Circular to Unitholders - Suntec REIT

Circular to Unitholders - Suntec REIT

Circular to Unitholders - Suntec REIT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

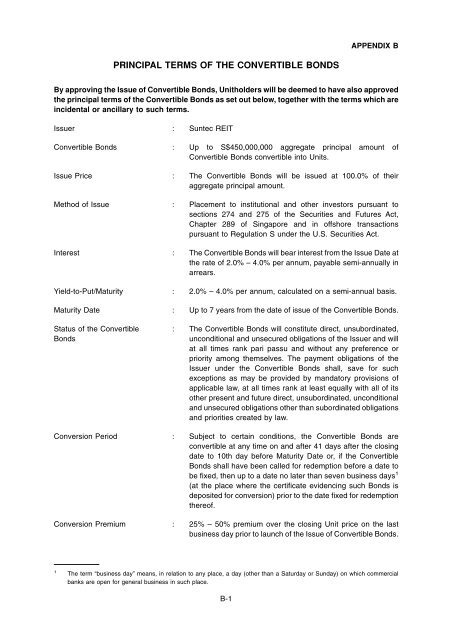

APPENDIX B<br />

PRINCIPAL TERMS OF THE CONVERTIBLE BONDS<br />

By approving the Issue of Convertible Bonds, <strong>Unitholders</strong> will be deemed <strong>to</strong> have also approved<br />

the principal terms of the Convertible Bonds as set out below, <strong>to</strong>gether with the terms which are<br />

incidental or ancillary <strong>to</strong> such terms.<br />

Issuer : <strong>Suntec</strong> <strong>REIT</strong><br />

Convertible Bonds : Up <strong>to</strong> S$450,000,000 aggregate principal amount of<br />

Convertible Bonds convertible in<strong>to</strong> Units.<br />

Issue Price : The Convertible Bonds will be issued at 100.0% of their<br />

aggregate principal amount.<br />

Method of Issue : Placement <strong>to</strong> institutional and other inves<strong>to</strong>rs pursuant <strong>to</strong><br />

sections 274 and 275 of the Securities and Futures Act,<br />

Chapter 289 of Singapore and in offshore transactions<br />

pursuant <strong>to</strong> Regulation S under the U.S. Securities Act.<br />

Interest : The Convertible Bonds will bear interest from the Issue Date at<br />

the rate of 2.0% – 4.0% per annum, payable semi-annually in<br />

arrears.<br />

Yield-<strong>to</strong>-Put/Maturity : 2.0% – 4.0% per annum, calculated on a semi-annual basis.<br />

Maturity Date : Up <strong>to</strong> 7 years from the date of issue of the Convertible Bonds.<br />

Status of the Convertible<br />

Bonds<br />

: The Convertible Bonds will constitute direct, unsubordinated,<br />

unconditional and unsecured obligations of the Issuer and will<br />

at all times rank pari passu and without any preference or<br />

priority among themselves. The payment obligations of the<br />

Issuer under the Convertible Bonds shall, save for such<br />

exceptions as may be provided by manda<strong>to</strong>ry provisions of<br />

applicable law, at all times rank at least equally with all of its<br />

other present and future direct, unsubordinated, unconditional<br />

and unsecured obligations other than subordinated obligations<br />

and priorities created by law.<br />

Conversion Period : Subject <strong>to</strong> certain conditions, the Convertible Bonds are<br />

convertible at any time on and after 41 days after the closing<br />

date <strong>to</strong> 10th day before Maturity Date or, if the Convertible<br />

Bonds shall have been called for redemption before a date <strong>to</strong><br />

be fixed, then up <strong>to</strong> a date no later than seven business days 1<br />

(at the place where the certificate evidencing such Bonds is<br />

deposited for conversion) prior <strong>to</strong> the date fixed for redemption<br />

thereof.<br />

Conversion Premium : 25% – 50% premium over the closing Unit price on the last<br />

business day prior <strong>to</strong> launch of the Issue of Convertible Bonds.<br />

1<br />

The term “business day” means, in relation <strong>to</strong> any place, a day (other than a Saturday or Sunday) on which commercial<br />

banks are open for general business in such place.<br />

B-1