Circular to Unitholders - Suntec REIT

Circular to Unitholders - Suntec REIT

Circular to Unitholders - Suntec REIT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview<br />

This overview section is qualified in its entirety by, and should be read in conjunction with, the full<br />

text of this <strong>Circular</strong>. Meanings of capitalized terms may be found in the Glossary of this <strong>Circular</strong>.<br />

The Acquisition of a One-third Interest in<br />

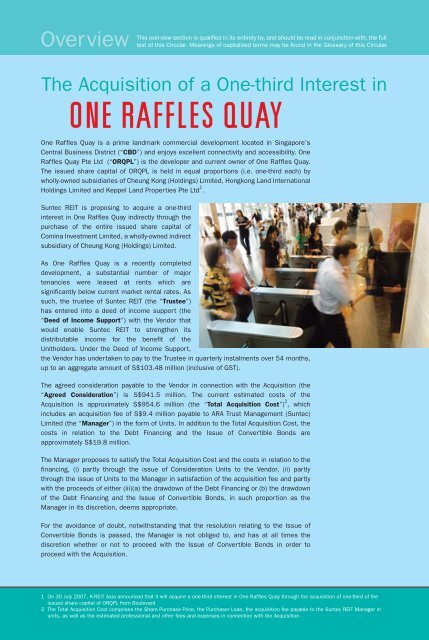

One Raffles Quay is a prime landmark commercial development located in Singapore’s<br />

Central Business District (“CBD”) and enjoys excellent connectivity and accessibility. One<br />

Raffles Quay Pte Ltd (“ORQPL”) is the developer and current owner of One Raffles Quay.<br />

The issued share capital of ORQPL is held in equal proportions (i.e. one-third each) by<br />

wholly-owned subsidiaries of Cheung Kong (Holdings) Limited, Hongkong Land International<br />

Holdings Limited and Keppel Land Properties Pte Ltd 1 .<br />

<strong>Suntec</strong> <strong>REIT</strong> is proposing <strong>to</strong> acquire a one-third<br />

interest in One Raffles Quay indirectly through the<br />

purchase of the entire issued share capital of<br />

Comina Investment Limited, a wholly-owned indirect<br />

subsidiary of Cheung Kong (Holdings) Limited.<br />

As One Raffles Quay is a recently completed<br />

development, a substantial number of major<br />

tenancies were leased at rents which are<br />

significantly below current market rental rates. As<br />

such, the trustee of <strong>Suntec</strong> <strong>REIT</strong> (the “Trustee”)<br />

has entered in<strong>to</strong> a deed of income support (the<br />

“Deed of Income Support”) with the Vendor that<br />

would enable <strong>Suntec</strong> <strong>REIT</strong> <strong>to</strong> strengthen its<br />

distributable income for the benefit of the<br />

<strong>Unitholders</strong>. Under the Deed of Income Support,<br />

the Vendor has undertaken <strong>to</strong> pay <strong>to</strong> the Trustee in quarterly instalments over 54 months,<br />

up <strong>to</strong> an aggregate amount of S$103.48 million (inclusive of GST).<br />

The agreed consideration payable <strong>to</strong> the Vendor in connection with the Acquisition (the<br />

“Agreed Consideration”) is S$941.5 million. The current estimated costs of the<br />

Acquisition is approximately S$954.6 million (the “Total Acquisition Cost”) 2 , which<br />

includes an acquisition fee of S$9.4 million payable <strong>to</strong> ARA Trust Management (<strong>Suntec</strong>)<br />

Limited (the “Manager”) in the form of Units. In addition <strong>to</strong> the Total Acquisition Cost, the<br />

costs in relation <strong>to</strong> the Debt Financing and the Issue of Convertible Bonds are<br />

approximately S$19.8 million.<br />

The Manager proposes <strong>to</strong> satisfy the Total Acquisition Cost and the costs in relation <strong>to</strong> the<br />

financing, (i) partly through the issue of Consideration Units <strong>to</strong> the Vendor, (ii) partly<br />

through the issue of Units <strong>to</strong> the Manager in satisfaction of the acquisition fee and partly<br />

with the proceeds of either (iii)(a) the drawdown of the Debt Financing or (b) the drawdown<br />

of the Debt Financing and the Issue of Convertible Bonds, in such proportion as the<br />

Manager in its discretion, deems appropriate.<br />

For the avoidance of doubt, notwithstanding that the resolution relating <strong>to</strong> the Issue of<br />

Convertible Bonds is passed, the Manager is not obliged <strong>to</strong>, and has at all times the<br />

discretion whether or not <strong>to</strong> proceed with the Issue of Convertible Bonds in order <strong>to</strong><br />

proceed with the Acquisition.<br />

1 On 30 July 2007, K-<strong>REIT</strong> Asia announced that it will acquire a one-third interest in One Raffles Quay through the acquisition of one-third of the<br />

issued share capital of ORQPL from Boulevard<br />

2 The Total Acquisition Cost comprises the Share Purchase Price, the Purchaser Loan, the acquisition fee payable <strong>to</strong> the <strong>Suntec</strong> <strong>REIT</strong> Manager in<br />

units, as well as the estimated professional and other fees and expenses in connection with the Acquisition