TVK Annual Report 2010 (pdf, 2.5 MB)

TVK Annual Report 2010 (pdf, 2.5 MB)

TVK Annual Report 2010 (pdf, 2.5 MB)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

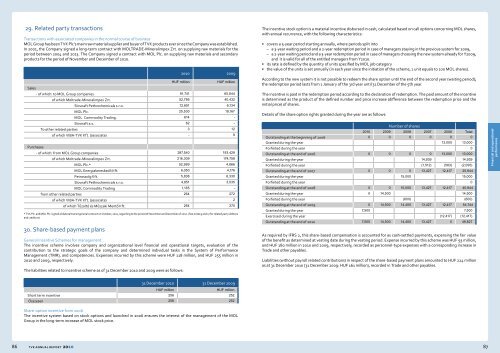

29. Related party transactions<br />

Transactions with associated companies in the normal course of business<br />

MOL Group has been <strong>TVK</strong> Plc’s main raw material supplier and buyer of <strong>TVK</strong> products ever since the Company was established.<br />

In 2001, the Company signed a long-term contract with MOLTRADE-Mineralimpex Zrt. on supplying raw materials for the<br />

period between 2004 and 2013. The Company signed a contract with MOL Plc. on supplying raw materials and secondary<br />

products for the period of November and December of <strong>2010</strong>.<br />

<strong>2010</strong> 2009<br />

HUF million<br />

HUF million<br />

Sales<br />

- of which: to MOL Group companies 91,741 65,844<br />

of which Moltrade-Mineralimpex Zrt. 52,786 40,432<br />

Slovnaft Pethrochemicals s.r.o. 12,651 6,134<br />

MOL Plc. 25,530 19,167<br />

MOL Commodity Trading. 614 -<br />

Slovnaft a.s. 62 -<br />

To other related parties 3 12<br />

of which VIBA-<strong>TVK</strong> Kft. (associate) - 9<br />

Purchases<br />

- of which: from MOL Group companies 287,540 193,429<br />

of which Moltrade-Mineralimpex Zrt. 216,309 174,758<br />

MOL Plc.* 52,969 4,866<br />

MOL Energiakereskedő Kft. 6,050 4,176<br />

Petroszolg Kft. 5,838 6,330<br />

Slovnaft Pethrochemicals s.r.o. 4,851 3,035<br />

MOL Commodity Trading 1,165 -<br />

from other related parties 264 272<br />

of which VIBA-<strong>TVK</strong> Kft. (associate) - 2<br />

of which Tűzoltó és Műszaki Mentő Kft. 264 270<br />

* <strong>TVK</strong> Plc. and MOL Plc. signed a bilateral transit general contract on October, <strong>2010</strong>, regarding to the period of November and December of <strong>2010</strong>. (See notes 9 and 17 for related party debtors<br />

and creditors)<br />

30. Share-based payment plans<br />

General Incentive Schemes for management<br />

The incentive scheme involves company and organizational level financial and operational targets, evaluation of the<br />

contribution to the strategic goals of the company and determined individual tasks in the System of Performance<br />

Management (TMR), and competencies. Expenses incurred by this scheme were HUF 118 million, and HUF 255 million in<br />

<strong>2010</strong> and 2009, respectively.<br />

The liabilities related to incentive scheme as of 31 December <strong>2010</strong> and 2009 were as follows:<br />

The incentive stock option is a material incentive disbursed in cash, calculated based on call options concerning MOL shares,<br />

with annual recurrence, with the following characteristics:<br />

• covers a 5-year period starting annually, where periods split into<br />

––<br />

a 3-year waiting period and a 2-year redemption period in case of managers staying in the previous system for 2009,<br />

––<br />

a 2-year waiting period and a 3-year redemption period in case of managers choosing the new system already for Y2009,<br />

and it is valid for all of the entitled managers from Y<strong>2010</strong>.<br />

• its rate is defined by the quantity of units specified by MOL job category<br />

• the value of the units is set annually (in each year since the initiation of the scheme, 1 unit equals to 100 MOL shares).<br />

According to the new system it is not possible to redeem the share option until the end of the second year (waiting period);<br />

the redemption period lasts from 1 January of the 3rd year until 31 December of the 5th year.<br />

The incentive is paid in the redemption period according to the declaration of redemption. The paid amount of the incentive<br />

is determined as the product of the defined number and price increase (difference between the redemption price and the<br />

initial price) of shares.<br />

Details of the share option rights granted during the year are as follows:<br />

Number of shares<br />

<strong>2010</strong> 2009 2008 2007 2006 Total<br />

Outstanding at the beginning of 2006 0 0 0 0 0 0<br />

Granted during the year 13,000 13,000<br />

Forfeited during the year 0<br />

Outstanding at the end of 2006 0 0 0 0 13,000 13,000<br />

Granted during the year 14,939 14,939<br />

Forfeited during the year (1,512) (583) (2,095)<br />

Outstanding at the end of 2007 0 0 0 13,427 12,417 25,844<br />

Granted during the year 15,000 15,000<br />

Forfeited during the year 0<br />

Outstanding at the end of 2008 0 0 15,000 13,427 12,417 40,844<br />

Granted during the year 0 14,500 14,500<br />

Forfeited during the year (600) (600)<br />

Outstanding at the end of 2009 0 14,500 14,400 13,427 12,417 54,744<br />

Granted during the year 7,500 7,500<br />

Exercised during the year (12,417) (12,417)<br />

Outstanding at the end of <strong>2010</strong> 7,500 14,500 14,400 13,427 0 49,827<br />

As required by IFRS 2, this share-based compensation is accounted for as cash-settled payments, expensing the fair value<br />

of the benefit as determined at vesting date during the vesting period. Expense incurred by this scheme was HUF 93 million,<br />

and HUF 180 million in <strong>2010</strong> and 2009, respectively, recorded as personnel-type expenses with a corresponding increase in<br />

Trade and other payables.<br />

Liabilities (without payroll related contributions) in respect of the share-based payment plans amounted to HUF 224 million<br />

as at 31 December <strong>2010</strong> (31 December 2009: HUF 161 million), recorded in Trade and other payables.<br />

Financial and operational<br />

performance<br />

31 December <strong>2010</strong> 31 December 2009<br />

HUF million<br />

HUF million<br />

Short term incentive 256 252<br />

Összesen 256 252<br />

Share-option incentive from 2006<br />

The incentive system based on stock options and launched in 2006 ensures the interest of the management of the MOL<br />

Group in the long-term increase of MOL stock price.<br />

86 <strong>TVK</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong><br />

87