Circular to Unitholders - Suntec REIT

Circular to Unitholders - Suntec REIT

Circular to Unitholders - Suntec REIT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

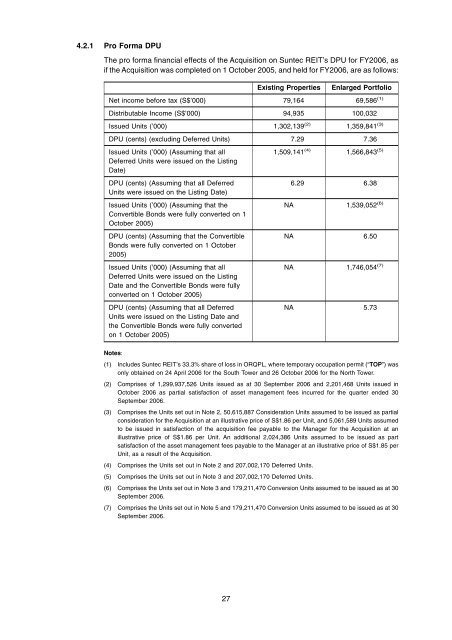

4.2.1 Pro Forma DPU<br />

The pro forma financial effects of the Acquisition on <strong>Suntec</strong> <strong>REIT</strong>’s DPU for FY2006, as<br />

if the Acquisition was completed on 1 Oc<strong>to</strong>ber 2005, and held for FY2006, are as follows:<br />

Existing Properties<br />

Enlarged Portfolio<br />

Net income before tax (S$’000) 79,164 69,586 (1)<br />

Distributable Income (S$’000) 94,935 100,032<br />

Issued Units (’000) 1,302,139 (2) 1,359,841 (3)<br />

DPU (cents) (excluding Deferred Units) 7.29 7.36<br />

Issued Units (’000) (Assuming that all<br />

Deferred Units were issued on the Listing<br />

Date)<br />

DPU (cents) (Assuming that all Deferred<br />

Units were issued on the Listing Date)<br />

Issued Units (’000) (Assuming that the<br />

Convertible Bonds were fully converted on 1<br />

Oc<strong>to</strong>ber 2005)<br />

DPU (cents) (Assuming that the Convertible<br />

Bonds were fully converted on 1 Oc<strong>to</strong>ber<br />

2005)<br />

Issued Units (’000) (Assuming that all<br />

Deferred Units were issued on the Listing<br />

Date and the Convertible Bonds were fully<br />

converted on 1 Oc<strong>to</strong>ber 2005)<br />

DPU (cents) (Assuming that all Deferred<br />

Units were issued on the Listing Date and<br />

the Convertible Bonds were fully converted<br />

on 1 Oc<strong>to</strong>ber 2005)<br />

1,509,141 (4) 1,566,843 (5)<br />

6.29 6.38<br />

NA 1,539,052 (6)<br />

NA 6.50<br />

NA 1,746,054 (7)<br />

NA 5.73<br />

Notes:<br />

(1) Includes <strong>Suntec</strong> <strong>REIT</strong>’s 33.3% share of loss in ORQPL, where temporary occupation permit (“TOP”) was<br />

only obtained on 24 April 2006 for the South Tower and 26 Oc<strong>to</strong>ber 2006 for the North Tower.<br />

(2) Comprises of 1,299,937,526 Units issued as at 30 September 2006 and 2,201,468 Units issued in<br />

Oc<strong>to</strong>ber 2006 as partial satisfaction of asset management fees incurred for the quarter ended 30<br />

September 2006.<br />

(3) Comprises the Units set out in Note 2, 50,615,887 Consideration Units assumed <strong>to</strong> be issued as partial<br />

consideration for the Acquisition at an illustrative price of S$1.86 per Unit, and 5,061,589 Units assumed<br />

<strong>to</strong> be issued in satisfaction of the acquisition fee payable <strong>to</strong> the Manager for the Acquisition at an<br />

illustrative price of S$1.86 per Unit. An additional 2,024,386 Units assumed <strong>to</strong> be issued as part<br />

satisfaction of the asset management fees payable <strong>to</strong> the Manager at an illustrative price of S$1.85 per<br />

Unit, as a result of the Acquisition.<br />

(4) Comprises the Units set out in Note 2 and 207,002,170 Deferred Units.<br />

(5) Comprises the Units set out in Note 3 and 207,002,170 Deferred Units.<br />

(6) Comprises the Units set out in Note 3 and 179,211,470 Conversion Units assumed <strong>to</strong> be issued as at 30<br />

September 2006.<br />

(7) Comprises the Units set out in Note 5 and 179,211,470 Conversion Units assumed <strong>to</strong> be issued as at 30<br />

September 2006.<br />

27