Disclosures to Promote Transparency and Market - IFSB

Disclosures to Promote Transparency and Market - IFSB

Disclosures to Promote Transparency and Market - IFSB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

given in Section 7, <strong>to</strong>gether with a general statement as <strong>to</strong> how their disclosures shall be<br />

treated within the scope of these principles.<br />

27. Given the differences in the practices of IIFS across jurisdictions (such as the<br />

availability of investment account products, prevalence of Islamic windows, etc), some of<br />

the contents presented below may not necessarily apply <strong>to</strong> all institutions. The<br />

recommended tables shall be followed as <strong>and</strong> when applicable, with appropriate<br />

adaptations by the supervisory authorities. Also, in view of the differences among<br />

countries <strong>and</strong> IIFS on the availability of his<strong>to</strong>rical data on key items in balance sheets <strong>and</strong><br />

income statements, some of the requested disclosures of past data would have <strong>to</strong> be<br />

phased in during a transitional period until a track record of key data is built up.<br />

28. In line with the above, the disclosure requirements in the following tables are<br />

intended <strong>to</strong> be applied on a “comply or explain” basis. In other words, instances of nonobservance<br />

of any of the components of these disclosure requirements (for example,<br />

where observance is not feasible because the component is not applicable <strong>to</strong> the IIFS or<br />

because the necessary data are not available) shall be clearly <strong>and</strong> adequately explained.<br />

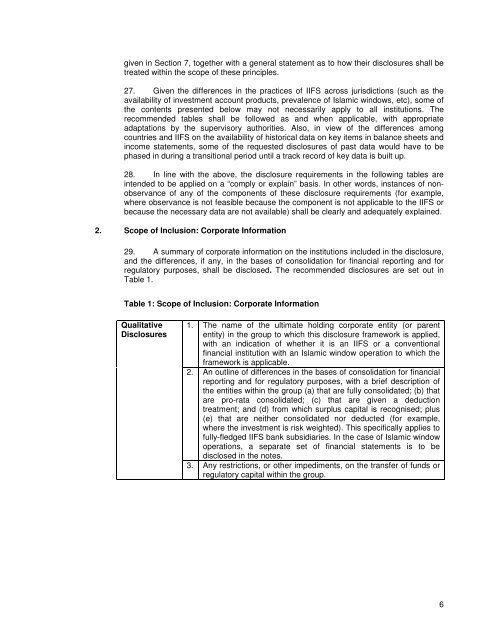

2. Scope of Inclusion: Corporate Information<br />

29. A summary of corporate information on the institutions included in the disclosure,<br />

<strong>and</strong> the differences, if any, in the bases of consolidation for financial reporting <strong>and</strong> for<br />

regula<strong>to</strong>ry purposes, shall be disclosed. The recommended disclosures are set out in<br />

Table 1.<br />

Table 1: Scope of Inclusion: Corporate Information<br />

Qualitative<br />

<strong>Disclosures</strong><br />

1. The name of the ultimate holding corporate entity (or parent<br />

entity) in the group <strong>to</strong> which this disclosure framework is applied,<br />

with an indication of whether it is an IIFS or a conventional<br />

financial institution with an Islamic window operation <strong>to</strong> which the<br />

framework is applicable.<br />

2. An outline of differences in the bases of consolidation for financial<br />

reporting <strong>and</strong> for regula<strong>to</strong>ry purposes, with a brief description of<br />

the entities within the group (a) that are fully consolidated; (b) that<br />

are pro-rata consolidated; (c) that are given a deduction<br />

treatment; <strong>and</strong> (d) from which surplus capital is recognised; plus<br />

(e) that are neither consolidated nor deducted (for example,<br />

where the investment is risk weighted). This specifically applies <strong>to</strong><br />

fully-fledged IIFS bank subsidiaries. In the case of Islamic window<br />

operations, a separate set of financial statements is <strong>to</strong> be<br />

disclosed in the notes.<br />

3. Any restrictions, or other impediments, on the transfer of funds or<br />

regula<strong>to</strong>ry capital within the group.<br />

6