60F. Investment holding company.

60F. Investment holding company.

60F. Investment holding company.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Page 1 of 4<br />

Tajuk<br />

Tarikh Kuatkuasa :<br />

Tarikh<br />

Kuatkuasa<br />

Kategori<br />

Rencana<br />

Tamat<br />

:<br />

: <strong>60F</strong>. <strong>Investment</strong> <strong>holding</strong> <strong>company</strong>.<br />

:<br />

Rujukan Perundangan\Akta Cukai Pendapatan 1967 - Seksyen\PART III - ASCERTAINMENT<br />

OF CHARGEABLE INCOME\Chapter 8 - Special cases\<br />

Akta Cukai Pendapatan 1967<br />

(Akta 53)<br />

Pindaan Sehingga Akta 719 Tahun 2011<br />

Tarikh Keluaran :<br />

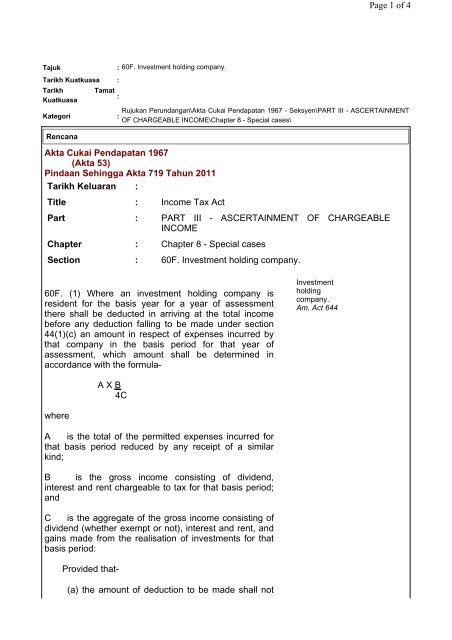

Title : Income Tax Act<br />

Part : PART III - ASCERTAINMENT OF CHARGEABLE<br />

INCOME<br />

Chapter : Chapter 8 - Special cases<br />

Section : <strong>60F</strong>. <strong>Investment</strong> <strong>holding</strong> <strong>company</strong>.<br />

<strong>60F</strong>. (1) Where an investment <strong>holding</strong> <strong>company</strong> is<br />

resident for the basis year for a year of assessment<br />

there shall be deducted in arriving at the total income<br />

before any deduction falling to be made under section<br />

44(1)(c) an amount in respect of expenses incurred by<br />

that <strong>company</strong> in the basis period for that year of<br />

assessment, which amount shall be determined in<br />

accordance with the formula-<br />

<strong>Investment</strong><br />

<strong>holding</strong><br />

<strong>company</strong>.<br />

Am. Act 644<br />

A X B<br />

4C<br />

where<br />

A is the total of the permitted expenses incurred for<br />

that basis period reduced by any receipt of a similar<br />

kind;<br />

B is the gross income consisting of dividend,<br />

interest and rent chargeable to tax for that basis period;<br />

and<br />

C is the aggregate of the gross income consisting of<br />

dividend (whether exempt or not), interest and rent, and<br />

gains made from the realisation of investments for that<br />

basis period:<br />

Provided that-<br />

(a) the amount of deduction to be made shall not

Page 2 of 4<br />

exceed five per cent of the gross income<br />

consisting of dividend, interest and rent for that<br />

basis period; and<br />

(b) where, by reason of an absence or insufficiency<br />

of aggregate income for that year of assessment,<br />

effect cannot be, given or cannot be given in full to<br />

any deduction falling to be made to the investment<br />

<strong>holding</strong> <strong>company</strong> under this section for that year,<br />

that deduction which has not been so made shall<br />

not be made to the investment <strong>holding</strong> <strong>company</strong><br />

for any subsequent year of assessment.<br />

(1A) Notwithstanding any other provision of this<br />

Act, where in any year of assessment income of an<br />

investment <strong>holding</strong> <strong>company</strong> consists of -<br />

(a) income from the <strong>holding</strong> of investment, it shall<br />

not be treated as income from a source consisting<br />

of a business; or<br />

(b) income other than income from the <strong>holding</strong> of<br />

investment, it shall be treated as gains or profits<br />

under paragraph 4(f).<br />

(1B) If it is shown that it has been established as<br />

between the Director General and the <strong>company</strong> for any<br />

tax purposes that the <strong>company</strong> is an investment <strong>holding</strong><br />

<strong>company</strong> for the basis period for any year of assessment<br />

it shall be presumed until the contrary is proved that the<br />

<strong>company</strong> is an investment <strong>holding</strong> <strong>company</strong> for the<br />

purpose of this Act for the basis period for every<br />

subsequent year of assessment.<br />

(1C) This section shall not apply to an investment<br />

<strong>holding</strong> <strong>company</strong> referred to in section <strong>60F</strong>A.<br />

History<br />

Paragraph <strong>60F</strong>(1A), 1(B) and 1(C) are inserted by Act<br />

644 of 2005 s16(a), shall have effect for the year of<br />

assessment 2006 and subsequent years of assessment.<br />

(2) In this section -<br />

"business of <strong>holding</strong> of an investment" means<br />

business of letting of property where a <strong>company</strong> in any<br />

year of assessment provides any maintenance or<br />

support services in respect of the property.<br />

History<br />

The definition of "business of <strong>holding</strong> of an investment"

Page 3 of 4<br />

is inserted by s18(b), Act 661 of 2006 and shall have<br />

effect for for the year of assessment 2006 and<br />

subsequent years of assessment.<br />

“dividend” is deemed to include income<br />

distributed by a unit trust;<br />

History<br />

The definition of "dividend" is inserted by s13, Act 719 of<br />

2011 and shall have effect for the year assessment 2011<br />

and subsequent years of assessment<br />

"investment <strong>holding</strong> <strong>company</strong>" means a <strong>company</strong><br />

whose activities consist mainly in the <strong>holding</strong> of<br />

investments and not less than eighty per cent of its<br />

gross income other than gross income from a source<br />

consisting of a business of <strong>holding</strong> of an investment<br />

(whether exempt or not) is derived therefrom;<br />

History<br />

Subsection <strong>60F</strong>(2) is amended by s18(a), Act 661 of<br />

2006 by inserting after the words "gross income" the<br />

words "other than gross income from a source consisting<br />

of a business of <strong>holding</strong> of an investment". The<br />

amendment shall have effect for for the year of<br />

assessment 2006 and subsequent years of assessment.<br />

The definition of "investment <strong>holding</strong> <strong>company</strong>" is<br />

substituted by Act 644 s16(b), shall effect for the year of<br />

assessment 2006 and subsequent years of assessment.<br />

The definition formerly reads as follows :<br />

"investment <strong>holding</strong> <strong>company</strong>" means a <strong>company</strong> whose<br />

activities consist wholly in the making of investments<br />

and whose income is derived therefrom;<br />

"permitted expenses" means expenses incurred<br />

by an investment <strong>holding</strong> <strong>company</strong> in respect of-<br />

(a) directors' fees;<br />

(b) wages, salaries and allowances;<br />

(c) management fees;<br />

(d) secretarial, audit and accounting fees,<br />

telephone charges, printing and stationery costs<br />

and postage; and<br />

(e) rent and other expenses incidental to the

Page 4 of 4<br />

History<br />

maintenance of an office, which are not deductible<br />

under section 33(1).<br />

Section <strong>60F</strong> inserted by Act 497 of 1993 s5, shall have<br />

effect for the year of assessment 1993 and subsequent<br />

years of assessment.