Disclosures to Promote Transparency and Market - IFSB

Disclosures to Promote Transparency and Market - IFSB

Disclosures to Promote Transparency and Market - IFSB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

subject <strong>to</strong> a capital requirement, depending upon the extent of risk-sharing between<br />

shareholders <strong>and</strong> unrestricted IAH.<br />

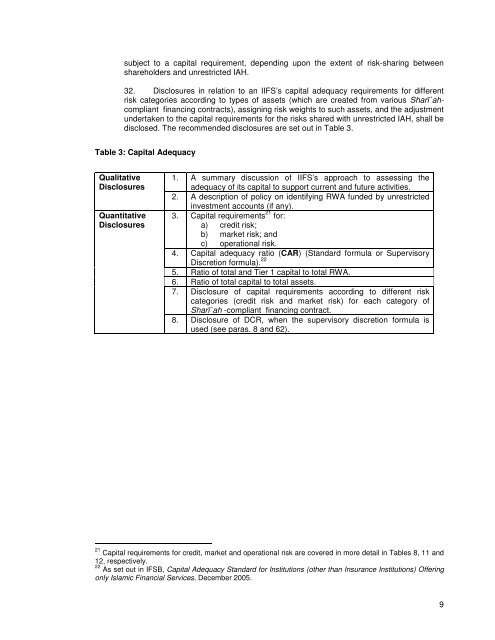

32. <strong>Disclosures</strong> in relation <strong>to</strong> an IIFS’s capital adequacy requirements for different<br />

risk categories according <strong>to</strong> types of assets (which are created from various Sharī`ahcompliant<br />

financing contracts), assigning risk weights <strong>to</strong> such assets, <strong>and</strong> the adjustment<br />

undertaken <strong>to</strong> the capital requirements for the risks shared with unrestricted IAH, shall be<br />

disclosed. The recommended disclosures are set out in Table 3.<br />

Table 3: Capital Adequacy<br />

Qualitative<br />

<strong>Disclosures</strong><br />

Quantitative<br />

<strong>Disclosures</strong><br />

1. A summary discussion of IIFS’s approach <strong>to</strong> assessing the<br />

adequacy of its capital <strong>to</strong> support current <strong>and</strong> future activities.<br />

2. A description of policy on identifying RWA funded by unrestricted<br />

investment accounts (if any).<br />

3. Capital requirements 21 for:<br />

a) credit risk;<br />

b) market risk; <strong>and</strong><br />

c) operational risk.<br />

4. Capital adequacy ratio (CAR) (St<strong>and</strong>ard formula or Supervisory<br />

Discretion formula). 22<br />

5. Ratio of <strong>to</strong>tal <strong>and</strong> Tier 1 capital <strong>to</strong> <strong>to</strong>tal RWA.<br />

6. Ratio of <strong>to</strong>tal capital <strong>to</strong> <strong>to</strong>tal assets.<br />

7. Disclosure of capital requirements according <strong>to</strong> different risk<br />

categories (credit risk <strong>and</strong> market risk) for each category of<br />

Sharī`ah -compliant financing contract.<br />

8. Disclosure of DCR, when the supervisory discretion formula is<br />

used (see paras. 8 <strong>and</strong> 62).<br />

21 Capital requirements for credit, market <strong>and</strong> operational risk are covered in more detail in Tables 8, 11 <strong>and</strong><br />

12, respectively.<br />

22 As set out in <strong>IFSB</strong>, Capital Adequacy St<strong>and</strong>ard for Institutions (other than Insurance Institutions) Offering<br />

only Islamic Financial Services, December 2005.<br />

9