Disclosures to Promote Transparency and Market - IFSB

Disclosures to Promote Transparency and Market - IFSB

Disclosures to Promote Transparency and Market - IFSB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

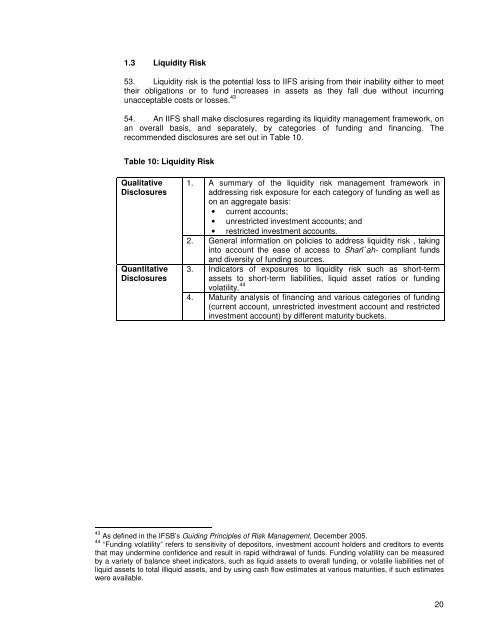

1.3 Liquidity Risk<br />

53. Liquidity risk is the potential loss <strong>to</strong> IIFS arising from their inability either <strong>to</strong> meet<br />

their obligations or <strong>to</strong> fund increases in assets as they fall due without incurring<br />

unacceptable costs or losses. 43<br />

54. An IIFS shall make disclosures regarding its liquidity management framework, on<br />

an overall basis, <strong>and</strong> separately, by categories of funding <strong>and</strong> financing. The<br />

recommended disclosures are set out in Table 10.<br />

Table 10: Liquidity Risk<br />

Qualitative<br />

<strong>Disclosures</strong><br />

Quantitative<br />

<strong>Disclosures</strong><br />

1. A summary of the liquidity risk management framework in<br />

addressing risk exposure for each category of funding as well as<br />

on an aggregate basis:<br />

• current accounts;<br />

• unrestricted investment accounts; <strong>and</strong><br />

• restricted investment accounts.<br />

2. General information on policies <strong>to</strong> address liquidity risk , taking<br />

in<strong>to</strong> account the ease of access <strong>to</strong> Sharī`ah- compliant funds<br />

<strong>and</strong> diversity of funding sources.<br />

3. Indica<strong>to</strong>rs of exposures <strong>to</strong> liquidity risk such as short-term<br />

assets <strong>to</strong> short-term liabilities, liquid asset ratios or funding<br />

volatility. 44<br />

4. Maturity analysis of financing <strong>and</strong> various categories of funding<br />

(current account, unrestricted investment account <strong>and</strong> restricted<br />

investment account) by different maturity buckets.<br />

43 As defined in the <strong>IFSB</strong>’s Guiding Principles of Risk Management, December 2005.<br />

44 “Funding volatility” refers <strong>to</strong> sensitivity of deposi<strong>to</strong>rs, investment account holders <strong>and</strong> credi<strong>to</strong>rs <strong>to</strong> events<br />

that may undermine confidence <strong>and</strong> result in rapid withdrawal of funds. Funding volatility can be measured<br />

by a variety of balance sheet indica<strong>to</strong>rs, such as liquid assets <strong>to</strong> overall funding, or volatile liabilities net of<br />

liquid assets <strong>to</strong> <strong>to</strong>tal illiquid assets, <strong>and</strong> by using cash flow estimates at various maturities, if such estimates<br />

were available.<br />

20