Disclosures to Promote Transparency and Market - IFSB

Disclosures to Promote Transparency and Market - IFSB

Disclosures to Promote Transparency and Market - IFSB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

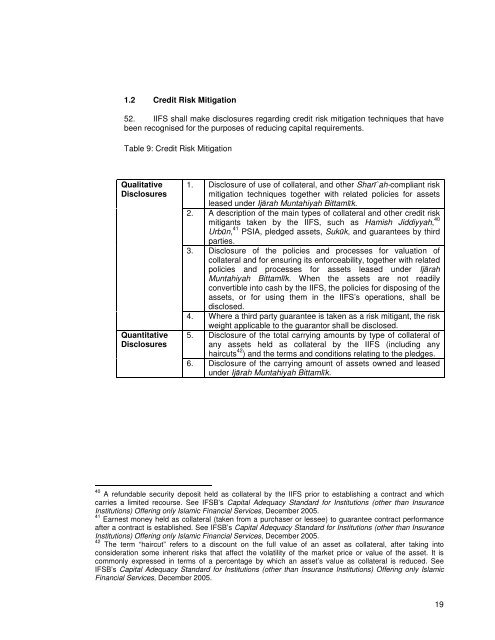

1.2 Credit Risk Mitigation<br />

52. IIFS shall make disclosures regarding credit risk mitigation techniques that have<br />

been recognised for the purposes of reducing capital requirements.<br />

Table 9: Credit Risk Mitigation<br />

Qualitative<br />

<strong>Disclosures</strong><br />

Quantitative<br />

<strong>Disclosures</strong><br />

1. Disclosure of use of collateral, <strong>and</strong> other Sharī`ah-compliant risk<br />

mitigation techniques <strong>to</strong>gether with related policies for assets<br />

leased under Ijārah Muntahiyah Bittamlīk.<br />

2. A description of the main types of collateral <strong>and</strong> other credit risk<br />

mitigants taken by the IIFS, such as Hamish Jiddiyyah, 40<br />

Urbūn, 41 PSIA, pledged assets, Sukūk, <strong>and</strong> guarantees by third<br />

parties.<br />

3. Disclosure of the policies <strong>and</strong> processes for valuation of<br />

collateral <strong>and</strong> for ensuring its enforceability, <strong>to</strong>gether with related<br />

policies <strong>and</strong> processes for assets leased under Ijārah<br />

Muntahiyah Bittamlīk. When the assets are not readily<br />

convertible in<strong>to</strong> cash by the IIFS, the policies for disposing of the<br />

assets, or for using them in the IIFS’s operations, shall be<br />

disclosed.<br />

4. Where a third party guarantee is taken as a risk mitigant, the risk<br />

weight applicable <strong>to</strong> the guaran<strong>to</strong>r shall be disclosed.<br />

5. Disclosure of the <strong>to</strong>tal carrying amounts by type of collateral of<br />

any assets held as collateral by the IIFS (including any<br />

haircuts 42 ) <strong>and</strong> the terms <strong>and</strong> conditions relating <strong>to</strong> the pledges.<br />

6. Disclosure of the carrying amount of assets owned <strong>and</strong> leased<br />

under Ijārah Muntahiyah Bittamlīk.<br />

40 A refundable security deposit held as collateral by the IIFS prior <strong>to</strong> establishing a contract <strong>and</strong> which<br />

carries a limited recourse. See <strong>IFSB</strong>’s Capital Adequacy St<strong>and</strong>ard for Institutions (other than Insurance<br />

Institutions) Offering only Islamic Financial Services, December 2005.<br />

41 Earnest money held as collateral (taken from a purchaser or lessee) <strong>to</strong> guarantee contract performance<br />

after a contract is established. See <strong>IFSB</strong>’s Capital Adequacy St<strong>and</strong>ard for Institutions (other than Insurance<br />

Institutions) Offering only Islamic Financial Services, December 2005.<br />

42 The term “haircut” refers <strong>to</strong> a discount on the full value of an asset as collateral, after taking in<strong>to</strong><br />

consideration some inherent risks that affect the volatility of the market price or value of the asset. It is<br />

commonly expressed in terms of a percentage by which an asset’s value as collateral is reduced. See<br />

<strong>IFSB</strong>’s Capital Adequacy St<strong>and</strong>ard for Institutions (other than Insurance Institutions) Offering only Islamic<br />

Financial Services, December 2005.<br />

19