Benchmark Study 1

Benchmark Study 1

Benchmark Study 1

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

IPP<br />

BENCHMARK REPORT<br />

1 ST BENCHMARK REPORT<br />

V. 1.0 – Final document<br />

Date: 30.06.2011<br />

Page 1<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

Table of contents<br />

EXECUTIVE SUMMARY......................................................................................................... 6<br />

CHAPTER 1............................................................................................................................ 9<br />

CURRENT SITUATION OF IPP REGIONS........................................................................... 9<br />

CHAPTER 1.1....................................................................................................................... 10<br />

SAXONY-ANHALT CURRENT SITUATION........................................................................ 10<br />

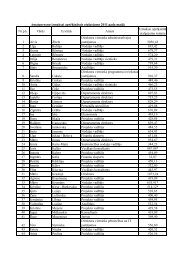

1. Key Regional Data ......................................................................................................... 11<br />

2. Location and Geography ................................................................................................ 11<br />

3. Education and Health System ........................................................................................ 12<br />

Education system .............................................................................................................. 12<br />

Population and health care ................................................................................................ 12<br />

Health Care ....................................................................................................................... 14<br />

Human capital, labour market and employment ................................................................. 14<br />

4. Accessibility and Transport Infrastructure....................................................................... 16<br />

5. Key features of Economy and Industry........................................................................... 17<br />

Tourism ............................................................................................................................. 18<br />

Automotive industry ........................................................................................................... 18<br />

Bio and gene technology ................................................................................................... 19<br />

Chemical industry .............................................................................................................. 19<br />

Service economy ............................................................................................................... 19<br />

Food industry..................................................................................................................... 20<br />

Wood, Paper and Packaging ............................................................................................. 20<br />

Mechanical engineering..................................................................................................... 20<br />

Medical technology............................................................................................................ 21<br />

Logistics ............................................................................................................................ 21<br />

Mining................................................................................................................................ 21<br />

Energy............................................................................................................................... 22<br />

Renewable energy............................................................................................................. 22<br />

Agriculture ......................................................................................................................... 22<br />

Research and Development .............................................................................................. 23<br />

6. Government and territory ............................................................................................... 27<br />

The federal state of Saxony-Anhalt.................................................................................... 27<br />

Territory ............................................................................................................................. 27<br />

Page 2<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

7. Key development challenges for Saxony – Anhalt.......................................................... 28<br />

CHAPTER 1.2....................................................................................................................... 31<br />

ESZAK-ALFÖLD CURRENT SITUATION ............................................................................ 31<br />

1. Key Regional Data (2010): ............................................................................................. 32<br />

2. Location & Geography.................................................................................................... 32<br />

3. Education & Health System (*) ....................................................................................... 32<br />

4. Key features of the Economy Industry (*) ....................................................................... 34<br />

Energy............................................................................................................................... 34<br />

Agriculture ......................................................................................................................... 34<br />

Industry.............................................................................................................................. 35<br />

Services/Tourism & Sport .................................................................................................. 35<br />

R & D and Innovation System............................................................................................ 37<br />

5. Accessibility & Transport Infrastructure (*)...................................................................... 37<br />

6. Level of Territory Governance (*) ................................................................................... 38<br />

7. Territory & Environment (*)............................................................................................. 39<br />

8. Key development challenges for Eszak-Alföld................................................................ 40<br />

CHAPTER 1.3....................................................................................................................... 41<br />

COMUNIDAD VALENCIANA CURRENT SITUATION......................................................... 41<br />

1.-Key Regional Data: ........................................................................................................... 42<br />

2.-Location & Geography....................................................................................................... 42<br />

3.-Education & Health System............................................................................................... 43<br />

Education System.............................................................................................................. 43<br />

Health system.................................................................................................................... 46<br />

4.-Key features of the Economy & Industry ........................................................................... 47<br />

Industry ............................................................................................................................. 48<br />

Energy .............................................................................................................................. 49<br />

Agriculture ......................................................................................................................... 50<br />

Services............................................................................................................................. 50<br />

Construction ...................................................................................................................... 51<br />

Tourism & Sports............................................................................................................... 52<br />

R & D and Innovation System............................................................................................ 53<br />

5.-Accessibility & transport Infrastructure .............................................................................. 53<br />

6.-Level of Territory Governance........................................................................................... 54<br />

7.-Territory & Environment .................................................................................................... 54<br />

8.- Key development challenges for Comunidad Valenciana ................................................. 56<br />

Page 3<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

CHAPTER 1.4....................................................................................................................... 58<br />

LATVIA CURRENT SITUATION.......................................................................................... 58<br />

1. Key Regional Data: ........................................................................................................ 59<br />

2. Location & Geography.................................................................................................... 59<br />

3. Education and Health System ........................................................................................ 59<br />

Education .......................................................................................................................... 59<br />

Health care ........................................................................................................................ 60<br />

4. Key features of the Economy Industry............................................................................ 61<br />

Wood................................................................................................................................. 61<br />

Textile................................................................................................................................ 62<br />

Energy............................................................................................................................... 63<br />

Agriculture ......................................................................................................................... 65<br />

Tourism ............................................................................................................................. 65<br />

R&D and Innovation System.............................................................................................. 67<br />

Innovation governance and policy trends........................................................................... 68<br />

5. Accessibility & transport Infrastructure ........................................................................... 71<br />

6. Level of Territory Governance ........................................................................................ 72<br />

7. Territory & Environment ................................................................................................. 72<br />

Water................................................................................................................................. 73<br />

Land .................................................................................................................................. 73<br />

Waste ................................................................................................................................ 73<br />

8. Key development challenges for Latvia .......................................................................... 74<br />

CHAPTER 2.......................................................................................................................... 80<br />

SUPPORT STRUCTURES FOR INTERNALIZATION......................................................... 80<br />

CHAPTER 2.1....................................................................................................................... 81<br />

SUPPORT STRUCTURES FOR INTERNATIONALIZATION SAXONY ANHALT................ 81<br />

Main tools of support for regional & local organizations......................................................... 82<br />

Enterprise Europe Network office Sachsen-Anhalt (EEN) .................................................. 82<br />

EU Service-Agentur ........................................................................................................... 85<br />

EU-Funding experts of universities .................................................................................... 87<br />

GOEUROPE...................................................................................................................... 88<br />

CHAPTER 2.2....................................................................................................................... 93<br />

SUPPORT STRUCTURES FOR INTERNATIONALIZATION .............................................. 93<br />

ESZAK-ANFÖLD................................................................................................................... 93<br />

Main tools of support for regional & local organizations......................................................... 94<br />

Page 4<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

INNOVA............................................................................................................................. 94<br />

CHAPTER 2.3....................................................................................................................... 97<br />

SUPPORT STRUCTURES FOR INTERNATIONALIZATION COMUNIDAD VALENCIANA 97<br />

Support structure for regional & local organizations............................................................... 98<br />

Fundación Comunidad Valenciana-Región Europea ( FCVRE) ......................................... 98<br />

SEIMED (Servicio Empresa e Innovación en el Mediterráneo Español Enterprise).......... 100<br />

REDIT (Network of Technological Institutes of the Valencian Region) ............................. 103<br />

RUVID (Network of Universities of the Valencian Region for researching and innovation)105<br />

Chamber Of Commerce, Industry And Navigation ........................................................... 107<br />

Chamber Council............................................................................................................. 109<br />

Local Development Agencies........................................................................................... 110<br />

OPIDI (Companies Projects Office R+D+i)....................................................................... 111<br />

CHAPTER 2.4..................................................................................................................... 113<br />

SUPPORT STRUCTURES FOR INTERNATIONALIZATION LATVIA.............................. 113<br />

Main tools of support for regional & local organizations - Latvia .......................................... 114<br />

State Regional Development Agency (SRDA) ................................................................. 114<br />

Investment and Development Agency of Latvia (IDAL) .................................................... 116<br />

State Education Development Agency (SEDA)................................................................ 120<br />

Foundation “Ventspils High Technology Park” (VATP)..................................................... 122<br />

Latvian Association of Local and Regional Governments (LARG).................................... 127<br />

Vidzeme Planning Region (one of the 5 planning regions in Latvia)................................. 130<br />

Vidzeme University of Applied Sciences .......................................................................... 135<br />

CHAPTER 3........................................................................................................................ 138<br />

MAIN OBSTACLES FOR COOPERATION ....................................................................... 138<br />

Main barriers and obstacles to co-operation........................................................................ 139<br />

CHAPTER 4........................................................................................................................ 145<br />

BENCHMARKS FOR THE IPP REGIONS ON INTERNATIONALIZATION ..................... 145<br />

<strong>Benchmark</strong> for the IPP regions............................................................................................ 146<br />

CHAPTER 5........................................................................................................................ 162<br />

AREAS FOR COOPERATION .......................................................................................... 162<br />

Page 5<br />

www.i-p-p.eu

EXECUTIVE SUMMARY<br />

IPP BENCHMARK REPORT<br />

V. 1.0<br />

Public innovation intermediaries (such as business parks, innovation centers and innovation policy<br />

units) play a crucial role in providing innovation support measures, creating partnerships, finding<br />

innovative solutions, and raising the rate of innovation. The lack of external links and the limited cooperation<br />

of innovation intermediaries are important drawback factors to the accomplishement of a<br />

higher rate of innovation and, therefore, to generating growth and employment at regional level. Those<br />

factors are often accompanied by low performance targets set by the funding authorities. The<br />

Interregional Partnership Platform (IPP) is an INTERREG IV C project aiming to improve the capacity of<br />

regions for innovation by increasing the performance of innovation intermediaries at local and regional<br />

levels in the partner regions in European co-operation and EU innovation programmes. During the<br />

project the participating regions will identify and exchange successful access models both to increase<br />

the outward orientation of innovation intermediaries and to develop a long-term framework of<br />

interregional know-how transfer among the local and regional actors. The partners will jointly implement<br />

successful practices in two pilot actions, and will develop a joint benchmark and a monitoring and IT<br />

tool in order to regularly assess the participation rate of organizations. Finally, the results of the cooperation<br />

would be used to give policy recommendations to improve innovation policies and in<br />

particular the structural funds mainstream programmes of the regions.<br />

One of the key elements of the project is the development of an interregional benchmark for<br />

internationalisation. This first <strong>Benchmark</strong> Report for the INTERREG IV C Project “Interregional<br />

Partnership Platform” is meant to:<br />

o<br />

o<br />

o<br />

o<br />

o<br />

Provide an overview of the current situation of the IPP regions, based on information on the IPP<br />

regions and on some of the findings of the 5th Cohesion Report concerning the overall situation and<br />

main challenges (i.e. with regard to the Europe 2020 targets, etc.) – Chapter 1<br />

Identifiy the support structures for internationalizations of the IPP regions, and the key policies and<br />

instruments useful to support institutions in the IPP regions - Chapter 2<br />

Present the main obstacles to co-operation, based on the information about the questionnaires and<br />

other information about the IPP regions –Chapter 3<br />

Develop a set of indicators and benchmarks to give indications to the IPP regions on how to assess<br />

their current position and their current internationalisation policies taking into account the rate of<br />

participation in EU programmes and the co-operation capacity – Chapter 4<br />

Identify future scope for co-operation and make recommendations for best practices which can<br />

serve as the basis for the selection of pilot projects - Chapter 5<br />

First of all, the first <strong>Benchmark</strong> Report records many important features related to the IPP Regions<br />

Page 6<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

general conditions.<br />

With regard to internationalization and innovation, the first <strong>Benchmark</strong> Report has identified a certain<br />

number of challenges that all IPP regions must face. They are:<br />

Similarities:<br />

• A low R&D intensity of local businesses due to their small size whereby it has to be further<br />

investigated whether the generally low level of R&D expenditure in small and medium sized<br />

companies is due to a general lack of innovation activity, or whether this is a consequence of a<br />

small workforce in which there is no clear division of functions between innovation, product<br />

development and production.<br />

• A dominance of public expenditure on innovation and internationalization policy by the IPP regions,<br />

that particularly focuses on the increase of the innovation rate of the business sector of the IPP<br />

regions<br />

• The lack of involvement of the local level in international and European co-operation despite<br />

widespread interest of local and regional actors to change the situation<br />

• The large degree of publicly funded support infrastructures and networks for internationalization in<br />

the IPP regions focusing on specific programmes and target groups<br />

• The absence of high tech products and the relatively short value chains in the regions making them<br />

particularly vulnerable to international competition<br />

Differences:<br />

• The impact of global financial and economic crisis has affected the IPP regions in different ways;<br />

while Latvia and Valencia were particularly hit by the aftermath of the financial and economic crisis,<br />

the impact in Eszak-Alföld, and particularly in Saxony-Anhalt, were much less serious<br />

• The impact of demographic change is also significantly different among some of the IPP regions.<br />

While Ezsak Alföld and Saxony-Anhalt suffer a high degree of outmigration and ageing society,<br />

Valencia, in particular way, is facing a growing population.<br />

Opportunities:<br />

Due to their specific development challenges, there is plenty of scope for extending co-operation,<br />

particularly in the following areas:<br />

• in the field of business to business co-operation, i.e. European Enterprise Network Partners of the<br />

IPP regions including the Chambers of Commerce<br />

• in the field of business and research co-operation, i.e. REDIT – Research Organisation in Valencia -<br />

– INNOVA Agency and the Investment and Development Agency of Latvia, Technological Centre of<br />

Latvia<br />

• in the field of regional/local development, i.e. EU-Service Agency – FCVRE – RDA Eszak Alföld –<br />

SRDA Latvia, Latvian Association of Local and Regional Governments<br />

Page 7<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

<strong>Benchmark</strong>ing:<br />

In order to measure the impact and effectiveness of support policies, it might be useful to arrange a<br />

regular update of the initial data in order to single out a number of key benchmarks of comparison<br />

among IPP regions. These key data should include the following aspects:<br />

• the rate of participation in a selected number of primary EU co-operation programmes<br />

• distance of the IPP regions in meeting the Europe 2020 targets<br />

• key data reflecting on the economic, social and environmental development of the IPP regions.<br />

Outlook for the Future:<br />

Over the life cycle of the IPP project, two addictional benchmark reports are foreseen which allow a<br />

more indepth analysis of key aspects of internationalization. The latter are:<br />

• the input/output ratio in supporting businesses and local authorities on their participation in selected<br />

European co-operation programmes<br />

• the identification of successful strategies aimed to motivate and involve local actors in European cooperation<br />

actions,<br />

• the anaylsis of the overall impact of successful internationalization strategies for regional<br />

development in the IPP regions, and particularly<br />

• the further impact of the exchange of best practices in increasing the rate of internationalization and<br />

participation in EU programmes through the implementation of a number of pilot projects during the<br />

next stages of the IPP project.<br />

The first <strong>Benchmark</strong> Report, therefore, only represents a starting point for further discussion and joint<br />

strategy building.<br />

Page 8<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

CHAPTER 1<br />

CURRENT SITUATION<br />

OF IPP REGIONS<br />

Page 9<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

CHAPTER 1.1<br />

SAXONY-ANHALT<br />

CURRENT SITUATION<br />

Page 10<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

1. Key Regional Data<br />

o Area: 2 044 770 ha = 20.447,7 km²<br />

o Population: 2.356219,00 1<br />

o Population Density: 115 /km²<br />

o GDP : 49.976,00 million €<br />

o GDP / Capita: (21.300,00) € / capita<br />

o Employment Rate: 69,5 %<br />

o Activity Rate: 80,1 %<br />

o Unemployment Rate: 13,7 %<br />

2. Location and Geography<br />

Saxony-Anhalt is one of 16 federal states of the Federal Republic of Germany. It was first established<br />

as one of the new East German federal states in October 1990. In respect of its surface and population,<br />

it is the eighth largest state in Germany, and has the tenth largest population in Germany.<br />

The area of Saxony-Anhalt has a total of 20 445 square kilometres (5.7 percent of the German<br />

territory), where live about 2.52 million inhabitants (3.5 percent of the total German population). While<br />

the northern parts of the state are sparsely populated, the population density in different parts of the<br />

central and southern part of the state is over 150 inhabitants per square kilometre. The national average<br />

is about 123.5 inhabitants per square kilometres. The state capital and seat of government is<br />

Magdeburg.<br />

Magdeburg is the second largest city in the state with a population of 229.725, after Halle/Saale with<br />

about 234.802 inhabitants (as at 30 June 2007).2<br />

1 STALA http://www.stala.sachsen-<br />

anhalt.de/Internet/Home/Daten_und_Fakten/1/12/124/12411/Bevoelkerungsentwicklung_Sachsen-<br />

Anhalts_seit_1966.html<br />

2 http://www.sachsen-anhalt.de/LPSA/index.php?id=6909, downloaded on 10 November<br />

Page 11<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

3. Education and Health System<br />

Education system<br />

There are two universities (the Otto von Guericke University in Magdeburg and the Martin Luther<br />

University in Halle-Wittenberg), one college of art (Burg Giebichenstein Hochschule für Kunst und<br />

Design) and four universities of applied sciences ("Fachhochschule”) (Anhalt University of Applied<br />

Sciences, Harz University of Applied Sciences, Magdeburg-Stendal University of Applied Sciences,<br />

Merseburg University of Applied Sciences) in the region of Saxony-Anhalt. This is a separated, well<br />

developed, efficient system of the state-run higher education. In the future further developments are<br />

planed to be realized in this field. The colleges are the major objects of these developments. 3<br />

The Federal Government, the German states and German science and commerce are keen for their<br />

country to be seen as an excellent choice for those who wish to use education and research to further<br />

their careers. German colleges and universities are enhancing their international credentials with a view<br />

to making the country’s educational institutions more attractive to foreign students and scientists.<br />

Successful attempts have also been made in Saxony-Anhalt to increase the international profile of its<br />

colleges and universities. 4<br />

The number of foreign students was fluctuating between 480 and 570 in the period of 1980-1991, and it<br />

has been increasing constantly since the year of 1991. In 2009 were 4.604 foreign students in the<br />

higher education of Saxony-Anhalt. The number of the German students was fluctuating between<br />

46.800 and 48.300 in the period of 2004-2009. In 2005, 4.483 foreign students were studying in<br />

Saxony-Anhalt, of whom 2,835 attended the two universities, 1.488 the universities of applied<br />

sciences and 150 the colleges of art and theology. Nearly half of them come from China.<br />

Population and health care<br />

In the past 20 years the number of population of Saxony-Anhalt has been declining rapidly. Comparing<br />

the number of the population in 2008 with the data of 1990, it was an 18 % decrease from 1990 to<br />

2008.<br />

At the end of 2008 Saxony-Anhalt had 2.381.872 inhabitants, but in the next year it declined by 30.600.<br />

The reasons of this are migration, which contributes to the total decrease by 40 %, and the decline in<br />

the number of births, which contributes to the total decrease by 60%. However, in 2007 and 2008 the<br />

number of marriages and births increased. The northern part of the region must face a higher loss of<br />

population than the southern part, because of ageing and migration. 5<br />

3 http://www.studienkreis.de/service/schulsysteme/in/sachsen-anhalt.html downloaded on 10 November<br />

4 http://www.sachsen-anhalt.de/LPSA/index.php?id=21809 downloaded on 10 November<br />

5 http://www.stala.sachsen-anhalt.de/Internet/Home/Veroeffentlichungen/Pressemitteilungen/2009/12/155.html<br />

downloaded on 11 November<br />

Page 12<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

The number of population in Saxony-Anhalt from 1995 to 2008<br />

Based on the data of: www.citypopulation.de 6<br />

On the next chart can be seen, that the older age-group make the most of the population, firstly the<br />

persons, who are between 45-65 years old.<br />

Persons<br />

The distribution of the population according to age<br />

in 2008<br />

800000<br />

700000<br />

600000<br />

500000<br />

400000<br />

300000<br />

200000<br />

100000<br />

0<br />

under 6<br />

years<br />

6-15 15-25 25-45 45-65 65-75 above<br />

75<br />

years<br />

Age from... to...<br />

Persons<br />

Based on the data of: http://www.stala.sachsen-anhalt.de 7<br />

According to the data of 2008, 51% of the population were women. More than two thirds of the<br />

population lives in urban districts (Kreisfreie Städte), as Halle or Magdeburg. The number of births was<br />

6 http://www.citypopulation.de/php/diagram.php?pageid=germany-sachsenanhalt&type=ADM1&id=15 downloaded<br />

on 11 November<br />

7 http://www.stala.sachsen-anhalt.de/bevoelkerung/bewegungen/index.html, downloaded on 10 November<br />

Page 13<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

under the national average in 2008, 1000 mothers gave births to 1275 children, while the national<br />

average was 1400 children pro 1000 mothers. The ageing of population is a specific problem in the<br />

state, because of the declining number of births and migration. 8<br />

Health Care<br />

The distribution of doctors in different parts of the state and according to different specialities is very<br />

unequal. In every district is at least one speciality that suffers from shortage of doctors; however other<br />

specialities have surpluses in doctors. Aging of doctors is a specific problem in the state which<br />

responsible for the growing costs of medical care.<br />

Ministry of Health and Social Affairs in cooperation with AOK and Kassenärztlichen Vereinigung<br />

Sachsen-Anhalt” are giving scholarship for medical students, requiring them to settle down in this state.<br />

Ministry of Health and Social Affairs and Ärztekammer Sachsen-Anhalt made an agreement with<br />

Österreichischen Ärztekammer in the autumn of 2008, according to this agreement recruiting of<br />

Austrian doctors is inspired in the state. Between 1991 and 2010 more than 800 Million Euro has been<br />

spent on the development and construction of hospitals. 9<br />

Human capital, labour market and employment<br />

Companies are particularly appreciative of the high levels of qualification and motivation, thoroughness<br />

and punctuality of the workforce in Saxony-Anhalt, and their moderate wage expectations. More than 80<br />

percent of all employees have a vocational educational qualification – one of the highest percentages in<br />

Germany. The close collaboration between business and science ensures that skilled workers gain<br />

qualifications in a practical environment.<br />

Investors also value the region’s flexible working practices:<br />

o 75 % of companies conduct wage negotiations at company level (in-house agreements)<br />

o machine operation times of 24 hours a day, 7 days a week, are the norm under licensing rules<br />

o labour costs are consequently 15 to 40 % below those of western Germany. 10<br />

The difficulties in the labour market’s situation, which was caused by the change of the regime, meant<br />

the biggest problem for Saxony-Anhalt among the federal states.<br />

The Labour Market had gone through a radical alteration. In 1987 the number of the population in the<br />

8 Aktualisierung der sozio-ökonomischen Situation Sachsen-Anhalts, Begleitung und Bewertung der EU-<br />

Strukturfonds des Landes Sachsen-Anhalt 2007-2013<br />

9 http://www.sachsen-anhalt.de/LPSA/fileadmin/Elementbibliothek/Master-<br />

Bibliothek/Soziales/Sozialbericht_2010/Sozialbericht_lese.pdf downloaded on 14 November<br />

10 http://www.sachsen-anhalt.de/LPSA/index.php?id=22671 downloaded on 13 November<br />

Page 14<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

employable age (between the age of 15 and 65) was 2 Million, but this number had sunk to 1.87 Million<br />

by the year of 2000. It was 67.7% of the population in 1987, and 69.6% in 2000. The reason of this<br />

increase is the sinking number of the population under 15 years.<br />

The number of employees was 1.577.400 in 1987, which was 18.4% of the employees of the German<br />

Democratic Republic (DDR). Comparing these figures to the population it turns out, that the<br />

employment rate was 52.1 % in 1987.<br />

The unemployment is a central problem in Sachsen-Anhalt. There are differences between the northern<br />

and southern part of the state and between the eastern and western part of the state, and there is also<br />

a central-peripheral development line. The unemployment rate was the highest in Aschersleben (25,3%)<br />

and in Hettstedt (26,5%) in 2000. In the areas, which are densely populated, the unemployment rate is<br />

lower. The economically active population is migrating to the densely populated areas, so the number of<br />

the employees is increasing there. 11<br />

Number of unemployed between 1991-<br />

2009<br />

25<br />

Number of<br />

unemployed in %<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Reihe1<br />

1990 1995 2000 2005 2010<br />

Years<br />

12<br />

In the last years the unemployment rate has fallen sharply in Saxony-Anhalt. The good cyclical situation<br />

of the economy contributed to this between 2005 and 2008.<br />

In November 2010 the unemployment rate was 10,8 %. 13<br />

11<br />

http://www.leader-saale-unstrut.de/admingate/site/pdf/Progammplan%20Leader+.pdf<br />

12 http://www.statistik.sachsenanhalt.de/Internet/Home/Daten_und_Fakten/1/13/132/13211/Arbeitslosenquoten_nach_Kreisen.html.<br />

http://www.g-i-s-a.de/res.php?id=199, http://www.bpb.de/wissen/MCBEV2<br />

and http://www.arbeitsagentur.de/nn_29210/nn_29402/Dienststellen/RD-SAT/RD-SAT/A01-Allgemein-<br />

Info/Presse/2009/03-amb-08-sa.html<br />

Page 15<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

The most part of the success was made possible by the structural improvement. This was based on the<br />

reform of the labour market at the beginning of the decade, and the wage policy. In the future it is an<br />

important factor in the state’s economy to improve further the unemployment rate. It is necessary to<br />

evolve an adequate wage policy and to create work possibilities, which could be reconciled with the<br />

family.<br />

The problem of unemployment affects Germany as a whole, but has hit the East German states<br />

particularly hard. In Saxony-Anhalt too, the employment situation is fraught; nonetheless, in contrast to<br />

many of the other federal states, it has always been possible in recent years to offer a traineeship to<br />

every young person in the state. 14<br />

4. Accessibility and Transport Infrastructure<br />

In recent years, the infrastructure of Saxony-Anhalt has been considerably strengthened and<br />

improved. Nowadays, Saxony-Anhalt occupies a leading position amongst the East German federal<br />

states in terms of infrastructural provision per head of population. The state’s transport infrastructure is,<br />

of course, heavily influenced by its central location at the heart of Germany and also of Europe. Today,<br />

the region is connected with close transport network to its neighbouring states.<br />

The road and rail networks of Saxony-Anhalt are amongst the densest and most efficient in Germany.<br />

In respect of motorways, four motorways cross the state, which are A2 (Hannover –Magdeburg –<br />

Berlin), A9 (Nürnberg – Halle - Berlin) A14 (Dresden – Magdeburg), and the new A38 (Göttingen-Halle).<br />

The well developed road network provides an excellent connection and links important transport<br />

arteries. 15<br />

Several important railways have crossed the region of Saxony-Anhalt since already the establishment<br />

of the German railway network in the 19th century. The three principal cities in the state, Halle,<br />

Magdeburg and Dessau, lie at the intersections of major German and international rail routes, and have<br />

access to other German and European cities through the intercity network of Deutsche Bahn AG. The<br />

network operated by Deutsche Bahn AG currently extends to 2.093,5 km. The normal - gauge network<br />

of railways not in federal ownership currently covers a distance of 944 km. In Saxony-Anhalt there are<br />

also 115.5 km of narrow-gauge railways in the Harz region, operated by Harzer Schmalspurbahnen<br />

GmbH.<br />

370 railway stations and request stops are served by the railways in Saxony-Anhalt. As far as rail<br />

freight is concerned, there is a network of 5 public trimodal interfaces, complemented by freight<br />

13 http://www.pub.arbeitsagentur.de/hst/services/statistik/000000/html/start/karten/aloq_kreis.html<br />

14 http://www.sachsen-anhalt.de/LPSA/index.php?id=22675 downloaded on 13 November<br />

15 http://www.sachsen-anhalt.de/LPSA/index.php?id=6909 downloaded on 10 November<br />

Page 16<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

transport centres and facilities for combined freight transport. 16<br />

The most important international airports are the airports of Leipzig – Halle, Berlin and Hannover,<br />

which are particularly important for their scheduled and charter flights. Saxony-Anhalt also has a<br />

business airport and five satellite airports for regional and business flights.<br />

Saxony-Anhalt is integrated into the European waterway network by means of the Rivers Elbe, Saale<br />

and Havel, the Elbe-Havel Canal and the Mittelland Canal. Since 2003, uninterrupted waterway access<br />

to Berlin has been possible, irrespective of fluctuating water-levels in the Elbe. There are 17 operating<br />

ports and transhipment points, as well as additional company-owned ports. 17<br />

5. Key features of Economy and Industry<br />

The main features of the economic structure<br />

In comparison with the other German states, Saxony-Anhalt ranks in the bottom quarter of the states in<br />

the field of innovation, despite of the high expenditures on financial subsidies. The reasons of this are<br />

the following:<br />

o Most of the companies in Saxony-Anhalt the are Small- and Medium Size Enterprises. More than<br />

95% of the companies are employing less than 50 persons.<br />

o There is a shortage of the large enterprises. Nationwide more than 80% of the Research and<br />

Development personnel are working at large enterprises. It is typical for the state, that most<br />

branches of such companies specialise in production and manufacturing, but either don’t engage in<br />

Research and Development at all, or are spending just very little on it.<br />

o Due to the small number and lack of size of companies engaging in R&D expenditures in this field<br />

are low, which also limits the intensity of cooperation between economy and sciences.<br />

o The limited number of companies doing research also has a negative effect on the number of employees<br />

specialied in R&D within the economic sector. Furthermore a substantial share of R&D in<br />

the business sector is carried out by public utility research institutes..<br />

o Before the reunification entrepreneurship was not widely spread in Saxony-Anhalt. As a result the<br />

region experiences a deficit in the establishment of knowledge based and technology oriented enterprises<br />

16 http://www.sachsen-anhalt.de/LPSA/index.php?id=6909 and http://www.sachsenanhalt.de/LPSA/index.php?id=22686<br />

downloaded on 10 November<br />

17 http://www.sachsen-anhalt.de/LPSA/index.php?id=6909 downloaded on 10 November<br />

Page 17<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

Tourism<br />

In the last four years Saxony-Anhalt was able to constantly increase the number of Tourists and guestnights.<br />

2009 the region had 2,68 Million Tourists and 6,74 Million guest-nights. The average duration of<br />

stay was 2,5 days.<br />

Saxony – Anhalt has well developed walking paths, bicycle roads, and the tourists also have a<br />

possibility to boat, to paddle a canoe or to sail on the channels, such as on the Elbe- Saale, on the<br />

Mittelland Canal, and on the Elbe-Havel Canal. The region is famous for its precious wine-growing<br />

culture. 18<br />

In Saxony-Anhalt more then 80.000 ancient monuments can be found, and 100.000 archaeology<br />

cultural memorials. The Garden Kingdom of Dessau-Wörlitz is a UNESCO World Heritage Site since<br />

November 2000 and reflects the englightened mindset of the Dessau court with its unique concentration<br />

of historic monuments. The landscape became a world view of its time. The Mansion Garden of<br />

Ballenstedt, the cloister parks in Drübeck, in Gardelegen, or in Wallanlagen are waiting for the<br />

passionate of the garden art. 19<br />

The Bauhaus which was founded in Weimar 1919 before continuing in Dessau between 1926 and<br />

1932, occupies a special role in the history of culture, architecture, design, art and the new media of the<br />

20th century. In 1996, both locations were included in the list of World Heritage Sites of UNESCO. 20<br />

Automotive industry<br />

Saxony-Anhalt has a strong tradition in the automotive supply industry. Magdeburg has long been a<br />

centre of German plant and machine construction, foundry technology has important historical links with<br />

the Harz region, and Dessau enjoys a reputation for high standards in the field of automotive<br />

engineering. Today the automotive supply industry is a key growth area. Some 240 companies<br />

employing a workforce in the region of 16,500 manufacture car parts or systems or provide engineering<br />

services as the valued partners of such distinguished manufacturers as DaimlerChrysler, VW, BMV and<br />

Porsche.<br />

Companies collaborate with the universities in Magdeburg and Halle with universities of applied<br />

sciences and eminent scientific societies and in the MAHREG-Automotive skills network in their pursuit<br />

of gaining a competitive edge through innovative materials and processes. 21<br />

18 http://www.sachsen-anhalt.de/LPSA/index.php?id=467 downloaded on 11 November<br />

19 http://www.sachsen-anhalt.de/LPSA/index.php?id=469 downloaded on 11 November<br />

20 http://www.sachsen-anhalt.de/LPSA/index.php?id=20929 downloaded on 11 November<br />

21 http://www.sachsen-anhalt.de/LPSA/index.php?id=22602 downloaded on 11 November<br />

Page 18<br />

www.i-p-p.eu

Bio and gene technology<br />

IPP BENCHMARK REPORT<br />

V. 1.0<br />

In recent years, bio and gene technology have developed apace in Saxony-Anhalt. The state has<br />

gained recognition throughout the world for its proficiency in the field of plant biotechnology, which has<br />

evolved from its considerable expertise in the chemical and agricultural sectors.<br />

The industry has been further bolstered since 2003 by the joint endeavors of business and the State<br />

Government in the BioMitteldeutschland initiative. The InnoPlanta network shows the way forward for<br />

innovative plant biotechnology. 22<br />

Chemical industry<br />

The chemical industry is of considerable structural importance for the economy of Saxony-Anhalt. In<br />

terms of aggregate sales volume, it is the second-largest industry in the manufacturing sector. A<br />

significant amount has so far been invested in approximately 350 projects in the ‘chemical triangle’. The<br />

State Government has backed the privatisation and restructuring processes of recent years with<br />

considerable funds of its own, as well as with Federation and EU grants.<br />

o<br />

o<br />

o<br />

European Chemical Regions Network (ECRN):<br />

The ECRN has direct partners in twenty-two chemical regions of Germany, Italy, Spain, Poland,<br />

Estonia, Great Britain, the Netherlands, France and the Czech Republic. Its aim is to highlight<br />

regional factors when developing framework requirements for the European chemical industry. 23<br />

Central European Chemical Network:<br />

A chemical industry and plastics processing network for the central German chemical triangle,<br />

whose aim is to create synergy effects for the sustainable development of central German chemical<br />

facilities.<br />

Association for the promotion of Polymer Development and Plastics Technology in Central<br />

Germany:<br />

It is a central German network, whose objective is to improve cooperation between science and<br />

industry and between individual companies along the value chain of polymer development and<br />

plastics technology. 24<br />

Service economy<br />

Accounting as it does for around 70 percent of the state’s gross domestic product as well as of its jobs<br />

market, the service sector is widely regarded today as a crucial generator of growth and employment.<br />

The company and personal service sectors are experiencing a particularly buoyant period of expansion.<br />

Saxony-Anhalt is a highly prized location for call centers. The media industry is also in the ascendancy.<br />

The Central German Multimedia Centre (MMZ) deserves particular recognition as part of this positive<br />

22 http://www.sachsen-anhalt.de/LPSA/index.php?id=22603 downloaded on 11 November<br />

23 http://www.ecrn.net/abouttheecrn/welcomeandoverview.php downloaded on 29. December<br />

24 http://www.sachsen-anhalt.de/LPSA/index.php?id=22604 downloaded on 11 November<br />

Page 19<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

trend. The state provides the industry with practical support through the Central German Media Fund<br />

(MDM). 25<br />

Food industry<br />

The food industry in Saxony-Anhalt is its most important business sector in terms of turnover and<br />

employment, and consequently plays a pivotal role in the state’s industrial structure. It owes this<br />

success to the state’s highly-productive agricultural industry and to the premium-quality primary<br />

products on its doorstep. Traditional brands are manufactured by the following companies, amongst<br />

others: Burger Knäcke AG Burg, Halloren Schokoladenfabrik Gmbh Halle, Hasseröder Braurei GmbH<br />

Wernigerode, Röstfein Kaffee GmbH Magdeburg, Salzwedeler Baumkuchen.<br />

Wood, Paper and Packaging<br />

Saxony-Anhalt is gaining increasing recognition in the European wood-processing industry. National<br />

and international markets are now being supplied with high-quality and environmentally-friendly<br />

products from Saxony-Anhalt.<br />

As a result, the wood and paper industry is experiencing an enormous growth in turnover in Saxony-<br />

Anhalt. The Altmark (Arneburg and Nettgau) and Magdeburg have emerged as leading players in the<br />

state’s wood and paper industry.<br />

The state’s well-developed infrastructure has also contributed to the enormous growth of this industry. 26<br />

Mechanical engineering<br />

Saxony-Anhalt has been the source of much innovation during the course of a long tradition of<br />

mechanical engineering, which dates back to the early days of industrialisation. Following a difficult<br />

period of restructuring in the early 1990s, mechanical engineering is once again a growth industry in the<br />

state, thanks to wide-ranging investment, and the development of new products and new markets.<br />

In Saxony-Anhalt, the industry typically comprises medium-sized enterprises specializing in meeting the<br />

particular needs of the customer, with the emphasis on low-volume production, an extensive range of<br />

product-related services and high quality assurance standards.<br />

A broad range of innovative products is available, from agricultural machinery to specialized equipment<br />

for high-precision production processes in the aerospace industry. Key specializations include hoists<br />

and conveyors, the manufacture of pumps and compressors, the machine tool industry and the<br />

construction of wind power plants. 27<br />

25 http://www.sachsen-anhalt.de/LPSA/index.php?id=22611 downloaded on 11November<br />

26 http://www.sachsen-anhalt.de/LPSA/index.php?id=22613 downloaded on 11 November<br />

27 http://www.sachsen-anhalt.de/LPSA/index.php?id=22620 downloaded on 11 November<br />

Page 20<br />

www.i-p-p.eu

Medical technology<br />

IPP BENCHMARK REPORT<br />

V. 1.0<br />

Medical technology is another growth industry which will figure large in Saxony-Anhalt’s future. The<br />

regional network for neuromedical technology of the Magdeburg region, known as InnoMed (German<br />

Website), has evolved in association with Otto von Guericke University Magdeburg, the Leibniz Institute<br />

for Neurobiology and the ZENIT Centre for Neuroscientific Innovation.<br />

The network marries a high level of expertise in the neurosciences with the latest developments in<br />

medical technology. The research institutions collaborate closely within the association with businesses<br />

from in and around Magdeburg.<br />

The InnoLife medical engineering and technology centre in Schönebeck-Bad Salzelmen is equipped<br />

with an excellent infrastructure and the latest in communication technology. 28<br />

Logistics<br />

The areas around Magdeburg, Halle and Dessau are important logistics centers which have attracted<br />

major enterprises of the calibre of the Otto group, the Rossmann chain of chemists and Edeka The<br />

Swiss mail-order pharmacy Zur Rose operates a modern customer service centre in Halle. The<br />

American computer giant Dell opened a sales and customer service centre in Halle in 2006.<br />

Its central location in the European market area, its proximity to eastern European markets and the high<br />

standard of its transport routes, in particular of its high-capacity roads, railways and waterways, and not<br />

least its accessibility by air, have created favourable infrastructural conditions and made Saxony-Anhalt<br />

a prime business location.<br />

Leipzig/Halle intercontinental airport plays its own important role in this. Unrestricted 24-hour operation,<br />

take-off and landing without payload restrictions and the construction of a second take-off and landing<br />

runway are persuasive arguments in favour of air-based logistics. 29<br />

Mining<br />

Mining and closely related industries have remained an essential feature of Saxony-Anhalt, whose<br />

natural reserves of raw materials offer the state an important advantage as an industrial centre.<br />

In the field of brown coal mining the MIBRAG mbH - Profen open-cast mine and ROMONTA GmbH -<br />

Amsdorf open-cast mine are the main companies. With regard to potash and rock salt extraction there<br />

are sites in Zielitz and Bernburg.<br />

28 http://www.sachsen-anhalt.de/LPSA/index.php?id=22622 downloaded on 11 November<br />

29 http://www.sachsen-anhalt.de/LPSA/index.php?id=22623 downloaded on 11 November<br />

Page 21<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

With regard to Non-metallic minerals the economic restructuring process went hand in hand with mine<br />

redevelopment, especially in the case of brown coal. Former open-cast mines and brown field sites<br />

have become attractive targets for investment, in part for recreational, leisure and tourist projects. 30<br />

Energy<br />

Saxony-Anhalt is one of Germany’s principal energy providers. Despite the extensive adjustment<br />

process of the last decade, brown coal remains the most important source of energy extracted there,<br />

followed by natural gas. Renewable energy has also gained a foothold, and promises considerable<br />

development potential.<br />

Renewable energy<br />

Saxony-Anhalt is a great proponent of renewable energy, which accounts for 17.6 % of all the energy<br />

used in the state. Most of this renewable energy, indeed about 85.4 %, comes from wind power.<br />

Another 8.5 % is produced from biomass, 2 % from biogas, 2.4 % from hydroelectric power plants and<br />

0.2 % from photovoltaic plants. Landfill gas and sewage gas supply 1.3 % of its needs.<br />

Saxony-Anhalt is a national leader when it comes to the production of biogenous fuels: it is responsible<br />

for 70 % of biomethanol production capacity and 50 % of biodiesel production capacity in Germany.<br />

Magdeburg is home to one of the centres of wind energy plant production, namely ENERCON, the<br />

market leader in Germany. A photovoltaic facility of global importance is currently under construction at<br />

Thalheim near Wolfen. Leading and expanding manufacturers of solar cells have located to ‘Solar<br />

Valley’, including Q-Cells, Europe's largest independent producer, the German-American joint venture<br />

EverQ, and CSG Solar from Australia. 31<br />

Agriculture<br />

About 1,17 Million hectares of Saxony-Anhalt area are used for agricultural purposes, and 4.800<br />

companies are active in the field of agriculture in 2010. The field of Magdeburg is well-known for its<br />

fertile black soil. The centre of the live-stock- farming is Altmark. Grape-growing and wine-growing in<br />

the river valleys of Elbe, Saale and Unstrut date back to 1000 years. According to the data of 2005,<br />

27.738 employees worked at 4887 companies of the state, but the number of employees was only<br />

26.000 in 2007. One agricultural company has on average 240 hectares field. The two-thirds of the<br />

companies are engaged in live-stock-farming, and the other one-third is engaged in cultivation of plants.<br />

In Saxony-Anhalt are produced a high quality animal and vegetable products, which amount exceeds<br />

the national demand. The agriculture reserves and improves national resources with the appropriate<br />

usage of fields, and it provides the development of the regional economic structure.<br />

30 http://www.sachsen-anhalt.de/LPSA/index.php?id=22628 downloaded on 12 November<br />

31 http://www.sachsen-anhalt.de/LPSA/index.php?id=22630, downloaded on 12 November<br />

Page 22<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

The agriculture as an economic branch plays a very important role in the state, and it belongs to the<br />

most successful fields. In the past 15 years the state has been developed mainly by agriculture. The<br />

main reasons of this are advantageous premises and structurally good built companies. Prices of the<br />

agricultural products were fluctuating in 2010, however companies reached good achievements. The<br />

field used for vegetable growing has been increasing since 1991, and today it totals up to 5.744<br />

hectares. Onion (on 1.216 hectares) and asparagus (on 1.168 hectares) have also been growing in the<br />

state since 1995. 32<br />

Research and Development<br />

Research and innovation have a long tradition in Saxony-Anhalt. Otto von Guericke, famous for his<br />

experiments with vacuums and, in particular, for the “Magdeburg hemispheres” experiment which he<br />

presented in 1654, was also for many years the mayor of Magdeburg. Hugo Junkers built the first allmetal<br />

aeroplane at the Junkers works in Dessau, a pioneering innovation which was to spread the fame<br />

of Dessau around the world in the 1920s.<br />

During the same period, the Merseburg - Bitterfeld – Dessau region was evolving into a centre of the<br />

modern chemical industry in Germany. The first synthetic rubber, the first colour film, the first synthetic<br />

fibres and the first hard PVC were all produced here in the 1930s.<br />

This surge came to an abrupt halt with the 2nd World War and the subsequent division of Germany into<br />

East and West. The main reasons for this were the enormous reparations which East Germany had to<br />

pay the Soviet Union, coupled with a massive transfer of technology from East to West Germany, which<br />

was to continue until reunification in 1990.<br />

Today, central Germany is on the way to becoming a modern commercial and research centre.<br />

Saxony-Anhalt’s future lies above all in the pursuit of new technologies and in attracting industries of<br />

the future to locate here, creating jobs in economic sectors other than those which have been typical of<br />

the region in the past.<br />

Universities, college of art and universities of applied sciences<br />

The state’s universities, universities of applied sciences and colleges are the most important centres of<br />

publicly-subsidised research in Saxony-Anhalt. The various priorities set by research, and the<br />

interdisciplinary and inter-institutional cooperation between the experts who conduct it, also help the<br />

universities and colleges to acquire prestige which transcends state boundaries.<br />

32 http://www.sachsen-anhalt.de/LPSA/index.php?id=2107 and http://www.sachsenanhalt.de/LPSA/index.php?id=1808<br />

downloaded on 12 November<br />

Page 23<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

Universities and college of art<br />

Martin Luther University in Halle-Wittenberg conducts research primarily in the fields of biological<br />

sciences, materials sciences, the Enlightenment and pietism, schools, Oriental studies, ethnology,<br />

pedagogy, environmental studies, cardiovascular diseases, oncology, environmental medicine, social<br />

studies and agriculture. There is multidisciplinary cooperation between the subject areas of biology,<br />

biochemistry and biotechnology, pharmacy, medicine and agronomy. The considerable cooperation<br />

between the university and non-university research institutions is highly significant.<br />

Otto von Guericke University in Magdeburg has made a name for itself for its close collaborations<br />

between the engineering, natural and life sciences, economic and social sciences and the humanities.<br />

The aim is to expand these areas in order to compete in the international arena. Computer science,<br />

economics, social science and the humanities are oriented primarily towards engineering and life<br />

sciences, and mathematics, physics and chemistry have a close bearing on the technical disciplines.<br />

Biology and psychology have a neuroscientific profile, and unite the disciplines of medicine, technology<br />

and the humanities.<br />

The Burg Giebichenstein College of Art in Halle contributes to research and artistic development<br />

projects in the fields of the liberal and applied arts, design and interior design and the fine arts.<br />

Universities of applied sciences<br />

The state’s universities of applied sciences have a growing research component, which is highly<br />

valued by the State Government. Research at these institutions is application-oriented, and the<br />

importance of technology transfer is recognised.<br />

Fields of research at the universities of applied sciences:<br />

o Mechanical engineering, industrial engineering, design, industrial design, process and<br />

environmental engineering, chemistry, food technology and biotechnology, electrical engineering,<br />

computer science and specialised communication, social affairs and health;<br />

o Agriculture, land stewardship, ecotrophology and architecture, construction engineering and<br />

surveying, water and waste management;<br />

o The ‘Network of expertise for applied and transfer-oriented research’ (KAT), an association of<br />

universities of applied sciences, with the following skills centres:<br />

o Anhalt University of Applied Sciences: life science skills centre;<br />

o Magdeburg-Stendal University of Applied Sciences: skills centre for renewable resources;<br />

o Harz University of Applied Sciences: skills centre for information and communication technologies,<br />

tourism and the service industry;<br />

o Merseburg University of Applied Sciences: skills centre for chemistry and synthetics.33<br />

33 http://www.sachsen-anhalt.de/LPSA/index.php?id=21880 downloaded on 13 November<br />

Page 24<br />

www.i-p-p.eu

o<br />

o<br />

o<br />

o<br />

o<br />

o<br />

Non-university research institutions<br />

IPP BENCHMARK REPORT<br />

V. 1.0<br />

University research in Saxony-Anhalt is actively supported and complemented by an efficient system of<br />

non-university research institutions. These institutions are involved in a number of ways, for instance, in<br />

the areas of special research and innovation and in the postgraduate courses of the state’s universities.<br />

These establishments are institutionally supported by the state in association with the Federation and<br />

the German states. As well as pure research, these establishments also investigate application-oriented<br />

matters. Thus an attempt is made to strike a balance between pure and applied research and to make<br />

use of their findings in industry and commerce. The following fields of research in non-university<br />

institutions can be found:<br />

Plant research,<br />

Brain research,<br />

Environmental research,<br />

Materials research,<br />

Technological research,<br />

Economics research.<br />

Cluster potential in Saxony-Anhalt<br />

The main objective of the state’s innovation policy is to continue the development of the promising<br />

potentials of clusters. The cluster analysis evaluated the development of clusters in different fields,<br />

which were determined on the basis of a SWOT analysis. Based on these results 34 - among others - the<br />

following clusters were defined:<br />

o Chemical/Plastics: Cluster Chemie/Kunststoffe Mitteldeutschland<br />

o Automotive industry: (MAHREG)<br />

o Mechanical engineering<br />

o Renewable Energy (Bitterfeld-Wolfen)<br />

o Biotechnology (BioMitteldeutschland)<br />

o Medical<br />

o Creative industry (Halle)<br />

o Information and Nanotechnology<br />

Further special potentials:<br />

As the complementation of the cluster potential analysis, the opportunities in the usage of the biomass<br />

were identified. This provides a detailed review of the agricultural potential.<br />

The “Forestry and Wood Saxony-Anhalt” cluster study emphasizes the potentials of the effective and<br />

sustainable usage of the wood raw materials.<br />

Science and Research Potential<br />

Strength: Saxony-Anhalt has a well-developed science base.<br />

34 http://www.sachsenanhalt.de/fileadmin/Elementbibliothek/Bibliothek_Politik_und_Verwaltung/Bibliothek_Wirtschaftsministerium/<br />

Dokumente_MW/investieren/Clusterpotenzialanalyse_2008.pdf<br />

Page 25<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

Weaknesses: In Saxony-Anhalt, comparing with the old states of the Federal Republic, the institutional<br />

incomes are 30% lower, which points out the problem of the compatibility between the supply structure<br />

and the science; the attitude of the demand and the low activity of the research.<br />

Guidelines of the innovation strategy<br />

The main points of the innovations are in the fields of chemical/ plastics, automotive and supplier<br />

industry, mechanical engineering and plant construction, biotechnology, pharmaceutical industry,<br />

renewable energy, medical, health care economy. These are the core areas of the state’s innovation<br />

policy.<br />

The subsidies and measures are concentrated on these main points of the innovation. At the same time<br />

it is possible to find other or new areas with a potential innovation and a good chance of development.<br />

Well-aimed Research and Development means are applied to motivate strong companies with own<br />

R&D activities to settle down in Saxony-Anhalt.<br />

An efficient innovation-oriented infrastructure is the requirement of the intensive cooperation between<br />

the science and the economy.<br />

A significant part of the subsidies, which are provided for the science, are turned to support the<br />

knowledge and technology transfer and applied research.<br />

The innovative capability and dynamic of the economy depends on the supply of well-qualified labour,<br />

especially in the fields of engineering and science. Several measures are taken in order to prevent<br />

particularly the migration of the young people; some of these have been already implemented. The<br />

support of Research, Development and Innovation is regarded as a complex task of the state policy in<br />

the recent Structural Funds Period 2007-2013. In consideration of the Structural Funds Period’s end in<br />

2013, the purposeful structure of the “Future Foundation for Saxony-Anhalt” must be developed. The<br />

programs of the EU and Saxony-Anhalt as well as the significant range of the support’s supply were<br />

harmonized successfully with the highlights of the state’s innovation policy in the past years.<br />

The following packages of measures serve the transformation of the innovation strategy:<br />

o Program for supporting the Research, Development and Innovation<br />

o Extension of the innovation infrastructure along the selected highlights<br />

o The improvement of the science and technology transfer<br />

o Supporting the establishments of innovative companies<br />

o The satisfaction of the labour demand<br />

o The communication of the Innovation strategy<br />

Page 26<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

6. Government and territory<br />

The federal state of Saxony-Anhalt<br />

The State Parliament and State Government of Saxony-Anhalt meet in its capital, Magdeburg.<br />

The State Parliament is re-elected every five years by the men and women of Saxony-Anhalt. It is the<br />

supreme constitutional body, and as such is the legislator, passing state laws, finalising the budget,<br />

electing the Minister-President and keeping a check on the State Government and its administration.<br />

The Minister-President is elected by the State Parliament, and stands at the head of the State<br />

Government. He determines the guidelines of government policy and bears responsibility for these.<br />

Each Minister manages his own portfolio independently within these guidelines, and is personally<br />

responsible for his actions. The State Government rules collectively on all matters which are devolved<br />

upon it by law. At present, the State Government comprises another nine Ministers in addition to the<br />

Minister-President; they run the State Chancellery and the various government departments. The State<br />

Chancellery is the official residence of the Minister-President. It assists the Head of Government in<br />

establishing and implementing policy guidelines as well as in his function as the figurehead of the state.<br />

It coordinates the work of the Government and the administration. The municipalities (local authorities<br />

and rural districts) of Saxony-Anhalt and the local authority associations are responsible for<br />

administering their own affairs in accordance with the law. They elect their own assemblies every five<br />

years, which assist and monitor the work of the chief administrative officers and the Mayors. Both the<br />

state constitution and the municipal constitution must be observed. The municipalities and rural districts<br />

have their own coats of arms in addition to the state coat of arms. 35<br />

Territory<br />

The area of Saxony-Anhalt consists of 3 urban districts<br />

(“Kreisfreie Städte”): Dessau-Roßlau, Halle (Saale) and<br />

Magdeburg; and 11 districts (“Landkreise”):<br />

Distribution of the EU resources<br />

The largest part of Saxony-Anhalts falls under the<br />

convergence objective. These regions receive the largest<br />

means of the Structural Funds. There is a gradual<br />

distribution of resources in the state as Halle belongs to<br />

the Phasing-out regions. Convergence regions<br />

Magdeburg/Dessau receive 53% of subsidies; and the<br />

area of Halle receives 22,8% of resources. 24,2% of<br />

means is distributed in a regionally undefined way, that is financed from the EAFRD (ELER) and EFF.<br />

35 http://www.sachsen-anhalt.de/LPSA/index.php?id=20710, downloaded on 14 November<br />

Page 27<br />

www.i-p-p.eu

7. Key development challenges for Saxony – Anhalt<br />

IPP BENCHMARK REPORT<br />

V. 1.0<br />

Since reunification in 1990, Saxony-Anhalt has developed a reputation as an innovative business<br />

centre. The business community in Germany and abroad particularly values the region because of:<br />

o its rapidly developing innovation potential,<br />

o its skilled and highly motivated workforce,<br />

o its extremely competitive labour costs compared with elsewhere in Germany ensure lower operating<br />

costs<br />

o its well-developed infrastructure,<br />

o its innovative research landscape,<br />

o its attractive selection of industrial and commercial sites, and its affordable property prices and<br />

rents,<br />

o its rapid licensing procedures and short authorization times,<br />

o the unparalleled financial support which is available,<br />

o the high quality of its leisure and recreational facilities.<br />

Since 1990, new industries such as the automotive industry, biotechnology, information and<br />

communication technology and the service sector have become established alongside more traditional<br />

sectors such as the chemical industry, mechanical engineering and the food industry.<br />

In spite of these excellent basic conditions Saxony-Anhalt is nevertheless facing a couple of challenges<br />

to hold and increase the developed status quo.<br />

SME support and co-operation<br />

In Saxony-Anhalt, large-scale enterprises with own research capacities, which often represents<br />

concentration cores of enterprise-intensive research, are absent. 95% of the enterprises occupy less<br />

than 50 employees. Typically for Saxony-Anhalt are establishments reduced to production plants or<br />

manufacturing sites to a great extent without R&D-activities. Hence, the cooperation intensity between<br />

science and economy is also limited. The greatest obstacle in the innovation process is the small equity<br />

capitalisation because of the small-scale business structure. Because of the historical situation a high<br />

above average part of the companies are relatively young and not yet established on the market.<br />

Therefore the main targets for SME support are:<br />

o Widen the support structure of public institutions on all administrative levels<br />

o Expansion of existing innovation focuses<br />

o Perfection of innovation-oriented infrastructure<br />

o Strengthening of the universities, universities of applied sciences and external-university research<br />

establishments as an innovation and economic factor<br />

o Improvement of knowledge and technology transfer<br />

o Qualification of professionals<br />

o Support of institutions and foundations of innovation and knowledge-based enterprises<br />

Page 28<br />

www.i-p-p.eu

IPP BENCHMARK REPORT<br />

V. 1.0<br />

The public innovation promotion needs to be improved, in particular by increasing the performance and<br />

efficiency of the innovation transfer between SMEs.<br />

To foster the exchange of experiences between project partners in this specific topic will be essential<br />

and could be achieved by:<br />

o<br />

o<br />

o<br />

collecting best practices, especially those being integrated into the Mainstream-Programmes<br />

project ideas multiplying positive effects of the structural funds support<br />

efficient assistance measures, adjusted to the current economic situation<br />