109B. Deduction of tax from special classes of income in certain ...

109B. Deduction of tax from special classes of income in certain ...

109B. Deduction of tax from special classes of income in certain ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Page 1 <strong>of</strong> 3<br />

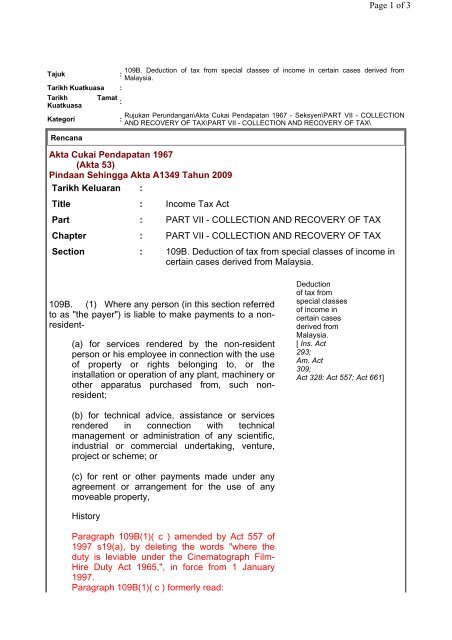

Tajuk<br />

<strong>109B</strong>. <strong>Deduction</strong> <strong>of</strong> <strong>tax</strong> <strong>from</strong> <strong>special</strong> <strong>classes</strong> <strong>of</strong> <strong><strong>in</strong>come</strong> <strong>in</strong> certa<strong>in</strong> cases derived <strong>from</strong><br />

:<br />

Malaysia.<br />

Tarikh Kuatkuasa :<br />

Tarikh Tamat<br />

:<br />

Kuatkuasa<br />

Kategori<br />

Rujukan Perundangan\Akta Cukai Pendapatan 1967 - Seksyen\PART VII - COLLECTION<br />

:<br />

AND RECOVERY OF TAX\PART VII - COLLECTION AND RECOVERY OF TAX\<br />

Rencana<br />

Akta Cukai Pendapatan 1967<br />

(Akta 53)<br />

P<strong>in</strong>daan Seh<strong>in</strong>gga Akta A1349 Tahun 2009<br />

Tarikh Keluaran :<br />

Title : Income Tax Act<br />

Part : PART VII - COLLECTION AND RECOVERY OF TAX<br />

Chapter : PART VII - COLLECTION AND RECOVERY OF TAX<br />

Section : <strong>109B</strong>. <strong>Deduction</strong> <strong>of</strong> <strong>tax</strong> <strong>from</strong> <strong>special</strong> <strong>classes</strong> <strong>of</strong> <strong><strong>in</strong>come</strong> <strong>in</strong><br />

certa<strong>in</strong> cases derived <strong>from</strong> Malaysia.<br />

<strong>109B</strong>. (1) Where any person (<strong>in</strong> this section referred<br />

to as "the payer") is liable to make payments to a non-<br />

resident-<br />

(a) for services rendered by the non-resident<br />

person or his employee <strong>in</strong> connection with the use<br />

<strong>of</strong> property or rights belong<strong>in</strong>g to, or the<br />

<strong>in</strong>stallation or operation <strong>of</strong> any plant, mach<strong>in</strong>ery or<br />

other apparatus purchased <strong>from</strong>, such nonresident;<br />

<strong>Deduction</strong><br />

<strong>of</strong> <strong>tax</strong> <strong>from</strong><br />

<strong>special</strong> <strong>classes</strong><br />

<strong>of</strong> <strong><strong>in</strong>come</strong> <strong>in</strong><br />

certa<strong>in</strong> cases<br />

derived <strong>from</strong><br />

Malaysia.<br />

[ Ins. Act<br />

293;<br />

Am. Act<br />

309;<br />

Act 328: Act 557; Act 661]<br />

(b) for technical advice, assistance or services<br />

rendered <strong>in</strong> connection with technical<br />

management or adm<strong>in</strong>istration <strong>of</strong> any scientific,<br />

<strong>in</strong>dustrial or commercial undertak<strong>in</strong>g, venture,<br />

project or scheme; or<br />

(c) for rent or other payments made under any<br />

agreement or arrangement for the use <strong>of</strong> any<br />

moveable property,<br />

History<br />

Paragraph <strong>109B</strong>(1)( c ) amended by Act 557 <strong>of</strong><br />

1997 s19(a), by delet<strong>in</strong>g the words "where the<br />

duty is leviable under the C<strong>in</strong>ematograph Film-<br />

Hire Duty Act 1965,", <strong>in</strong> force <strong>from</strong> 1 January<br />

1997.<br />

Paragraph <strong>109B</strong>(1)( c ) formerly read:

Page 2 <strong>of</strong> 3<br />

" ( c ) for rent or other payments, not be<strong>in</strong>g<br />

payments <strong>of</strong> film rentals, where the duty is<br />

leviable under the C<strong>in</strong>ematograph Film Hire Duty<br />

Act 1965, made under any agreement or<br />

arrangement for the use <strong>of</strong> any moveable<br />

property, ".<br />

which is deemed to be derived <strong>from</strong> Malaysia, he shall,<br />

upon pay<strong>in</strong>g or credit<strong>in</strong>g the payments, deduct<br />

there<strong>from</strong> <strong>tax</strong> at the rate applicable to such payments,<br />

and (whether or not that <strong>tax</strong> is so deducted) shall with<strong>in</strong><br />

one month after pay<strong>in</strong>g or credit<strong>in</strong>g such payment,<br />

render an account and pay the amount <strong>of</strong> that <strong>tax</strong> to the<br />

Director General:<br />

Provided that the Director General may-<br />

(i) give notice <strong>in</strong> writ<strong>in</strong>g to the payer requir<strong>in</strong>g him<br />

to deduct and pay <strong>tax</strong> at some other rates or to<br />

pay or credit the payments without deduction <strong>of</strong><br />

<strong>tax</strong>; or<br />

(ii) under <strong>special</strong> circumstances, allow extension<br />

<strong>of</strong> time for <strong>tax</strong> deducted to be paid over.<br />

(2) Where the payer fails to pay any amount due<br />

<strong>from</strong> him under subsection (1), that amount which he<br />

fails to pay shall be <strong>in</strong>creased by a sum equal to ten per<br />

cent <strong>of</strong> the amount which he fails to pay, and that<br />

amount and the <strong>in</strong>creased sum. shall be a debt due<br />

<strong>from</strong> him to the Government and shall be payable<br />

forthwith to the Director General.<br />

History<br />

Subsection <strong>109B</strong>(2) is amended by Act 661 <strong>of</strong> 2006<br />

deemed to have come <strong>in</strong>to operation on 2 september<br />

2006, by substitut<strong>in</strong>g for the words “an amount equal to<br />

ten per cent <strong>of</strong> the payments liable to deduction <strong>of</strong> <strong>tax</strong><br />

under paragraph (1)(a), (b) or (c) and the total sum” the<br />

words “a sum equal to ten per cent <strong>of</strong> the amount which<br />

he fails to pay, and that amount and the <strong>in</strong>creased<br />

sum”.<br />

Subsection <strong>109B</strong>(2) formerly read:<br />

Where the payer fails to pay any amount due <strong>from</strong> him<br />

under subsection (1), that amount which he fails to pay<br />

shall be <strong>in</strong>creased by an amount equal to ten percent <strong>of</strong><br />

the payments liable to deduction <strong>of</strong> <strong>tax</strong> under<br />

subsection (1)(a), (1)(b) or (1)(c) and the total sum shall<br />

be a debt due <strong>from</strong> him to the Government and shall be<br />

payable forthwith to the Director General.

Page 3 <strong>of</strong> 3<br />

Subsection <strong>109B</strong>(2) substituted by Act 557 <strong>of</strong> 1997 s19<br />

(b), <strong>in</strong> force <strong>from</strong> 25 October 1996.<br />

Subsection <strong>109B</strong>(2) formerly read:<br />

" ( 2) Where the payer fails to pay any amount due <strong>from</strong><br />

him under subsection (1), the amount which he fails to<br />

pay shall be a debt due <strong>from</strong> him to the Government<br />

and shall be payable forthwith to the Director General.<br />

".<br />

(3) Where <strong>in</strong> pursuance <strong>of</strong> this section any<br />

amount is paid to the Director General by the payer or<br />

recovered by the Director General <strong>from</strong> the payer-<br />

(a) the Director General shall, <strong>in</strong> the manner<br />

provided by section 110, apply that amount<br />

towards payment <strong>of</strong> the <strong>tax</strong> charged on the<br />

person to whom the payer was liable to pay the<br />

payments to which the amount relates; and<br />

(b) if the payer has not deducted that amount <strong>in</strong><br />

pay<strong>in</strong>g the payment under subsection (1) with<br />

respect to which the amount relates, he may<br />

recover that amount <strong>from</strong> that person as a debt<br />

due to the payer.<br />

(4) In this section "person" <strong>in</strong>cludes a partnership.