PETITION - tantransco

PETITION - tantransco

PETITION - tantransco

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

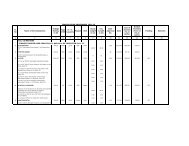

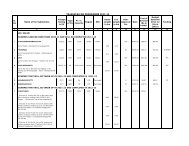

7.2.5 The proposed R&M charges for FY 2013-14 is shown in the table below:<br />

Table 43: R&M Expenses for FY 2013-14<br />

Rs. Crs<br />

Details FY 2013-14<br />

Estimate<br />

Plant & Machinery 4.03<br />

Building 0.09<br />

Civil Works 0.28<br />

Lines & Cable network 3.74<br />

Vehicles 0.40<br />

Furniture & Fixtures 0.00<br />

Office equipments 0.17<br />

Total Expenses 8.71<br />

Less: Capitalisation 1.45<br />

Net Repair & Maintenance expenses 7.26<br />

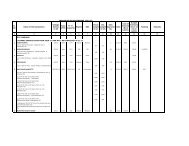

7.2.6 Based on above paragraphs, the proposed O&M cost for TANTRANSCO for the year FY<br />

2013-14 is Rs. 361 Crs. The breakup of O&M expenses for the year FY 2013-14 is shown<br />

as under:<br />

Table 44: O&M Expenses for FY 2013-14<br />

Rs. Crs<br />

Particulars FY 2013-14<br />

Projections<br />

Employee Expense 346<br />

Administration & General Expenses 8<br />

Repair & Maintenance Expenses 7<br />

Total 361<br />

7.2.7 It is requested to the Hon’ble Commission to approve the O&M expenses as showcased<br />

in the above table.<br />

7.3 GFA and Depreciation<br />

7.3.1 The depreciation rate considered in the petition are in line with the rates specified in<br />

the Tariff Regulations. The total depreciation is calculated on the opening balance of the<br />

Gross Fixed Assets (GFA) and on a average basis on the addition of the assets during the<br />

year.<br />

7.3.2 This is calculated in line with the tariff regulations and the APTEL order, the abstract of<br />

which is outlined below:<br />

The Honble Appellate Tribunal vide its Order dated July 15, 2009 (Appeal No. 137 of<br />

2008) allowed the Appeal and ruled as under (TPC Vs MERC):<br />

“In view of the provisions of the Tariff Regulations the Companies Act and the<br />

Accounting Standard-6, we find full justification and rationale in the contention of the<br />

appellant that proportionate depreciation has to be allowed even for part of the year<br />

when the assets have been put to use. The asset once put to use will be exposed to wear<br />

and tear which will not wait to depreciate till the start of the new financial year. We,<br />

therefore, allow the appeal in this view of the matter also.”<br />

7.3.3 In line with the above decision of Hon’ble Appellate Tribunal, TANTRANSCO has claimed<br />

depreciation on the assets added during the year by assuming that the assets will be<br />

added during the mid of the year.<br />

Page 35