Surveillance Rating Report Bank Asia Limited - Credit Rating ...

Surveillance Rating Report Bank Asia Limited - Credit Rating ...

Surveillance Rating Report Bank Asia Limited - Credit Rating ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CRAB <strong>Rating</strong>s<br />

<strong>Bank</strong>s<br />

<strong>Surveillance</strong> <strong>Rating</strong> <strong>Report</strong><br />

<strong>Bank</strong> <strong>Asia</strong> <strong>Limited</strong><br />

<strong>Rating</strong>s<br />

Previous <strong>Rating</strong>s<br />

Long Term : AA 3 Long Term : AA 2<br />

Short Term : ST-1 Short Term : ST-1<br />

Date of <strong>Rating</strong> : 11 June 2009 Date of <strong>Rating</strong> : 18 May 2008<br />

Validity<br />

: One Year<br />

Analysts:<br />

Razib Ahmed<br />

Financial Analyst<br />

Razib.ahmed@crab.com.bd<br />

Tahmina Islam<br />

Financial Analyst<br />

Tahmina.islam@crab.com.bd<br />

Highlights:<br />

Amount in BDT million<br />

2008 2007<br />

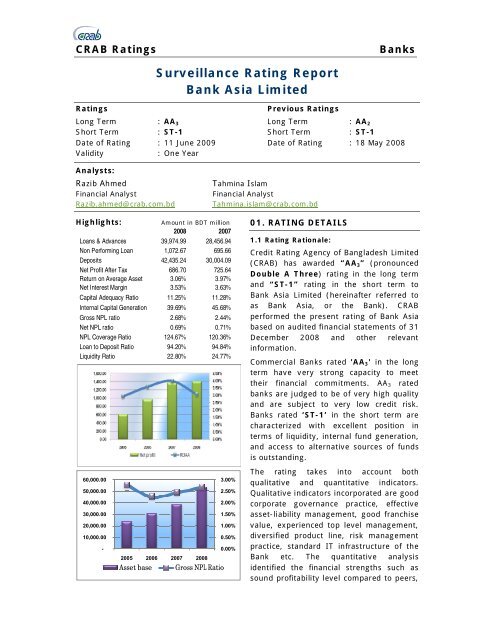

Loans & Advances 39,974.99 28,456.94<br />

Non Performing Loan 1,072.67 695.66<br />

Deposits 42,435.24 30,004.09<br />

Net Profit After Tax 686.70 725.64<br />

Return on Average Asset 3.06% 3.97%<br />

Net Interest Margin 3.53% 3.63%<br />

Capital Adequacy Ratio 11.25% 11.28%<br />

Internal Capital Generation 39.69% 45.68%<br />

Gross NPL ratio 2.68% 2.44%<br />

Net NPL ratio 0.69% 0.71%<br />

NPL Coverage Ratio 124.67% 120.36%<br />

Loan to Deposit Ratio 94.20% 94.84%<br />

Liquidity Ratio 22.80% 24.77%<br />

60,000.00<br />

50,000.00<br />

40,000.00<br />

30,000.00<br />

20,000.00<br />

10,000.00<br />

-<br />

2005 2006 2007 2008<br />

Asset base Gross NPL Ratio<br />

3.00%<br />

2.50%<br />

2.00%<br />

1.50%<br />

1.00%<br />

0.50%<br />

0.00%<br />

01. RATING DETAILS<br />

1.1 <strong>Rating</strong> Rationale:<br />

<strong>Credit</strong> <strong>Rating</strong> Agency of Bangladesh <strong>Limited</strong><br />

(CRAB) has awarded “AA 3 ” (pronounced<br />

Double A Three) rating in the long term<br />

and “ST-1” rating in the short term to<br />

<strong>Bank</strong> <strong>Asia</strong> <strong>Limited</strong> (hereinafter referred to<br />

as <strong>Bank</strong> <strong>Asia</strong>, or the <strong>Bank</strong>). CRAB<br />

performed the present rating of <strong>Bank</strong> <strong>Asia</strong><br />

based on audited financial statements of 31<br />

December 2008 and other relevant<br />

information.<br />

Commercial <strong>Bank</strong>s rated 'AA 3 ' in the long<br />

term have very strong capacity to meet<br />

their financial commitments. AA 3 rated<br />

banks are judged to be of very high quality<br />

and are subject to very low credit risk.<br />

<strong>Bank</strong>s rated ‘ST-1’ in the short term are<br />

characterized with excellent position in<br />

terms of liquidity, internal fund generation,<br />

and access to alternative sources of funds<br />

is outstanding.<br />

The rating takes into account both<br />

qualitative and quantitative indicators.<br />

Qualitative indicators incorporated are good<br />

corporate governance practice, effective<br />

asset-liability management, good franchise<br />

value, experienced top level management,<br />

diversified product line, risk management<br />

practice, standard IT infrastructure of the<br />

<strong>Bank</strong> etc. The quantitative analysis<br />

identified the financial strengths such as<br />

sound profitability level compared to peers,

CRAB <strong>Rating</strong>s<br />

<strong>Bank</strong>s<br />

adequate capital adequacy, good liquidity position, adequate provisioning against loans<br />

etc. However, the rating also took cognizance of deteriorated asset quality of the <strong>Bank</strong>.<br />

The rating has concerns about increase in <strong>Bank</strong>’s non-performing and special mention<br />

accounts, low recovery rate, moderate market share, dependency on high cost fixed<br />

deposits and call money market, high AD ratio, etc.<br />

The gross NPL of <strong>Bank</strong> <strong>Asia</strong> increased to BDT 1,072.67 million in 2008 from BDT 695.66<br />

million in 2007. As a result, gross NPL ratio rose to 2.68% from 2.44% in the same<br />

period. <strong>Bank</strong>’s credit monitoring and recovery process shows mixed trends. Because of<br />

effective monitoring, where, <strong>Bank</strong>’s fresh NPL generation was decreased to BDT<br />

1,045.20 million in 2008 from BDT 1,311.80 million; its amount in Special Mention<br />

Accounts increased to BDT 1,512.21 million from BDT 278.50 million in the same period.<br />

<strong>Bank</strong>’s recovery of delinquent loan shows diminishing trend, amounting BDT 667.10<br />

million in 2008, which was BDT 1,120.40 million in 2007. Major portion of such recovery<br />

was rescheduling in nature. The classification amount provisioned and therefore the net<br />

NPL ration was 0.69% in 2008.<br />

During 2008, <strong>Bank</strong> <strong>Asia</strong> achieved growth of deposits by 41.43% compared to 18.64% in<br />

2007. The <strong>Bank</strong>’s major portion of deposits was fixed in nature, which is of high cost.<br />

<strong>Bank</strong> <strong>Asia</strong>’s funding mix also points out <strong>Bank</strong>’s dependency on inter-bank borrowing in<br />

2008, which is high cost and volatile in nature. The <strong>Bank</strong>’s AD ratio in 2008 ranged from<br />

85% to 94% throughout the year.<br />

ALM analysis of previous few years shows liquidity mismatch in immediate maturity<br />

bucket (less than one month) in most cases; where liabilities exceed the asset base.<br />

During 2008, such negative gap was 2.72% of total assets.<br />

In 2008, operating profit of <strong>Bank</strong> <strong>Asia</strong> increased by 28.33%, which was 41.95% in 2007.<br />

Due to increase in provision amount for rising SMA and delinquent loans, the net profit<br />

increased by only 2.84% in 2008, which was 41.34% in 2007. <strong>Bank</strong>’s profitability has<br />

been much volatile than its peer.<br />

The loans and advances of the <strong>Bank</strong> achieved growth of 40.48% in 2008, which was<br />

27.86% in the previous year. Major concentration was in loans against trust receipt<br />

(LTR), secured overdraft, and term loan facilities. <strong>Bank</strong>’s industry wise loan portfolio is<br />

well diversified. During 2008, among the total credit portfolio, the <strong>Bank</strong> disbursed BDT<br />

15,909.88 million loans and advances in industry sector with the growth of 14.71% over<br />

previous year. <strong>Bank</strong>’s major exposures in industrial area were in RMG & Textile, food &<br />

allied, steel, real estate, paper industries etc. <strong>Bank</strong> <strong>Asia</strong> defined 17 loan accounts as<br />

large loans, with outstanding amount of BDT 8,958.6 million and no large loan borrower<br />

exceeded the range provided by Bangladesh <strong>Bank</strong>.<br />

The capital adequacy ratio of the <strong>Bank</strong> slightly reduced to 11.25% in 2008 from 11.28%<br />

in 2007 due to low growth in retained earnings of the <strong>Bank</strong>, which is the component of<br />

core capital.<br />

1.2 <strong>Rating</strong> History<br />

<strong>Bank</strong> <strong>Asia</strong> <strong>Limited</strong> was assigned AA 2 rating in the long term and ST-1 in the short term<br />

by CRAB on 18 May 2008 which had a validity of 1 (one) year from the date of rating<br />

award. The last rating was based on the audited financial statements for the year ended<br />

31 December 2007.<br />

Page 2 of 2