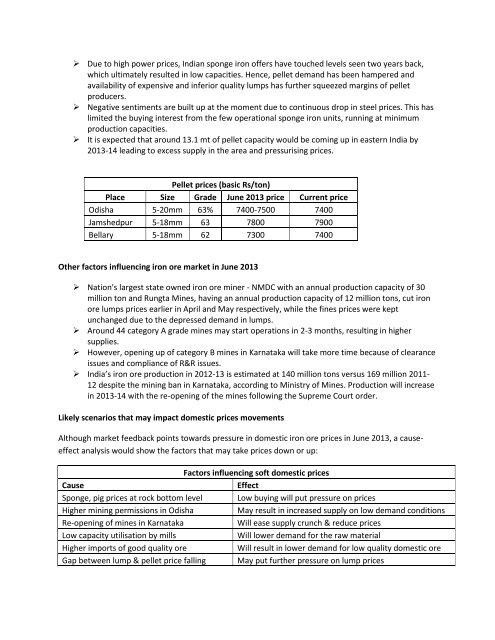

Pellet prices (basic Rs/ton)<br />

Place Size Grade June 2013 price Current price<br />

Odisha 5-20mm 63% 7400-7500 7400<br />

Jamshedpur 5-18mm 63 7800 7900<br />

Bellary 5-18mm 62 7300 7400<br />

Other factors influencing <strong>iron</strong> <strong>ore</strong> market in June 2013<br />

‣ Nation's largest state owned <strong>iron</strong> <strong>ore</strong> miner - NMDC with an annual production capacity of 30<br />

million ton and Rungta Mines, having an annual production capacity of 12 million tons, cut <strong>iron</strong><br />

<strong>ore</strong> lumps prices earlier in April and <strong>May</strong> respectively, while the fines prices were kept<br />

unchanged due to the depressed demand in lumps.<br />

‣ Around 44 category A grade mines may start operations in 2-3 months, resulting in higher<br />

supplies.<br />

‣ However, opening up of category B mines in Karnataka will take m<strong>ore</strong> time because of clearance<br />

issues and compliance of R&R issues.<br />

‣ India’s <strong>iron</strong> <strong>ore</strong> production in 2012-13 is estimated at 140 million tons versus 169 million 2011-<br />

12 despite the mining ban in Karnataka, according to Ministry of Mines. Production will increase<br />

in 2013-14 with the re-opening of the mines following the Supreme Court order.<br />

Likely scenarios that may impact domestic prices movements<br />

Although market feedback points towards pressure in domestic <strong>iron</strong> <strong>ore</strong> prices in June 2013, a causeeffect<br />

analysis would show the factors that may take prices down or up:<br />

Factors influencing soft domestic prices<br />

Cause<br />

Effect<br />

Sponge, pig prices at rock bottom level Low buying will put pressure on prices<br />

Higher mining permissions in Odisha<br />

<strong>May</strong> result in increased supply on low demand conditions<br />

Re-opening of mines in Karnataka<br />

Will ease supply crunch & reduce prices<br />

Low capacity utilisation by mills<br />

Will lower demand for the raw material<br />

Higher imports of good quality <strong>ore</strong><br />

Will result in lower demand for low quality domestic <strong>ore</strong><br />

Gap between lump & pellet price falling <strong>May</strong> put further pressure on lump prices