Akta Cukai Pendapatan 1967 (Akta 53) Pindaan Sehingga Akta ...

Akta Cukai Pendapatan 1967 (Akta 53) Pindaan Sehingga Akta ...

Akta Cukai Pendapatan 1967 (Akta 53) Pindaan Sehingga Akta ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

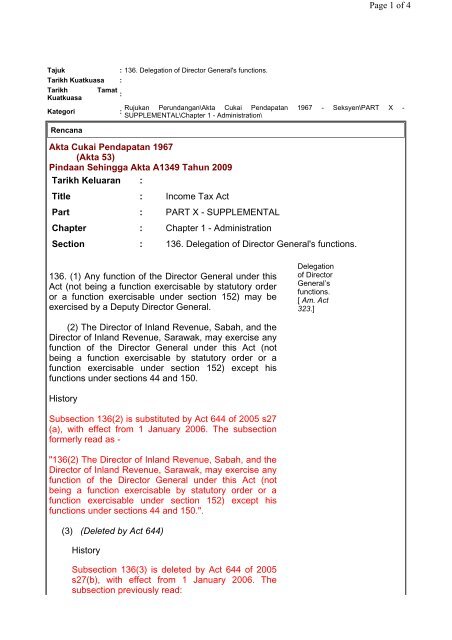

Page 1 of 4<br />

Tajuk<br />

: 136. Delegation of Director General's functions.<br />

Tarikh Kuatkuasa :<br />

Tarikh Tamat<br />

:<br />

Kuatkuasa<br />

Rujukan Perundangan\<strong>Akta</strong> <strong>Cukai</strong> <strong>Pendapatan</strong> <strong>1967</strong> - Seksyen\PART X -<br />

Kategori :<br />

SUPPLEMENTAL\Chapter 1 - Administration\<br />

Rencana<br />

<strong>Akta</strong> <strong>Cukai</strong> <strong>Pendapatan</strong> <strong>1967</strong><br />

(<strong>Akta</strong> <strong>53</strong>)<br />

<strong>Pindaan</strong> <strong>Sehingga</strong> <strong>Akta</strong> A1349 Tahun 2009<br />

Tarikh Keluaran :<br />

Title : Income Tax Act<br />

Part : PART X - SUPPLEMENTAL<br />

Chapter : Chapter 1 - Administration<br />

Section : 136. Delegation of Director General's functions.<br />

136. (1) Any function of the Director General under this<br />

Act (not being a function exercisable by statutory order<br />

or a function exercisable under section 152) may be<br />

exercised by a Deputy Director General.<br />

Delegation<br />

of Director<br />

General’s<br />

functions.<br />

[ Am. Act<br />

323.]<br />

(2) The Director of Inland Revenue, Sabah, and the<br />

Director of Inland Revenue, Sarawak, may exercise any<br />

function of the Director General under this Act (not<br />

being a function exercisable by statutory order or a<br />

function exercisable under section 152) except his<br />

functions under sections 44 and 150.<br />

History<br />

Subsection 136(2) is substituted by Act 644 of 2005 s27<br />

(a), with effect from 1 January 2006. The subsection<br />

formerly read as -<br />

"136(2) The Director of Inland Revenue, Sabah, and the<br />

Director of Inland Revenue, Sarawak, may exercise any<br />

function of the Director General under this Act (not<br />

being a function exercisable by statutory order or a<br />

function exercisable under section 152) except his<br />

functions under sections 44 and 150.".<br />

(3) (Deleted by Act 644)<br />

History<br />

Subsection 136(3) is deleted by Act 644 of 2005<br />

s27(b), with effect from 1 January 2006. The<br />

subsection previously read:

Page 2 of 4<br />

" (3) Assistant Directors General of Inland<br />

Revenue may exercise any function of the Director<br />

General under this Act (not being a function<br />

exercisable by statutory order or a function<br />

exercisable under section 152) except his<br />

functions under sections 44, 137 (1) and 150."<br />

(4) (Deleted by Act 644)<br />

History<br />

Subsection 136(4) is deleted by Act 644 of 2005<br />

s27(b), with effect from 1 January 2006. The<br />

subsection previously read:<br />

"(4) Senior Assistant and Assistant Directors of<br />

Inland Revenue may exercise any function of the<br />

Director General under this Act (not being a<br />

function exercisable by statutory order or a<br />

function exercisable under section 152) except his<br />

functions under sections 44, 137 (1) and 150.".<br />

History<br />

Subsection 136(4) amended by Act A1028<br />

s5 with the following:<br />

(a) by deleting the words "123,";<br />

(b) by substituting for the colon at the end of<br />

the paragraph a full stop; and<br />

(c) by deleting the proviso, with effect from 2<br />

July 1998.<br />

Subsection 136(4) formerly read :<br />

"(4) Senior Assistant and Assistant Directors<br />

of Inland Revenue may exercise any function<br />

of the Director General under this Act (not<br />

being a function exercisable by statutory<br />

order or a function exercisable under section<br />

152) except his functions under sections 44,<br />

123, 137 (1) and 150:<br />

Provided that the Director General may by<br />

writing under his hand authorize any Senior<br />

Assistant or Assistant Directors of Inland<br />

Revenue (subject to any exceptions or<br />

limitations contained in the authorization) to<br />

exercise his function under section 123. ".<br />

(5) The Director General may by writing under his<br />

hand authorize any public officer or any employee of the<br />

Inland Revenue Board of Malaysia (subject to any

Page 3 of 4<br />

exceptions or limitations contained in the authorization)<br />

to exercise or assist in exercising any function of the<br />

Director General under this Act which is exercisable<br />

under subsection (4) by Senior Assistant or Assistant<br />

Directors of Inland Revenue.<br />

History<br />

Subsection 136(5) is amended by substituting for<br />

the words "under subsection (4) by Senior<br />

Assistant or Assistant Directors of Inland<br />

Revenue” the words “under subsection (2) by the<br />

appointed officers”, with effect from 1 January<br />

2006.<br />

Subsection 136(5) amended by Act A955 of 1996<br />

s3(a), by inserting after the words "public officer"<br />

the words "or any employee of the Inland Revenue<br />

Board of Malaysia", in force from 2 August 1996.<br />

(6) Where a public officer or an employee of the<br />

Inland Revenue Board of Malaysia exercises any of the<br />

Director General's functions by virtue of any provision of<br />

subsections (1) to (5), he shall do so subject to the<br />

general supervision and control of the Director General.<br />

History<br />

Subsection 136(6) amended by Act A955 of 1996<br />

s3(b), by inserting after the words "public officer"<br />

the words "or an employee of the Inland Revenue<br />

Board of Malaysia", in force from 2 August 1996.<br />

(7) The delegation by or under any provision of<br />

subsections (1) to (5) of the exercise of any function of<br />

the Director General shall not prevent the exercise of<br />

that function by the Director General himself.<br />

(8) References in this Act to the Director General<br />

shall be construed, in relation to any case where a<br />

public officer or an employee of the Inland Revenue<br />

Board of Malaysia is authorized by any provision of<br />

subsection (1) to (5) to exercise the functions of the<br />

Director General, as including references to that officer<br />

or employee.<br />

History<br />

Subsection 136(8) amended by Act 557 of 1997<br />

s20, by inserting after the words "to that officer"<br />

the words "or employee", in force from 2 August

Page 4 of 4<br />

9/22/2010<br />

1996.<br />

Subsection 136(8) amended by Act A955 of 1996<br />

s3( c ), by inserting after the words "public officer"<br />

the words "or an employee of the Inland Revenue<br />

Board of Malaysia", in force from 2 August 1996.