Euro 25,000,000,000 Debt Issuance Programme - Münchener ...

Euro 25,000,000,000 Debt Issuance Programme - Münchener ...

Euro 25,000,000,000 Debt Issuance Programme - Münchener ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

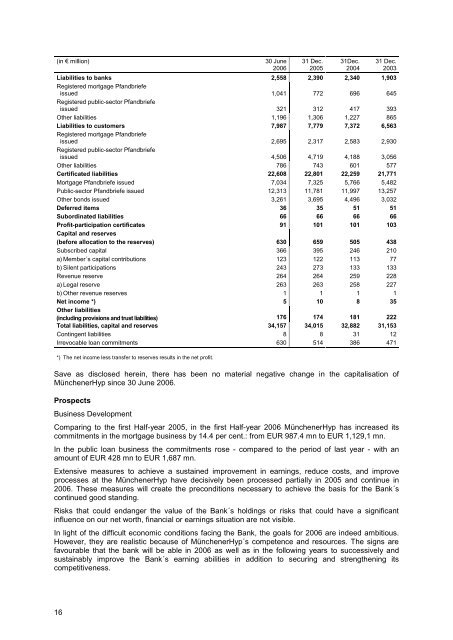

(in € million) 30 June 31 Dec. 31Dec. 31 Dec.<br />

2006 2005 2004 2003<br />

Liabilities to banks 2,558 2,390 2,340 1,903<br />

Registered mortgage Pfandbriefe<br />

issued 1,041 772 696 645<br />

Registered public-sector Pfandbriefe<br />

issued 321 312 417 393<br />

Other liabilities 1,196 1,306 1,227 865<br />

Liabilities to customers 7,987 7,779 7,372 6,563<br />

Registered mortgage Pfandbriefe<br />

issued 2,695 2,317 2,583 2,930<br />

Registered public-sector Pfandbriefe<br />

issued 4,506 4,719 4,188 3,056<br />

Other liabilities 786 743 601 577<br />

Certificated liabilities 22,608 22,801 22,<strong>25</strong>9 21,771<br />

Mortgage Pfandbriefe issued 7,034 7,3<strong>25</strong> 5,766 5,482<br />

Public-sector Pfandbriefe issued 12,313 11,781 11,997 13,<strong>25</strong>7<br />

Other bonds issued 3,261 3,695 4,496 3,032<br />

Deferred items 36 35 51 51<br />

Subordinated liabilities 66 66 66 66<br />

Profit-participation certificates 91 101 101 103<br />

Capital and reserves<br />

(before allocation to the reserves) 630 659 505 438<br />

Subscribed capital 366 395 246 210<br />

a) Member´s capital contributions 123 122 113 77<br />

b) Silent participations 243 273 133 133<br />

Revenue reserve 264 264 <strong>25</strong>9 228<br />

a) Legal reserve 263 263 <strong>25</strong>8 227<br />

b) Other revenue reserves 1 1 1 1<br />

Net income *) 5 10 8 35<br />

Other liabilities<br />

(including provisions and trust liabilities) 176 174 181 222<br />

Total liabilities, capital and reserves 34,157 34,015 32,882 31,153<br />

Contingent liabilities 8 8 31 12<br />

Irrevocable loan commitments 630 514 386 471<br />

*) The net income less transfer to reserves results in the net profit.<br />

Save as disclosed herein, there has been no material negative change in the capitalisation of<br />

<strong>Münchener</strong>Hyp since 30 June 2006.<br />

Prospects<br />

Business Development<br />

Comparing to the first Half-year 2005, in the first Half-year 2006 <strong>Münchener</strong>Hyp has increased its<br />

commitments in the mortgage business by 14.4 per cent.: from EUR 987.4 mn to EUR 1,129,1 mn.<br />

In the public loan business the commitments rose - compared to the period of last year - with an<br />

amount of EUR 428 mn to EUR 1,687 mn.<br />

Extensive measures to achieve a sustained improvement in earnings, reduce costs, and improve<br />

processes at the <strong>Münchener</strong>Hyp have decisively been processed partially in 2005 and continue in<br />

2006. These measures will create the preconditions necessary to achieve the basis for the Bank´s<br />

continued good standing.<br />

Risks that could endanger the value of the Bank´s holdings or risks that could have a significant<br />

influence on our net worth, financial or earnings situation are not visible.<br />

In light of the difficult economic conditions facing the Bank, the goals for 2006 are indeed ambitious.<br />

However, they are realistic because of <strong>Münchener</strong>Hyp´s competence and resources. The signs are<br />

favourable that the bank will be able in 2006 as well as in the following years to successively and<br />

sustainably improve the Bank´s earning abilities in addition to securing and strengthening its<br />

competitiveness.<br />

16