Form M Guidebook Cover 2007.pmd - LHDN

Form M Guidebook Cover 2007.pmd - LHDN

Form M Guidebook Cover 2007.pmd - LHDN

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

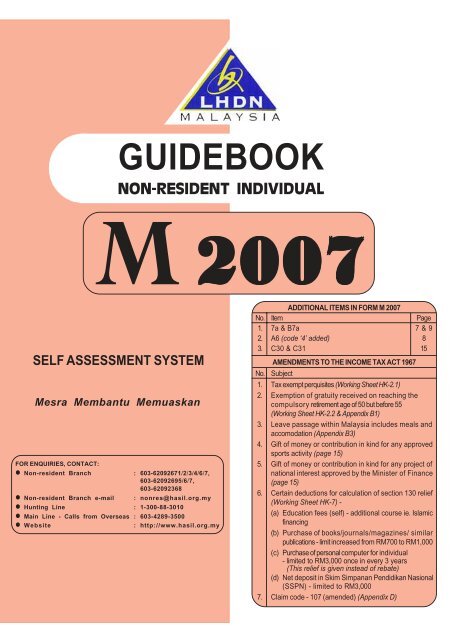

GUIDEBOOK<br />

NON-RESIDENT INDIVIDUAL<br />

M 2007<br />

SELF ASSESSMENT SYSTEM<br />

Mesra Membantu Memuaskan<br />

FOR ENQUIRIES, CONTACT:<br />

• Non-resident Branch : 603-62092671/2/3/4/6/7,<br />

603-62092695/6/7,<br />

603-62092368<br />

• Non-resident Branch e-mail : nonres@hasil.org.my<br />

• Hunting Line : 1-300-88-3010<br />

• Main Line - Calls from Overseas : 603-4289-3500<br />

• Website<br />

: http://www.hasil.org.my<br />

ADDITIONAL ITEMS IN FORM M 2007<br />

No. Item Page<br />

1. 7a & B7a 7 & 9<br />

2. A6 (code ‘4’ added) 8<br />

3. C30 & C31 15<br />

AMENDMENTS TO THE INCOME TAX ACT 1967<br />

No. Subject<br />

1. Tax exempt perquisites (Working Sheet HK-2.1)<br />

2. Exemption of gratuity received on reaching the<br />

compulsory retirement age of 50 but before 55<br />

(Working Sheet HK-2.2 & Appendix B1)<br />

3. Leave passage within Malaysia includes meals and<br />

accomodation (Appendix B3)<br />

4. Gift of money or contribution in kind for any approved<br />

sports activity (page 15)<br />

5. Gift of money or contribution in kind for any project of<br />

national interest approved by the Minister of Finance<br />

(page 15)<br />

6. Certain deductions for calculation of section 130 relief<br />

(Working Sheet HK-7) -<br />

(a) Education fees (self) - additional course ie. Islamic<br />

financing<br />

(b) Purchase of books/journals/magazines/ similar<br />

publications - limit increased from RM700 to RM1,000<br />

(c) Purchase of personal computer for individual<br />

- limited to RM3,000 once in every 3 years<br />

(This relief is given instead of rebate)<br />

(d) Net deposit in Skim Simpanan Pendidikan Nasional<br />

(SSPN) - limited to RM3,000<br />

7. Claim code - 107 (amended) (Appendix D)

<strong>Form</strong> M <strong>Guidebook</strong> Self Assessment System<br />

CONTENTS OF GUIDEBOOK<br />

ITEM<br />

Page<br />

Foreword 1<br />

What Is <strong>Form</strong> M <strong>Guidebook</strong> 1<br />

Reminder Before Filling Out The Return <strong>Form</strong> 2<br />

Part 1 — <strong>Form</strong> M<br />

Basic Information 7<br />

Part A : Particulars of Individual 7<br />

Part B : Particulars of Husband / Wife 9<br />

Part C : Statutory Income and Total Income 9<br />

Part D : Tax Payable / Repayable 16<br />

Part E : Status of Tax For Year of Assessment 2007 18<br />

Part F : Income of Preceding Years Not Declared 18<br />

Part G : Particulars of Executor of the Deceased Person’s Estate 18<br />

Part H : Particulars of Losses, Capital Allowances and Withholding Taxes 19<br />

Part J : Special Deduction, Further Deduction and Double Deduction 21<br />

Part K : Incentive Claim / Exempt Income 21<br />

Part L : Financial Particulars of Individual 22<br />

Declaration 24<br />

Particulars of Tax Agent who Completes this Return <strong>Form</strong> 24<br />

Reminder 24<br />

Part 2 — Working Sheets<br />

HK-1 – Computation of Statutory Income from Business 25<br />

HK-1A – Not applicable to non-resident individuals (not enclosed) -<br />

HK-1B1 – Computation of Statutory Income from Partnership Business 28<br />

HK-1C – Not applicable to non-resident individuals (not enclosed) -<br />

HK-1D – Not applicable to non-resident individuals (not enclosed) -<br />

HK-1E – Computation of Statutory Income from Pioneer Business 29<br />

HK-1.1 – Computation of Mining Allowance 29<br />

HK-1.2 – Summary of Capital Allowances 29<br />

HK-1.3 – Adjustment of Losses for Business and Partnership 29<br />

HK-1.4 – Adjustment of Losses for Pioneer Business 30<br />

HK-2 – Computation of Statutory Income from Employment 30<br />

HK-2.1 – Receipts under Paragraph 13(1)(a) 33<br />

HK-2.2 – Computation of Taxable Gratuity 34<br />

HK-2.3 – Computation of Tax Allowance 34<br />

HK-2.4 – Benefits-In-Kind (BIK) [paragraph 13(1)(b)] 34<br />

HK-2.5 – Value of Living Accomodation Benefit [paragraph 13(1)(c)] 34<br />

i

<strong>Form</strong> M <strong>Guidebook</strong> Self Assessment System<br />

HK-2.6 – Refund from Unapproved Pension or Provident Fund,<br />

Scheme or Society 35<br />

HK-2.7 – Computation of Taxable Compensation 35<br />

HK-3 – Tax Deduction under Section 110 (Dividends) 36<br />

HK-4 – Particulars of Properties/Assets and Total Rental 36<br />

HK-5 – Not applicable to non-resident individuals (not enclosed) -<br />

HK-6 – Tax Deduction under Section 110 (Others) 36<br />

HK-7 – Non-Resident Malaysian Citizen Relief (Section 130) 36<br />

HK-8 – Not applicable to non-resident individuals (not enclosed) -<br />

HK-9 – Claim for Section 133 Tax Relief - Income from Countries<br />

Without Avoidance of Double Taxation Agreement 36<br />

HK-10 – Instalments / Schedular Tax Deductions Paid 37<br />

HK-11 – Basis Year Payment to Non-residents (Withholding Tax) 37<br />

HK-12 – Not applicable to non-resident individuals (not enclosed) -<br />

HK-13 – Deduction for Maintenance of Unmarried Children 37<br />

HK-14 – Life Insurance Premiums / Contributions to Approved<br />

Provident or Pension Fund, Education and Medical Insurance 38<br />

Series<br />

CONTENTS OF WORKING SHEETS<br />

(Paper marked blue)<br />

Working Sheet<br />

Page<br />

HK-1 – Computation of Statutory Income from Business 1<br />

HK-1A – Not applicable to non-resident individuals (not enclosed) -<br />

HK-1B1 – Computation of Statutory Income from Partnership Business 4<br />

HK-1C – Not applicable to non-resident individuals (not enclosed) -<br />

HK-1D – Not applicable to non-resident individuals (not enclosed) -<br />

HK-1E – Computation of Statutory Income from Pioneer Business 5<br />

HK-1.1 – Mining Allowance 9<br />

HK-1.1A – Summary of Mining Allowances 11<br />

HK-1.2 – Summary of Capital Allowances 12<br />

HK-1.2.1 – Agriculture Allowance 13<br />

HK-1.2.1A – Summary of Agriculture Allowances 15<br />

HK-1.2.2 – Forest Allowance 16<br />

HK-1.2.2A – Summary of Forest Allowances 18<br />

HK-1.2.3 – Industrial Building Allowance 19<br />

HK-1.2.3A – Summary of Industrial Building Allowances 21<br />

HK-1.2.4 – Plant and Machinery Allowance 22<br />

HK-1.2.4A – Summary of Plant and Machinery Allowances 24<br />

HK-1.2A – Summary of Capital Expenditure 25<br />

HK-1.3 – Adjustment of Losses for Business and Partnership 26<br />

HK-1.4 – Adjustment of Losses for Pioneer Business 27<br />

HK-2 – Computation of Statutory Income from Employment 28<br />

ii

<strong>Form</strong> M <strong>Guidebook</strong> Self Assessment System<br />

HK-2.1 – Receipts under Paragraph 13(1)(a) 30<br />

HK-2.2 – Computation of Taxable Gratuity 31<br />

HK-2.3 – Computation of Tax Allowance 32<br />

HK-2.4 – Benefits-In-Kind (BIK) [paragraph 13(1)(b)] 33<br />

HK-2.5 – Value of Living Accomodation Benefit [paragraph 13(1)(c)] 34<br />

HK-2.6 – Refund from Unapproved Pension or Provident Fund,<br />

Scheme or Society 36<br />

HK-2.7 – Computation of Taxable Compensation 37<br />

HK-3 – Tax Deduction under Section 110 (Dividends) 38<br />

HK-4 – Particulars of Properties / Assets and Total Rental 40<br />

HK-5 – Not applicable to non-resident individuals (not enclosed) -<br />

HK-6 – Tax Deduction under Section 110 (Others) 42<br />

HK-7 – Non-Resident Malaysian Citizen Relief (Section 130) 43<br />

HK-8 – Not applicable to non-resident individuals (not enclosed) -<br />

HK-9 – Claim for Section 133 Tax Relief - Income from Countries<br />

Without Avoidance of Double Taxation Agreement 46<br />

HK-10 – Instalments/Schedular Tax Deductions Paid 47<br />

HK-11 – Basis Year Payment to Non-Residents (Withholding Tax) 48<br />

HK-13 – Deduction for Maintenance of Unmarried Children 49<br />

HK-14 – Life Insurance Premiums / Contributions to Approved<br />

Provident or Pension Fund, Education and Medical Insurance 51<br />

Series<br />

CONTENTS OF APPENDICES<br />

(Paper marked brown)<br />

Appendix<br />

Page<br />

Appendix A1 - 1. Gross Business Income 1<br />

2. Allowable Expenses 1<br />

Appendix A1.1 - Reminder on the need to keep record of adjustments and 3<br />

tax computation for the business<br />

Appendix B1 - Gratuity 5<br />

Appendix B2 - Tax Allowance 8<br />

Appendix B3 - Benefits-In-Kind (BIK) [paragraph 13(1)(b)] 10<br />

Appendix B4 - Value of Living Accomodation Benefit [paragraph 13(1)(c)] 14<br />

Appendix B5 - Compensation for Loss of Employment 18<br />

Appendix C - Foreign Currency Exchange Rates (Yearly Average) 19<br />

Appendix D - Claim Codes 20<br />

Appendix E - Country Codes 21<br />

Appendix F - Avoidance of Double Taxation Agreements (DTA) and<br />

Withholding Tax Rates on Payments to Non-residents 26<br />

Appendix G - Business Codes 28<br />

Appendix H - Director General’s Public Rulings 49<br />

iii

<strong>Form</strong> M <strong>Guidebook</strong> Self Assessment System<br />

FOREWORD<br />

Lembaga Hasil Dalam Negeri Malaysia (<strong>LHDN</strong>M) expresses its appreciation towards individuals who have consistently performed<br />

their duty as responsible taxpayers in the settlement of their annual income tax. Their tax contributions have assisted in the<br />

development and improvement of the national socio-economic status.<br />

To expedite and facilitate the performance by taxpayers of their respective tax responsibility, the government has entrusted<br />

its faith in them to assess and settle their income tax with the introduction of the Self Assessment System commencing from<br />

the year of assessment 2004 for individuals and non-corporate taxpayers.<br />

Simplified forms with explanations and guides on how to fill out those forms and compute the chargeable income and income<br />

tax have been prepared to assist taxpayers.<br />

WHAT IS FORM M GUIDEBOOK<br />

The following are contents of the <strong>Form</strong> M <strong>Guidebook</strong>:<br />

1. A complete guide on how to fill out the <strong>Form</strong> M.<br />

2. A series of Working Sheets (series HK-1 ... ) for computing the statutory income and loss from business:<br />

HK-1 - Computation of Statutory Income from Business<br />

HK-1A - Not applicable to non-resident individuals (not enclosed)<br />

HK-1B1 - Computation of Statutory Income from Partnership Business<br />

HK-1C - Not applicable to non-resident individuals (not enclosed)<br />

HK-1D - Not applicable to non-resident individuals (not enclosed)<br />

HK-1E - Computation of Statutory Income from Pioneer Business<br />

HK-1.1 - Mining Allowance<br />

HK-1.1A - Summary of Mining Allowances<br />

HK-1.2 - Summary of Capital Allowances<br />

HK-1.2.1 - Agriculture Allowance<br />

HK-1.2.1A - Summary of Agriculture Allowances<br />

HK-1.2.2 - Forest Allowance<br />

HK-1.2.2A - Summary of Forest Allowances<br />

HK-1.2.3 - Industrial Building Allowance<br />

HK-1.2.3A - Summary of Industrial Building Allowances<br />

HK-1.2.4 - Plant and Machinery Allowance<br />

HK-1.2.4A - Summary of Plant and Machinery Allowances<br />

HK-1.2A - Summary of Capital Expenditure<br />

HK-1.3 - Adjustment of Losses for Business and Partnership<br />

HK-1.4 - Adjustment of Losses for Pioneer Business<br />

3. A series of Working Sheets (series HK-2 ... ) for computing the statutory income from employment:<br />

HK-2 - Computation of Statutory Income from Employment<br />

HK-2.1 - Receipts under Paragraph 13(1)(a)<br />

HK-2.2 - Computation of Taxable Gratuity<br />

HK-2.3 - Computation of Tax Allowance<br />

HK-2.4 - Benefits-In-Kind (BIK) [paragraph 13(1)(b)]<br />

HK-2.5 - Value of Living Accomodation Benefit [paragraph 13(1)(c)]<br />

HK-2.6 - Refund from Unapproved Pension or Provident Fund, Scheme or Society<br />

HK-2.7 - Computation of Taxable Compensation<br />

1

<strong>Form</strong> M <strong>Guidebook</strong><br />

Self Assessment System<br />

4. Other Working Sheets are as follows:<br />

HK-3 - Tax Deduction under Section 110 (Dividends)<br />

HK-4 - Particulars of Properties / Assets and Total Rental<br />

HK-5 - Not applicable to non-resident individuals (not enclosed)<br />

HK-6 - Tax Deduction under Section 110 (Others)<br />

HK-7 - Non-Resident Malaysian Citizen Relief (Section 130)<br />

HK-8 - Not applicable to non-resident individuals (not enclosed)<br />

HK-9 - Claim for Section 133 Tax Relief - Income from Countries<br />

Without Avoidance of Double Taxation Agreement<br />

HK-10 - Instalments/Schedular Tax Deductions Paid<br />

HK-11 - Basis Year Payment to Non-residents (Withholding Tax)<br />

HK-12 - Not applicable to non-resident individuals (not enclosed)<br />

HK-13 - Deduction for Maintenance of Unmarried Children<br />

HK-14 - Life Insurance Premiums / Contributions to Approved Provident or<br />

Pension Fund, Education and Medical Insurance<br />

5. A series of Appendices (series A ....) to explain and give guidance in computing the business income:<br />

Appendix A1 - 1. Gross business income<br />

2. Allowable expenses<br />

Appendix A1.1 - Reminder on the need to keep record of adjustments and tax computation for the business<br />

6. A series of Appendices (series B .....) to serve as a guide in the computation of employment income:<br />

Appendix B1 - Explanation on Gratuity<br />

Appendix B2 - Explanation on Tax Allowance/Tax Borne by the Employer<br />

Appendix B3 - Explanation on Benefits-In-Kind or Amenities arising out of Employment<br />

Appendix B4 - Explanation on Living Accomodation provided by the Employer<br />

Appendix B5 - Explanation on Income from Compensation<br />

7. The following are other appendices to enable the entry of required information in the <strong>Form</strong> M:<br />

Appendix C - Foreign Currency Exchange Rates (Yearly Average)<br />

Appendix D - Claim Codes: 1. Special Deductions<br />

2. Further Deductions<br />

3. Double Deductions<br />

Appendix E - List of countries with their respective code for the individual to fill in the code of the country where<br />

he is resident/a citizen<br />

Appendix F - List of countries with which Avoidance of Double Taxation Agreements have been signed<br />

Appendix G - List of codes for various types of businesses carried on by the individual<br />

Appendix H - List of Director General’s Public Rulings as guidelines for computing the income according to<br />

the provision of the Income Tax Act (ITA) 1967<br />

REMINDER BEFORE FILLING OUT THE RETURN FORM<br />

Please take note of the following:<br />

1. (a) A non-resident individual is required to fill out <strong>Form</strong> M. He is considered not resident in Malaysia if he does<br />

not qualify for residence status under the provision of section 7 ITA 1967. Refer to Public Ruling No. 2/2005<br />

(issued on 6 June 2005) on the determination of residence status.<br />

(b) If he is resident by virtue of section 7 for a particular year of assessment, he is required to make an early<br />

request for either:<br />

<strong>Form</strong> B (with business source of income) OR <strong>Form</strong> BE (without business source of income)<br />

meant for a resident individual so that it can be completed and furnished to <strong>LHDN</strong>M within the stipulated<br />

period.<br />

2

<strong>Form</strong> M <strong>Guidebook</strong> Self Assessment System<br />

(c)<br />

(d)<br />

Husband and wife are required to fill out separate return forms if each of them has income accruing in or<br />

derived from Malaysia.<br />

Working sheets, records and documents need not be furnished with the <strong>Form</strong> M except in the following<br />

cases:-<br />

If the individual is entitled to a tax refund as per item D11 (<strong>Form</strong> M), he is required to furnish:<br />

(i) Working Sheet HK-3 and original dividend vouchers in respect of the claim for section 110 tax deduction<br />

(dividends);<br />

(ii)<br />

(iii)<br />

Working Sheet HK-6 and relevant documents pertaining to the claim for section 110 tax deduction (others);<br />

Working Sheet HK-7 and relevant documents relating to the claim for non-resident Malaysian citizen<br />

tax relief (section 130).<br />

All working sheets, records and documents are to be kept for a period of seven (7) years after the end of<br />

the year in which the return is furnished (sections 82 and 82A)<br />

2. CONDITIONS ON ELIGIBILTY TO ELECT FOR JOINT ASSESSMENT<br />

A husband/wife who is not resident in Malaysia may elect only if:<br />

(a) he or she who elects is a Malaysian citizen and has total income * ;<br />

(b) the spouse in whose name the joint assessment is to be raised, has total income * ; and<br />

(c) both husband and wife were living together and did not cease to live together or to be husband and wife of<br />

each other in the basis year for a year of assessment. Where the husband has more than one wife, election<br />

shall only be made with one wife. Election is valid only if no other wife/wives of his elects to combine her<br />

total income with his total income.<br />

* Note:- An individual is considered as having no ‘total income’ (ie. amount ‘Nil’ for item C32 <strong>Form</strong> M) if:<br />

(i) he/she suffered loss from business; or<br />

(ii) the amount of expenditure exceeds the gross income in respect of non-business source(s)<br />

for a year of assessment and therefore does not satisfy the condition for joint assessment.<br />

3. JOINT ASSESSMENT<br />

An individual is also not eligible to elect for joint assessment is he/she does not have any source<br />

of income.<br />

(a) Election for joint assessment has to be made in writing under item A6 of the <strong>Form</strong> M.<br />

(b)<br />

(c)<br />

The individual and the spouse are required to fill out separate return forms (M / B / BE). If the spouse<br />

in whose name the joint assessment is to be raised is resident in Malaysia, then the spouse is required to<br />

fill out either <strong>Form</strong> B or BE, whichever is applicable.<br />

Example:<br />

If the wife elects for joint assessment, she is required to enter ‘1’ in item A6 and her total income in item<br />

C35 of her <strong>Form</strong> M. She need not fill in items C36 and C37 of Part C, Parts D and E of her <strong>Form</strong> M. However,<br />

other parts of the return form (if relevant) must be completed.<br />

Subsequently, she has to enter her total income in either item:-<br />

C36 (<strong>Form</strong> M),<br />

C35 (<strong>Form</strong> B) OR<br />

C17 (<strong>Form</strong> BE) of her husband; and<br />

enter ‘1’ if it includes business income or ‘2’ if not.<br />

Instalments/Schedular Tax Deductions (STD) [if any] paid by the husband and wife for the current year of<br />

assessment, have to be totalled and entered in either item:-<br />

E2 (<strong>Form</strong> M),<br />

F2 (<strong>Form</strong> B) OR<br />

F2 (<strong>Form</strong> BE) of her husband on whom the tax is to be raised.<br />

The method for filling in these items is shown in the following example.<br />

3

<strong>Form</strong> M <strong>Guidebook</strong><br />

Self Assessment System<br />

Example:<br />

Mr. A and his wife are Malaysian citizens. His wife is resident in Malaysia for the basis year whereas<br />

he is not. Both are not in the employment of any Malaysian public service or statutory authority. They have two<br />

(2) school-going children.<br />

As he is a Malaysian citizen, he can elect for joint assessment and has done so in his <strong>Form</strong> M (item<br />

A6). He has a total income from Malaysia of RM48,000 (employment income) and schedular tax deductions amounting<br />

to RM3,600 for the basis year. Part C of his <strong>Form</strong> M has to be completed as follows:<br />

FORM M OF MR. A<br />

PART C :<br />

STATUTORY INCOME AND TOTAL INCOME<br />

C10<br />

Employment * / Director’s fees<br />

* Claim for exemption under:<br />

C10<br />

,<br />

,<br />

4<br />

8 0 0 0 ,<br />

1 = Paragraph 21 Schedule 6<br />

2 = Avoidance of Double Taxation<br />

Agreement between Malaysia and<br />

(Use Country Code)<br />

C35<br />

TOTAL INCOME (SELF) ( C32 to C34d )<br />

C35<br />

,<br />

,<br />

4<br />

8 0 0 0 ,<br />

He need not fill in items C36 and C37 of Part C, Parts D and E of his <strong>Form</strong> M. However, other parts of the form (if relevant)<br />

have to be completed.<br />

Mrs. A has a total income from Malaysia of RM36,000 (rental income) and advance payment made by instalments of RM1,200<br />

for the basis year. Parts C, D and E of her <strong>Form</strong> BE have to be completed as follows :-<br />

FORM BE OF MRS. A<br />

PART C :<br />

STATUTORY INCOME AND TOTAL INCOME<br />

C4<br />

Rents, royalties and premiums<br />

C4<br />

,<br />

,<br />

3<br />

6 0 0 0 ,<br />

C7 AGGREGATE INCOME ( C1 to C6 )<br />

C7<br />

,<br />

,<br />

3<br />

6 0 0 0 ,<br />

C16<br />

TOTAL INCOME (SELF) [ C7 - ( C8 to C15 ) ]<br />

(Enter “0” if value is negative)<br />

C16<br />

,<br />

,<br />

3<br />

6 0 0 0 ,<br />

C17<br />

TOTAL INCOME TRANSFERRED FROM<br />

HUSBAND / WIFE FOR JOINT ASSESSMENT<br />

C17<br />

,<br />

,<br />

4<br />

8 0 0 0 ,<br />

* Type of income transferred<br />

from HUSBAND / WIFE<br />

2<br />

1 = With business income<br />

2 = Without business income<br />

C18<br />

AGGREGATE OF TOTAL INCOME ( C16 + C17 )<br />

C18<br />

,<br />

,<br />

8<br />

4 0 0 0 ,<br />

4

<strong>Form</strong> M <strong>Guidebook</strong> Self Assessment System<br />

PART D :<br />

RELIEF<br />

D1<br />

Individual and dependent relatives<br />

8 0 0 0 ,<br />

D9<br />

Husband / Wife / Payment of alimony to former wife<br />

RESTRICTED TO 3,000<br />

3 0 0 0 ,<br />

D11a<br />

Child - Under the age of 18 years<br />

Eligible Rate<br />

100% 50%<br />

No.<br />

No.<br />

0 2 2 , 0 0 0<br />

x 1,000 = x 500 =<br />

,<br />

2 0 0 0 ,<br />

D14<br />

Total Relief ( D1 to D13 )<br />

D14<br />

,<br />

1<br />

3 0 0 0 ,<br />

PART E :<br />

TAX PAYABLE<br />

E1<br />

CHARGEABLE INCOME [ ( C16 - D14 ) or ( C18 - D14 ) ]<br />

E1<br />

,<br />

,<br />

7<br />

1 0 0 0 ,<br />

E2<br />

INCOME TAX COMPUTATION (Refer to the tax rate schedule provided)<br />

E2a<br />

Tax on the first<br />

,<br />

,<br />

7<br />

0 0 0 0 ,<br />

, , 7, 2 7 5 . 0 0<br />

E2b<br />

Tax on the<br />

balance<br />

,<br />

,<br />

1 0 0 0 ,<br />

At Rate (%)<br />

2 4<br />

, , , 2 4 0 . 0 0<br />

E3<br />

TOTAL INCOME TAX ( E2a + E2b )<br />

E3<br />

, , 7, 5 1 5 . 0 0<br />

E14<br />

TAX PAYABLE [ E9 - ( E10 + E11 + E12 + E13 ) ]<br />

E14<br />

, , 7, 5 1 5 . 0 0<br />

PART F : STATUS OF TAX FOR YEAR OF ASSESSMENT 2007<br />

F1<br />

Tax payable (from E14)<br />

F1<br />

, , 7, 5 1 5 . 0 0<br />

LESS:<br />

F2<br />

Instalments / Schedular Tax Deductions Paid for 2007<br />

Income - SELF and HUSBAND / WIFE if joint assessment<br />

, , 4, 8 0 0 . 0 0<br />

F3<br />

Balance of tax payable ( F1 - F2 )<br />

F3<br />

, , 2, 7 1 5 . 0 0<br />

In the above example, only significant items in the return form are shown. Where appropriate, other items not shown have to<br />

be completed also.<br />

Please take note that the tax computation should be done separately for the husband and wife when using relevant working<br />

sheets provided in this <strong>Guidebook</strong>. Record of separate tax computations for the husband and wife must be properly kept for<br />

reference by <strong>LHDN</strong>M.<br />

5

<strong>Form</strong> M <strong>Guidebook</strong><br />

Self Assessment System<br />

4. GENERAL RULES FOR FILLING OUT THE FORM M<br />

Please complete the return form in BLOCK LETTERS. Use black ink pen.<br />

You are required to enter relevant information for the basis year in the boxes provided under every section of the<br />

return form as listed below. Leave the box(es) blank if not relevant to you.<br />

i. Basic Information<br />

ii. Part A : Particulars of Individual<br />

iii. Part B : Particulars of Husband/Wife<br />

iv. Part C : Statutory Income and Total Income<br />

If the individual elects for joint assessment to be raised in the name of the spouse, he is required<br />

to enter his total income in item C33 but need not fill in items C34 and C35; Parts D and E of his<br />

own return form. However, other parts of the return form (where relevant) have to be completed.<br />

v. Part D : Tax Payable / Repayable<br />

The individual who elects for joint assessment does not have to fill in this section of his own<br />

return form.<br />

vi. Part E : Status of Tax for Year of Assessment 2007<br />

The individual is not required to fill in this section of his own return form if he elects for joint<br />

assessment.<br />

vii. Part F : Income of Preceding Years Not Declared<br />

viii. Part G : Particulars of Executor of the Deceased Person’s Estate<br />

ix. Part H : Particulars of Losses, Capital Allowances and Withholding Taxes<br />

x. Part J : Special Deduction, Further Deduction and Double Deduction<br />

xi. Part K : Incentive Claim / Exempt Income<br />

xii. Part L : Financial Particulars of Individual<br />

xiii.<br />

Declaration<br />

If the return form is not affirmed and duly signed, it shall be deemed incomplete and returned to you. Penalty<br />

will be imposed in case of late resubmission of the return form to <strong>LHDN</strong>M.<br />

xiv.<br />

Particulars of Tax Agent who completes this Return <strong>Form</strong><br />

This section has to be filled in, affirmed and duly signed by the tax agent who completes the return form.<br />

6

<strong>Form</strong> M <strong>Guidebook</strong> Self Assessment System<br />

Part I - <strong>Form</strong> M<br />

BASIC INFORMATION<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

1 Name Name as per identity card/passport. - -<br />

2 Tax Reference Income tax reference number. - -<br />

No.<br />

Enter SG or OG followed by the reference no. in the boxes<br />

provided.<br />

Example I:<br />

SG / OG S G 1 0 2 3 4 5 6 7 0 8 0<br />

For reference no. SG 10234567080<br />

Example II:<br />

SG / OG S G 1 0 2 3 4 5 6 7 0 8 1<br />

For reference no. SG 10234567081<br />

Example III:<br />

SG / OG O G 0 1 2 3 4 5 6 7 0 9 0<br />

For reference no. OG 01234567090<br />

3 New Identity Card New identity card number. - -<br />

No.<br />

4 Old Identity Card Old identity card number. - -<br />

No.<br />

5 Police No. Police number (if any). - -<br />

6 Army No. Army number (if any). - -<br />

7 Current Number of passport currently in use. - -<br />

Passport No.<br />

7a Last Passport This refers to the last passport number filed with <strong>LHDN</strong>M prior<br />

No. Registered to the current passport.<br />

with <strong>LHDN</strong>M<br />

8 Expiry Date of Expiry date of passport currently in use. -<br />

- Current Passport<br />

9 Date of Birth Date of birth as per birth certificate/identity card/passport. - -<br />

PART A :<br />

PARTICULARS OF INDIVIDUAL<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

A1 Malaysian Citizen Enter ‘1’ if you are a Malaysian citizen or ‘2’ if not. - -<br />

A2 Country of Refer to the <strong>Form</strong> M Explanatory Notes or the full list in - E<br />

Residence/ Appendix E (<strong>Guidebook</strong>) for the code of the country where<br />

Domicile<br />

you are a resident/domicile.<br />

A3 Sex Enter ‘1’ if male or ‘2’ if female. - -<br />

A4 Status as at Enter ‘1’ if unmarried, ‘2’ if married, ‘3’ if a divorcee/ - -<br />

31-12-2007 widow/widower or ‘4’ if deceased.<br />

7

<strong>Form</strong> M <strong>Guidebook</strong><br />

Self Assessment System<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

A5 Date of Marriage / If the marriage, divorce/separation (according to any law) or - -<br />

Divorce / Demise demise occurred in the current year, enter the date according<br />

to the sequence: day, month and year.<br />

A6 Type of Assessment Enter ‘1’ if the wife elects for joint assessment to be raised - -<br />

in the name of her husband<br />

Or<br />

‘2’ if the husband elects for joint assessment to be raised in<br />

the name of his wife.<br />

Or<br />

‘3’ if the individual and spouse elect for separate assessment<br />

to be raised in their respective name.<br />

Or<br />

‘4’ if the individual is single/adivorcee/widow/widower/<br />

deceased person; or married with a spouse who has income<br />

which is tax exempt/no source of income.<br />

A7 Compliance with Public Ruling is a guide for the public which sets out the - -<br />

Public Rulings interpretation of the Director General of Inland Revenue in<br />

respect of a particular tax law, policy and procedure that are<br />

to be applied.<br />

Refer to:-<br />

Appendix H in this <strong>Guidebook</strong> for the list of Director<br />

General’s Public Rulings; and<br />

<strong>LHDN</strong>M website: http://www.hasil.org.my for details of each<br />

Public Ruling.<br />

Enter ‘1’ for full compliance with Public Rulings or ‘2’ if there<br />

is non-compliance with any Public Ruling.<br />

A8 Record-keeping This refers to the keeping of sufficient records as required - -<br />

under the provision of ITA 1967. Enter ‘1’ for compliance or<br />

‘2’ for non-compliance.<br />

A9 Correspondence Address to be used for any correspondence with <strong>LHDN</strong>M. - -<br />

Address<br />

A10 Permanent Address Address in country of origin where the individual/executor of - -<br />

in Country of Origin the deceased person’s estate resides.<br />

of Individual /<br />

Executor of the<br />

Deceased Person’s<br />

Estate<br />

A11 Address of Address where the main business is carried on. - -<br />

Business Premise<br />

A12 Telephone No. Telephone number of individual’s office/residence/handphone. - -<br />

A13 e-mail e-mail address (if any). - -<br />

A14 Name of Bank For the purpose of tax refund (if any) by <strong>LHDN</strong>M, state the - -<br />

name of the bank through which the payment is to be made.<br />

A15 Bank Account No. Your account number at the bank in relation to item A14. - -<br />

A16 Employer’s Name Name of employer. - -<br />

A17 Employer’s No. Enter the employer’s E file reference number. - -<br />

Example: E 1023456708<br />

8

<strong>Form</strong> M <strong>Guidebook</strong> Self Assessment System<br />

P ART B :<br />

PARTICULARS OF HUSBAND / WIFE<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

B1 Name of Husband / Name of the husband/wife as per identity card. - -<br />

Wife<br />

B2 Tax Reference No. Fill in the income tax reference number of your husband/wife - -<br />

by entering SG or OG followed by the reference no. in the<br />

boxes provided.<br />

B3 New Identity Card No. New identity card number of the husband/wife. - -<br />

B4 Old Identity Card No. Old identity card number of the husband/wife. - -<br />

B5 Police No. Police number of the husband/wife (if any). - -<br />

B6 Army No. Army number of the husband/wife (if any). - -<br />

B7 Current Current passport number of the husband/wife. - -<br />

Passport No.<br />

B7a Last Passport No. This refers to the husband/wife’s passport number last filed - -<br />

Registered with with <strong>LHDN</strong>M prior to the current passport.<br />

<strong>LHDN</strong>M<br />

B8 Expiry Date of Expiry date of the husband’s/wife’s current passport. - -<br />

Current Passport<br />

B9 Date of Birth Date of birth as per birth certificate/identity card/passport. - -<br />

Note:<br />

Where there is more than one (1) wife, prepare the required information according to format<br />

B1 to B9 by using attachment(s) and furnish together with the <strong>Form</strong> M.<br />

PART C :<br />

STATUTORY INCOME AND TOTAL INCOME<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

C1 Statutory Business If there is only one business, use the boxes provided for<br />

Income Business 1. - -<br />

Business 1<br />

With effect from the year 2004, this business shall be known<br />

as ‘Business 1’until the business is wound up. Other<br />

businesses shall be known as ‘Business 2’ and so forth.<br />

Business Code Business code is available in Appendix G (<strong>Guidebook</strong>). - G<br />

Amount Use separate working sheet for each business. HK-1 and A1<br />

Transfer the amount from item J5 Working Sheet HK-1 to HK-1.1 to<br />

this item.<br />

HK-1.2A<br />

C2 Business 2 Refer to the explanation for item C1. Refer to Refer to<br />

item C1 item C1<br />

C3 Business 3 + 4 Refer to the explanation for item C1. Refer to Refer to<br />

and so forth (if any) If there are more than three (3) businesses, enter the sum of item C1 item C1<br />

statutory income from Business 3 and so forth in this item.<br />

List out Business 3 and so forth as per format C1 and C2 for<br />

each business by using attachment(s) and furnish together<br />

with the <strong>Form</strong> M.<br />

C4 Statutory Partnership If there is only one partnership business, use the boxes - -<br />

Income provided for Partnership 1.<br />

Partnership 1<br />

With effect from the year 2004, this partnership shall be known<br />

as ‘Partnership 1’until the partnership business is wound up.<br />

Other partnership businesses shall be known as ‘Partnership 2’<br />

and so forth.<br />

9

<strong>Form</strong> M <strong>Guidebook</strong><br />

Self Assessment System<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

Tax Reference No. State the income tax reference number of the partnership - -<br />

business concerned.<br />

Example: D 01234567-09<br />

Amount Use separate working sheet for each partnership business. HK-1B1 -<br />

Transfer the amount from item E Working Sheet HK-1B1 to<br />

this item.<br />

C5 Partnership 2 Refer to the explanation for item C4. HK-1B1 -<br />

C6 Partnership 3 + 4 Refer to the explanation for item C4. HK-1B1 -<br />

and so forth (if any) If there are more than three (3) partnership businesses, enter<br />

the sum of statutory business income from Partnership 3 and<br />

so forth in this item. List out Partnership 3 and so forth as per<br />

format C4 and C5 for each partnership business by using<br />

attachment(s) and furnish together with the <strong>Form</strong> M.<br />

C7 Aggregate statutory Sum of amounts from items C1 to C6. - -<br />

income from<br />

businesses<br />

C8 Business losses Business losses not absorbed due to insufficiency of the HK-1.3 -<br />

brought forward previous year’s income and therefore brought forward for<br />

deduction against the current year’s aggregate statutory<br />

income from businesses and partnerships.<br />

Amount from item B Working Sheet HK-1.3.<br />

If the amount in item C8 exceeds the amount in item C7,<br />

enter the amount as per item C7 in this box. Enter ‘0’ in this<br />

box if there is no business loss brought forward.<br />

C9 TOTAL C7 minus C8 - -<br />

C10 Employment * / Amount from item N4 Working Sheet HK-2. HK-2 B1-B5<br />

Director’s Fees<br />

* Claim for exemption under paragraph 21 Schedule 6 ACP 1967:<br />

Income of a non-resident individual is tax exempt if derived from<br />

an employment exercised by him in Malaysia for:-<br />

(a) a period or periods which together do not exceed 60 days in<br />

the basis year for a year of assessment; or<br />

(b) a continuous period (not exceeding 60 days) which overlaps<br />

the basis years for 2 successive years of assessment; or<br />

(c) a continuous period (not exceeding 60 days) which overlaps<br />

the basis years for 2 successive years of assessment and for<br />

a period or periods which together with that continuous period<br />

do not exceed 60 days.<br />

Enter ‘1’ in the box provided if there’s a claim for exemption under<br />

paragraph 21 Schedule 6.<br />

Contoh 1:<br />

Mr. Johnson was in Malaysia for the following periods:-<br />

01.06.2007 to 10.07.2007 40 days (employment)<br />

16.09.2007 to 03.10.2007 18 days (employment)<br />

Total: 58 days<br />

His employment income is tax exempt for the year of assessment<br />

2007 as he is not resident (not physically present in Malaysia for<br />

at least 182 days in the basis year) and has exercised his<br />

employment for less than 60 days.<br />

10

<strong>Form</strong> M <strong>Guidebook</strong> Self Assessment System<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

Contoh 2:<br />

Mr. Tanaka was employed in Malaysia for the following periods:-<br />

01.10.2007 to 20.10.2007 20 days<br />

21.11.2007 to 31.12.2007 41 days<br />

Total: 61 days<br />

He left Malaysia on 29th December 2007. 30th December 2007<br />

is a non-working day and he was on vacation leave on 31st<br />

December 2007. As such, he was physically present in Malaysia<br />

for 59 days only.<br />

His income for the period of employment (61 days) will be<br />

subjected to tax at the non-resident tax rate of 28% (paragraph<br />

22 Schedule 6).<br />

Contoh 3:<br />

Mr. Mathew exercised his employment in Malaysia for the<br />

following periods:-<br />

18.11.2007 to 31.12.2007 44 days<br />

01.01.2008 to 20.01.2007 20 days<br />

Total: 64 days<br />

His employment income for the continuous period (exceeding<br />

60 days) which overlaps the basis years for 2 successive years<br />

of assessment will be subjected to tax at the non-resident rate<br />

of 28% for the years of assessment 2007 and 2008.<br />

Contoh 4:<br />

Mr. Peter exercised his employment in Malaysia for the<br />

following periods:-<br />

16.12.2007 to 31.12.2007 16 days<br />

01.01.2008 to 15.01.2008 15 days<br />

01.03.2008 to 15.04.2008 46 days<br />

Total: 77 days<br />

His employment income for the continuous period which<br />

overlaps the basis years for 2 successive years of assessment<br />

and another period which in total exceeds 60 days, will be<br />

subjected to tax at the non-resident rate of 28% for the years of<br />

assessment 2007 and 2008.<br />

The 60-day exemption rule does not apply to:-<br />

(a) non-resident directors of Malaysian companies<br />

(b) public entertainers<br />

Example:<br />

Professional entertainers, artistes, sportpersons or other<br />

individual who entertain publicly or privately on stage, radio,<br />

television, at a stadium or sports ground for profit or otherwise<br />

unless their visit is supported by public funds of a government<br />

of another country.<br />

This 60-day exemption rule does not apply to film stars coming to<br />

Malaysia in connection with the shooting of scenes although they<br />

are not considered as public entertainers.<br />

* Claim for exemption under an Avoidance of Double Taxation<br />

Agreement<br />

Where there is a claim for exemption under an Avoidance of<br />

Double Taxation Agreement, enter ‘2’ and the appropriate country<br />

code in the boxes provided.<br />

11

<strong>Form</strong> M <strong>Guidebook</strong><br />

Self Assessment System<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

Country code - Refer to page 18 of the <strong>Form</strong> M Explanatory<br />

Notes or the full list in Appendix E of this<br />

<strong>Guidebook</strong>.<br />

Countries having Avoidance of Double Taxation Agreements<br />

with Malaysia - Refer to Appendix F of this <strong>Guidebook</strong>.<br />

C11 Dividends Amount from item C(iii) Working Sheet HK-3. HK-3 -<br />

C12 Discounts These relate to earnings from discounting transactions such - -<br />

as dealings in treasury bills, bills of exchange and promissory<br />

notes which are liable to tax.<br />

C13 Rents and Rents – These are income from rental / leasing of immovable HK-4 -<br />

premiums<br />

properties such as landed properties (land, buildings,<br />

etc.) situated in Malaysia and other similar assets.<br />

Allowable expenses are deductible against the gross<br />

rental income from the property (source). Where the<br />

property does not generate any income, such expenses<br />

are disallowed. Rental income from each source is<br />

computed separately. Only the sum of net income from<br />

all rental sources is taken into account in the tax<br />

computation.<br />

Examples of allowable expenditure:<br />

Interest charged on loan taken to acquire the property<br />

(source), quit rent, assessment, fire insurance premium,<br />

renewal of the rental / lease agreement, repairs and<br />

maintenance, management fee, service charges and<br />

sinking fund for the apartment/condominium, rental<br />

collection fee (restricted to 5% of the total gross<br />

rental for the year from that source), estate agent’s<br />

commission for finding tenants to ensure that the<br />

property continues to be let out.<br />

Examples of non-allowable expenditure:<br />

Capital repayment of the loan taken to acquire the<br />

property, renovations and improvements to the<br />

property, estate agent’s commission for finding the<br />

very first tenant/lessee for that property and the cost<br />

of preparation of the rental agreement with that tenant.<br />

Amount from item D Working Sheet HK-4.<br />

Premiums – Amounts received in connection with the granting of - -<br />

a lease on immovable properties such as land and<br />

buildings, are liable to tax.<br />

Enter the sum of rents and premiums (if any) in item C13.<br />

C14 Pensions, annuities Pensions – Pensions derived from Malaysia and paid to a person - -<br />

and other periodical<br />

on reaching the age of 55 years/compulsory age of<br />

payments not falling<br />

retirement or who retires due to ill-health are exempt<br />

under C10 to C13<br />

from tax if paid out from an approved fund, scheme<br />

or society. Where a person is paid more than one<br />

pension, only the higher or highest pension is exempt<br />

from tax. Other pensions not tax exempt have to be<br />

taken into account in the tax computation.<br />

Amount of pension to be taxed is as per the annual<br />

pension statement.<br />

12

<strong>Form</strong> M <strong>Guidebook</strong> Self Assessment System<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

Example:A retiree receives two (2) pensions.<br />

Pension (public service - approved fund)<br />

Political pension<br />

Total:<br />

Amount of taxable pension:<br />

RM35,000<br />

RM55,000<br />

RM90,000<br />

RM35,000<br />

Annuities – These are sums of money received in accordance with - -<br />

a will, settlement, insurance policy, investment of<br />

money or contract entitling the annuitant to a series of<br />

payments, whether or not received regularly or for a<br />

limited period only. Annuities received under annuity<br />

contracts issued by the Malaysian life insurers are tax<br />

exempt (paragraph 36 Schedule 6 ITA 1967). Only<br />

annuities not tax exempt are taken into account in<br />

the tax computation.<br />

Periodical payments – These refer to recurring payments received<br />

not falling under any of the above categories such as - -<br />

alimony and sums payable under a separation order.<br />

The amounts received are taxable.<br />

Enter the sum of taxable pensions, annuities and periodical payments<br />

(if any) in item C14.<br />

C15 Other gains or Other taxable income not falling under any of the above categories HK-6 -<br />

profits not falling includes payments received for part-time/occasional broadcasting,<br />

under C10 to C14 lecturing, writing, etc.<br />

Where Working Sheet HK-6 is used, transfer amount G from the<br />

working sheet to item C15 <strong>Form</strong> M.<br />

Where such income entitles an individual to a tax refund as per<br />

item D11 <strong>Form</strong> M in respect of a claim for section 110 tax deduction<br />

(others), Working Sheet HK-6 and relevant documents must be<br />

furnished with the <strong>Form</strong> M.<br />

C16 Additions These are income subject to tax and shall be included in - -<br />

pursuant to<br />

aggregate income if a claim for deduction of the following<br />

paragraph 43(1)(c) expenditure had previously been made and allowed by <strong>LHDN</strong>M.<br />

These refer to earnings/proceeds received in respect of<br />

qualifying prospecting expenditure under Schedule 4 ITA 1967.<br />

Please refer to paragraph 43(1)(c) and paragraph 16 Schedule 4<br />

ITA 1967 before computing the amount that should be taken into<br />

account as part of the aggregate income.<br />

Enter the amount computed in this item.<br />

C17 Aggregate statutory Sum of amounts from items C10 to C16. - -<br />

income from other<br />

sources<br />

C18 AGGREGATE Sum of amounts from items C9 and C17. - -<br />

INCOME<br />

C19 Current year Adjusted business loss is computed separately for each HK-1 and -<br />

business losses business according to the format as per Working Sheet HK-1. HK-1.3<br />

Current year losses from business and partnership can be<br />

deducted from the same year’s aggregate income.<br />

Example: Business and partnership losses of the year 2007<br />

can be deducted from the aggregate income of the<br />

same year.<br />

13

<strong>Form</strong> M <strong>Guidebook</strong><br />

Self Assessment System<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

Where the losses cannot be fully absorbed due to insufficiency<br />

of the aggregate income, the excess can be carried forward<br />

to be set off against the following year’s aggregate statutory<br />

income from businesses and partnerships.<br />

Adjustment of losses for business and partnership (if any)<br />

should be done on Working Sheet HK-1.3.<br />

Total up all the adjusted losses if there are losses from more<br />

than one (1) business and enter the amount in item D1<br />

Working Sheet HK-1.3.<br />

Current year partnership losses (amount from items A13 and<br />

A19 in the CP30) are to be entered in item D2 Working Sheet<br />

HK-1.3.<br />

Enter the amount from item E Working Sheet HK-1.3 in this<br />

box. The amount in item C19 is restricted to the amount in<br />

item C18. If the amount in item C19 exceeds the amount in<br />

item C18, enter the amount as per item C18 in this box.<br />

C20 TOTAL C18 minus C19 - -<br />

C21 Qualifying The amount of expenditure on prospecting operations wholly - -<br />

prospecting<br />

and exclusively incurred in searching for, discovering or<br />

expenditure - winning access to mineral deposits in an eligible area or in<br />

Schedule 4 and testing such deposits, qualifies for deduction.<br />

paragraph 44(1)(b)<br />

Refer to Schedule 4 and paragraph 44(1)(b) ITA 1967 for the<br />

type of expenditure which qualifies; and paragraph 5 Schedule 4<br />

ITA 1967 on the method of computation. Computations are to be<br />

kept for examination by <strong>LHDN</strong>M.<br />

Enter the amount of claim (unclaimed balance from previous<br />

years and current year claim) in this box.<br />

Enter any balance not absorbed in item K1.<br />

C22 Qualifying farm Refer to the saving and transitional provision for Schedule 4A - -<br />

expenditure - relating to the balance of capital expenditure not fully claimed.<br />

Schedule 4A and<br />

paragraph 44(1)(b) Computations are to be kept for examination by <strong>LHDN</strong>M.<br />

Enter the amount of claim (unclaimed balance from previous<br />

years) in this box.<br />

Enter any balance not absorbed in item K2.<br />

C23 TOTAL C20 minus ( C21 plus C22 ). Enter ‘0’ if value is negative. - -<br />

C24 Gift of money to Gift of money to the Government, State Government, local - -<br />

the Government, authorities or institutions/organisations approved by the<br />

State Government, Director General - Subsection 44(6)<br />

local authorities or<br />

approved institutions<br />

and organisations<br />

C25 Gift of artefacts, An amount equal to the value of the gift as determined by the - -<br />

manuscripts or Department of Museum and Antiquities or the National Archives.<br />

paintings to the<br />

Government / State Subsection 44(6A)<br />

Government<br />

C26 Gift of money for Gift of money in the basis year for the provision of library - -<br />

the provision of facilities accessible to the public and contributions to public<br />

library facilities libraries, libraries of schools and institutions of higher<br />

or to libraries education, not exceeding RM20,000.<br />

Subsection 44(8)<br />

14

<strong>Form</strong> M <strong>Guidebook</strong> Self Assessment System<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

C27 Gift of money or An amount equal to any gift of money or contribution in kind (its - -<br />

contribution in kind value to be determined by the relevant local authority) in the<br />

for the provision of basis year for the provision of facilities in public places for the<br />

facilities in public benefit of disabled persons.<br />

places for the benefit<br />

of disabled persons Subsection 44(9)<br />

C28 Gift of money or An amount equal to any gift of money or the cost or value (as - -<br />

medical equipment certified by the Ministry of Health) of any gift of medical<br />

to any healthcare equipment in the basis year to any healthcare facility approved<br />

facility approved by by the Ministry, not exceeding RM20,000.<br />

the Ministry of Health Subseksyen 44(10)<br />

C29 Gift of paintings An amount equal to the value of any gift of painting (to be - -<br />

to the National Art determined by the National Art Gallery or any state art gallery) in<br />

Gallery or any the basis year to the National Art Gallery or any state art gallery.<br />

state art gallery Subsection 44(11)<br />

C30 Gift of money or Gift of money or contribution in kind for any sports activity - -<br />

contribution in kind approved by the Minister or any sports body approved by the<br />

for any approved Commissioner of Sports appointed under the Sports Development<br />

sports activity Act 1997. Amount to be deducted shall not exceed the difference<br />

between 7% of the aggregate income in C18 and the amount<br />

deducted pursuant to subsection 44(11C) ie. ( C30 + C31 ) is<br />

restricted to 7% of the amount in C18.<br />

Subsection 44(11B)<br />

C31 Gift of money or Gift of money or contribution in kind for anyproject of national - -<br />

contribution in kind interest approved by the Minister. Amount to be deducted shall<br />

for any project of not exceed the difference between 7% of the aggregate income<br />

national interest in C18 and the amount deducted pursuant to subsection 44(11B).<br />

approved by the ie. ( C31 + C30 ) is restricted to 7% of the amount in C18.<br />

Minister of Finance Subsection 44(11C)<br />

C32 TOTAL C23 minus ( C24 to C31 ). Enter ‘0’ if value is negative. - -<br />

C33 TAXABLE Pioneer status is a tax incentive as defined in sections 5 to 25 HK-1E -<br />

PIONEER<br />

of the Promotion of Investments Act (PIA) 1986. When granted<br />

INCOME<br />

to an individual, his business income from participating in a<br />

promoted activity or producing a promoted product in relation<br />

to agriculture (agro-based) shall be fully/partially tax exempt.<br />

Refer to Working Sheet HK-1E for the amount to be entered in<br />

this item.<br />

C34 Gross income This refers to income subject to tax at gross on which rates other - -<br />

subject to tax at than 28% apply eg. interest, royalties, special classes of<br />

other rates<br />

income under section 4A and other relevant income.<br />

C34a Interest including Only interest not tax exempt is taken into account in the tax - -<br />

loan stock interest computation.<br />

However, interest paid or credited by licensed banks/financial<br />

institutions in Malaysia and interest derived from Malaysia<br />

on an approved loan are tax exempt (paragraphs 27 and 33<br />

Schedule 6 ITA 1967) as well as interest specifically exempted<br />

under an Avoidance of Double Taxation Agreement.<br />

C34b Royalties These are sums received in respect of: - -<br />

the use of or the right to use property or rights such as<br />

copyrights, patents, trademarks, films and tapes, know-how<br />

or information concerning technical, industrial, commercial<br />

or scientific knowledge, experience or skill; or<br />

the alienation of any such property, know-how or information<br />

as mentioned above.<br />

15

<strong>Form</strong> M <strong>Guidebook</strong><br />

Self Assessment System<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

C34c Special classes of Income derived from Malaysia by a non-resident person in - -<br />

income under respect of amounts paid in consideration of:<br />

section 4A<br />

services rendered by the person or his employee in<br />

connection with the use of property or rights belonging to,<br />

or the installation or operation of any plant, machinery or<br />

other apparatus purchased from, such person;<br />

technical advice, assistance or services rendered in<br />

connection with the technical management or<br />

administration of any scientific, industrial or commercial<br />

undertaking, venture, project or scheme; or<br />

rent or other payments made under any agreement or<br />

arrangement for the use of any movable property.<br />

C34d Other income Other income (if any) not listed above. - -<br />

C35 TOTAL INCOME Sum of amounts from items C32 to C34d. - -<br />

(SELF)<br />

C36 TOTAL INCOME Joint Assessment - -<br />

TRANSFERRED The individual (in whose name the joint assessment is to be<br />

FROM HUSBAND / raised), must enter the total income of the spouse (who elects<br />

WIFE* FOR JOINT for joint assessment) in this item.<br />

ASSESSMENT<br />

Enter ‘1’in the box provided if the total income of the spouse<br />

includes business income or ‘2’ if not.<br />

C37 AGGREGATE OF Sum of amounts from items C35 and C36. - -<br />

TOTAL INCOME<br />

PART D :<br />

TAX PAYABLE / REPAYABLE<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

D1 CHARGEABLE Amount from item C35 or item C37 whichever applies. - -<br />

INCOME<br />

D2 COMPUTATION OF In general, the chargeable income of a non-resident individual is - -<br />

to TAX CHARGEABLE taxed at the flat rate of 28%.<br />

D2g<br />

Chargeable Income<br />

Rate (%)<br />

Income Tax<br />

D2a<br />

D2f<br />

, 4 8 0 0 0 28 , 13,<br />

4 4 0 0 0<br />

If the chargeable income (amount D1) includes income subject to<br />

tax at gross on which rates other than 28% apply, it has to be<br />

apportioned according to the rate applicable.<br />

Tax rates according to the ITA 1967 (percentage on gross):<br />

Interest - 15%, Royalty - 10%, Section 4A - 10%,<br />

Other income - Refer to ITA 1967<br />

Refer to Appendix F (<strong>Guidebook</strong>) for tax rates according to the<br />

Avoidance of Double Taxation Agreements.<br />

, ,<br />

, .<br />

Gross income subject to tax at other rates<br />

Chargeable Income<br />

Rate (%)<br />

Income Tax<br />

, , 1 2,<br />

0 0 0 15 , , 1 , 8 0 0.<br />

0<br />

0<br />

16

<strong>Form</strong> M <strong>Guidebook</strong> Self Assessment System<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

D3 Total Income Tax Sum of amounts from items D2a to D2g. - -<br />

D4 Fees / Levy paid in A rebate is given in respect of any fee paid to the Malaysian - -<br />

2007 by a holder of Government under the Fees Act 1951 for the issue of an<br />

an Employment Employment Pass, Visit Pass (Temporary Employment) or Work<br />

Pass, Visit Pass Pass, but shall not exceed the amount of income tax charged in<br />

(Temporary item D3 (section 6C ITA 1967).<br />

Employment) or<br />

Work Pass<br />

D5 Total D3 minus D4 - -<br />

D6 Section 110 Computation can be done on Working Sheet HK-3. HK-3 -<br />

tax deduction Enter the amount from item D Working Sheet HK-3 in this item.<br />

(dividends)<br />

If entitled to a tax refund as per item D11, submit original dividend<br />

vouchers and Working Sheet HK-3 with the <strong>Form</strong> M.<br />

D7 Section 110 This refers to a claim for credit (if any) with respect to income HK-6 -<br />

tax deduction (other than dividends) from which tax has withheld/charged and<br />

(others) in<br />

remitted to <strong>LHDN</strong>M in accordance with the provisions of income<br />

respect of<br />

tax.<br />

C15 and / or C34<br />

Use Working Sheet HK-6 to compute.<br />

Enter the amount from item B Working Sheet HK-6 in this box.<br />

D8 Section 130 tax This relief is only available to a Malaysian citizen who is in the HK-7 -<br />

relief for a<br />

employment of a Malaysian public service or statutory body and<br />

non-resident is a non-resident by virtue of that employment.<br />

Malaysian citizen<br />

exercising<br />

Computation should be done on Working Sheet HK-7.<br />

employment outside Enter the amount from item D3 Working Sheet HK-7 in this box.<br />

Malaysia in the public<br />

services or the<br />

service of a statutory<br />

authority of Malaysia<br />

D9 Total deduction Sum of amounts from items D6 to D8. - -<br />

and relief<br />

D10 TAX PAYABLE D5 minus D9 (If the amount in D5 is more than the amount in D9). - -<br />

D11 TAX REPAYABLE D9 minus D5 (If the amount in D9 is more than the amount in D5). HK-3, HK-6 -<br />

If entitled to a tax refund, submit:<br />

(i) Working Sheet HK-3 and original dividend vouchers in<br />

respect of the claim for section 110 tax deduction<br />

(dividends);<br />

(ii)<br />

(iii)<br />

Working Sheet HK-6 and relevant documents pertaining to<br />

the claim for section 110 tax deduction (others)<br />

Working Sheet HK-7 and relevant documents relating to the<br />

the claim for non-resident Malaysian citizen tax relief<br />

(section 130).<br />

17

<strong>Form</strong> M <strong>Guidebook</strong><br />

Self Assessment System<br />

PART E : STATUS OF TAX FOR YEAR OF ASSESSMENT 2007<br />

Payments made through the instalment/Schedular Tax Deduction (STD) scheme are set off against the tax payable in this section.<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

E1 Tax payable Amount from item D10. - -<br />

Enter ‘0’ in this item if you are entitled to a tax refund as per item<br />

D11.<br />

E2 Instalments/ Working Sheet HK-10 can be used to compute the total amount HK-10 -<br />

Schedular Tax of instalments/Schedular Tax Deductions (STD) paid for tax on<br />

Deductions Paid for income of year of assessment 2007. Payments made in respect<br />

2007 Income - SELF of outstanding tax for previous years of assessment must be<br />

and HUSBAND / excluded. Refer to the annual statement of income (<strong>Form</strong> EA / EC)<br />

WIFE if joint for the amount of STD to be entered.<br />

assessment<br />

E3 Balance of tax E1 minus E2 - -<br />

payable<br />

The balance of tax payable must be paid within the stipulated period.<br />

Use the Remittance Slip (CP501) provided together with the return<br />

form. Please take note of the instructions and addresses given on the<br />

reverse side of the enclosed CP501 before making any payment.<br />

Enter ‘0’ if the amount in item E2 exceeds the amount in item E1.<br />

E4 Tax paid in excess E2 minus E1 - -<br />

PART F :<br />

INCOME OF PRECEDING YEARS NOT DECLARED<br />

This refers to income received in respect of any earlier year not previously declared such as payment of salary, bonus, allowance,<br />

commission, dividend in arrears,etc. If the amount received relates to more than one (1) year, enter separately according to the<br />

year for which it is paid. Use attachment(s) in case of insufficient writing space and submit together with the return form.<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

F1 Enter the type of income, the year for which it is paid, the gross - -<br />

to<br />

amount and where relevant, the amount of your contribution as<br />

F3<br />

an employee to an approved provident/pension fund such as the<br />

Employees Provident Fund (EPF).<br />

PART G : PARTICULARS OF EXECUTOR OF THE DECEASED PERSON’S ESTATE<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

G1 Executor’s Name Name of the appointed executor of the deceased person’s estate. - -<br />

G2 New Identity New identity card number of the executor. - -<br />

Card No.<br />

G3 Old Identity Old identity card number of the executor. - -<br />

Card No.<br />

G4 Police No. Police number of the executor (if any). - -<br />

G5 Army No. Army number of the executor (if any). - -<br />

G6 Passport No. Current passport number of the executor (if any). - -<br />

18

<strong>Form</strong> M <strong>Guidebook</strong> Self Assessment System<br />

PART H : PARTICULARS OF LOSSES, CAPITAL ALLOWANCES AND WITHHOLDING TAXES<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

H1a Balance from Balance from current year’s business/partnership losses not HK-1.3 -<br />

current year losses absorbed.<br />

Enter the amount from item F Working Sheet HK-1.3.<br />

H1b Balance from Balance from previous years’ business/partnership losses not HK-1.3 -<br />

previous years’ absorbed.<br />

losses<br />

Enter the amount from item C Working Sheet HK-1.3.<br />

H1c Losses carried Sum of amounts from items H1a and H1b. HK-1.3 -<br />

forward<br />

OR<br />

Amount from item G Working Sheet HK-1.3.<br />

H1d Pioneer loss Pioneer business loss can only be absorbed by income from HK-1.4 -<br />

other pioneer business. Hence, its accounts must be kept<br />

separate from that of non-pioneer business.<br />

Amount absorbed Enter the amount of pioneer loss absorbed in this item. HK-1.4 -<br />

Amount from item D Working Sheet HK-1.4.<br />

Balance carried The balance of pioneer loss not absorbed is to be entered here. HK-1.4 -<br />

forward<br />

Amount from item E Working Sheet HK-1.4.<br />

H2 Capital Claim for capital allowances in the computation of statutory - -<br />

Allowances<br />

income from business and partnership.<br />

H2a Business 1 This refers to Business 1 in item C1. - -<br />

Allowance absorbed Capital allowance absorbed in the current year for Business 1. HK-1 -<br />

Amount from item K5 Working Sheet HK-1.<br />

Balance carried Balance of capital allowance not absorbed in the current year HK-1 -<br />

forward for Business 1.<br />

Amount from item K6 Working Sheet HK-1.<br />

H2b Business 2 This refers to Business 2 in item C2. HK-1 -<br />

Refer to the explanation for item H2a regarding ‘Allowance<br />

absorbed’ and ‘Balance carried forward’.<br />

H2c Business 3 + 4 This refers to Business 3 + 4 and so forth in item C3. HK-1 -<br />

and so forth (if any)<br />

Refer to the explanation for item H2a regarding ‘Allowance<br />

absorbed’ and ‘Balance carried forward’.<br />

H2d Partnership 1 This refers to Partnership 1 in item C4. - -<br />

Allowance absorbed Capital allowance absorbed in the current year for Partnership 1. HK-1B1 -<br />

Amount from item F4 Working Sheet HK-1B1.<br />

Balance carried Balance of capital allowance not absorbed in the current year for HK-1B1 -<br />

forward Partnership 1.<br />

Amount from item F5 Working Sheet HK-1B1.<br />

H2e Partnership 2 This refers to Partnership 2 in item C5. HK-1B1 -<br />

Refer to the explanation for item H2d regarding ‘Allowance<br />

absorbed’ and ‘Balance carried forward’.<br />

19

<strong>Form</strong> M <strong>Guidebook</strong><br />

Self Assessment System<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

H2f Partnership 3 + 4 This refers to Partnership 3 + 4 and so forth in item C6. HK-1B1 -<br />

and so forth (if any)<br />

Refer to the explanation for item H2d regarding ‘Allowance<br />

absorbed’ and ‘Balance carried forward’.<br />

H3 Withholding Taxes These refer to basis year payments to non-resident individuals - -<br />

subject to the withholding tax provision under sections 107A,<br />

109, 109A and 109B. Regulations and procedures regarding its<br />

remittance to <strong>LHDN</strong>M have to be complied. The gross amount<br />

paid to non-residents shall not be allowed as a business<br />

expense if there is non-compliance with the withholding tax<br />

provision.<br />

H3a Section 107A Payments to a non-resident contractor for services under a HK-11 -<br />

contract.<br />

Total Gross<br />

Amount Paid<br />

Enter the total gross amount paid in the box provided.<br />

Total Tax Withheld<br />

and Remitted to<br />

Lembaga Hasil Withholding tax rate according to ITA 1967:<br />

Dalam Negeri<br />

Malaysia<br />

Enter the amount of tax withheld and remitted to <strong>LHDN</strong>M.<br />

10% on the gross amount [paragraph 107A(1)(a)] on account of tax<br />

which is or may be payable by that non-resident contractor<br />

Plus<br />

3% on the gross amount [paragraph 107A(1)(b)] on account of tax<br />

which is or may be payable by the employees of that non-resident<br />

contractor.<br />

H3b Section 109 Payment of interest or royalties to a non-resident person. HK-11 F<br />

Total Gross<br />

Amount Paid<br />

Enter the total gross amount paid in the box provided.<br />

Total Tax Withheld Enter the amount of tax withheld and remitted to <strong>LHDN</strong>M.<br />

and Remitted to Withholding tax rates according to Part II Schedule 1 ITA 1967<br />

Lembaga Hasil (percentage on gross):<br />

Dalam Negeri<br />

Malaysia Interest - 15% Royalty - 10%<br />

Refer to Appendix F in this <strong>Guidebook</strong> on withholding tax rates<br />

according to the Avoidance of Double Taxation Agreements.<br />

H3c Section 109A Payment in respect of services performed/rendered in Malaysia HK-11 -<br />

by a public entertainer.<br />

Total Gross<br />

Amount Paid<br />

Enter the total gross amount paid in the box provided.<br />

Total Tax Withheld Enter the amount of tax withheld and remitted to <strong>LHDN</strong>M.<br />

and Remitted to<br />

Lembaga Hasil Withholding tax rate: 15% of gross (Part II Schedule 1 ITA 1967)<br />

Dalam Negeri<br />

Malaysia<br />

20

<strong>Form</strong> M <strong>Guidebook</strong> Self Assessment System<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

H3d Section 109B Payment of the kind classified under section 4A to a non-resident HK-11 F<br />

person. Refer to Public Ruling 4/2005 on its withholding tax.<br />

Total Gross<br />

Amount Paid<br />

Enter the total gross amount paid in the box provided.<br />

Total Tax Withheld Enter the amount of tax withheld and remitted to <strong>LHDN</strong>M.<br />

and Remitted to<br />

Lembaga Hasil Withholding tax rate: 10% of gross (Part V Schedule 1 ITA 1967)<br />

Dalam Negeri<br />

Malaysia<br />

Refer to Appendix F in this <strong>Guidebook</strong> on withholding tax rates<br />

according to the Avoidance of Double Taxation Agreements.<br />

PART J : SPECIAL DEDUCTION, FURTHER DEDUCTION AND DOUBLE DEDUCTION<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

J1 to Claim Code Refer to the claim codes provided in the <strong>Form</strong> M Explanatory - D<br />

J4<br />

Notes or Appendix D in this <strong>Guidebook</strong>.<br />

Amount<br />

Enter the amount in the box provided.<br />

J5 Total Claimed Sum of amounts from items J1 to J4. - -<br />

PART K : INCENTIVE CLAIM / EXEMPT INCOME<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

K1 Schedule 4 Refer to the explanation for item C21. - -<br />

qualifying<br />

expenditure<br />

Any balance after deducting the amount claimed in item C21<br />

is carried forward by entering the amount in this item.<br />

Enter ‘0’ if there is no balance to be carried forward.<br />

K2 Schedule 4A Refer to the explanation for item C22. - -<br />

qualifying<br />

expenditure<br />

Any balance not absorbed in item C22 is carried forward by<br />

entering the amount in this item.<br />

Enter ‘0’ if there is no balance.<br />

K3 Pioneer income Enter the amount of tax exempt pioneer income i.e. amount HK-1E -<br />

(Amount Exempted) from item M4 Working Sheet HK-1E.<br />

21

<strong>Form</strong> M <strong>Guidebook</strong><br />

Self Assessment System<br />

PART L:<br />

FINANCIAL PARTICULARS OF INDIVIDUAL<br />

Extract relevant particulars from the current year’s Manufacturing Account (if any), Trading, Profit & Loss Account and Balance<br />

Sheet of the main business. Where there is more than one (1) main business, enter the particulars of the business with the<br />

highest turnover.<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

L1 Business code Refer to Appendix G in this <strong>Guidebook</strong> before entering the - G<br />

business code applicable to the type of business carried on.<br />

L2 Sales or Turnover Gross amount including accrued income from sales, fees and - -<br />

other receipts.<br />

L3 Opening stock Opening stock of finished goods as per Trading Account. - -<br />

L4 Purchases and cost Gross amount of purchases minus purchase returns and - -<br />

of production<br />

discounts/rebates received.<br />

Cost of production as per Manufacturing Account.<br />

L5 Closing stock Closing stock of finished goods as per Trading Account. - -<br />

L6 Cost of sales L3 plus L4 minus L5 - -<br />

Enter ‘0’ if none.<br />

L7 GROSS PROFIT / Gross Profit: L2 minus L6 - -<br />

(GROSS LOSS) (if the amount in item L2 is more than the amount in item L6)<br />

OR<br />

Gross Loss: L6 minus L2<br />

(if the amount in item L6 is more than the amount in item L2)<br />

If gross loss, mark ‘X’ in the box provided.<br />

L8 Other business Sum of sales/turnover from businesses other than L1. - -<br />

income<br />

For income from partnership - amount from item A13 of the CP30.<br />

L9 Dividends Amount from item C(i) Working Sheet HK-3. HK-3 -<br />

L10 Interest and Gross amount received/receivable - -<br />

discounts<br />

L11 Rents, royalties Gross amount received/receivable.<br />

and premiums For rents - Amount from item B1 Working Sheet HK-4. HK-4 -<br />

L12 Other income Sum of gross income from non-business sources other than L9 - -<br />

to L11.<br />

L13 TOTAL Sum of amounts from items L8 to L12. - -<br />

L14 Loan interest Total expenditure on interest excluding interest on hire-purchase/ - -<br />

lease.<br />

L15<br />

L16<br />

L17<br />

Salaries and wages<br />

Rental / Lease<br />

Contracts and<br />

subcontracts<br />

Amount as per Profit and Loss Account - -<br />

22

<strong>Form</strong> M <strong>Guidebook</strong> Self Assessment System<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

L18<br />

L19<br />

L20<br />

L21<br />

L22<br />

Commissions<br />

Bad debts<br />

Travelling and<br />

transport<br />

Repairs and<br />

maintenance<br />

Promotion and<br />

advertisement<br />

Amount as per Profit and Loss Account - -<br />

L23 Other expenses Total amount of other expenses in the Profit and Loss Account - -<br />

not listed in items from L14 to L22.<br />

L24<br />

TOTAL<br />

EXPENDITURE Sum of amounts from items L14 to L23. - -<br />

L25 NET PROFIT / Amount as per Profit and Loss Account. - -<br />

(NET LOSS) If net loss, indicate ‘X’ in the box provided.<br />

L26 Non-allowable Amount from item F1 Working Sheet HK-1 / Working Sheet HK-1 or -<br />

expenses HK-1E (whichever applies). HK-1E<br />

L27<br />

L28<br />

L29<br />

L30<br />