Circular to Unitholders - Suntec REIT

Circular to Unitholders - Suntec REIT

Circular to Unitholders - Suntec REIT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Under the Deed of Income Support, the Vendor has undertaken, starting from Completion, <strong>to</strong> pay<br />

<strong>to</strong> <strong>Suntec</strong> <strong>REIT</strong> quarterly instalments for 54 months up <strong>to</strong> an aggregate amount of S$103.48<br />

million (inclusive of GST). The Vendor’s commitment under the Deed of Income Support is<br />

guaranteed by the Guaran<strong>to</strong>r. Both CBRE and Knight Frank have taken in<strong>to</strong> account these<br />

payments under the Deed of Income Support in their valuation of the Property.<br />

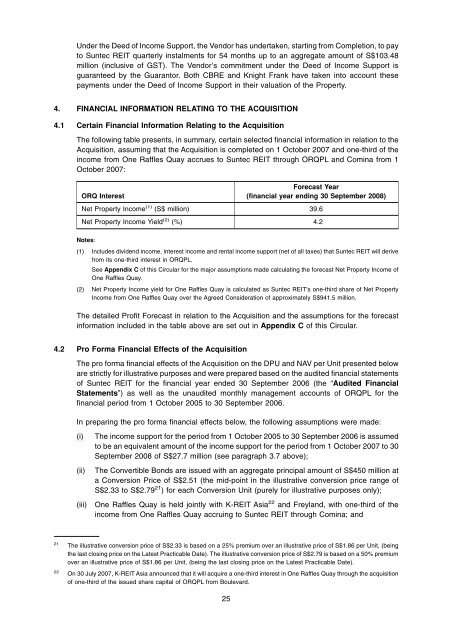

4. FINANCIAL INFORMATION RELATING TO THE ACQUISITION<br />

4.1 Certain Financial Information Relating <strong>to</strong> the Acquisition<br />

The following table presents, in summary, certain selected financial information in relation <strong>to</strong> the<br />

Acquisition, assuming that the Acquisition is completed on 1 Oc<strong>to</strong>ber 2007 and one-third of the<br />

income from One Raffles Quay accrues <strong>to</strong> <strong>Suntec</strong> <strong>REIT</strong> through ORQPL and Comina from 1<br />

Oc<strong>to</strong>ber 2007:<br />

ORQ Interest<br />

Forecast Year<br />

(financial year ending 30 September 2008)<br />

Net Property Income (1) (S$ million) 39.6<br />

Net Property Income Yield (2) (%) 4.2<br />

Notes:<br />

(1) Includes dividend income, interest income and rental income support (net of all taxes) that <strong>Suntec</strong> <strong>REIT</strong> will derive<br />

from its one-third interest in ORQPL.<br />

See Appendix C of this <strong>Circular</strong> for the major assumptions made calculating the forecast Net Property Income of<br />

One Raffles Quay.<br />

(2) Net Property Income yield for One Raffles Quay is calculated as <strong>Suntec</strong> <strong>REIT</strong>’s one-third share of Net Property<br />

Income from One Raffles Quay over the Agreed Consideration of approximately S$941.5 million.<br />

The detailed Profit Forecast in relation <strong>to</strong> the Acquisition and the assumptions for the forecast<br />

information included in the table above are set out in Appendix C of this <strong>Circular</strong>.<br />

4.2 Pro Forma Financial Effects of the Acquisition<br />

The pro forma financial effects of the Acquisition on the DPU and NAV per Unit presented below<br />

are strictly for illustrative purposes and were prepared based on the audited financial statements<br />

of <strong>Suntec</strong> <strong>REIT</strong> for the financial year ended 30 September 2006 (the “Audited Financial<br />

Statements”) as well as the unaudited monthly management accounts of ORQPL for the<br />

financial period from 1 Oc<strong>to</strong>ber 2005 <strong>to</strong> 30 September 2006.<br />

In preparing the pro forma financial effects below, the following assumptions were made:<br />

(i)<br />

(ii)<br />

(iii)<br />

The income support for the period from 1 Oc<strong>to</strong>ber 2005 <strong>to</strong> 30 September 2006 is assumed<br />

<strong>to</strong> be an equivalent amount of the income support for the period from 1 Oc<strong>to</strong>ber 2007 <strong>to</strong> 30<br />

September 2008 of S$27.7 million (see paragraph 3.7 above);<br />

The Convertible Bonds are issued with an aggregate principal amount of S$450 million at<br />

a Conversion Price of S$2.51 (the mid-point in the illustrative conversion price range of<br />

S$2.33 <strong>to</strong> S$2.79 21 ) for each Conversion Unit (purely for illustrative purposes only);<br />

One Raffles Quay is held jointly with K-<strong>REIT</strong> Asia 22 and Freyland, with one-third of the<br />

income from One Raffles Quay accruing <strong>to</strong> <strong>Suntec</strong> <strong>REIT</strong> through Comina; and<br />

21<br />

22<br />

The illustrative conversion price of S$2.33 is based on a 25% premium over an illustrative price of S$1.86 per Unit, (being<br />

the last closing price on the Latest Practicable Date). The illustrative conversion price of S$2.79 is based on a 50% premium<br />

over an illustrative price of S$1.86 per Unit, (being the last closing price on the Latest Practicable Date).<br />

On 30 July 2007, K-<strong>REIT</strong> Asia announced that it will acquire a one-third interest in One Raffles Quay through the acquisition<br />

of one-third of the issued share capital of ORQPL from Boulevard.<br />

25