I Developments in Washington's Law of Law-Making - Gonzaga ...

I Developments in Washington's Law of Law-Making - Gonzaga ...

I Developments in Washington's Law of Law-Making - Gonzaga ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

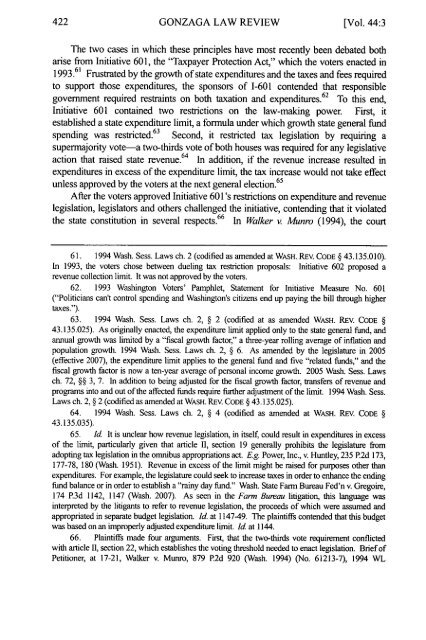

GONZAGA LAW REVIEW<br />

[Vol. 44:3<br />

The two cases <strong>in</strong> which these pr<strong>in</strong>ciples have most recently been debated both<br />

arise from Initiative 601, the "Taxpayer Protection Act," which the voters enacted <strong>in</strong><br />

1993. 61 Frustrated by the growth <strong>of</strong> state expenditures and the taxes and fees required<br />

to support those expenditures, the sponsors <strong>of</strong> 1-601 contended that responsible<br />

government required restra<strong>in</strong>ts on both taxation and expenditures. 62 To this end,<br />

Initiative 601 conta<strong>in</strong>ed two restrictions on the law-mak<strong>in</strong>g power. First, it<br />

established a state expenditure limit, a formula under which growth state general fund<br />

63<br />

spend<strong>in</strong>g was restricted. Second, it restricted tax legislation by requir<strong>in</strong>g a<br />

supermajority vote-a two-thirds vote <strong>of</strong> both houses was required for any legislative<br />

action that raised state revenue. 64 In addition, if the revenue <strong>in</strong>crease resulted <strong>in</strong><br />

expenditures <strong>in</strong> excess <strong>of</strong> the expenditure limit, the tax <strong>in</strong>crease would not take effect<br />

unless approved by the voters at the next general election. 65<br />

After the voters approved Initiative 601 's restrictions on expenditure and revenue<br />

legislation, legislators and others challenged the <strong>in</strong>itiative, contend<strong>in</strong>g that it violated<br />

the state constitution <strong>in</strong> several respects. 66 In Walker v. Munro (1994), the court<br />

61. 1994 Wash. Sess. <strong>Law</strong>s ch. 2 (codified as amended at WASH. REv. CODE § 43.135.010).<br />

In 1993, the voters chose between duel<strong>in</strong>g tax restriction proposals: Initiative 602 proposed a<br />

revenue collection limit. It was not approved by the voters.<br />

62. 1993 Wash<strong>in</strong>gton Voters' Pamphlet, Statement for Initiative Measure No. 601<br />

("Politicians cant control spend<strong>in</strong>g and Wash<strong>in</strong>gton's citizens end up pay<strong>in</strong>g the bill through higher<br />

taxes.").<br />

63. 1994 Wash. Sess. <strong>Law</strong>s ch. 2, § 2 (codified at as amended WASH. REv. CODE §<br />

43.135.025). As orig<strong>in</strong>ally enacted, the expenditure limit applied only to the state general fund, and<br />

annual growth was limited by a "fiscal growth factor," a three-year roll<strong>in</strong>g average <strong>of</strong> <strong>in</strong>flation and<br />

population growth. 1994 Wash. Sess. <strong>Law</strong>s ch. 2, § 6. As amended by the legislature <strong>in</strong> 2005<br />

(effective 2007), the expenditure limit applies to the general fund and five "related funds," and the<br />

fiscal growth factor is now a ten-year average <strong>of</strong> personal <strong>in</strong>come growth. 2005 Wash. Sess. <strong>Law</strong>s<br />

ch. 72, §§ 3, 7. In addition to be<strong>in</strong>g adjusted for the fiscal growth factor, transfers <strong>of</strong> revenue and<br />

programs <strong>in</strong>to and out <strong>of</strong> the affected funds require further adjustment <strong>of</strong> the limit. 1994 Wash. Sess.<br />

<strong>Law</strong>s ch. 2, § 2 (codified as amended at WASH. REv. CODE § 43.135.025).<br />

64. 1994 Wash. Sess. <strong>Law</strong>s ch. 2, § 4 (codified as amended at WASH. REv. CODE §<br />

43.135.035).<br />

65. Id It is unclear how revenue legislation, <strong>in</strong> itself, could result <strong>in</strong> expenditures <strong>in</strong> excess<br />

<strong>of</strong> the limit, particularly given that article II, section 19 generally prohibits the legislature from<br />

adopt<strong>in</strong>g tax legislation <strong>in</strong> the omnibus appropriations act. E.g. Power, Inc., v. Huntley, 235 P.2d 173,<br />

177-78, 180 (Wash. 1951). Revenue <strong>in</strong> excess <strong>of</strong> the limit might be raised for purposes other than<br />

expenditures. For example, the legislature could seek to <strong>in</strong>crease taxes <strong>in</strong> order to enhance the end<strong>in</strong>g<br />

fund balance or <strong>in</strong> order to establish a "ra<strong>in</strong>y day fund." Wash. State Farm Bureau Fed'n v. Gregoire,<br />

174 P.3d 1142, 1147 (Wash. 2007). As seen <strong>in</strong> the Farm Bureau litigation, this language was<br />

<strong>in</strong>terpreted by the litigants to refer to revenue legislation, the proceeds <strong>of</strong> which were assumed and<br />

appropriated <strong>in</strong> separate budget legislation. Id. at 1147-49. The pla<strong>in</strong>tiffs contended that this budget<br />

was based on an improperly adjusted expenditure limit. Id at 1144.<br />

66. Pla<strong>in</strong>tiffs made four arguments. First, that the two-thirds vote requirement conflicted<br />

with article 11, section 22, which establishes the vot<strong>in</strong>g threshold needed to enact legislation. Brief <strong>of</strong><br />

Petitioner, at 17-21, Walker v. Munro, 879 P.2d 920 (Wash. 1994) (No. 61213-7), 1994 WL