Disclosures to Promote Transparency and Market - IFSB

Disclosures to Promote Transparency and Market - IFSB

Disclosures to Promote Transparency and Market - IFSB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

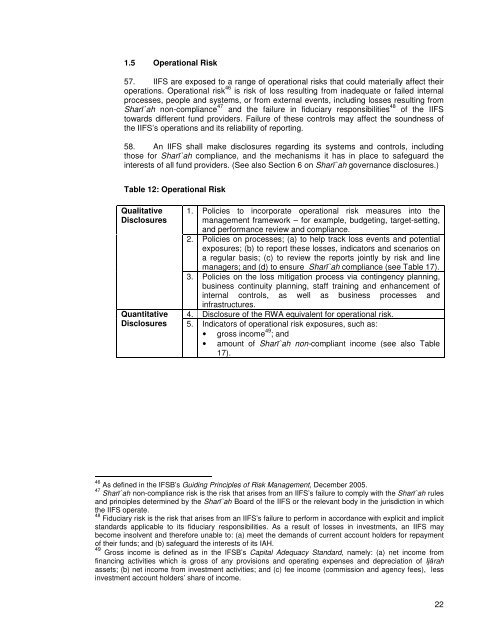

1.5 Operational Risk<br />

57. IIFS are exposed <strong>to</strong> a range of operational risks that could materially affect their<br />

operations. Operational risk 46 is risk of loss resulting from inadequate or failed internal<br />

processes, people <strong>and</strong> systems, or from external events, including losses resulting from<br />

Sharī`ah non-compliance 47 <strong>and</strong> the failure in fiduciary responsibilities 48 of the IIFS<br />

<strong>to</strong>wards different fund providers. Failure of these controls may affect the soundness of<br />

the IIFS’s operations <strong>and</strong> its reliability of reporting.<br />

58. An IIFS shall make disclosures regarding its systems <strong>and</strong> controls, including<br />

those for Sharī`ah compliance, <strong>and</strong> the mechanisms it has in place <strong>to</strong> safeguard the<br />

interests of all fund providers. (See also Section 6 on Sharī`ah governance disclosures.)<br />

Table 12: Operational Risk<br />

Qualitative<br />

<strong>Disclosures</strong><br />

Quantitative<br />

<strong>Disclosures</strong><br />

1. Policies <strong>to</strong> incorporate operational risk measures in<strong>to</strong> the<br />

management framework – for example, budgeting, target-setting,<br />

<strong>and</strong> performance review <strong>and</strong> compliance.<br />

2. Policies on processes; (a) <strong>to</strong> help track loss events <strong>and</strong> potential<br />

exposures; (b) <strong>to</strong> report these losses, indica<strong>to</strong>rs <strong>and</strong> scenarios on<br />

a regular basis; (c) <strong>to</strong> review the reports jointly by risk <strong>and</strong> line<br />

managers; <strong>and</strong> (d) <strong>to</strong> ensure Sharī`ah compliance (see Table 17).<br />

3. Policies on the loss mitigation process via contingency planning,<br />

business continuity planning, staff training <strong>and</strong> enhancement of<br />

internal controls, as well as business processes <strong>and</strong><br />

infrastructures.<br />

4. Disclosure of the RWA equivalent for operational risk.<br />

5. Indica<strong>to</strong>rs of operational risk exposures, such as:<br />

• gross income 49 ; <strong>and</strong><br />

• amount of Sharī`ah non-compliant income (see also Table<br />

17).<br />

46 As defined in the <strong>IFSB</strong>’s Guiding Principles of Risk Management, December 2005.<br />

47 Sharī`ah non-compliance risk is the risk that arises from an IIFS’s failure <strong>to</strong> comply with the Sharī`ah rules<br />

<strong>and</strong> principles determined by the Sharī`ah Board of the IIFS or the relevant body in the jurisdiction in which<br />

the IIFS operate.<br />

48 Fiduciary risk is the risk that arises from an IIFS’s failure <strong>to</strong> perform in accordance with explicit <strong>and</strong> implicit<br />

st<strong>and</strong>ards applicable <strong>to</strong> its fiduciary responsibilities. As a result of losses in investments, an IIFS may<br />

become insolvent <strong>and</strong> therefore unable <strong>to</strong>: (a) meet the dem<strong>and</strong>s of current account holders for repayment<br />

of their funds; <strong>and</strong> (b) safeguard the interests of its IAH.<br />

49 Gross income is defined as in the <strong>IFSB</strong>’s Capital Adequacy St<strong>and</strong>ard, namely: (a) net income from<br />

financing activities which is gross of any provisions <strong>and</strong> operating expenses <strong>and</strong> depreciation of Ijārah<br />

assets; (b) net income from investment activities; <strong>and</strong> (c) fee income (commission <strong>and</strong> agency fees), less<br />

investment account holders’ share of income.<br />

22