Circular to Unitholders - Suntec REIT

Circular to Unitholders - Suntec REIT

Circular to Unitholders - Suntec REIT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

eference <strong>to</strong> (i) Gross Rent payable pursuant <strong>to</strong> comparable leases for tenancies that<br />

have recently been negotiated, (ii) the effect of competing retail and office properties,<br />

(iii) assumed tenant retention rates on lease expiry, (iv) likely market conditions, (v)<br />

inflation levels and (vi) tenant demand levels.<br />

• If a committed lease expires in the financial year ending 30 September 2008, the<br />

Manager has assumed that the rental rates payable under the new lease (or lease<br />

renewal) will be the market rent, increased by the projected growth rate in accordance<br />

with the methodology set out in paragraph (c) below, or the actual rent committed (if<br />

the lease agreement or letter of offer has been entered in<strong>to</strong>).<br />

(b)<br />

Other Income<br />

Other income includes income earned from the operations of the car park at Park Mall, income<br />

from existing licence agreements, income from air-conditioning, water and electricity charges <strong>to</strong><br />

tenants, rental of atrium space, turnover rent, if any, and other miscellaneous income.<br />

The assessment of other income earned for the Forecast Year is based on existing agreements,<br />

current income collections and the Manager’s assessment of the other income <strong>to</strong> be generated<br />

by the Existing Properties. In order <strong>to</strong> project other income for the Forecast Year, the Manager<br />

has forecast that other income will be S$8.6 million, having taken in<strong>to</strong> consideration the his<strong>to</strong>rical<br />

trend of such income achieved.<br />

(c)<br />

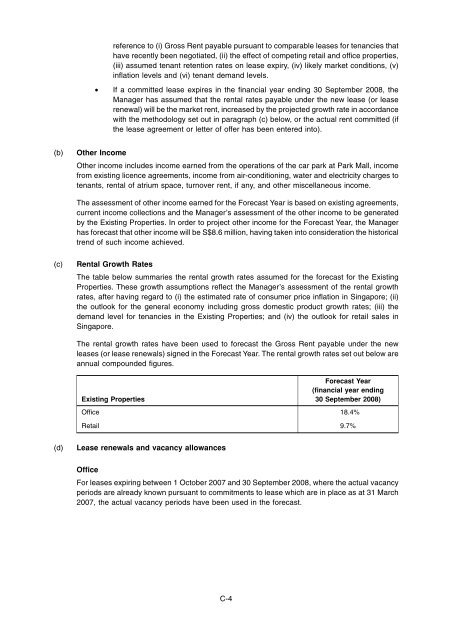

Rental Growth Rates<br />

The table below summaries the rental growth rates assumed for the forecast for the Existing<br />

Properties. These growth assumptions reflect the Manager’s assessment of the rental growth<br />

rates, after having regard <strong>to</strong> (i) the estimated rate of consumer price inflation in Singapore; (ii)<br />

the outlook for the general economy including gross domestic product growth rates; (iii) the<br />

demand level for tenancies in the Existing Properties; and (iv) the outlook for retail sales in<br />

Singapore.<br />

The rental growth rates have been used <strong>to</strong> forecast the Gross Rent payable under the new<br />

leases (or lease renewals) signed in the Forecast Year. The rental growth rates set out below are<br />

annual compounded figures.<br />

Existing Properties<br />

Office<br />

Retail<br />

Forecast Year<br />

(financial year ending<br />

30 September 2008)<br />

18.4%<br />

9.7%<br />

(d)<br />

Lease renewals and vacancy allowances<br />

Office<br />

For leases expiring between 1 Oc<strong>to</strong>ber 2007 and 30 September 2008, where the actual vacancy<br />

periods are already known pursuant <strong>to</strong> commitments <strong>to</strong> lease which are in place as at 31 March<br />

2007, the actual vacancy periods have been used in the forecast.<br />

C-4