Practice Problems (with solutions) in Option - Mechanical and ...

Practice Problems (with solutions) in Option - Mechanical and ...

Practice Problems (with solutions) in Option - Mechanical and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PRACTICE PROBLEMS FOR REAL OPTIONS<br />

MIE566F: DECISION ANALYSIS, FALL, 2003<br />

DEPARTMENT OF MECHANICAL AND INDUSTRIAL ENGINEERING, UNIVERSITY OF TORONTO<br />

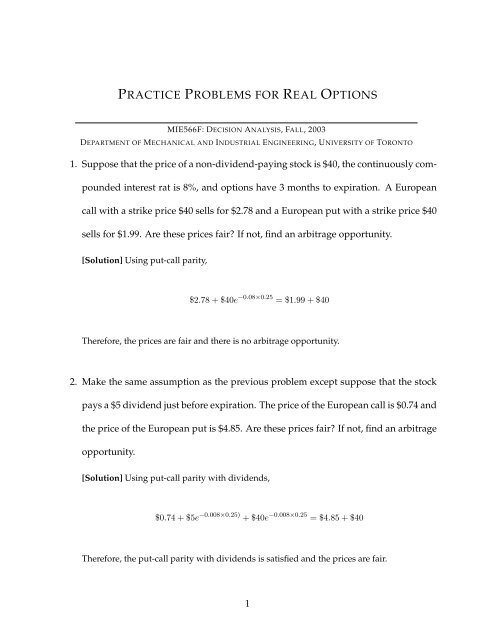

1. Suppose that the price of a non-dividend-pay<strong>in</strong>g stock is $40, the cont<strong>in</strong>uously compounded<br />

<strong>in</strong>terest rat is 8%, <strong>and</strong> options have 3 months to expiration. A European<br />

call <strong>with</strong> a strike price $40 sells for $2.78 <strong>and</strong> a European put <strong>with</strong> a strike price $40<br />

sells for $1.99. Are these prices fair If not, f<strong>in</strong>d an arbitrage opportunity.<br />

[Solution] Us<strong>in</strong>g put-call parity,<br />

$2.78 + $40e −0.08×0.25 = $1.99 + $40<br />

Therefore, the prices are fair <strong>and</strong> there is no arbitrage opportunity.<br />

2. Make the same assumption as the previous problem except suppose that the stock<br />

pays a $5 dividend just before expiration. The price of the European call is $0.74 <strong>and</strong><br />

the price of the European put is $4.85. Are these prices fair If not, f<strong>in</strong>d an arbitrage<br />

opportunity.<br />

[Solution] Us<strong>in</strong>g put-call parity <strong>with</strong> dividends,<br />

$0.74 + $5e −0.008×0.25) + $40e −0.008×0.25 = $4.85 + $40<br />

Therefore, the put-call parity <strong>with</strong> dividends is satisfied <strong>and</strong> the prices are fair.<br />

1

3. A stock currently sells for $32.00. A 6-month call option <strong>with</strong> a strike of $35.00 has<br />

a premium of $2.27. Assum<strong>in</strong>g a 4% cont<strong>in</strong>uously compounded risk-free rate <strong>and</strong> a<br />

6% cont<strong>in</strong>uous dividend yield, what is the price of the associated put option<br />

[Solution] We will use put-call parity <strong>with</strong> dividends to compute the price of the put option.<br />

c + Ke −rT = $2.27 + $35e −0.04×0.5 = $36.5770<br />

p + S 0 e −δT = p + $32e −0.06×0.5 = p + $32.81<br />

Therefore, by equat<strong>in</strong>g two quantities, p = $36.5770 − $32.81 = $3.767.<br />

4. A stock currently sells for $32.00. A 6-month call option <strong>with</strong> a strike of $30.00 has a<br />

premium of $4.29, <strong>and</strong> a 6-month put <strong>with</strong> the same strike has a premium of $2.64.<br />

Assume a 4% cont<strong>in</strong>uously compounded risk-free rate. What is the present value of<br />

dividends payable over the next 6 months<br />

[Solution] We will use put-call parity <strong>with</strong> dividends to computer the present value of the<br />

dividends that will be paid dur<strong>in</strong>g the lifetime of the options. S<strong>in</strong>ce<br />

c + D + Ke −rT = p + S 0<br />

We have<br />

D = p + S 0 − c − Ke −rT = $2.64 + $32 − $4.29 − $30e −0.04×0.5 = $0.944<br />

5. Suppose the S&R <strong>in</strong>dex is 800, the cont<strong>in</strong>uously compounded risk-free rate is 5%,<br />

2

<strong>and</strong> the dividend yield is 0%. A 1-year European call <strong>with</strong> a strike of $815 cost $75<br />

<strong>and</strong> a 1-year European put <strong>with</strong> a strike of $815 costs $45. Consider the strategy of<br />

buy<strong>in</strong>g the stock, sell<strong>in</strong>g the call, <strong>and</strong> buy<strong>in</strong>g the put.<br />

(a) What is the rate of return on this position held until the expiration of the options<br />

(b) What is the arbitrage implied by your answer to (a)<br />

[Solution]<br />

By buy<strong>in</strong>g the stock, sell<strong>in</strong>g the 815-strike call, <strong>and</strong> buy<strong>in</strong>g the 815 strike put, your balance<br />

will be<br />

−$800 + $75 − $45 = −$770<br />

This debt will become −$770e −0.05×1 = $809.4787 <strong>in</strong> 1 year, when the options are expired.<br />

If S T > $815, we will discard the put <strong>and</strong> the call will be exercised by the holder. Therefore,<br />

we will have to sell the stock for $815. S<strong>in</strong>ce our debt is only $809.4784, we will still have<br />

$5.5213. If S T < $815, we will exercise the put <strong>in</strong> order to sell the stock for $815. On the<br />

other h<strong>and</strong>, the call holder will discard the call option. As a result we will have $815, which<br />

is enough to clear our debt. The rema<strong>in</strong><strong>in</strong>g balance will be $5.5213. We <strong>in</strong>vest $770 <strong>and</strong> the<br />

net profit is $5.5213. The present value of the net profit is $5.5213e −0.05×1 = $5.2520.<br />

6. Let S = $41, K = $40, σ = 0.3, r = 8%, T = 0.25 (3 months), <strong>and</strong> δ = 0. Compute the<br />

Black-Scholes call price.<br />

[Solution] See class notes<br />

3

7. Us<strong>in</strong>g the same <strong>in</strong>puts as <strong>in</strong> the previous problem, compute the price of a put whose<br />

strike <strong>and</strong> time to maturity are the same as the call.<br />

[Solution] See class notes<br />

8. Suppose S = $41, K = $40, σ = 0.3, r = 8%, <strong>and</strong> T = 0.25(3 months). The stock will<br />

pay $3 dividend <strong>in</strong> 1 month, but make no other payouts over the life of the option.<br />

(a) F<strong>in</strong>d the present value of the dividend.<br />

(b) Compute the Black-Scholes call price.<br />

[Solution] See class notes<br />

4