TVK Annual Report 2010 (pdf, 2.5 MB)

TVK Annual Report 2010 (pdf, 2.5 MB)

TVK Annual Report 2010 (pdf, 2.5 MB)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Headcount<br />

Full Time Employees December 31, 2009 December 31, <strong>2010</strong><br />

Corporate level 1,139 1,112<br />

Group level 1,167 1,140<br />

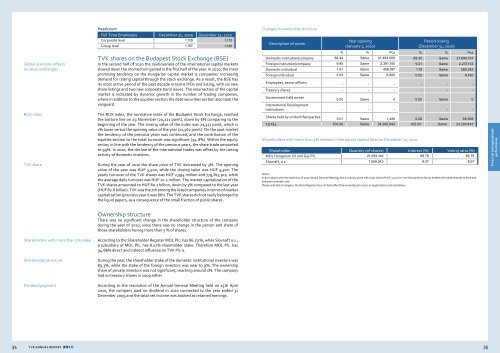

Changes in ownership structure<br />

Description of owner<br />

Year opening<br />

(January 1, <strong>2010</strong>)<br />

Period closing<br />

(December 31, <strong>2010</strong>)<br />

Global economy effects<br />

on stock exchanges<br />

BUX index<br />

<strong>TVK</strong> share<br />

<strong>TVK</strong> shares on the Budapest Stock Exchange (BSE)<br />

In the second half of <strong>2010</strong> the cautiousness of the international capital markets<br />

slowed down the momentum gained in the first half of the year. In <strong>2010</strong>, the most<br />

promising tendency on the Hungarian capital market is companies’ increasing<br />

demand for raising capital through the stock exchange. As a result, the BSE has<br />

its most active period of the past decade in terms IPOs and listing, with six new<br />

share listings and two new corporate bond issues. The resurrection of the capital<br />

market is indicated by dynamic growth in the number of trading companies,<br />

where in addition to the equities section the debt securities section also took the<br />

vanguard.<br />

The BUX index, the normative index of the Budapest Stock Exchange, reached<br />

the bottom line on 29 November (20,221 point), down by 6% comparing to the<br />

beginning of the year. The closing value of the index was 21,327 point, which is<br />

1% lower versus the opening value of the year (21,562 point). On the spot market<br />

the tendency of the previous years was continued, and the contribution of the<br />

equities section to the total turnover was significant (94.8%). Within the equity<br />

sector, in line with the tendency of the previous years, the share trade amounted<br />

to 99%. In <strong>2010</strong>, the decline of the international trades was offset by the raising<br />

activity of domestic investors.<br />

During the year of <strong>2010</strong> the share price of <strong>TVK</strong> decreased by 3%. The opening<br />

value of the year was HUF 3,400, while the closing value was HUF 3,300. The<br />

yearly turnover of the <strong>TVK</strong> shares was HUF 2,594 million and 779,815 pcs, while<br />

the average daily turnover was HUF 10.2 million. The market capitalization of the<br />

<strong>TVK</strong> shares amounted to HUF 80.2 billion, down by 3% compared to the last year<br />

(HUF 82.6 billion). <strong>TVK</strong> was the 7th among the listed companies in terms of market<br />

capitalization (previous year it was 8th). The <strong>TVK</strong> shares did not really belonged to<br />

the liquid papers, as a consequence of the small fraction of public shares.<br />

% % Pcs % % Pcs<br />

Domestic institution/company 88.44 Same 21,484,808 89.30 Same 21,690,707<br />

Foreign institution/company 9.85 Same 2,391,740 9.21 Same 2,237,133<br />

Domestic individual 1.67 Same 406,187 1.19 Same 288,245<br />

Foreign individual 0.03 Same 6,680 0.02 Same 6,190<br />

Employees, senior officers<br />

- - - - - -<br />

Treasury shares - - - - - -<br />

Government held owner<br />

0.00 Same 0 0.00 Same 0<br />

International Development<br />

Institutions - - - - - -<br />

Shares held by unidentified parties<br />

0.01 Same 1,428 0.28 Same 68,568<br />

TOTAL 100.00 Same 24,290,843 100.00 Same 24,290,843<br />

Shareholders with more than 5% interest in the equity capital total on December 31, <strong>2010</strong><br />

Shareholder Quantity (of shares) Interest (%) Voting ratio (%)<br />

MOL Hungarian Oil and Gas Plc. 21,083,142 86.79 86.79<br />

Slovnaft, a.s. 1,959,243 8.07 8.07<br />

Notes:<br />

In accordance with the resolution of 2007 <strong>Annual</strong> General Meeting, every ordinary share with a par value of HUF 1,010 (i.e. one thousand ten forint) entitles the holder thereof to have one<br />

and one hundredth vote.<br />

Please note that in Hungary, the Share Register does not fully reflect the ownership structure, as registration is not mandatory.<br />

Financial and operational<br />

performance<br />

Ownership structure<br />

There was no significant change in the shareholder structure of the company<br />

during the year of <strong>2010</strong>, since there was no change in the person and share of<br />

those shareholders having more than 5 % of shares.<br />

Shareholders with more than 5% stake<br />

According to the Shareholder Register MOL Plc. has 86.79 %, while Slovnaft a.s.,<br />

a subsidiary of MOL Plc, has 8.07% shareholder stake. Therefore MOL Plc. has<br />

94.86% direct and indirect influence on <strong>TVK</strong> Plc is.<br />

Shareholder structure<br />

During the year, the shareholder stake of the domestic institutional investors was<br />

89.3%, while the stake of the foreign investors was near to 9%. The ownership<br />

share of private investors was not significant, reaching around 1%. The company<br />

had no treasury shares in 2009 either.<br />

Dividend payment<br />

According to the resolution of the <strong>Annual</strong> General Meeting held on 15th April<br />

<strong>2010</strong>, the company paid no dividend in <strong>2010</strong> connected to the year ended 31<br />

December 2009 and the total net income was booked as retained earnings.<br />

34 <strong>TVK</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong><br />

35