iron-ore-report_May 13.pdf

iron-ore-report_May 13.pdf

iron-ore-report_May 13.pdf

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

VIZAG<br />

VIZAG<br />

VIZAG<br />

VIZAG<br />

VIZAG<br />

MAGDAL<br />

LA<br />

MAGDAL<br />

LA<br />

MAGDAL<br />

LA<br />

BRILLIANT<br />

JOURNEY<br />

IRIS HALO<br />

GMT PHOENIX<br />

CHANDI<br />

PRASAD<br />

LARK<br />

BLUE SEND<br />

GEM OF<br />

PARADIP<br />

RAM PRASAD<br />

13 FINES RT<br />

13/<strong>May</strong>/<br />

13<br />

14/<strong>May</strong>/<br />

13<br />

19/<strong>May</strong>/<br />

13<br />

9/<strong>May</strong>/1<br />

3<br />

8/<strong>May</strong>/1<br />

3<br />

4/<strong>May</strong>/1<br />

3<br />

3/<strong>May</strong>/1<br />

3<br />

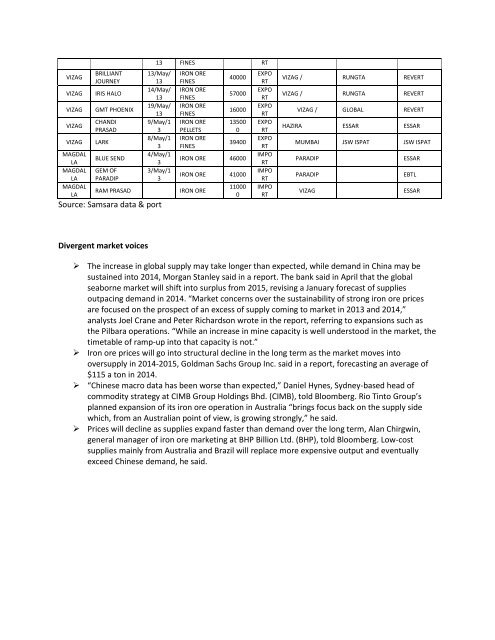

Source: Samsara data & port<br />

IRON ORE<br />

FINES<br />

IRON ORE<br />

FINES<br />

IRON ORE<br />

FINES<br />

IRON ORE<br />

PELLETS<br />

IRON ORE<br />

FINES<br />

40000<br />

57000<br />

16000<br />

13500<br />

0<br />

39400<br />

IRON ORE 46000<br />

IRON ORE 41000<br />

IRON ORE<br />

11000<br />

0<br />

EXPO<br />

RT<br />

EXPO<br />

RT<br />

EXPO<br />

RT<br />

EXPO<br />

RT<br />

EXPO<br />

RT<br />

IMPO<br />

RT<br />

IMPO<br />

RT<br />

IMPO<br />

RT<br />

VIZAG / RUNGTA REVERT<br />

VIZAG / RUNGTA REVERT<br />

VIZAG / GLOBAL REVERT<br />

HAZIRA ESSAR ESSAR<br />

MUMBAI JSW ISPAT JSW ISPAT<br />

PARADIP<br />

ESSAR<br />

PARADIP<br />

EBTL<br />

VIZAG<br />

ESSAR<br />

Divergent market voices<br />

‣ The increase in global supply may take longer than expected, while demand in China may be<br />

sustained into 2014, Morgan Stanley said in a <strong>report</strong>. The bank said in April that the global<br />

seaborne market will shift into surplus from 2015, revising a January f<strong>ore</strong>cast of supplies<br />

outpacing demand in 2014. “Market concerns over the sustainability of strong <strong>iron</strong> <strong>ore</strong> prices<br />

are focused on the prospect of an excess of supply coming to market in 2013 and 2014,”<br />

analysts Joel Crane and Peter Richardson wrote in the <strong>report</strong>, referring to expansions such as<br />

the Pilbara operations. “While an increase in mine capacity is well understood in the market, the<br />

timetable of ramp-up into that capacity is not.”<br />

‣ Iron <strong>ore</strong> prices will go into structural decline in the long term as the market moves into<br />

oversupply in 2014-2015, Goldman Sachs Group Inc. said in a <strong>report</strong>, f<strong>ore</strong>casting an average of<br />

$115 a ton in 2014.<br />

‣ “Chinese macro data has been worse than expected,” Daniel Hynes, Sydney-based head of<br />

commodity strategy at CIMB Group Holdings Bhd. (CIMB), told Bloomberg. Rio Tinto Group’s<br />

planned expansion of its <strong>iron</strong> <strong>ore</strong> operation in Australia “brings focus back on the supply side<br />

which, from an Australian point of view, is growing strongly,” he said.<br />

‣ Prices will decline as supplies expand faster than demand over the long term, Alan Chirgwin,<br />

general manager of <strong>iron</strong> <strong>ore</strong> marketing at BHP Billion Ltd. (BHP), told Bloomberg. Low-cost<br />

supplies mainly from Australia and Brazil will replace m<strong>ore</strong> expensive output and eventually<br />

exceed Chinese demand, he said.